[ad_1]

On a heat August morning in 2013, I took a gathering that modified my life.

The subject of dialogue? How bitcoin would change the world.

As I ate breakfast alongside enterprise capitalists and hedge fund merchants, our featured visitor Barry Silbert took the ground.

I realized that day that Barry and I share greater than a love of bitcoin. We each began at Salomon Brothers within the late ‘90s. I used to be in bond buying and selling and he was on the opposite facet of the agency in asset administration.

After Salomon, Barry went on to begin Second Market, a preferred buying and selling alternate for pre-IPO shares. Because the final decade of enterprise capital exercise has proven us, Barry’s bought a knack for recognizing huge alternatives.

He mentioned, very plainly: “I’ve invested a considerable portion of my web value in bitcoin, and I consider this can sooner or later be the world’s world reserve foreign money.”

On the time, this was verging on the insane.

Bitcoin was nonetheless buying and selling under $100 after falling from over $1,000. Only a few folks have been taking it severely.

Criminals used it to purchase unlawful items on darkish websites like Silk Highway. It was troublesome to put money into for the on a regular basis individual, and not possible for monetary establishments who needed to observe guidelines. Even in case you did handle to purchase it, folks have been being hacked and exchanges have been imploding left and proper.

However regardless of all this, after listening to Barry’s pitch … I knew I wanted to be taught extra.

If this was going to be the subsequent huge factor, I didn’t need to miss it. However I additionally needed to check it out first.

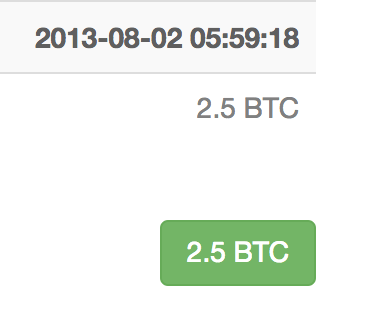

So I purchased 2.5 bitcoins for $250. I even discovered the transaction receipt, right down to the second I positioned the order.

And I want I’d purchased way more.

Over the subsequent few years, Barry nailed it.

Bitcoin blew up! It went from $100 on that August day to a excessive of $20,000 in 2017 — a 19,900% achieve. That was the height of “bitcoin mania.”

Barry based Digital Forex Group two years after our assembly … which, via its subsidiary Grayscale, finally launched the first-ever bitcoin funding car to the inventory market.

However bitcoin’s emergence was solely the beginning of the crypto revolution.

Because it burst onto the scene 14 years in the past, 1000’s of cryptocurrencies have sprung up. Every has a special use, however all of them share a standard theme: transacting and not using a intermediary.

At present, like Barry did 10 years in the past, I’m going to stay my neck out and say one thing you may suppose is a little bit bit insane.

Investing in cryptocurrency now’s akin to investing in dot-com corporations again in 2004.

Should you had purchased eBay, Google, or Amazon again then — after they collapsed from their highs — you’d be sitting on a achieve of 248%, 3,400%, 4,200% respectively.

I pick these three corporations as a result of all of them launched through the bubble and nonetheless stand robust at the moment. They have been the “subsequent technology” tech corporations after the “first-gen” Apple and Microsoft that got here earlier than.

Like them, Bitcoin was the primary technology of cryptos.

As this expertise matures, the subsequent generations of cryptocurrencies are going to be lifechanging — and extremely worthwhile.

Right here’s what I imply…

Why Blockchain & Net 3.0 Is a Large Deal

The explanation I’m so bullish on bitcoin and plenty of different cryptos is due to blockchain expertise.

Should you don’t know a lot about blockchain, simply consider it as a digital ledger that ensures the accuracy of transactions with laptop code.

Every platform constructed on a blockchain has a local cryptocurrency. These are used to maintain tabs on who owns what inside that particular community.

Since every person’s historical past is saved on the blockchain, you’ll be able to transact to anybody on the earth and not using a intermediary or centralized entity to approve. Anybody can see any transaction at any time, and this shared report successfully replaces the intermediary.

