Claudiad

The job report for February confirmed a robust rise of 311,000, exceeding estimates of 225,000. Nevertheless, the unemployment price elevated to three.6% from the unusually low degree of three.4% final month. Wages rose by 0.2%, barely decrease than the estimated 0.3%, however elevated by 4.6% year-over-year, up from 4.4% in January.

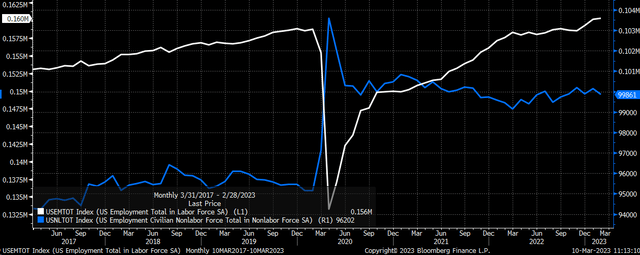

The uptick within the unemployment price was on account of extra employees getting into the job market in February, because the variety of people not within the labor pressure decreased to 99.8 million from 100 million the earlier month, whereas the entire labor pressure elevated to 160.3 million from 160.1 million in January.

Bloomberg

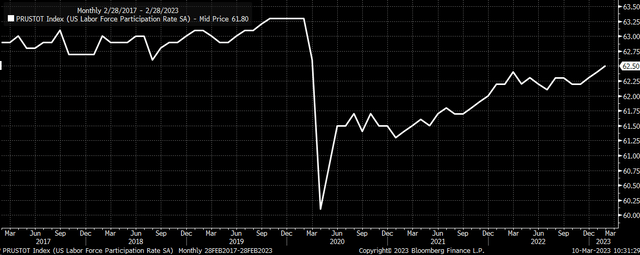

One other vital and optimistic growth was the elevated labor participation price to 62.5%, the very best degree because the pandemic began. This means a broadening of the general energy in employment and is a promising signal for the job market’s well being.

Bloomberg

The robust job information gives the potential for a 50 foundation factors (bps) price hike, however the slower tempo of wage development month-over-month means it isn’t a slam dunk. A powerful CPI (Shopper Worth Index) print will probably be mandatory to extend the probability of a 50 bps price hike. At present, the market is pricing in roughly a 35% probability of the Fed rising charges by 50 bps in March, which is down considerably from earlier than the discharge of the job report.

Bloomberg

It’s tough to find out the extent to which the change in price hike expectations is solely as a result of job report. The lower-than-expected wage development and the upper unemployment price could have performed a job. Nevertheless, different elements, resembling issues over Silicon Valley Financial institution’s current cash-raising efforts failure, may additionally be contributing to the market’s volatility. These issues have unfold to different regional banks, resulting in a big decline in yields and a flight to security. For instance, 2-year yields have fallen sharply, by 24 bps to 4.63% immediately, and have seen a big drop from round 5.1% earlier this week.

Bloomberg

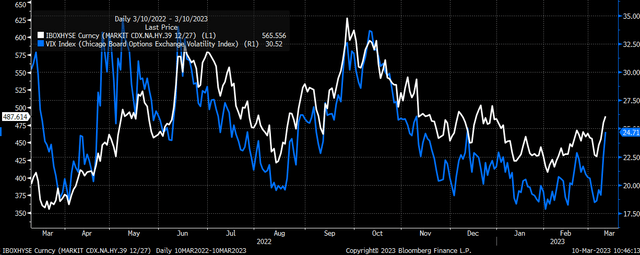

Moreover, the CDX Excessive Yield Index signifies that high-yield credit score spreads are rising. Whereas these spreads are nonetheless a lot decrease than the place they had been within the fall of 2022, their rise suggests that there’s potential for additional will increase if credit score circumstances deteriorate. This can be a vital growth because the CDX Excessive Yield Index typically results in the VIX index and implied volatility rising. Up to now, the connection between the 2 indices has been extremely correlated, and thus, the rising credit score spreads could sign a possible enhance in market volatility.

Bloomberg

The drop in charges and the potential for a 50 bps price hike are much less associated to the job report and have extra to do with the issues surrounding Silicon Valley Financial institution and probably different banks going through related points. Nevertheless, even with the market’s volatility, the Fed is unlikely to change its path of price hikes at this level as a result of tight labor market and excessive inflation charges. If the Fed does alter its path, it should probably be on account of destructive information that implies the struggles of Silicon Valley Financial institution and different banks are the beginning of a bigger subject. This can be a state of affairs that no person needs to see, and definitely, no person needs that to occur.

Be a part of Studying The Markets Danger-Free With A Two-Week Trial!

(*The Free Trial provide just isn’t accessible within the App retailer)

Discover out why Studying The Markets was one of many fastest-growing SA market companies in 2022. Attempt it totally free.

Studying the Markets helps readers study the method I utilized in 2022 to detect the bear market, navigate its twists and turns, and keep away from these head fakes that fooled so many. I share the method and my opinion available on the market every day by means of written commentary and movies.

Take a look at my e-newsletter if you wish to begin with one thing much less intensive.