Kativ/iStock Unreleased by way of Getty Pictures

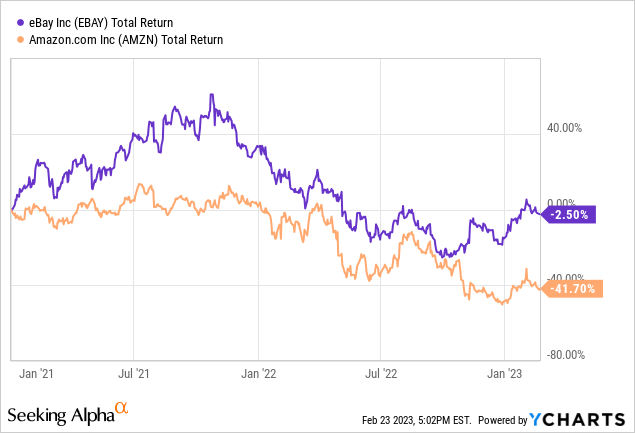

On the finish of December 2020 right here, I advised a profitable unfold commerce thought can be to personal eBay Inc. (NASDAQ:EBAY) as an extended place, equally weighted towards Amazon.com Inc. (NASDAQ:AMZN) as a brief. The objective was to cut back coming volatility and downward strikes within the general market, whereas pairing one thing of a high-margin worth choose towards a low-margin development favourite (with Amazon extraordinarily stretched for a valuation throughout the center of the COVID pandemic ship-to-home craze). And, this commerce has labored out fairly handsomely over two years and a number of other months, with eBay delivering a slight whole return lack of -2.5% vs. a considerable -41.7% loss from Amazon.

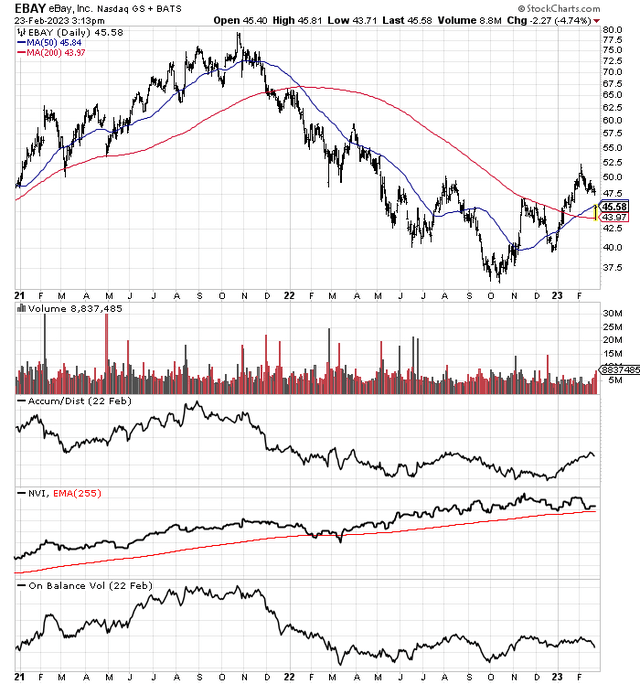

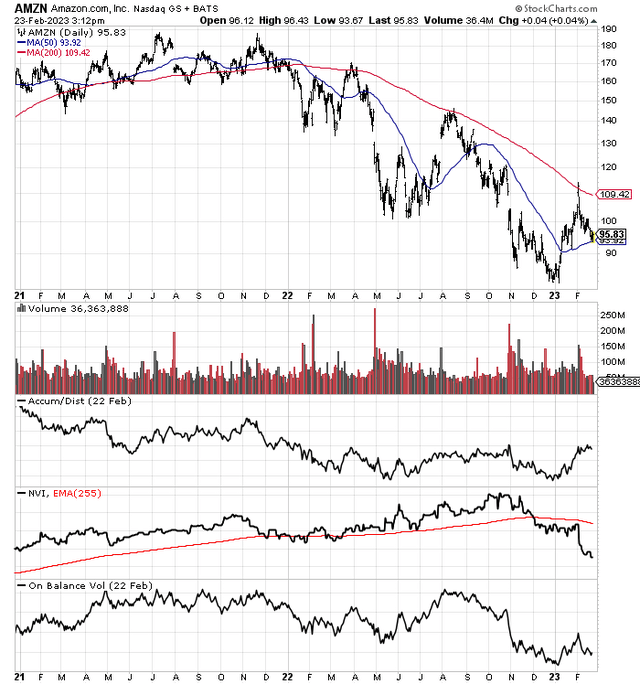

YCharts – eBay vs. Amazon, Whole Returns since December thirtieth, 2020 StockCharts.com – eBay, 26 Months of Each day Value & Quantity Modifications StockCharts.com – Amazon, 26 Months of Each day Value & Quantity Modifications

Granted the +39% web theoretical return (earlier than buying and selling bills and any margin curiosity on the brief transaction) has not been spectacular (+30% together with truthful carrying prices), however it has bested the minimal +10% funding efficiency of a buy-and-hold whole return outlined by the SPDR S&P 500 ETF (SPY) because the finish of December 2020.

