InspirationGP/iStock through Getty Photographs

Trying into our crystal ball

For fund managers, Christmas is a time for reflection. Assembly and market volumes decline, offering a uncommon alternative to breathe and assume deeply about no matter you might care to consider. Many peer into crystal balls, making an attempt to foretell the trail for international markets and economies over the approaching 12 months. Common readers, nonetheless, will know this isn’t our sport. A major quantity of educational proof (and over 22 years of private expertise) means that not solely are economies extraordinarily tough to forecast, however even should you can precisely forecast them, it typically doesn’t assist with forecasting what occurs inside markets.

The UK inventory market in 2022 supplies the most recent (in a really lengthy listing) of examples. If in December 2021 we precisely predicted probably the most aggressive US fee will increase in 40 years, a warfare in Europe, an vitality disaster, price of dwelling disaster, a political disaster, a recession, rolling strikes throughout a number of industries, and systemic danger to the monetary system from over-levered LDI funds, what would you may have forecast the efficiency of the UK inventory market to be throughout 2022? A forecast for it to extend, and to materially outperform abroad markets, can be laughable. However that’s precisely what has occurred.

That offers us consolation that utilizing our valuable reflection time to forecast economies can be time wasted. As an alternative, it’s higher to search for valuation extremes, that are a mirrored image of investor’s confidence a technique or one other, and easily ask “would possibly that confidence be misplaced?”. May issues that at the moment look bleak enhance? May issues that at the moment look unbelievable deteriorate barely? Historical past means that few issues keep the identical, and as buyers, being positioned forward of any change could be extraordinarily worthwhile.

At this level final 12 months, we wrote the areas of the UK the place buyers had been most pessimistic had been Oil and Gasoline, Mining and Banking shares. Throughout 2022 every of these sectors had 12 months, though for causes none of us would have been capable of predict. We merely based mostly our view on which sectors had been most out of favour, which had been least expensive, and subsequently set to learn probably the most if there was any alleviation of the damaging headwinds these shares had been dealing with. Final 12 months, that labored out fairly properly.

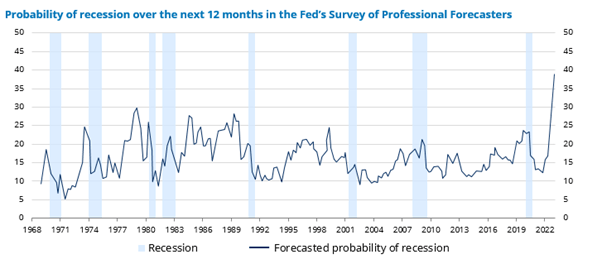

As we speak, probably the most vexing problem for buyers is the forthcoming client recession. It’s uncommon for economists to forecast recessions; famously the Financial institution of England has by no means forecast a recession – till now. The US faces an identical state of affairs, with forecasters often unable to forecast recessions (marked in gray on the chart under). As we speak, they’re as positive as they’ve ever been, {that a} recession is coming.

Probably the most anticipated recession ever

Supply: Federal Reserve Financial institution of Philadelphia, Haver Analytics, Apollo Chief Economist

Round half of all UK proprietor occupied homes (4m) can be uncovered to increased mortgage charges subsequent 12 months (both floating fee, or mounted charges expiring). Alongside a rise in vitality costs from £2,500 to £3,000 for the common family in April ‘23, there’ll inevitably a squeeze on shoppers. That a lot we all know. What we don’t know, is what we don’t know. Stunning issues might occur to make issues higher. Stunning issues might occur to make issues worse. These ‘unknown unknowns’ are what make forecasting tough.

