Vanit Janthra

Plug Energy Inc. (NASDAQ:PLUG) is an organization that has continued to overpromise and underdeliver.

We highlighted in our earlier replace that one other markdown from its already downgraded FY22 outlook demonstrated vital execution challenges.

But, only one month later, the firm failed to fulfill its already downgraded projections once more.

Accordingly, Plug Energy posted income progress of 36% YoY in FQ4, properly under its downgraded projections of 61% progress in January.

Such a miss is unacceptable, demonstrating that it could not even meet the steering that it penciled in simply barely greater than a month in the past.

Subsequently, it is clear that the Andy Marsh-led firm has misplaced credibility with buyers, even because it stays assured of its long-term outlook.

Buyers are proper to query the visibility of its long-term projections, given the disastrous efficiency in 2022. Therefore, we imagine buyers are proper to justify that it could possibly be the “usual story for 2023.”

Marsh acknowledged that Plug Energy “didn’t meet expectations,” as he highlighted:

We attribute [our underperformance] primarily to three elements: obstacles properly encountered whereas introducing new merchandise, delays in setting up our hydrogen plant and macroeconomic situations that affected the price of pure gasoline, leading to a big improve in the price of our hydrogen. (Plug Energy FQ4’22 earnings name.)

Briefly, Plug Energy Inc. execution is discovered wanting once more. Worse nonetheless, administration reiterated its $1.4B income progress outlook for 2023, indicating a YoY progress of practically 100%, with gross margin steering of 10%.

We thought Marsh & workforce would think about chopping its FY23 outlook to rein in a much less aggressive ramp cadence that has proved extremely difficult. The corporate highlighted it expects to profit from a 15% discount in hydrogen costs by its suppliers, given the huge collapse in pure gasoline costs (NG1:COM).

Nonetheless, its lack of ability to execute a number of shifting elements in its core materials dealing with enterprise (55% of FY23 income outlook), electrolyzer gross sales (30% of FY23 income outlook), and different segments, together with gas cells and stationary merchandise, has hampered Plug Energy Inc.’s credibility.

Whereas the secular tailwinds driving hydrogen are strong, it hasn’t been one of many elementary driving forces in renewable power investments in 2022. Bloomberg reported that “the 2 smallest sectors for funding are carbon seize and hydrogen.” Nonetheless, it additionally highlighted that “each grew considerably in relative phrases.”

As such, the potential for inexperienced hydrogen appears intact if Plug Energy may seize the tailwinds by means of its execution. The EU plans to part in vans on “batteries or hydrogen gas cells ubiquitous inside a couple of years.” As such, the appliance of hydrogen-powered vans may increase the overall addressable market (“TAM”) because the world continues its electrification transformation.

The drivers for inexperienced hydrogen use instances within the EU may additionally enhance the economics for Plug Energy, because the EU “goals to incorporate 20 million metric tons of unpolluted hydrogen into the continent’s power combine by 2030.”

Additionally, Plug Energy highlighted it’s engaged on leveraging alternatives in electrical automobile (“EV”) charging by promoting its stationary merchandise to assist the grid because the electrification journey picks up the tempo.

Furthermore, PJM Interconnection, one of many largest grid operators within the U.S., highlighted in a latest report that it sees an elevated “danger of shortages and blackouts within the US electrical grid because the force-fed power transition to renewable fuels destabilizes the grid.”

Therefore, the risk to grid safety is a big tailwind that Plug Energy may capitalize on. The corporate expects a “vital demand pull for its inexperienced hydrogen in stationary purposes,” additional lifting its skill to ramp income and profitability towards its long-term targets.

All these tailwinds driving the potential for inexperienced hydrogen are attractive and sure one of many vital the reason why buyers in Plug Energy Inc. are nonetheless holding the bag, regardless of the drawdown in 2022.

The query is whether or not the bag remains to be value holding in 2023?

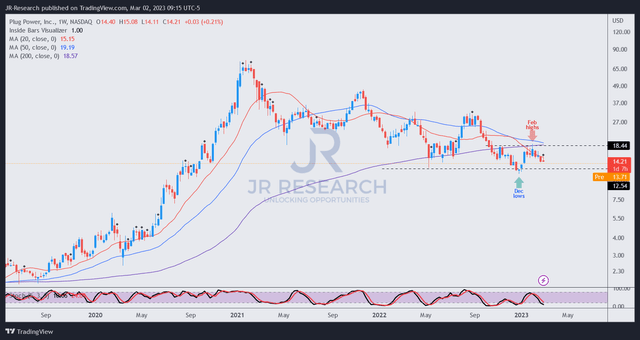

PLUG value chart (weekly) (TradingView)

PLUG has collapsed greater than 80% from its early 2021 highs, with the bears in full management.

This downtrend bias in PLUG appears to counsel that bearish buyers have possible reloaded at its latest February highs, anticipating the corporate to underperform once more.

They’ve gotten it spot on, and Plug Energy’s torrid execution wants a large wake-up name.

Plug Energy Inc. buyers nonetheless holding the bag should be ready for an additional decline that appears more and more possible after its momentum was firmly rejected at its 200-week shifting common or MA (purple line).

A re-test of its late December lows ought to present extra readability, however we is not going to encourage Plug Energy Inc. buyers to play the mean-reversion commerce right here.

Avoid Plug Energy Inc. for now.

Ranking: Maintain (Reiterated).