This technique is extraordinarily safe. It’s truly thought of not possible to hack, as a result of a hacker must change the transaction historical past on each laptop on the community to take action.

However blockchain expertise isn’t merely an alternate cost system. It’s additionally set to provide us extra management of our personal information.

In actual fact, it’s set to energy a pattern that I count on will massively disrupt each side of our lives.

Every little thing from actual property, insurance coverage, well being care, vitality, provide chains, the federal government — you identify it.

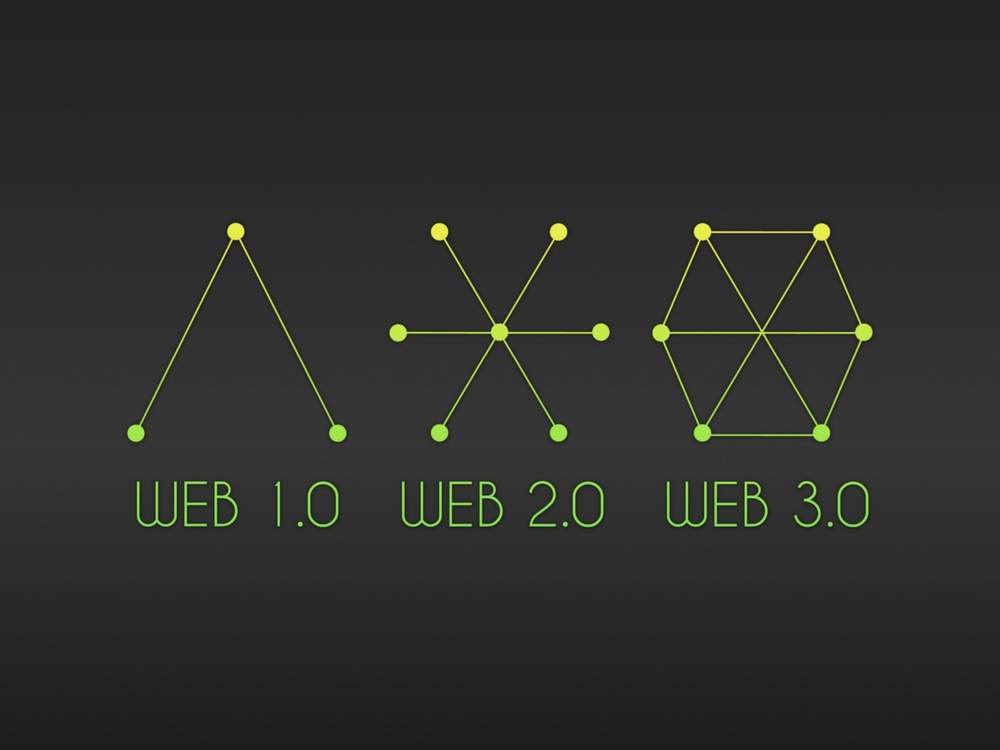

This motion is named Net 3.0 — the third, latest technology of the web.

Earlier than I outline precisely what that’s — and the way blockchain is powering it — let’s have a look at how we bought right here.

Bear in mind dial-up modem? While you needed to have a phoneline to hook up with the web, and it took hours to obtain a track?

That was Net 1.0. On this period, main corporations like Microsoft and Yahoo managed the web.

Net 1.0 is essentially often called the “Learn” model of the web. It is because on a regular basis customers might solely actually learn what huge corporations put on the web, not add or interact with it in any manner. It additionally wasn’t simple to speak to different web customers outdoors of e mail and instantaneous messengers.

Then got here the rise of content material technology, interactive internet functions and social media. Seemingly in a single day, anybody with an web connection might create their very own blogs, share their social gathering photographs on Fb or their political beliefs on Twitter. As a substitute of simply “Learn,” the web grew to become “Learn and Write.”

