photovs/iStock Editorial by way of Getty Photographs

United Airways (NASDAQ:UAL) introduced the launch of an funding automobile to help development in sustainable aviation gas analysis, know-how and manufacturing. That one thing must occur to make aviation extra sustainable is simple particularly when we wish to attain web zero emissions by 2050. Whereas I’m not unfavourable on the funding automobile, I do suppose that its preliminary influence shouldn’t be overstated and the challenges with sustainable aviation gas shouldn’t be understated.

What’s Sustainable Aviation Gasoline?

Sustainable aviation gas or SAF is aviation gas produced from sustainable feedstocks reminiscent of used cooking oils, animal fat, crops and biomass amongst others. Present laws don’t permit operations of 100% sustainable aviation gas operations and the utmost allowable mix with standard fuels is 50%. Extensive scale adoption of sustainable aviation gas would cut back carbon emissions by 80%.

Why is SAF wanted?

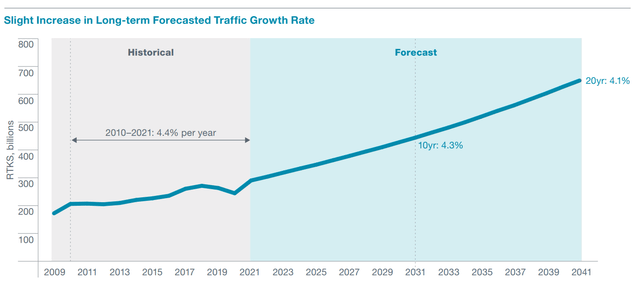

Boeing

Clearly to get to web zero drastic adjustments in aviation are wanted. However why is it wanted. General SAF is required as a result of the aspiration is to turn out to be carbon impartial by 2050. The explanation why particularly SAF is likely to be wanted or every other drastic device to cut back emissions is as a result of site visitors is anticipated to double within the coming 18 years, and usually in an undisturbed market, this doubling would have already got occurred after 16 years. The best way airplane growth is flowing now, the expansion in site visitors shouldn’t be being offset by technological development in airplane design and turbofan know-how. Plane iterations and designs come roughly each 15 years and normally have 15 to twenty % decrease gas burn and thus emissions.

CFM

The CFM LEAP engines as an example present a 16% discount in gas burn particular gas consumption. Modeling the discount at 15% because of this in case you had been to exchange the whole in-service fleet from in the future to the opposite with a brand new subsequent technology jet, you wouldn’t be chopping emissions. Airways would solely be chopping particular emissions, however as a complete, the carbon footprint would nonetheless be greater. You’ll be trying on the carbon footprint being roughly at 165% to 175% from the place they’re as we speak. The present technological progress in aerodynamics, turbine know-how and implementation feasibility merely doesn’t permit for extra important reductions. A attainable 80% lower would imply that the carbon footprint would drop to 35% on double the site visitors which already is a significant increase. So, most positively there’s massive potential for SAF.

In 2013, I already wrote about artificial fuels discussing the discount of fuels with the next power density fashioned by way of Fischer-Tropsch processes and I got here to the conclusion {that a} extra energy-dense gas may shave off round 1.4% of gas utilization in a single iteration. If feathered into airplane design from the beginning, that would quantity to a major discount in gas utilization. Going to net-zero actually does require SAF, however electrification and design evolution are additionally required.

Is United Airways Pioneering In Aviation?

The large query in fact is whether or not United Airways is pioneering aviation. They did purchase 100 19-seat electrical planes from Coronary heart Aerospace and 100 eVTOLs from Archer Aviation, however the firm additionally signed a purchase order settlement for Growth’s supersonic jet which is only a greenwash in my opinion. Indirectly you can say they’re evolving, however I positively wouldn’t contemplate a $100 million funding in a SAF fund to be a pinnacle of pioneering.

Initially, this isn’t a United Airways solely program. There are companions concerned reminiscent of Air Canada (AC:CA), Boeing (BA), GE Aerospace (GE), JPMorgan Chase (JPM) and Honeywell (HON). These six corporations launched with a mean funding of $16+ million or $100+ million mixed. Simply measuring it towards United’s money circulation provides you an concept of how small their preliminary dedication actually is. United Airways had $6.1 billion in working money circulation in 2022 and capital expenditures of $2.7 billion giving the corporate a $3.4 billion free money circulation. The whole funding within the fund is 2.9% measured towards the free money circulation or 1.6% with the capital expenditures added again. Assuming that every one events made an analogous funding, then we’re taking a look at 0.27% of the working money circulation of 2022 being invested on this fund. United Airways is touting a $100+ million funding within the fund however realistically it’s a very small sum measured towards the free money circulation. There isn’t a approach United Airways would state “We simply invested 0.3% of our free money circulation for a sustainable future”, as a result of it will look relatively ridiculous and meaningless however that’s the actuality.

