Georgiy Datsenko

Coca-Cola (NYSE:KO) the soft-drink large is scheduled to report its calendar This fall ’22 monetary outcomes previous to the opening bell on Tuesday, February 14th, 2023.

Wall Avenue consensus is anticipating $0.45 in earnings per share on $9.9 to $10.0 billion in income for anticipated flat EPS development ($0.45 precise EPS in This fall ’21) on 6% income development.

Since September ’20, Coke has put up some good EPS “upside surprises” – between 10% and 20% – however that has begun to reasonable the final two quarters, because the EPS shock was simply 4% – 8%.

For full-year ’22, it is anticipated if the This fall ’22 consensus is met that KO income will develop 14% y.y whereas EPS will develop 6% y.y.

Longer-term look:

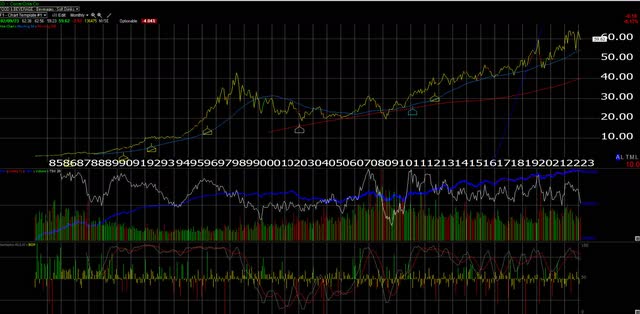

KO vs SPY whole return 2000 by means of 2022 (YCharts)

Warren Buffett purchased Coca-Cola within the late Nineteen Eighties when its case quantity development was fairly sturdy, and the inventory was the darling of the Nineteen Eighties and Nineteen Nineties secular bull market.

KO’s inventory truly peaked or hit an all-time-high in July ’98 simply previous to the LongTerm Capital Administration disaster, when then-Fed Chairman Alan Greenspan needed to recruit the banks to bail out Wall Avenue companies. KO was buying and selling round $47 – $48 in late July ’98, and it then did not make a brand new all-time-high till 2019. (See month-to-month chart beneath.)

KO month-to-month chart (Worden )

The inventory hasn’t damaged out within the conventional sense from that 1998 excessive, however has meandered forwards and backwards from the excessive $50s to mid $40s through the years, after divesting the bottling operations re-focusing the enterprise on case quantity and new product development.

The very fact is after the inventory acquired crushed on the shutdown of sporting occasions round Covid, Coke has rebounded neatly with higher case quantity and even pricing development: I assumed I learn after Q2 ’22 or Q3 ’22 (within the quarterly notes) that Coke had pushed by means of 12% value improve and case quantity nonetheless remained optimistic.

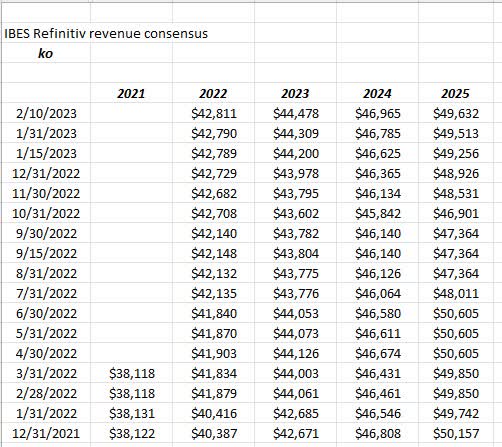

Ahead EPS and income estimate revisions:

KO ahead EPS estimate revisions (IBES Information by Refinitiv)

KO ahead income est’s and revisions (IBES knowledge by Refinitiv )

Whereas EPS estimates are extra “blended” the 2023 and 2024 income stopped declining and began to rise in October ’22 when the greenback started to reverse its file energy.

Is it sufficient to maneuver the valuation needle – in all probability not – however a small wind at your again isn’t a foul factor.

Coke is buying and selling at 20x common “anticipated” EPS development over the subsequent few years of simply 5%, and 20x cash-flow, so it is unlikely readers won’t ever get an opportunity so as to add to Coke at a screamingly-cheap valuation.

One clear optimistic: free-cash-flow development

| Trailing free-cash technology | FCF | development |

| 4 qtr (1-yr) avg | $11.9 bl | 8% |

| 12 qtr (3-yr) avg | $11.0 bl | 15% |

| 20 qtr (5-yr) avg | $9.6 bl | -1% |

| 40 qtr (10-yr) avg | $9.7 bl |

Supply: valuation spreadsheet, from earnings experiences and 10-Qs

Readers might marvel why concentrate on the geeky stuff like free-cash-flow technology, however this has a big effect on KO’s return-of-capital to shareholders and in addition the buyback functionality.

The valuation spreadsheet on KO goes all the way in which again to June 1997, and from March 2015, by means of early 2021, KO was paying out greater than 100% of its free-cash-flow on simply dividends alone.

At the moment, partly as a result of enchancment within the enterprise post-Covid and partly as a result of lack of the capital drag from bottling, as a share of free-cash-flow, KO’s dividend (in whole {dollars}) is now 75% and nonetheless falling.

When it comes to high quality of earnings, KO ought to actually be producing cash-flow and free-cash-flow that’s greater than 100% of web earnings, but it surely’s not and though it is improved, it may nonetheless be higher.

Listed below are the numbers on cash-flow and free-cash-flow vs web earnings:

KO’s high quality of earnings take a look at (Valuation spreadsheet )

Abstract/conclusion:

Since being named CEO in 2017, James Quincey has executed a great job and gotten the vital metrics shifting in the precise path, however there’s extra work left to do.

The stagnation within the CSD (carbonated smooth drink) market has pressured KO to look elsewhere for development and whereas they’re making strides, the legacy enterprise nonetheless dominates.

James Quincey tried to department into hashish, however I assumed Mr. Buffett and Mr. Munger pushed again on that (or at the very least that was my impression), so KO has tried to develop some alcoholic-beverage choices, which is a large market, however the tempo at which KO strikes, I am going to in all probability be lifeless earlier than that’s ever a fabric a part of the model (if ever).

Coming into Tuesday’s earnings launch, shopper staples have cheapened up significantly – KO is down 4% within the final 30 days per our technical software program.

The inventory is about 1% place in shopper accounts (not all accounts both) and its consistency and stability of earnings development, to not point out its decrease beta, can supply consolation in unsure markets.

A commerce all the way down to $55 or the 200-week shifting common can be a great place so as to add to the place, however it might by no means get there.

Among the basic enhancements, I would prefer to see KO proceed to enhance upon are free-cash-flow development as a share of web earnings, proceed with the constant return of capital (each dividends and share repo’s) and continued income and case-volume development.

Coke has proven some life after Covid ended and the US economic system has reopened. Would like to see that proceed.