This was Net 2.0. This section of the web additionally unleashed modern corporations with large market caps. It enabled podcasting and music streaming (Spotify), vlogging (YouTube and TikTok), and social media (Fb and Twitter).

With this innovation got here the lengthy tech increase we’ve seen for the reason that market bottomed in 2009. And a few analysts estimate the web has generated $10 trillion of financial worth because it was invented — largely because of Net 2.0.

However whereas Net 2.0 unleashed a courageous new world of funding, it got here at a value: our private information.

In Net 2.0, person information grew to become the world’s most precious commodity. It allowed Large Tech companies to regulate the web. And their algorithms had one mission: to seize your consideration by selecting what you need to learn or watch.

Don’t get me incorrect. Gmail, Airbnb, Twitter and the like are helpful platforms. However the draw back is that Large Tech corporations like these now have entry to our likes, photographs and even personal conversations. They usually get to find out what their algorithms present us.

That’s why the world is prepared for the subsequent technology of the web — Net 3.0.

The most important change Net 3.0 will carry is the best way we reclaim our information.

As a substitute of centralized corporations controlling the web — Amazon, Fb, Google — we’ll have the ability to maintain onto our personal information and share it solely when (and if!) we need to. It’s including an “Possession” layer onto the Learn and Write capabilities of Net 2.0.

And what’s the expertise driving this revolution in digital privateness?

That’s proper — blockchain.

That’s why once I hear others say “Oh, bitcoin is a rip-off” or “Crypto is simply to make the rip-off artists richer,” I’m confused.

Being anti-crypto in 2023 is loads like being anti-internet in 2004.

Positive, is crypto harmful within the incorrect fingers? Completely.

However to be truthful, the identical may be mentioned of the web. And that didn’t cease web corporations like Amazon, eBay and Alphabet from amassing large beneficial properties over the previous 20 years.

So, right here’s the factor: You don’t should “consider” in crypto to get wealthy on it. In actual fact, you don’t even want to know all the pieces about it.

That’s why I’m right here.

Crypto’s Turning Level

Everybody likes to slam crypto. In actual fact, bitcoin simply celebrated its 14th birthday — even supposing it’s been declared lifeless 471 occasions by everybody from Forbes, to Bloomberg, to The New York Occasions.

With that sort of observe report, clearly the mainstream media doesn’t know what it’s speaking about.

I’ve been following cryptocurrencies for the previous decade. I based and presently run a buying and selling service devoted to buying and selling crypto. At this level, I eat, breathe and sleep crypto.

And I’m telling you, crypto is not lifeless. In actual fact, it’s about to enter a brand new bull market.

And at the moment, I’m revealing the 2 indicators I observe which can be telling me it’s time to get again into crypto.

Should you’d like to observe my webinar and get the information for your self, simply click on proper right here.

And afterwards, I need to hear from you. E mail me at BanyanEdge@BanyanHill.com and let me know two issues:

- Are you bullish or bearish on crypto?

- In case you are fully “anti-crypto,” inform me why. Do you suppose it’s a rip-off? Do you suppose the basics are simply not there? Don’t maintain again.

I’ll be writing on this Sunday’s Banyan Edge article. Who is aware of — perhaps your suggestions is the one I’ll characteristic!

Regards,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Except you’ve been residing beneath a bridge, you’ve possible heard of ChatGPT, the brand new synthetic intelligence chatbot launched by Microsoft-funded OpenAI. I’ve spent the final week enjoying with it. And admittedly… it’s scary what this factor can do.

Think about one thing with Google’s data base… however as a substitute of discovering a listing of internet sites for you in response to a search question, it successfully scans all identified info and summarizes it for you, even expressing opinions. And it learns out of your follow-up questions.

