[ad_1]

On June 6, 2022, President Biden invoked the Protection Manufacturing Act to “speed up home manufacturing of fresh power applied sciences, together with photo voltaic panel components.”

The federal government is getting behind renewable power in such a giant approach, Biden used a presidential energy sometimes reserved for emergencies.

Should you noticed this as a sign to go all-in on renewable power shares, you most likely weren’t the one one.

Whereas it might in the future show to be the fitting name, proper now everybody’s lacking a far greater and speedy alternative.

Truthfully, this transfer by Biden solely serves as a distraction to the true power story of the yr … and, in my view, the remainder of this decade: oil and gasoline.

It doesn’t matter what the White Home does or says, I consider oil shares will massively outperform the S&P 500 for the remainder of the 2020s…

Only a few folks perceive or see this coming…

Let’s get into why a large oil bull market is taking form proper earlier than our eyes…

Oil’s Subsequent Tailwinds

Turning the clock again one yr, we had been within the midst of an oil and power increase pushed by two main components:

- A post-COVID demand crunch as folks bought again to touring and commuting for work.

- Russia’s invasion of Ukraine and the worldwide sanctions towards the aggressor that adopted.

However a shift occurred within the latter half of 2022, as oil costs fell and buyers digested these huge shifts.

We’ll nonetheless see some advantages from the tailwinds within the months forward, however it is a entire new ballgame.

You see, the worst oil and gasoline producers went out of enterprise through the oil bear market of 2014 to 2020.

However the very best ones lower their value constructions right down to the bone, making certain their survival.

And now that crude costs are excessive once more, they’re making file free money flows.

They’re in the very best place they’ve seen in many years … however buyers haven’t but caught on. Many bought burned in that six-year bear market I discussed above, so that they’re hardly even trying at power, not to mention shopping for it.

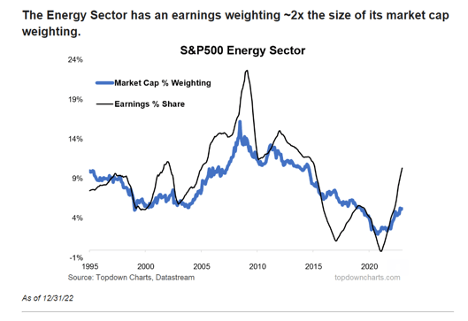

It’s left many oil and gasoline shares buying and selling at dirt-cheap valuations, even after an enormous rally in 2022. A lot so, the power sector now makes up 10% of the S&P 500’s earnings … however solely 5% of its market cap:

The buyers who saved an open thoughts and noticed the chance within the “outdated and soiled” power sector growing had been rewarded.

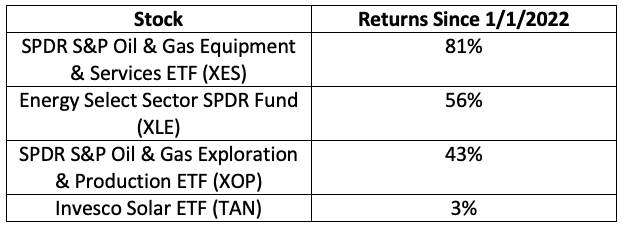

You possibly can see how this performed out by trying on the efficiency of among the high oil and gasoline exchange-traded funds (ETFs) in comparison with the greener funds just like the Invesco Photo voltaic ETF (NYSE: TAN) from the beginning of the bear market:

As you possibly can see, XES is up 81% during the last 12 months, whereas TAN is up simply 3%. (To not point out, the S&P 500 is down over 17%.)

That’s a 27X greater return than what you might take into account the benchmark “inexperienced power” funding.

The power sector has pulled again a bit in latest weeks, once more on the again of decrease oil costs, however the bullish development in power shares has most actually not run its course…

International oil demand will proceed to rise within the coming years.

And as our demand for oil continues to rise, whereas the availability facet stays tight because of years of underinvestment (do not forget that chart above) … costs will rise.

Briefly, there’s an undersupply of oil in the present day … since many producers went out of enterprise, and those that survived lower prices as a substitute of rising manufacturing (the pure factor to do in an oil bear market!).

However now, oil and gasoline corporations are massively worthwhile. And regardless of what President Biden might need you consider…

Oil Demand Isn’t Slowing Down

With a rising world inhabitants, oil demand will solely hold rising.

Not solely does oil stay the most well-liked alternative for gas and transportation, however it’s additionally broadly used for hundreds of on a regular basis objects equivalent to plastics, textiles, cosmetics and lubricants. (Bear in mind, these merchandise aren’t simply utilized by households, however factories and companies as properly.)

In order populations around the globe develop, economies require extra oil to maintain issues operating easily. Demand for oil will improve additional.

