[ad_1]

Typically I feel it will be good to be a finance professor.

They’re allowed to, even inspired to, have poor theories about investing.

Then, when some piece of information contradicts the speculation, they name it an anomaly and nobody bats an eye fixed.

From a sensible perspective, we would assume a principle with anomalies is incorrect. It doesn’t make a distinction to finance professors, as a result of investing isn’t the place they make their cash.

However most of us aren’t Ph.D.s at enterprise colleges. We’re traders. Now we have to generate income within the markets, not from e-book gross sales.

So, we should acknowledge and revenue from these anomalies that the Ph.D.s shrink back from.

The best monetary lie ever informed was by way of one such funding principle that’s riddled with anomalies.

This principle miraculously led to the absorption of trillions of {dollars} in wealth, regardless of promising mediocre funding returns.

I’ve spent my complete profession rejecting this principle, and proving that doing so results in far better returns and much better management over your wealth.

Right now, I’ll present you what I’ve been doing recently to proceed this mission.

The Lie of the Environment friendly Market Speculation

The speculation that inevitably results in mediocre funding returns is the environment friendly market speculation, or EMH.

The strictest model of the EMH says that inventory costs are perpetually right. The present market value of any inventory is that value as a result of it displays all obtainable data. So, the market value is at all times the right value of the inventory.

If that’s true, it’s inconceivable for any investor to beat the market. Many consider this. And that’s why index funds, which commit utterly to EMH, maintain trillions of {dollars} in wealth.

However there’s a number of proof exhibiting you may beat the market.

Worth traders who purchase particular person corporations at low cost costs have a protracted historical past of success. So do traders specializing in small-cap shares. Different nice traders have discovered success by buying and selling with momentum.

Worth, market cap and momentum are three of the anomalies to the environment friendly market speculation. There are numerous extra. Every of them gives traders a possible path to market-beating earnings.

The enterprise college professors know this. Lots of them wrote papers on anomalies. These papers usually, inadvertently, present step one on the trail to earnings.

Once I managed cash, we began our pitch to potential traders by explaining that we exploit the momentum anomaly to the EMH.

Many traders want easier phrases, in order that they name anomalies “elements.” Then they overweigh choose elements of their portfolio.

Warren Buffett, for instance, overweighs the worth issue. Many cash managers overweigh the momentum issue. Some create niches overweighting high quality of earnings, return on invested capital or different elements.

Institutional traders have accomplished this for many years. Particular person traders haven’t had the prospect — till not too long ago.

Democratizing Knowledge

Exploiting elements requires entry to knowledge. To use momentum, you want entry to cost knowledge. To use worth, you want entry to elementary knowledge.

For a very long time, knowledge was prohibitively costly. Even traders who discover the associated fee cheap might want to spend time or extra money writing personalized software program to determine the elements earlier than they’ll begin performing on them.

That’s why many traders take shortcuts to investing in these elements.

Many of the particular person traders I’ve met over time say they’re worth traders. They may solely purchase shares with low price-to-earnings (P/E) ratios. Or they’ll use another available metric to search out engaging shares.

This isn’t the way in which to use these anomalies.

True issue investing requires analyzing the issue for each inventory. The values have to be calculated, then sorted and ranked. There additionally have to be guidelines for when to purchase and promote.

It’s far more concerned than saying “I purchase when the P/E ratio is under 15.”

Regardless that knowledge is extra accessible than ever to particular person traders, there nonetheless isn’t a lot entry to elements.

Cash & Markets gives its Inventory Energy Ranking system which supplies issue scores for 1000’s of shares.

The free web site supplies inventory scores for six elements, three associated an organization’s monetary assertion and three derived from the worth motion. An introduction to the system is right here.

Currently, I’ve been using this ranking system to design a few of my very own techniques. And I’ll share precisely what I’ve give you subsequent week.

Within the meantime, although, take a while to punch a number of tickers into the Inventory Energy Ranking system at Cash and Markets. You’ll be able to simply use it to search out shares with strengths in sure elements, weaknesses in others and even the uncommon occurrences the place a inventory is robust throughout the board.

Regards,

Michael CarrEditor, One Commerce

Michael CarrEditor, One Commerce

P.S. Adam O’Dell, the brains behind the Inventory Energy Ranking system, makes use of it for lots greater than discovering nice shares to purchase.

For those who’ve spent any time with the system, you understand that it additionally flags potential landmine shares you’ll wish to steer clear from.

Or, if you understand a factor or two about methods to revenue from falling shares, you may goal them for earnings.

That’s precisely what Adam’s doing with what he believes is likely one of the market’s greatest landmines. It scores a dismal 22 out of 100 on the Inventory Energy Scores system and has misplaced lots of of billions of {dollars} in worth.

The tragic a part of all that is that just about everybody owns this inventory, whether or not they wish to or not. However Adam’s preventing again. Go right here to be taught how one can too.