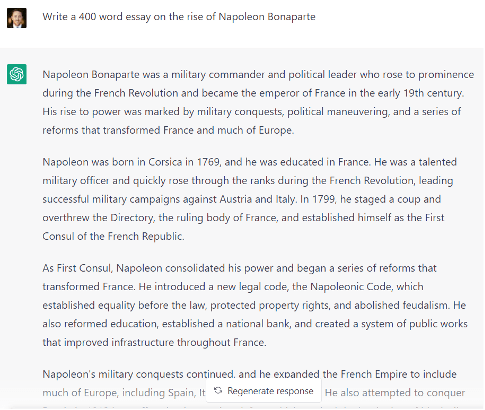

Only for grins, I requested it to put in writing a 400-word essay on the rise of Napoleon Bonaparte. It produced an excellent however not essentially distinctive abstract that regarded prefer it got here out of a well-written encyclopedia. I’d count on one thing comparable from a university historical past main.

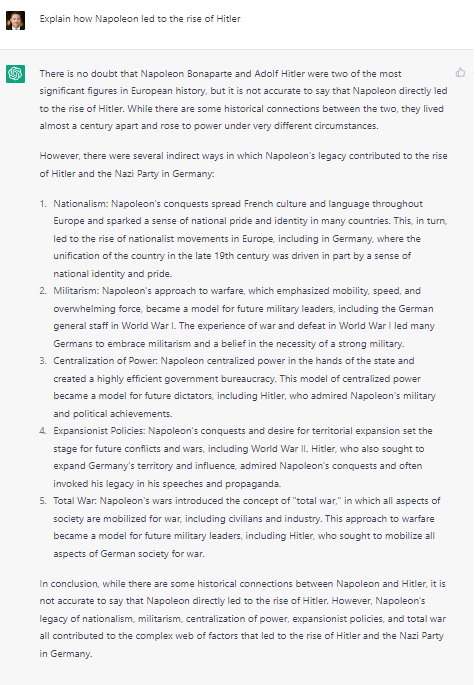

However right here’s the place it begins getting attention-grabbing. In response to its essay, I requested it to elucidate how Napoleon led to the rise of Adolph Hitler.

And inside seconds, it detailed how Napoleon’s rise coincided with nationalism, militarism, centralization of energy, expansionist insurance policies and whole struggle… all of which outlined the rise of Nazi Germany. It was an evidence I’d have anticipated from a PhD candidate.

After which I actually began taking place some obscure rabbit holes. I requested its sister AI module, Dall E, to create a picture of Napoleon Bonaparte that regarded like a Picasso portray. And it did.

Now, I’m simply enjoying with this. A pc-generated picture of Napoleon that appears prefer it was painted by Pablo Picasso is a humorous dialog starter at a celebration however hardly something of worth.

However then…

I used to be having drinks in Playa del Sol in Peru final week with a pal who occurs to be the top of selling for a significant telecom agency within the area. He instructed me he began enjoying with OpenAI’s toys… and ended up making a advertising marketing campaign that went viral.

A activity that may usually take a group of selling of us six weeks to place collectively was completed by one man in a matter of minutes doodling on his laptop computer.

Take into consideration the potential functions because the capabilities enhance.

Coding initiatives that may have taken groups of software program engineers is perhaps completed by one or two. Authorized briefs that may have wanted a military of attorneys to place collectively is perhaps written by a single lawyer and a chatbot. For all you recognize, the subsequent subject of Banyan Edge is perhaps written by ChatGPT… although I’d prefer to suppose we’re a little bit more durable to exchange.

We’re on the verge of a productiveness explosion. This can create alternatives we will’t even think about.

And this large shift is going on simply because the web transitions to Net 3.0.

Make no mistake, AI will turn into an enormous a part of the Net 3.0 story.

Proper now, essentially the most direct publicity you may get to AI is thru Microsoft (MSFT), with its current $10 billion stake in OpenAI. However don’t be stunned to see alternatives within the cryptocurrency house spring up within the coming years.

Ian King’s essentially the most related crypto researcher I do know, and he simply launched a brand new presentation on what he’s calling Crypto’s Turning Level.

Ian believes proper now’s the time to get ready for the subsequent crypto bull market. Be taught why proper right here.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link