[ad_1]

I’ve a recreation for you this week…

Let’s fake you’re looking for a brand new home. On a sunny Saturday your realtor exhibits you three that have been simply listed.

They’re similar, inside and outside… apart from the colour.

One is white, one is gray and one is beige.

Your realtor tells you the white home is asking $500,000, the gray home is asking $600,000, and the beige home needs $700,000.

Which home would you favor to purchase?

It’s not a trick query. It’s how I plan to show my 2-year-old son about worth investing as quickly as he’s in a position to speak.

On the coronary heart of it, “worth” measures the diploma of distinction between two issues:

- What you pay,

- For what you get.

If you happen to pay rather a lot, however solely get slightly … you’re getting a foul deal.

If you happen to pay slightly, however get rather a lot … you’re getting an excellent deal.

It actually is so simple as that.

It is best to wish to purchase the white home for $500,000 as a result of, in addition to the trivial and economically unimportant variable of paint coloration, you’re getting the identical home regardless of whether or not you purchase the white, gray or beige one.

The one distinction – and the crux of your decision-making course of – is the value you pay. And paying much less is all the time higher, all else equal.

And by no means was this lesson on worth timelier than over the previous three years…

2020-2022: The Worth Premium

There have been a variety of 2-year-olds out there in 2020. They have been fueled by COVID-19 stimulus checks, an extra of free time … and Reddit.

They couldn’t have cared much less whether or not a inventory was buying and selling at a good valuation. So in 2020, buyers truly bought penalized for purchasing the market’s most cost-effective shares, and rewarded for purchasing its costliest ones.

Take a look:

2020: Costly Beats Low cost

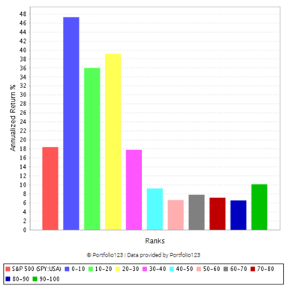

This chart exhibits the 2020 efficiency of the “worth” metric of the inventory rankings system I developed.

The tallest blue bar on the left exhibits the 2020 return of the market’s 10% costliest shares – 47.3% in a single 12 months! And consider, this was the identical 12 months shares collapsed within the wake of pandemic shutdowns.

The bars on the suitable present the efficiency of the market’s cheaper “worth” shares – all of them lagged the S&P 500 (pink bar, far left), which returned 18.4% that 12 months.

It was a mania, in fact … and it didn’t final.

People got here to their senses in 2021. Not have been they keen to purchase the market’s costliest shares at nosebleed valuations.

Expensive shares crashed. And “worth buyers” have been rewarded for purchasing solely the market’s most cost-effective shares…

My pals, this is what the chart for the worth issue is supposed to appear to be:

2021-Current: Low cost Beats Costly

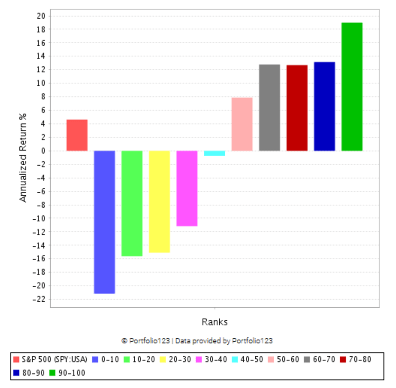

The inexperienced bar on the far proper exhibits the 2021-present efficiency of the market’s 10% most cost-effective shares.

You can have earned 19% per 12 months since January 2021, had you purchased the market’s most cost-effective shares … which completely crushes the S&P 500’s return of 4.6% per 12 months over the identical time.

Additionally, word the blue bar on the left aspect – this exhibits the worst efficiency got here from the market’s costliest shares, which thus far have misplaced 21.2% per 12 months.

So the 2-year-olds are blown up and the adults are sitting fairly. You is likely to be saying: “That’s nice and all … however hindsight is 20/20. The place have been you in 2021 after I wanted this?”

Properly, for one … I by no means bought caught up within the dear inventory recreation.

I used to be busy recommending high-quality shares, together with worth shares, in my flagship e-newsletter, Inexperienced Zone Fortunes. Extra on that in a minute.

However the extra essential query is that this … “Will ‘worth’ proceed to outperform?”

2022–2025: Purchase Worth Shares and Outperform

In a phrase … sure.

