spxChrome/iStock by way of Getty Photographs

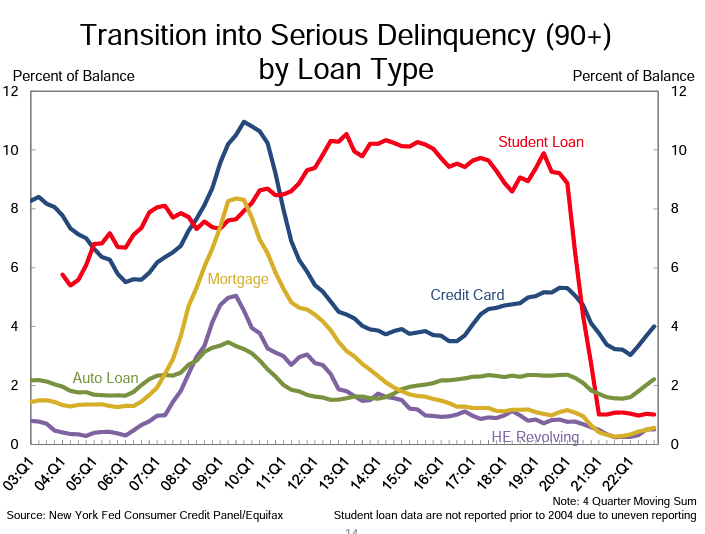

January’s bank card metrics typically present some deterioration in credit score high quality as customers take care of the realities of their vacation spending. Which means the month’s knowledge are sometimes skewed by seasonal tendencies. Taking the broader view, sure, the credit score high quality is trending down as pandemic period stimulus packages have lengthy expired (aside from the pause on federal pupil mortgage funds).

Baird analyst David George, who covers six of the seven shares within the desk beneath, summed up January’s bank card metrics, saying internet charge-offs have been worse than the standard seasonality, seasonal mortgage steadiness run-off price was increased than anticipated, and delinquencies elevated M/M according to seasonal expectations. The one inventory that George would not cowl within the In search of Alpha desk is Bread Finanancial (NYSE:BFH).

Within the broader image, card losses proceed to strategy the “regular” vary, that’s prepandemic degree, which he expects to happen throughout FY2023, George mentioned. His suggestion on shares is to attend till American Specific (NYSE:AXP) and Capital One (NYSE:COF) pull again earlier than including to positions.

Uncover Monetary (NYSE:DFS) noticed its January delinquency price of two.67% meet the prepandemic degree of two.65%; its internet charge-off price of two.81% nonetheless stays nicely beneath 3.45% in January 2020.

Wolfe Analysis analyst Invoice Carcache factors out that Uncover (DFS) and Bread Monetary (BFH) each broke above their 2019 ranges. For the 5 bank card shares he covers (AXP, COF, DFS, SYF, and BFH), delinquency charges on common rose 99 foundation factors Y/Y and stay 44 bps beneath 2019.

He reiterates his Underweight stance in card issuers as Wolfe Analysis macro strategist Chris Senyek believes the Federal Reserve will set off a recession because it seeks to chill labor markets.

“We anticipate delinquency price formations to proceed to rise over the approaching months earlier than accelerating later within the yr because the lengthy and variable lags related to financial coverage” finally drive a rise in preliminary jobless claims, Carcache mentioned in a current notice. In consequence, he expects “modest degradation in credit score and better internet charge-offs (30% above 2019 ranges, aided by denominator results as mortgage progress in the end slows).”

| 2023 | 2022 | 2020 | ||||||

| Firm | Ticker | Kind | January | December | November | 3-month common | January | Change in bps |

| Capital One | COF | delinquency | 3.65% | 3.43% | 3.32% | 3.47% | 4.10% | -45 |

| charge-off | 3.81% | 3.57% | 3.14% | 3.51% | 4.31% | -50 | ||

| American Specific | AXP | delinquency | 1.00% | 1.00% | 0.90% | 0.97% | 1.60% | -60 |

| charge-off | 1.50% | 1.20% | 1.00% | 1.23% | 2.30% | -80 | ||

| JPMorgan | NYSE:JPM | delinquency | 0.83% | 0.76% | 0.73% | 0.77% | 1.14% | -31 |

| charge-off | 1.17% | 1.24% | 1.64% | 1.35% | 2.19% | -102 | ||

| Synchrony | NYSE:SYF | delinquency | 3.80% | 3.70% | 3.60% | 3.70% | 4.50% | -70 |

| adjusted charge-off | 4.30% | 3.40% | 3.70% | 3.80% | 5.20% | -90 | ||

| Uncover | DFS | delinquency | 2.67% | 2.53% | 2.36% | 2.00% | 2.65% | 2 |

| charge-off | 2.81% | 2.54% | 2.46% | 2.60% | 3.45% | -64 | ||

| Bread Monetary | BFH | delinquency | 5.80% | 5.50% | 5.40% | 5.57% | 6.00% | -20 |

| charge-off | 6.70% | 6.70% | 6.10% | 6.50% | 7.20% | -50 | ||

| Citigroup | NYSE:C | delinquency | 1.04% | 1.01% | 0.98% | 1.01% | 1.58% | -54 |

| charge-off | 1.50% | 1.34% | 1.33% | 1.39% | 2.49% | -99 | ||

| Financial institution of America | NYSE:BAC | delinquency | 1.09% | 1.03% | 1.02% | 1.05% | 1.61% | -52 |

| charge-off | 1.50% | 1.43% | 1.33% | 1.42% | 2.54% | -104 | ||

| Avg. delinquency | 2.49% | 2.35% | 2.29% | 2.37% | 2.90% | -41 | ||

| Avg. charge-off | 2.91% | 2.68% | 2.59% | 2.73% | 3.71% | -80 | ||

The Federal Reserve Financial institution of New York’s This fall Family Debt and Credit score Report confirmed that bank card balances reached a brand new collection excessive at $986B. That spells bother for when the following recession hits. “It’s triple bother for bank card debtors. Balances are up, charges are up and extra individuals are carrying bank card debt (46 % of credit score cardholders, up from 39 % a yr in the past),” mentioned Ted Rossman, senior trade analyst at Bankrate.

SA contributor Lance Roberts explains why the buyer is more likely to be the most important loser when recession hits.