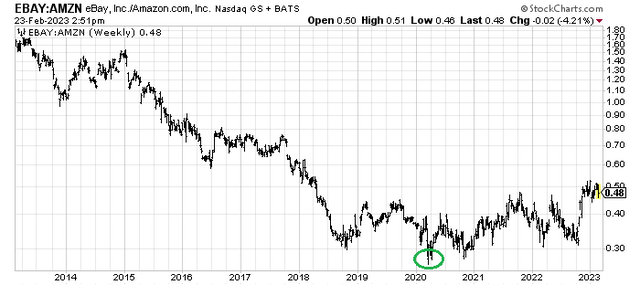

In truth, eBay has been “outperforming” Amazon since March 2020, nearly 3 years in the past. Why? Beginning valuations are the primary purpose. Amazon has been coming off nosebleed valuation territory and sky-high Wall Road pleasure after the pandemic peak in transport provides to your private home. The second purpose from the center of 2022 is eBay will possible survive a recession in shopper demand much better than Amazon’s retail-dependent enterprise mannequin. The principle distinction for this setup is eBay’s super-strong revenue margins vs. Amazon’s comparatively low return on gross sales.

The attention-grabbing a part of the historic document is eBay’s share value (plus a small dividend) divided by Amazon’s equal worth bottomed simply because the U.S. financial system was shut down throughout March-April 2020. I’ve circled in inexperienced this long-term change in efficiency. At that time, the dearth of Wall Road curiosity in eBay earlier than the pandemic, a significant restructuring and refocus on the core eBay product itemizing on-line web site, and a monster share repurchase program have supported its quote.

StockCharts.com – eBay vs. Amazon, Relative Share Value Efficiency, 10 Years, Writer Reference Level

I stay assured eBay will proceed to beat Amazon for funding efficiency (presumably for one more 6-12 months) because the valuations of those on-line retailers proceed to converge. As well as, my major fear for Amazon is working outcomes develop greatest throughout a low-inflation, financial growth backdrop. With out gross sales development, slight margins are prone to an enormous decline.

Amazon’s Margin Threat

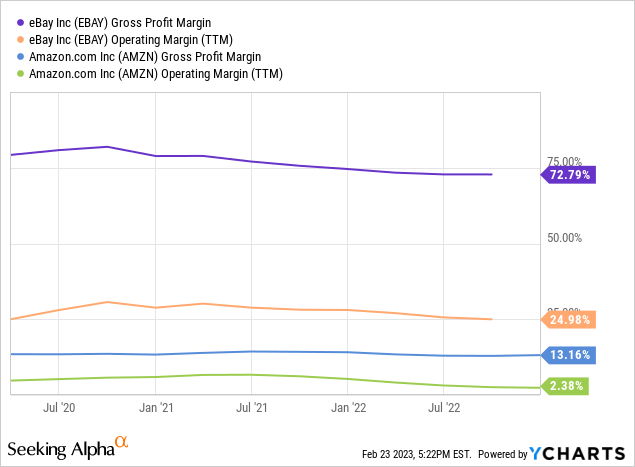

In a recessionary setting, which is my baseline forecast backed by the 40-year document inversion within the Treasury yield curve throughout late 2022 into early 2023, I anticipate eBay’s earnings to carry up higher. Why? Throughout a flat gross sales interval, firms with larger margins normally witness smaller proportion decreases in money stream and earnings. Properly, the distinction in margins is night time and day between the 2. Under is a graph of gross and working revenue margins. eBay’s 25% trailing working margin is an actual plus vs. Amazon’s 2.4%, assuming gross sales stagnate. If margins shrink 3% equally for each, eBay continues to be wildly worthwhile, whereas Amazon is breakeven to a cash burner (probably having to points shares or borrow capital to pay payments).