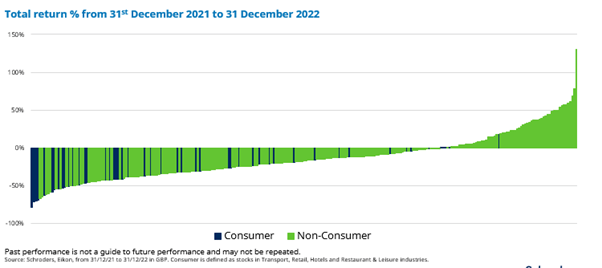

Inventory markets, after all, are ahead trying. Share costs don’t await recessions to be introduced earlier than happening, nor await constructive GDP figures to be introduced earlier than going up. The inventory market has been significantly ruthless this 12 months in marking down the share costs of client associated shares in anticipation of robust instances forward. The chart under reveals the efficiency of each member of the FTSE 350, with the bars both inexperienced for non-consumer, and blue for client associated shares. A cursory look will exhibit the negativity surrounding the patron, with nearly all of client shares very firmly on the left hand facet of the chart.

Efficiency of FTSE 350 ex Funding belief by constituent from 31st December 2021 to 31 December 2022.

Supply: Schroders, Eikon, from 31/12/21 to 31/12/22 in GBP.

If we needed to place numbers on it, the common client inventory has declined by virtually precisely one third. Provided that solely a small proportion of an organization’s worth is pushed by the money generated within the subsequent 12 months or two, a -33% decline suggests the market has taken a particularly damaging view of client shares, not only for subsequent 12 months, however for the foreseeable future. Time will inform if that’s overly aggressive. For reference, the common non-consumer inventory is barely down -9%.

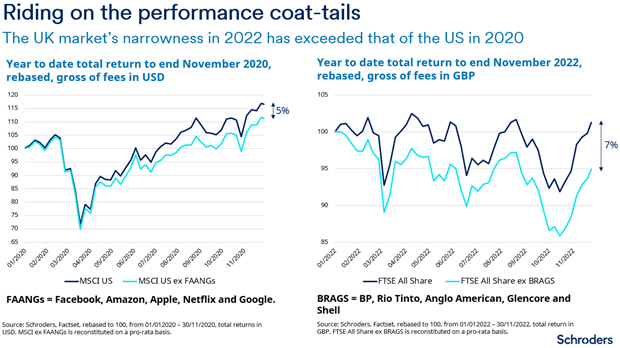

“Hold on a minute” I hear you ask. The UK market is up throughout 2022, how can the common inventory be down? The efficiency of the UK market just isn’t based mostly on the efficiency of the common firm. As an alternative, the affect of every firm on the benchmark relies on how giant that firm is. To take an excessive instance, think about a benchmark of 10 corporations, with 9 of them having a market cap of £100m and one with a market cap of £1bn. So long as the big firm doubled, the benchmark can be up barely (by 5%) even when the opposite 9 corporations went bankrupt, because the positive factors within the giant firm offset the losses within the small. In that state of affairs, most buyers could have misplaced important quantities of cash regardless of the market being up.

To a lesser diploma, that is what occurred throughout the UK market in 2022. The share worth of a handful of very giant corporations elevated, while nearly all of corporations fell. For these of you that like information, while the UK market was up in the course of the 12 months, three quarters of FTSE 350 UK corporations had a share worth which declined. That skew made it a really tough benchmark to outperform, and certainly solely 15% of energetic fund managers managed to take action throughout the IA UK All Corporations in 2022.

Nevertheless it was truly much more skewed than the evaluation above suggests. If we keep in mind corporations dimension, the narrowness of the market is much more excessive than when the S&P was dominated by a group of shares referred to as the FAANGs (Fb, Apple, Amazon, Netflix and Google) in 2021. Throughout 2022, 5 shares drove all the UK market’s efficiency. In case you had missed out on a group of shares we’ve nicknamed the BRAGS (BP, Rio Tinto, Anglo American, Glencore, Shell) the UK market return moved from constructive to damaging.

