Tippapatt/iStock through Getty Pictures

Block, Inc. (NYSE:SQ) has in fact taken a giant hit in gentle of the insurance policies of the Federal Reserve and the influence of upper rates of interest on what is taken into account a high-growth tech firm.

With the Fed anticipated to proceed to boost charges going ahead, it is extremely possible the share value of SQ will come underneath extra stress, the extent of which can depend on how excessive and the way shortly the Fed boosts rates of interest within the months forward.

The massive query presently is whether or not or not the market has already priced within the upcoming enhance in rates of interest, or it is ready to see if the Fed does implement a rise of 25 foundation factors, and what the commentary is at the moment in regard to future will increase.

I have been on report for some time saying the Fed will most likely not exceed an rate of interest stage of 5.25 p.c. Whereas I nonetheless suppose that is a risk, if inflation stays excessive and the U.S. financial system stays scorching, the end result may imply charges may rise to five.50 p.c, and probably as excessive as 5.75 p.c.

That stated, that’s going be a tricky stage to keep up due to the implications it could have on the U.S. authorities and its $31-trillion-plus debt load.

Because it pertains to SQ, it is probably not excellent news it doesn’t matter what the Fed does. Greater rates of interest often hit tech shares like SQ tougher, and that, mixed with the inevitable slowdown of the U.S. financial system will most likely hit the inventory pretty onerous.

On this article we’ll have a look at a few of its latest numbers, however largely at how the share value of Block is probably going to reply to near-term headwinds, and the way buyers ought to think about the implications in regard to entry factors or including to positions.

TradingView

Among the numbers

Complete web income within the fourth quarter of 2022 was $4.65 billion, up 14 p.c year-over-year. Full 12 months web income for 2022 was $17.53 billion, down one p.c year-over-year.

Gross revenue within the reporting interval was $1.66 billion, in comparison with gross revenue of 1.18 billion within the fourth quarter of 2021, a achieve of 40 p.c. Gross revenue for full 12 months 2022 was $5.99 billion, up 36 p.c from final 12 months in the identical quarter.

The corporate had an working lack of -$(135.00) million within the fourth quarter of 2022, and an working lack of -$(625.00) million for full 12 months 2022.

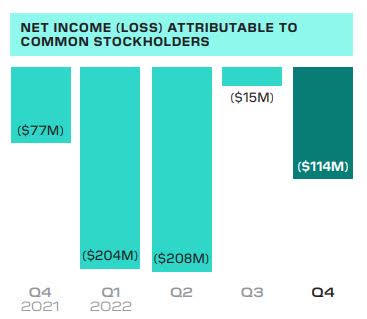

Within the fourth quarter of 2022, Block had a web lack of -$(114.00) million, or -$(0.19) per diluted share. For full 12 months 2022, SQ had a web lack of -$(541.00) million, or -$(0.93) per diluted share.

Investor Presentation

Working bills within the quarter had been $1.80 billion, up 45 p.c year-over-year.

On the finish of calendar 2022 the corporate held money and money equivalents of $6.9 billion, with $7.5 billion in total liquidity.

My predominant focus for the aim of this text is on the losses of the corporate, elevated spend, the upper price of capital, and the way that can have an effect on the efficiency of the corporate within the close to time period, and why it is essential to consider if contemplating taking a place in SQ.

Share value concerns

I wish to have a look at the share value of Block during the last a number of years to get a have a look at the place the bottoms have been throughout that point, and the way that aligns with what the latest bottoms have been, and what that might imply for a doable entry level.

During the last 5 years the share value of SQ fell to a quick low of roughly $31.50 per share on March 16, 2020, and moved up from there to about $37.00 per share for a few weeks, starting a chronic run from that point on to its 5-year excessive of round $289.00 per share on August 2, 2021, afterwards descending to a 52-week low of $51.34 on October 10, 2022.

Excluding the very brief 5-year low, since Could 7, 2018, the corporate has had a triple low of roughly $50.00 per share, and a triple high of about $91.00 per share. Since June 13, 2022, the inventory has traded in a variety of about $51.00 per share to roughly $90.00 per share.

At present it is buying and selling nearly in the course of these numbers at $71.00 per share. In case you went again to July 16, 2018, the share value of SQ would have been increased than it’s buying and selling immediately.

Why it issues

The rationale for going by the historical past of Block’s share value is to point out, to start with, that it has traded as a lot on the low facet because it has on the excessive facet, and when contemplating taking a place within the firm in gentle of the actual fact the Federal Reserve goes to proceed to boost rates of interest, there’s a a lot increased chance the inventory goes to commerce decrease at the side of the rise in rates of interest, a minimum of for a lot if not all of 2023. The extent of that can be decided by how inflation responds to the enhance in rates of interest.

Presently the query that has but to be answered is how excessive the Fed will increase charges earlier than pivoting. I believe it is going to increase charges, most likely pause to attend to see the outcomes, and reply accordingly.

If my thesis is appropriate, it could imply a chronic interval of uncertainty throughout 2023, with the end result being buyers holding again on taking positions in high-tech firms like SQ. Underneath that situation, the inventory would most likely both commerce stage or down; I do not see any catalysts that might probably overcome the Fed issue – a minimum of within the close to time period.

In considering phrases of a backside, assuming the Fed stays under the 6 p.c mark in rate of interest ranges, round $45.00 to $50.00 could be what I might search for on the low facet.

For those who like the corporate however wish to get in due to FOMO, one of the simplest ways to play it could be to make use of dollar-cost averaging. The place the share value stands immediately is not unhealthy, and taking a place right here and averaging down if the inventory goes down, would nonetheless end in a horny price foundation for these in Block for the long run.

The opposite factor to contemplate could be to place dimension with self-discipline. I believe for these within the inventory for the long run, there’s loads of upside left within the share value. The massive mistake is to take too massive of a place primarily based upon funding capital out there.

Conclusion

Within the sector SQ competes in it takes numerous invested capital to make sure being aggressive with its friends, and with the price of capital climbing and the corporate being unprofitable, the outlook within the close to time period is not that good.

For that motive, I see the share value coming underneath additional stress within the months forward, primarily based upon the actions of the Federal Reserve, price of capital, and the necessity to proceed spending so as to not fall behind its rivals.

Underneath that situation it means losses will proceed for now, and buyers and shareholders should stay affected person in both ready for a great entry level to take a brand new place within the agency, or in including to a place.

I imagine it is going to take a while to climb out of the opening the corporate is in, and people taking a place should wait till the Fed alerts it is going to pivot, whereas ready for rates of interest to reverse course and inflation to recede earlier than beginning to be rewarded with some earnings from the corporate.