I imagine “worth” will completely outperform the market over no less than the subsequent three years.

And right here’s why …

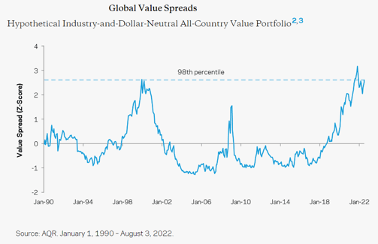

This chart exhibits the relative valuations of “costly” shares versus “low cost” shares.

When the road is shifting larger, costly shares are getting much more costly … and low cost shares are getting even cheaper.

Simply have a look at what the chart did between 1994 and 2000, through the dot-com bubble.

Again then, costly shares bought so costly … and low cost shares bought so low cost … that the unfold grew bigger than every other time in historical past.

In statistical phrases, the unfold reached the 98th percentile. In layman’s phrases, it reached an unsustainable “excessive.”

In fact, it didn’t final. As soon as the bubble popped in late 2000, the market’s costliest shares bought completely obliterated. And “worth” shares started an epic run of outperformance, which lasted from roughly 2000 to 2006 (as proven by the declining line within the chart above).

Now let’s speak about what this relationship has seemed like over the previous few years, and what I anticipate it to do over the subsequent three-plus years.

First, you may see a dramatic improve within the unfold starting in 2018. This exhibits how between 2018 and 2020, costly shares bought costlier and low cost shares bought cheaper – a traditional, tell-tale signal of a late-stage bull market bubble.

Then, after blowing previous that 98th percentile degree we hadn’t seen for the reason that dot-com bubble, the unfold turned decrease.

Costly shares bought cheaper, as a result of they bought off … and worth shares bought rather less low cost, as a result of sensible buyers began shopping for them.

Although, an important factor to notice is that the unfold is nonetheless hovering across the 95th to 98th percentile.

Although “worth” shares have outperformed strongly over the previous two years … they’re nonetheless far cheaper than costly shares, relative to historic norms.

Mentioned one other approach, worth shares are nonetheless very prone to outperform the marketplace for a number of years to come back.

Right here’s how I recommend you play it …

The right way to Discover Worth in a Expensive Market

Understand, I’m not saying you must sacrifice “development” or “high quality” or any of the opposite traits of firms and their shares that drive market-beating returns.

I’m simply highlighting the position that valuations play in your efficiency as a result of, now greater than ever, shopping for shares which might be moderately to cheaply priced is working.

In my Inexperienced Zone Fortunes e-newsletter, I’ve constructed a portfolio of shares which might be well-rounded on every of the six elements my inventory ranking mannequin is constructed on:

- Momentum

- Measurement

- Volatility

- Worth

- High quality

- Development

I’m keen to advocate shares from any sector, as long as they charge extremely on these metrics.

Although in recent times, I’ve discovered a number of the most compelling worth alternatives within the power sector.

In March 2021, I advisable an oil and gasoline exploration firm referred to as Civitas Sources (NYSE: CIVI).

The inventory was dirt-cheap on the time … it rated 99 out of 100 on my system’s worth metric, which means it was extra cheaply priced than all however 1% of the market’s shares.

Now, you may assume a inventory that that low cost will find yourself being extra of a landmine than an enormous winner. However my ranking system confirmed me that we’d not be sacrificing high quality or development if we purchased the inventory. It rated 83 out of 100 on high quality, and 87 out of 100 on development.

Lengthy story brief, I advisable the inventory in March 2021 and, together with dividends, it’s returned greater than 120% for us in simply two years.

And get this … it’s nonetheless an important worth!

Right this moment, the inventory charges 97 out of 100 on worth, and 93 out of 100 total.

That’s as a result of despite the fact that the inventory’s share worth has greater than doubled since I advisable it …

Civitas’ earnings per share have elevated three-fold within the final 12 months, and its free money stream has grown five-fold.

That brings us again to my 2-year-old’s clarification of worth investing – the relative distinction between what you pay and what you get.

With Civitas, you’re now paying roughly twice the share worth my Inexperienced Zone Fortunes readers paid for the inventory in March 2021 …

However what you get for that worth is possession in an organization that’s now producing three-times extra earnings and five-times extra free money stream.

That makes it an important worth!