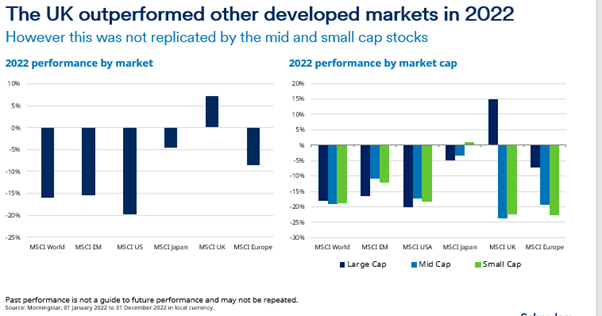

The corollary is while the UK market as a complete carried out properly in 2022, a majority of shares fell. Certainly, if we lower the market into it’s dimension buckets, we will see that UK exceptionalism was pushed by the big corporations; the mid and small cap areas of the UK had been even weaker than abroad markets.

To date, this outlook assertion has primarily focussed on what has occurred in the course of the previous 12 months. We achieve this intentionally as to know the place we’re going, it’s useful to first know the place we’re ranging from. To recap: our forecasts final 12 months had been moderately correct by merely focussing on the most cost effective areas of the market. The patron is extraordinarily prone to have a troublesome time in 2023, however client uncovered share costs have declined considerably upfront. Lastly, while a handful of shares had been up final 12 months, nearly all of shares within the UK have declined leaving their valuations extra enticing than they had been at first of the 12 months.

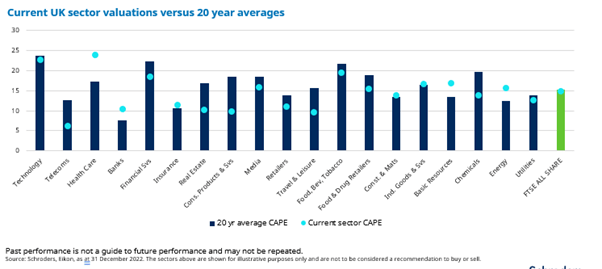

As we did final 12 months, let’s flip to sector valuations first to search for alternative.

Supply: Schroders, Eikon, as at 31 December 2022.

After we examine present valuations with their 20 12 months averages, we will see the areas that buyers have most/least confidence in.

There are 4 sectors (Healthcare, Banks, Primary assets and Vitality) costlier than their 20 12 months averages. In each case, there’s an articulate and persuasive motive for that valuation premium; that doesn’t make the explanation true.

On the flipside, there are six sectors buying and selling at important reductions to their 20 12 months averages (Telecoms, Actual Property, Shopper Merchandise & Companies, Journey & Leisure, Meals Retailers and Chemical compounds). Every of those sectors have headwinds as we speak; however that doesn’t make the headwinds everlasting.

To make sure our portfolios don’t have type drift, and to make sure they signify the perfect alternatives as we speak, we’ve been taking cash out of the oil and fuel and mining corporations. These are areas which have performed very properly over the previous 12 months. We’re rotating the proceeds into the areas most out of favour, the place individuals are most pessimistic, and the place valuations are lowest, shopping for actual property and retailing corporations particularly. We aren’t doing so oblivious to the possible difficulties head, as an alternative selecting to solely purchase those the place steadiness sheets are robust and which could be sustained by way of a value of dwelling disaster. With the valuations these corporations commerce on, and the upside we see in a standard financial atmosphere, they’re prone to be the foundations of our portfolios efficiency over the subsequent three to 5 years.

A couple of feedback on danger are price making at this level. Economists are usually not the one ones who wrestle to forecast economies. When instances are good, corporations themselves can not foresee modifications, and sometimes tackle debt to develop, to pay giant dividends, or to amass rivals. When financial turbulence inevitably arrives, corporations typically discover themselves overleveraged, with steadiness sheets ill-suited to the brand new financial actuality.

This time is completely different. While headlines are worrisome, corporations have had time to arrange. All bear in mind the teachings from the Covid downturn, certainly some are nonetheless flush with liquidity raised in the course of the Covid months and rebound. The Financial institution of England, by no means ones for hyperbole and pleasure, merely state “UK companies are coming into the interval of stress in a broadly resilient place”.

