[ad_1]

As soon as upon a time, earlier than George Soros grew to become a liberal activist, he was an awesome dealer. That’s the place he earned the cash to fund his causes.

As a dealer, Soros could be most well-known for breaking the Financial institution of England.

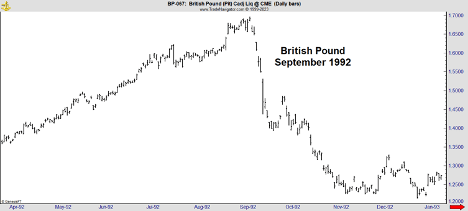

Again in 1992, the UK was making an attempt to tie its forex to the European Charge Mechanism, a precursor to the euro. The BOE was required to help the worth of the pound to be a part of the ERM.

Soros believed there have been too many financial variations between the U.Ok. and Europe for that plan to work. His evaluation confirmed the worth the BOE was required to defend was too excessive. He didn’t assume England had sufficient cash to try this.

He was so certain of his evaluation, he began betting in opposition to the pound in the summertime of 1992. Because the pound rallied, Soros elevated the dimensions of his wager. He was quick about $10 billion value of kilos when the Financial institution of England threw within the towel and allowed the pound to fall.

Soros’ commerce labored as a result of he believed markets are stronger than central banks. Right now, merchants would possibly come to the alternative conclusion.

Since 2009, central banks just like the Federal Reserve have been the one largest issue behind the unimaginable highs in inventory costs.

Each the Fed and the European Central Financial institution (ECB) pushed rates of interest to ranges that appeared inconceivable in 2007. Nobody thought rates of interest may very well be detrimental. But, the ECB achieved that purpose. (The Fed stopped at zero.)

Such low charges nearly demanded traders purchase shares, as bond yields had been hardly ever sufficient to beat inflation.

Now although, each of these banks are attempting to unwind their heavy-handed insurance policies with out inflicting a crash. They could succeed, even when these shifts result in years-long bears of their respective inventory markets.

However the Financial institution of Japan (BOJ) is in a league of its personal…

And due to the way it behaved post-2008, it now threatens your entire world economic system.

Breaking the Financial institution of Japan

In 2023, the BOJ pushed actual rates of interest on 10-year authorities bonds beneath 1% and into detrimental territory 5 years later.

To do that, like all central banks, the Financial institution of Japan purchased its personal authorities bonds.

Focusing on ultralow yields on 10-year bonds is dear. Within the first month of this yr, BOJ purchased $265 billion of presidency bonds. That’s about 6% of Japan’s annual GDP. And that was only one month of shopping for.

The architect of this coverage, present BOJ governor Haruhiko Kuroda, steps down in April.

Based on The Wall Avenue Journal, Kazuo Ueda might be his successor. He must be in place for conferences on April 27-28 and June 15-16.

Ueda holds a doctorate in economics from MIT. He was a classmate of former Fed Chairman Ben Bernanke. He and Bernanke shared the identical advisor, Dr. Stanley Fischer.

Ueda wrote within the Nikkei newspaper in July 2022 that the BOJ’s coverage of concentrating on detrimental charges for 10-year yields was an issue. He mentioned speculators may goal the financial institution. And he suggested an exit technique from Japan’s ultra-loose financial coverage.

That tells me he’ll abandon the coverage as soon as he turns into governor.

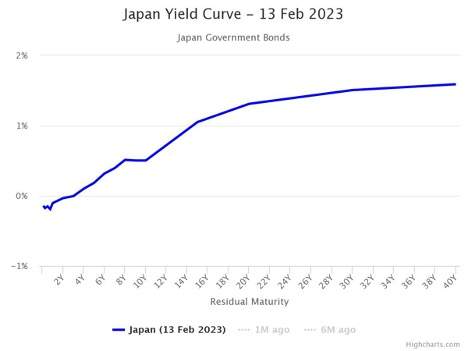

However it received’t be straightforward. The yield curve for Japanese authorities bonds reveals that charges rise quickly past 10 years.

If Ueda tightens coverage rapidly, charges will soar. That can trigger massive losses in bond portfolios. Insurers and pension funds would face a disaster. This occurred in the UK in September throughout Liz Truss’ short-lived Prime Ministership — the U.Ok. is now in a deep recession.

If Ueda acts slowly, speculators will assault Japanese monetary markets. Funds will wager in opposition to Japanese bonds. They’ll additionally purchase yen for the reason that yen ought to profit from increased charges.

That’s doubtlessly unhealthy information for exports which account for about 18% of Japan’s economic system — nearly twice as a lot as the ten% of financial exercise U.S. exports make up.

Any slowdown in exports may threaten progress in Japan and that’s a danger the BOJ can’t settle for. Ueda faces a disaster it doesn’t matter what he does. Japan’s insurance policies have created the right storm for international monetary markets. As circumstances change, fortunes might be made and misplaced.

Soros might be too busy being a liberal activist to commerce this proper now. However we aren’t.

The most secure commerce for traders within the U.S. is in U.S. shares. To be clear, I don’t imply shopping for them.

I imply shorting them.

Japan Heads Us Towards a International Recession

Japan’s coverage shift will create a worldwide liquidity disaster. Hedge funds going through losses in Japan might be compelled to promote different property to cowl their margin calls. In occasions like that, they usually promote U.S. Treasurys and shares. This may push charges up and trigger an financial slowdown.

Shorting U.S. shares is essentially the most readily accessible and doubtlessly most profitable technique to commerce this example, as U.S. markets are the biggest and most liquid on the planet.

It’s attainable Japan will set off a worldwide recession later this yr. One of the best merchants might be centered on short-term alternatives to navigate what may very well be essentially the most thrilling market of our lifetimes.

One such dealer is my good friend Adam O’Dell. He, like me, is effectively conscious of the systemic dangers that international markets face proper now. And he’s not sitting idly by. He’s discovering methods to revenue because it all shakes out.

To be clear, Adam isn’t essentially recommending his subscribers attempt breaking the Financial institution of Japan.

The commerce he has in thoughts is way less complicated. And it truly doesn’t even contain shorting.

His methodology of buying and selling includes restricted, measured danger and far increased potential rewards than any quick commerce would provide you with.

And if he’s proper, collaborating may end in multiples in your cash earlier than the yr is out.

Try the total particulars of Adam’s commerce — which he revealed for the primary time earlier this week — proper right here.

Regards,

Michael CarrEditor, One Commerce

Michael CarrEditor, One Commerce

[ad_2]

Source link