If you happen to’re excited by studying extra about Civitas, the corporate simply reported earnings on Wednesday – right here’s a direct hyperlink to the corporate’s investor relations web page.

You’ll see the corporate simply raised its dividend, which doesn’t shock me within the least given the money stream its producing!

If you happen to’re excited by a good and rising dividend, the subsequent one shall be paid out on March 30 to shareholders who purchase on or earlier than March 13.

Now, you need to perceive that no matter you select to do with this info is as much as you. Out of respect for my Inexperienced Zone Fortunes readers, I’ve to order my common updates on the inventory and particular worth steerage for them. (If you happen to’d wish to develop into one in all them, in fact, I welcome you with open arms.)

However this inventory is among the finest worth names I can discover, and it additionally occurs to be a part of my massive concept that oil shares are within the early phases of an extended and powerful bull market.

It doesn’t matter what you do subsequent, I implore you to take a position with a eager eye for worth proper now. You’ll be glad you probably did come 2025.

Regards, Adam O’DellChief Funding Strategist, Cash & Markets

Adam O’DellChief Funding Strategist, Cash & Markets

P.S. Need to know the only strategy to examine if a inventory you maintain is an efficient worth?

Go to MoneyandMarkets.com, click on the search bar within the higher proper, and sort within the ticker. My Inventory Energy Rankings system will charge your inventory on six market-beating metrics, together with worth… utterly totally free.

Go forward and lookup your prime holding, then write me at BanyanEdge@BanyanHill.com with what you study.

Like Adam, I let the information communicate for itself. And the information is obvious…

Worth investing, if executed persistently in a disciplined method, works. Particularly proper now

However how do you outline worth?

If there was a easy reply, everybody would do it and it could cease working.

The reality is, there’s a variety of methods to pores and skin this cat. It’s a must to have a look at a inventory from a number of totally different angle, distinctive to what that inventory or sector does, to get a transparent valuation image.

Let me present you only one such technique…

For our functions at this time, let’s maintain it normal with a “mainstream” inventory. I’ll use Disney (DIS) for example. It’s a inventory I’ve owned for years and don’t have any fast plans to promote.

The value/earnings ratio is a little bit of a large number for Disney proper now. Earnings collapsed through the pandemic, and even now their film enterprise has but to get again as much as pre-pandemic pace. So, let’s check out the corporate’s worth/gross sales (P/S) ratio.

Disney trades at a worth/gross sales ratio of two.2. What does that imply? Is that good or unhealthy?

To get an concept, let’s have a look at the ratio over the previous 20 years.

Earlier than the 2008 meltdown, a P/S of two was “about proper” for Disney. For a lot of the 2010s, Disney traded at a mean P/S of about 3. The ratio spiked in 2022 and 2021, due partly to gross sales dipping (a smaller denominator makes the ratio bigger) and partly resulting from enthusiasm over the Disney Plus streaming app.

Properly, after a brutal 2022, Disney is buying and selling again at a “regular” valuation in step with its historical past. That means that, by this metric, Disney is a fairly low cost inventory.

Do I instantly run out and purchase each inventory that trades at a P/S ratio in step with its historic common? No, clearly not. However it is a good place to begin for additional evaluation.

However there exists one distinctive instrument that can provide you a powerful valuation image with the press of a button: Adam’s Inventory Energy Rankings system.

Worth is among the six main elements that make up Adam’s system. However the worth issue itself is a composite of a number of worth metrics. That’s as a result of, as a result of quirks of accounting, some firms can seem perpetually low cost or perpetually costly by sure metrics.

To throw out an instance, actual property funding trusts (REITS) virtually all the time look costly based mostly on the value/earnings ratio as a result of their earnings are depressed by non-cash bills like depreciation. So any display that depends on the P/E ratio alone goes to overlook potential bargains in REITs.

Adam’s system accounts for issues like this, which is why it’s so worthwhile to not simply worth buyers, however ALL forms of buyers.

Like Adam stated above, take 5 minutes and lookup your prime holding totally free at MoneyandMarkets.com. If you happen to like what you see in your favourite inventory — and even if you happen to don’t — write us at BanyanEdge@BanyanHill.com with what you discover.

And if you happen to REALLY like utilizing Adam’s Inventory Energy Rankings system and wish to entry a portfolio of top-rated shares, do your self an enormous favor and take a look at Inexperienced Zone Fortunes at this time.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link