YCharts – eBay vs. Amazon, Gross & Working Revenue Margins, 3 Years

Worth vs. Development

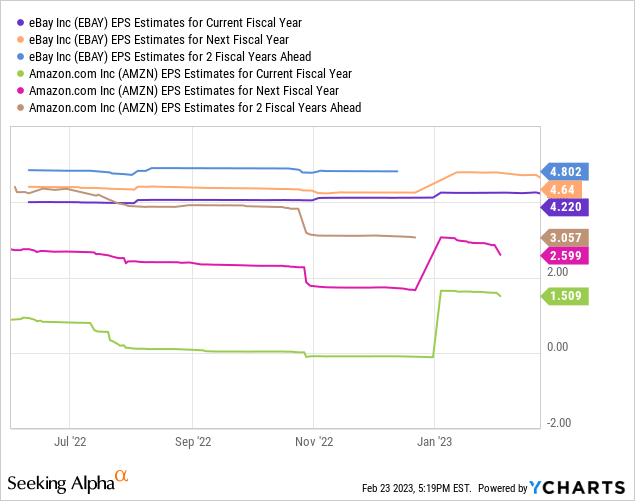

In the long run, the 2 symbolize a basic “worth” vs. “development” fairness funding battle. eBay is priced at lower than 10x EPS estimates for 2025, whereas Amazon stands at 30x EPS estimates three years out. If a recession hurts future earnings development, the a number of is even larger. All else being equal and assuming neither enterprise will develop shortly in 2023, shouldn’t buyers determine to personal the decrease P/E enterprise and shun an prolonged and riskier alternative?

YCharts – eBay vs. Amazon, Ahead Earnings Forecast 2023-25, Made on Feb twenty third, 2023, 9-Month Modifications

Earnings and Free Money Circulate Yields

While you get all the way down to investing fundamentals, house owners of a enterprise need money of their pocket, pure and easy. Earnings and free money stream yields are the way in which to gauge and evaluate possible and precise money returns in your funding greenback (utilizing present inventory quotes).

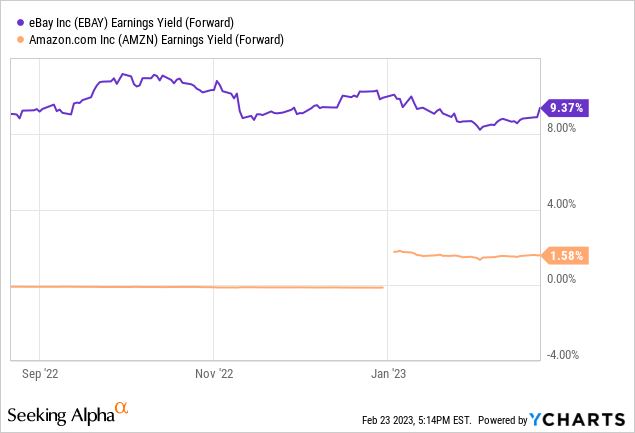

The “ahead” earnings yield story is drawn under, as Wall Road likes to look into the longer term. This week’s minor selloff in eBay and confirmed steering has helped the projected 2023 earnings yield to a terrific quantity above 9.3%. Amazon’s 1.6% yield doesn’t come near cost-of-living changes within the U.S. CPI of 6.4%. Why do you wish to personal a enterprise struggling in a recession, that’s throwing off a detrimental -4.8% “actual” inflation-adjusted return in your upfront funding? I don’t.

YCharts – eBay vs. Amazon, Ahead Earnings Yield, 6 Months

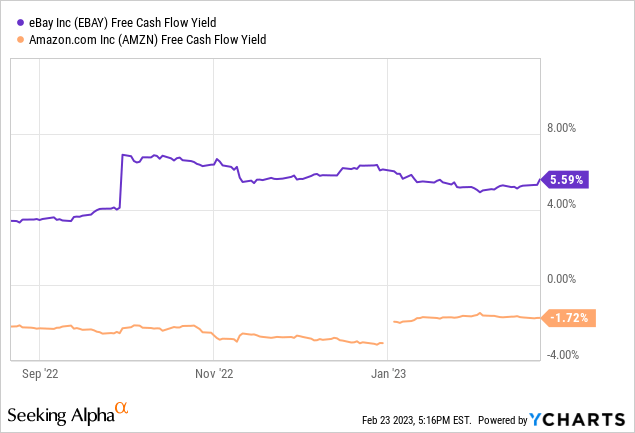

The 5.6% trailing free money stream yield can also be tilted in favor of eBay possession. Shareholders are nearly capable of declare victory over common inflation for a present enterprise return on funding at $45 per share. Alternatively, Amazon continues to burn money at a fee of -1.7% in your preliminary funding at $96 per share, on CapEx selections to spend on new buildings/autos for deliveries and broaden its large laptop community (operating the retail gross sales web site and AWS cloud resale unit).