That’s not a unanimous place of power, and as buyers we have to be cautious. Throughout the mixture, there are a variety of companies the place steadiness sheets are stretched, or the place liquidity is low. Debt markets are much less forgiving than they’ve been in recent times, and certainly have been closed to excessive yield issuance for a lot of the previous 12 months. This speaks to the significance of being extraordinarily cautious in relation to monetary danger as some companies will wrestle to refinance maturing debt services.

Inevitably, that can lead to some companies turning to fairness markets to plug their funding hole. Few portfolios have the remit to proactively search these companies out. Our Restoration funds are virtually distinctive throughout the business as having a complicated consumer base who perceive the returns that may be generated from these conditions. While we’re extraordinarily unlikely to take part in all fairness issuances, as one of many few business members with the specialist expertise to judge rescue rights points, we attempt for a seat on the negotiation desk with every of them. This may be time consuming, however for these corporations the place a contemporary fairness injection is a part of a holistic refinancing package deal which removes the monetary danger from the corporate, these alternatives could be extraordinarily worthwhile for our shoppers.

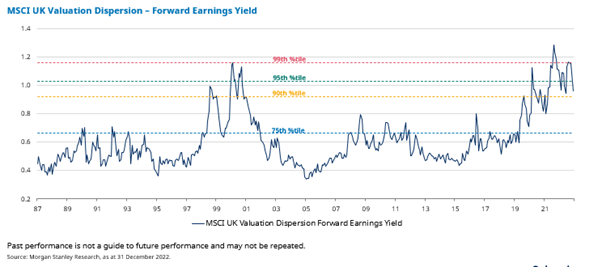

Many outlook statements will reference the virtually inevitably tough instances forward – as we’ve above. Nonetheless, I’d like to complete on two bits of excellent information. The primary is that that valuation spreads stay elevated. Though not as extensive as they had been coming into 2022, the hole stays enough to supply a robust tail wind for valuation based mostly buyers over the approaching years. We have to recognise that the tailwind might not blow in 2023 itself, however over the subsequent three to 5 years, the outlook for valuation based mostly buyers from a relative perspective is a robust one.

Supply: Morgan Stanley, as at 31 December 2022.

The second factor to deal with is the exceptional alternatives there are for long run affected person buyers. For these of us prepared (or in a position) to take a 3 to 5 12 months funding horizon there are important numbers of shares which display screen as enticing, in numerous sectors, throughout the UK market. This presents the chance (however not assure) for robust absolute returns within the coming years. 2022 was the primary 12 months since 1996 that the UK was the strongest performing developed fairness market. Maybe it received’t be one other 26 years till the subsequent time.

The Worth Perspective group

Vital Info:The views and opinions displayed are these of Nick Kirrage, Andrew Lyddon, Kevin Murphy, Andrew Williams, Andrew Evans, Simon Adler, Juan Torres Rodriguez, Liam Nunn, Vera German, Tom Biddle and Roberta Barr, members of the Schroder International Worth Fairness Crew (the Worth Perspective Crew), and different unbiased commentators the place said. They don’t essentially signify views expressed or mirrored in different Schroders’ communications, methods or funds. The Crew has expressed its personal views and opinions on this web site and these might change. This text is meant to be for info functions solely and it isn’t meant as promotional materials the least bit. Reliance shouldn’t be positioned on the views and knowledge on the web site when taking particular person funding and/or strategic selections. Nothing on this article needs to be construed as recommendation. The sectors/securities proven above are for illustrative functions solely and are to not be thought of a suggestion to purchase/promote. Previous efficiency just isn’t a information to future efficiency and might not be repeated. The worth of investments and the earnings from them might go down in addition to up and buyers might not get again the quantities initially invested. |

Unique Publish

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.