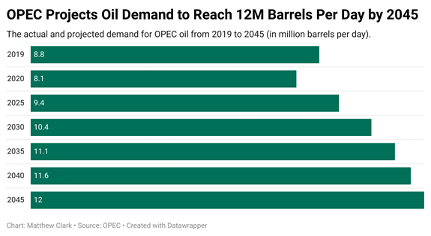

OPEC is definitely projecting the demand for oil to achieve file highs within the close to future:

As you possibly can see within the chart above, the demand for oil from OPEC nations might attain 12 million barrels per day by 2045.

And that’s simply oil from OPEC. The Worldwide Power Company (IEA) tasks that whole world oil demand will climb to 105.4 million barrels per day by 2030.

That’s a rise of 100,000 barrels of oil per day from final yr.

China, alone, will devour 15.7 million barrels per day by 2030. And with China proper in the course of easing its draconian lockdown restrictions, oil demand from its 1.4 billion residents is ready to surge.

Alongside this rising demand is the necessity for international locations to exchange depleting oil reserves.

As Mike Carr confirmed you earlier this month, the Biden administration took 180 million barrels of oil out of the Strategic Petroleum Reserve this yr alone to convey down gasoline costs.

These reserves should get replaced … by regulation.

Twenty-nine different international locations dedicated to tapping oil reserves to compensate for what was misplaced attributable to sanctions on Russian oil exports.

So, you’ve gotten 30 counties that want to exchange their oil reserves … and elevated demand for oil exterior of that alternative.

All of it spells a robust rise in oil costs by way of 2030.

So, the place can you discover the very best power shares to profit? You received’t have to go looking far…

USA: The World’s New Oil Market

The USA — sure, the identical nation presently utilizing emergency powers to supply photo voltaic panels — is quickly turning into the brand new heart of the worldwide oil market.

We had been as soon as a buyer of OPEC oil… Now, we’re turning right into a rival.

The IEA tasks the U.S. will account for 85% of the expansion in oil manufacturing worldwide by 2030 as we faucet into unmined shale oil formations. By 2025, the U.S. is ready to supply 20.9 million barrels of oil a day. By then, mixed exports of crude and refined oil will overtake these of Saudi Arabia.

OPEC controls over half the worldwide provide of oil now. That can shrink to 47% by 2025, the bottom because the Eighties.

Should you’re in search of regular, dependable returns, U.S. oil shares might show to be a profitable alternative.

Many oil shares have seen unbelievable progress over the previous yr attributable to greater power calls for and elevated effectivity of oil manufacturing.

In no scarcity of phrases, oil shares are the place to be proper now.

On the very least, it’s best to take into account including some publicity to the Power Choose Sector ETF (XLE) on this latest pullback. It’s an excellent entry level in what I’m assured might be an extended and robust uptrend on this sector.

Regards,

Adam O’DellChief Funding Strategist, Cash & Markets

Adam O’DellChief Funding Strategist, Cash & Markets

P.S. One other good transfer…

Contemplate testing this latest analysis presentation from Charles Mizrahi.

Charles, like me and my staff, has been all around the story for the previous yr. He’s been particularly centered on how a lot fossil gas is concerned in so-called inexperienced power manufacturing — which, because it seems, is extremely laborious to justify!

His strategy is totally different, however we each attain the identical conclusion. Fossil fuels might be a giant a part of our nation’s financial future.

Should you’re focused on studying how Charles is organising his readers to revenue from this new power bull market, click on right here.

Adam laid out a implausible bullish case for power shares over the approaching decade, and I agree. I’ve been lengthy power shares for some time now and have completely no plans to promote.

However whereas we’re at it, I assumed I’d add one other main motive why I consider power shares ought to do phenomenally properly within the years forward: Crude oil is priced in {dollars}!

Bear in mind, when costs are “going up,” they’re going up relative to one thing.

Our unit of measure is the greenback. However the greenback itself can be a tradable asset, and its worth can fluctuate wildly.

Power has been trending greater regardless of one of many greatest greenback bull markets in historical past. Ever because the 2008 meltdown, the greenback has been steadily gaining on the euro, yen, pound sterling and nearly each different main world forex. Should you’ve ever needed to go to Europe, go now. The greenback is the strongest it’s been relative to the euro in 20 years.

You possibly can see it within the chart under, which tracks the Greenback Index.

However right here’s the factor. Greenback bull markets don’t final endlessly. The greenback was trash relative to the euro and most main world currencies between 2000 and 2008. When alternate charges attain extremes, they reverse. And it seems like we’re seeing the early phases of that in the present day.

The greenback has been weakening since late 2022, and I anticipate that this development has rather a lot longer to run.

Now, I do have one caveat. Throughout market panics, the greenback tends to rise. The explanations for this are complicated, however it comes right down to a flight to security. When buyers are scared, they unload riskier positions and notably leveraged positions, and hoard {dollars}.

So, if this little bout of volatility we’re in will get worse, I’d anticipate the greenback to rally a little bit extra within the brief time period. However the important thing phrases listed below are “brief time period.” The development right here is decrease.

A less expensive greenback means dearer power … which in flip means fatter earnings for power firm extracting, transporting and promoting the stuff.

Simply chalk it up as yet another main bullish level in power’s favor.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link