For those who’re a present or aspiring house owner, chances are high you’re watching the actual property market intently… Low rates of interest within the years main as much as 2022 had the impact of inflating nearly every part … together with house costs.

However for the overwhelming majority of Individuals, the worth of the home is much much less essential than the scale of the month-to-month fee. And the decrease charges went, the costlier the home that the standard house owner may “afford” based mostly on the month-to-month fee.

That was nice when charges had been falling. It’s not so nice after they’re going the opposite course.

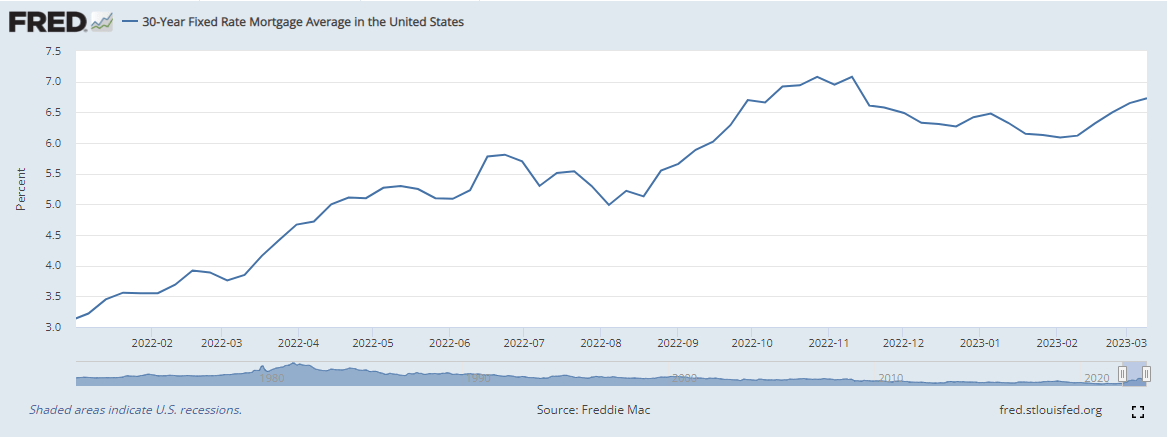

The typical 30-year mortgage price topped out at somewhat over 7% in late October after which began to float decrease over the following a number of months … till charges reversed course and began trending larger once more in February.

One thing has to present right here. With would-be homebuyers now priced out of the houses they deliberate to purchase, current house gross sales have dropped by a few third over the previous 12 months.

Costs haven’t collapsed (no less than, not but) as a result of current householders look like taking their houses off the market moderately than lowering the sale value. The variety of houses on the market has steadily decreased over the previous 12 months and reveals no signal of reversing.

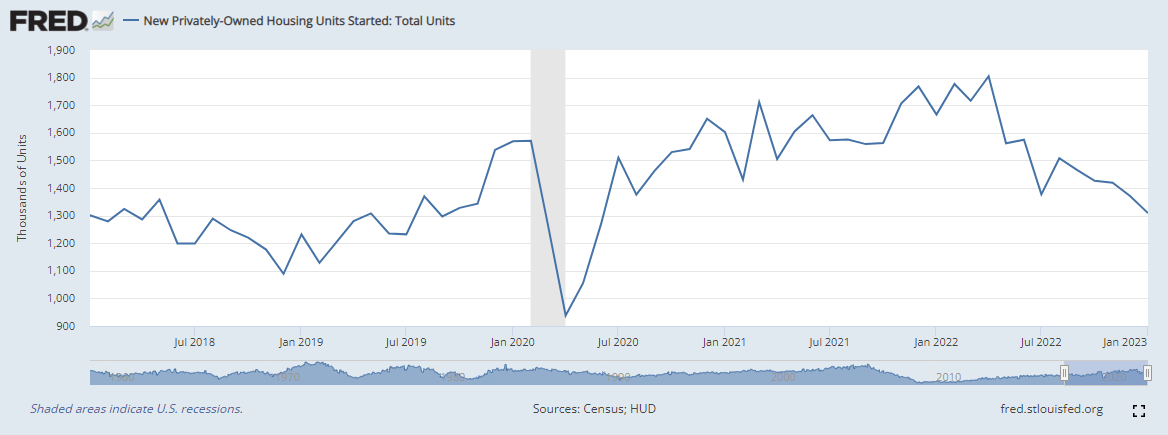

Right here’s the factor. Regardless of the dearth of affordability, house costs may not outright collapse as a result of the stock of latest houses simply merely isn’t there. New housing begins have additionally been sharply declining.

So … what does all of this imply?

It probably means no fast reduction for prime rents. It additionally means would-be patrons are priced out of the market resulting from excessive rates of interest, however stock is concurrently too tight for significant value declines.

For those who’re an current house owner, nice! You’re in a great place, and you’ve got an asset you may probably hire out.

However in case you’re trying to purchase, you is likely to be ready for some time. And also you would possibly wish to get used to elevated hire.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link