[ad_1]

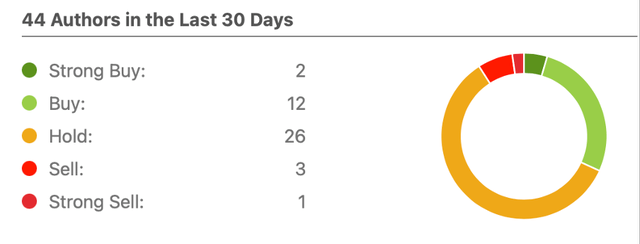

I not too long ago checked out Apple (NASDAQ:AAPL) and was shocked that the majority articles rated the inventory as a maintain or purchase, with solely 4 promote scores out of 44, of which only one as a powerful promote.

Apple inventory SA authors score breakdown (In search of Alpha)

I see Apple as a powerful promote and overvalued for two quite simple causes: A excessive valuation and slower than anticipated development forward.

Let me begin by discussing what’s presently priced within the inventory, elaborate on how it’s unlikely these expectations will probably be met and conclude by displaying how the danger of investing in Apple is excessive whereas the reward is low. Not a state of affairs I wish to be in relating to investing.

What Is Priced In

A take a look at EPS estimates is a simple technique to see what are the expectations priced in a inventory. My problem with EPS estimates is that these are often linear in nature and too short-term for investing functions. Most analysts make solely two-year estimations as a result of these are Wall Avenue’s requirements and even after they make these, it’s often based mostly on previous tendencies.

Apple inventory EPS estimates (In search of Alpha)

The consensus is that Apple will see flat earnings for 2023 as we have now seen a slower quarter, however going ahead analysts anticipate Apple will merely proceed to develop at roughly 10% per yr. After all, if 2023 is only a pause development yr and development resumes onward, Apple deserves the present valuation of 25. In that case, earnings are anticipated to double over the following 7 years, and the inventory ought to observe, all else equal.

Nevertheless, I’ve been following Apple for some time and I do know that linearity isn’t how Apple’s enterprise works. In 2016 I thought-about Apple a purchase as a result of Wall Avenue’s expectations had been of no development forward based mostly on only one yr with declining revenues and stagnant iPhone gross sales (2015). The P/E ratio was 10 and few appreciated Apple’s outlook. Now in 2023, after two nice years of robust development, Wall Avenue could be too exuberant.

[ad_2]

Source link