The S&P 500 (SP500) on Friday added 1.90% for the week to finish at 4,045.54 factors, posting positive aspects in three out of 5 classes. Its accompanying SPDR S&P 500 Belief ETF (NYSEARCA:SPY) rose 1.97% for the week.

With the weekly advance, the benchmark index managed to snap a three-week dropping streak. The index additionally closed out a risky February with a almost 3% fall on Tuesday, weighed down by Federal Reserve fee hike considerations sparked by robust financial information.

That sample initially continued this week. Nevertheless, on Thursday a Fed official mentioned the central financial institution may very well be able to pause its fee mountaineering this summer time, which helped to prop up markets. That positivity carried over onto Friday and helped the S&P 500 (SP500) to its weekly rise.

Market contributors have this week recalibrated their outlook for the height terminal fee to now attain a minimum of 5.5%, with a fraction of the market even contemplating 6%. Merchants seem to have grow to be extra comfy with the course of the central financial institution.

In the meantime, financial information this week has urged each a flourishing financial system and a decent labor market. With the Fed in a hawkish temper, any numbers that time to a strong financial system have sparked worries about greater rates of interest.

On Wednesday, ISM’s gauge of producing exercise for February rose for the primary time in six month, although staying in contraction territory. On high of that, the S&P manufacturing PMI rose for February. The studies confirmed that there was nonetheless energy within the financial system and that the cooling results of elevated rates of interest had been but to be felt.

On Thursday, the variety of People submitting for preliminary jobless claims unexpectedly slipped. Furthermore, fourth quarter unit labor prices rose, at the same time as common productiveness marked its largest annual hunch in almost 50 years. The numbers demonstrated continued resilience within the labor market.

The weekly financial calendar additionally noticed a shocking fall within the February Chicago PMI and the Convention Board’s measure of month-to-month shopper confidence.

The week additionally noticed the fourth quarter earnings season begin to wind down. Notable corporations that reported their outcomes included retail giants Goal (TGT) and Costco (COST), division retailer chain Macy’s (M), electrical automobile maker Rivian Automotive (RIVN), house enchancment retailer Lowe’s (LOW) and cloud computing firm Salesforce (CRM).

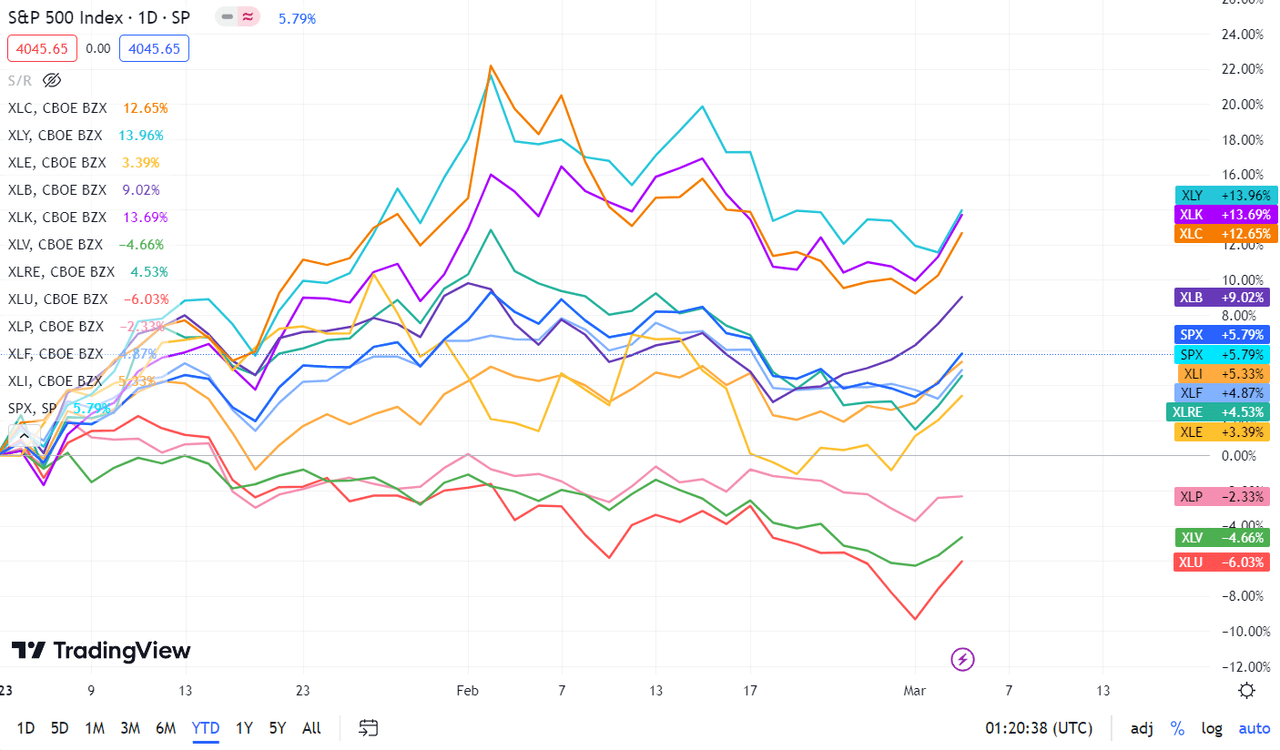

Turning to the weekly efficiency of the S&P 500 (SP500) sectors, 9 of the 11 ended within the inexperienced, led by Supplies and Communication Companies. Utilities and Shopper Staples had been the 2 sectors to finish within the crimson. See beneath a breakdown of the weekly efficiency of the sectors in addition to their accompanying SPDR Choose Sector ETFs from Feb. 24 near March 3 shut:

#1: Supplies +4.02%, and the Supplies Choose Sector SPDR ETF (XLB) +4.20%.

#2: Communication Companies +3.27%, and the Communication Companies Choose Sector SPDR Fund (XLC) +2.85%.

#3: Industrials +3.25%, and the Industrial Choose Sector SPDR ETF (XLI) +3.35%.

#4: Vitality +2.94%, and the Vitality Choose Sector SPDR ETF (XLE) +3.07%.

#5: Info Expertise +2.93%, and the Expertise Choose Sector SPDR ETF (XLK) +2.98%.

#6: Shopper Discretionary +1.61%, and the Shopper Discretionary Choose Sector SPDR ETF (XLY) +1.70%.

#7: Actual Property +1.55%, and the Actual Property Choose Sector SPDR ETF (XLRE) +1.63%.

#8: Financials +0.79%, and the Monetary Choose Sector SPDR ETF (XLF) +0.93%.

#9: Well being Care +0.51%, and the Well being Care Choose Sector SPDR ETF (XLV) +0.51%.

#10: Shopper Staples -0.41%, and the Shopper Staples Choose Sector SPDR ETF (XLP) -0.23%.

#11: Utilities -0.69%, and the Utilities Choose Sector SPDR ETF (XLU) -0.54%.

Under is a chart of the 11 sectors’ YTD efficiency and the way they fared in opposition to the S&P 500. For buyers wanting into the way forward for what’s taking place, check out the Searching for Alpha Catalyst Watch to see subsequent week’s breakdown of actionable occasions that stand out.