YCharts – eBay vs. Amazon, Free Money Circulate Yield, 6 Months

Return of Shareholder Capital

Another excuse to ponder proudly owning eBay over Amazon is the previous firm has been very beneficiant paying a money dividend and returning capital throughs share buybacks (whereas leveraging your possession curiosity in future working outcomes). eBay has been capable of afford an enormous discount within the share depend by liquidating various noncore belongings in Europe and South Korea, on prime of reinvesting sizable money stream coming within the door every year. Amazon, conversely, doesn’t pay an everyday dividend, whereas share buybacks have been minimal (missing the tens of billions in money stream to each develop its transport community and interact in share buybacks). eBay’s excellent share depend has shrunk by 32% because the starting of 2020, vs. Amazon’s web INCREASE of three% (together with smaller acquisitions paid with inventory and $42 billion in stock-based compensation for workers over three years).

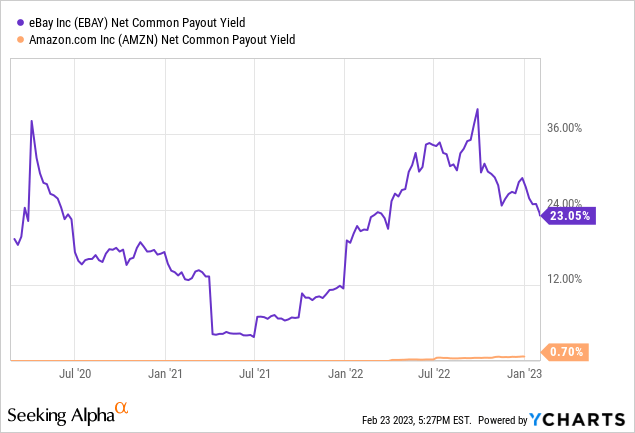

The added bodily demand for eBay shares has additionally been an vital prop for a stronger inventory quote since early 2020. The “web payout yield” for every enterprise together with dividends paid and the sum of share buybacks minus new issuance is drawn under.

YCharts – eBay vs. Amazon, Internet Payout Yield, 3 Years

Ultimate Ideas

For an expanded rationalization of my emotions and forecasts for each firms, you may evaluate earlier articles from November. My final bullish eBay write-up is linked right here. My newest full-length bearish view on Amazon could be discovered right here. Till the looming 2023 recession (or slowdown in retail spend at a minimal) has been absolutely felt by shoppers and companies, I stay of the view eBay is a greater place to park your funding cash.

What change might emerge to assist Amazon outperform eBay? I don’t actually envision a flip within the equation anytime quickly, the place I like to recommend Amazon as a Purchase and eBay as a Promote/Brief (the alternative of my present view). Greater than possible, a far decrease Amazon value below $70 will seem this yr, as recession spending by shoppers hits money stream and earnings.

As soon as the conclusion of slower Amazon development is priced into shares, I plan on transferring to a Maintain or Purchase score. The “unfold” commerce thought ends at that time, the place each firms have mathematical logic for long-term possession. Finally, if eBay and Amazon rise collectively in 2024, a greater funding technique can be to carry each names. However, I anticipate new draw back in Amazon to play out first.

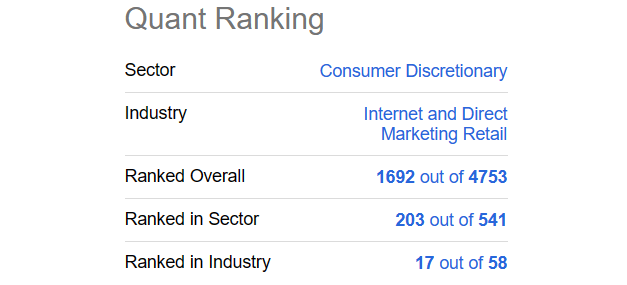

For an additional opinion, Searching for Alpha’s Quant Rankings are pretty equal, that means this instrument is not going to add a lot worth in figuring out which would be the main alternative for 2023.

Searching for Alpha Quant Rank – eBay, February twenty third, 2023

Searching for Alpha Quant Rank – Amazon, February twenty third, 2023

For goal pricing, in 12-months I’m projecting an eBay quote within the $50-$60 space, good for +12% to +34% as a complete return, together with the brand new dividend fee now above 2% yearly. A ahead P/E within the 11-13x zone is smart for a flooring valuation, with sluggish development within the working enterprise and an inflation fee round 4%. When it comes to Amazon, I’m within the $70 to $90 vary for a 1-year value estimate (-5% to -25% whole return), relying on the severity of recession and the U.S. rate of interest degree. Placing a ahead P/E a number of of 27-35x nonetheless appears wealthy to me, however a sliding inflation fee by the tip of 2023 (encouraging larger P/Es for equities) and a “development” premium might stay the Wall Road argument. Nevertheless you slice it, some convergence within the valuation distinction between the 2 ought to play out once more this yr because the financial system cools.

Thanks for studying. Please think about this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is advisable earlier than making any commerce.