United Airways talked about in its press launch that passengers have the choice to contribute to United Airways’ funding. So, not directly they’re additionally making an attempt to make the traveler pay. It’s good that passengers have the choice to contribute to it, however it will have spoken volumes if United Airways would truly not directly or kind have matched the dedication from the traveler or laid out an funding street map and they didn’t do this. The IEA calculated that to be able to attain the online zero emissions goal by 2050, the funding in clear power has to triple from 2025 to 2030 to $4 trillion. A $100 million funding looks as if a drop within the ocean and it truly is. Moreover that, letting passengers “purchase” SAF shouldn’t be new. KLM already lets passengers contribute to boost SAF manufacturing and the corporate launched the event of the primary plant for manufacturing of sustainable aviation gas was introduced in 2019 already. So, United Airways doesn’t appear to be one thing thoughts blowing right here.

Massive Phrases For A Small Dedication To Resolve A Massive Downside

Realistically, we additionally do not see any roadmap on how the UAVC Sustainable Flight Fund will obtain its objectives. The press launch on mentions the next:

In an effort to rally companies and shoppers, United as we speak launched the United Airways Ventures Sustainable Flight Fund, a first-of-its-kind funding automobile designed to help start-ups centered on decarbonizing air journey by accelerating the analysis, manufacturing and applied sciences related to sustainable aviation gas (SAF).

So, the corporate tries to speed up the analysis, manufacturing and SAF-related applied sciences, however nowhere does it set any targets or ambitions. Round 2030 world jet gas demand can be round 200 million barrels and virtually 600 million barrels by 2050. United has dedicated to purchasing three billion gallons of SAF over an unspecified timeframe and S&P International Commodity Insights calculated demand for SAF may rise to five.8% of the worldwide jet gas demand. Additionally, net-zero emissions are a noble goal for 2050 however actuality is that whereas SAF has probably the most potential for net-zero emissions, the feedstock for SAF is considerably restricted which means that the numerous discount of 65% in emissions on doubling site visitors is out of attain. The trade is by no means on a trajectory to come back even near assembly the net-zero emissions aspirations, as a result of they’re simply that “aspirations” and we see inadequate backing to mitigate the bottleneck which is availability of feedstock and a $100 million funding is realistically not going to maneuver the needle particularly since United Airways and its companions haven’t set any targets. All of it comes off as PR hyping on small investments.

I did my design synthesis train to acquire my BSc in Aerospace Engineering on a venture to realize a 75% discount amongst different targets based on the Flight Path 2050 targets for an plane the dimensions of the Airbus A321neo and what we discovered is that availability of feedstock for SAF is so limiting that one can’t obtain these targets with SAF. Different parts reminiscent of revolutionary designs are required.

TU Delft

In case we supply on with the present plane growth trajectory and use the SAF availability by 2050, we may solely get to a discount of 30%, 28 share factors of that’s pushed by airplane design evolution in two design cycles for the normal fuselage-wing configurations and a pair of share factors is pushed by the applying of SAF. That fast calculation additionally doesn’t have in mind the gradual fleet substitute relatively than an immediate substitute. So, we’re far-off from attending to net-zero emissions, and whereas the potential of SAF is massive, its restricted capability makes attaining the emission objectives impossible. With the present anticipated scarcity of sustainable aviation fuels, way more is required to get to a greener future and net-zero emissions even whereas touted by airways is out of sight and we aren’t seeing any significant funding to vary that.

How A lot Is Jet Gasoline Per Gallon?

At present a gallon of conventional fossil fuels prices round $2.55. As a result of scarcity of SAF, it prices round 2 to 9 instances greater than conventional fossil fuels. So, the explanation why United Airways desires to put money into growth of SAF manufacturing is obvious as a result of provide will rise and prices will come down however $100 million and not using a growth and funds roadmap is near meaningless.

Is United Airways Inventory A Purchase?

In search of Alpha

I marked shares of United Airways a purchase in December and since then the inventory has gained 20%. Nevertheless, the sustainable aviation gas funding doesn’t make United Airways shares kind of enticing. It barely is notable on the corporate’s money circulation, and in addition for folks on the lookout for inexperienced investments, there is no such thing as a purpose to purchase United Airways inventory.

Conclusion: United Airways Inventory A Purchase However Not As a result of Of Web-Zero Aspirations

I proceed to imagine that shares of United Airways are a purchase as the corporate is lastly committing to required fleet adjustments and the demand atmosphere for air journey stays sturdy. Nevertheless, in case you take a look at their net-zero emissions aspirations, there is no such thing as a purpose to purchase the inventory as a result of if we take a look at the challenges the trade faces, the comparatively low funding and the dearth of a roadmap to deploy the funds, there is no such thing as a readability or required scale to unravel the SAF dilemma.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.