[ad_1]

You’ve simply witnessed a twenty first century financial institution run … and the panic hasn’t handed.

It began with mismanagement and social media panic. It was facilitated by apps on smartphones, which noticed $42 billion in deposits go away the financial institution in at some point.

By the point it was over, Silicon Valley Financial institution (SVB) grew to become the second-largest financial institution failure in historical past.

Following SVB’s failure, financial institution shares had their worst day for the reason that monetary disaster of 2008.

However the collapse of SVB and Signature Financial institution, one other financial institution taken over by the FDIC, are fully completely different from 2008.

Mr. Market nonetheless braced for the worst although, and shares continued to dump over the previous 4 periods.

After shifting larger yesterday, shares resumed their downward fall this morning.

The inventory market plunged on the open due to fears the contagion has unfold and we’ll be seeing extra financial institution failures.

In actual fact, oil costs fell to a five-week low as a result of fallout from SVB’s collapse.

So why did buyers determine … to dump oil?

As a result of that’s what occurs when concern grips a market. All the things goes down collectively.

An Power Alternative

Over the previous few weeks in The Banyan Edge, I’ve proven you the way Biden’s power mandates are merely unattainable to fulfill with in the present day’s expertise.

Simply mining the supplies could be disastrous for the surroundings.

To not point out handing over the keys to the worldwide economic system to China and Xi Jinping.

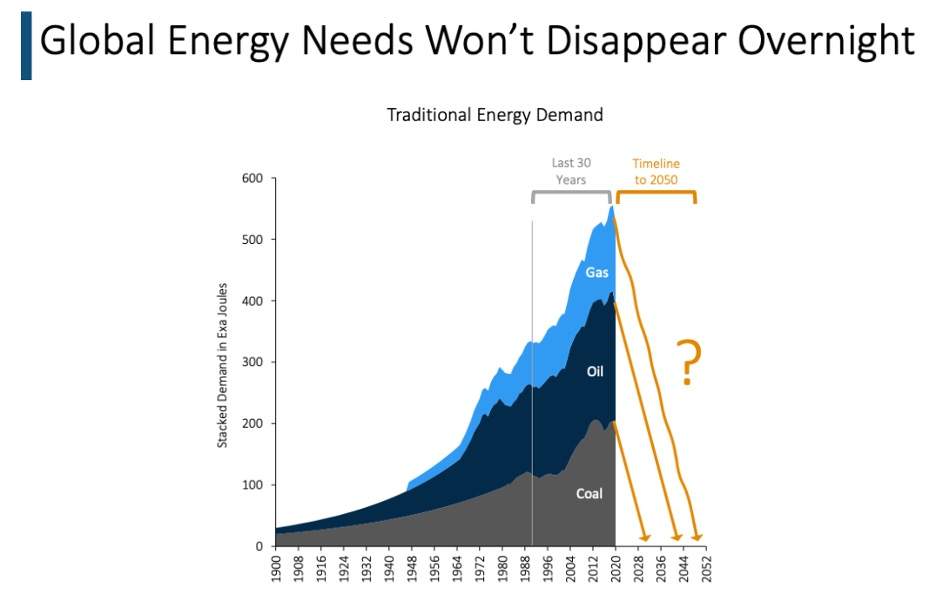

Check out the chart beneath, and also you’ll see what I imply. It reveals how demand for fossil fuels has skyrocketed since 1900.

The orange strains present how briskly we’d have to present all of it as much as meet Biden’s deadlines:

(Click on right here to view bigger picture.)

It appears rather a lot like pushing the economic system off a cliff.

That’s why Washington is already strolling again its warfare on fossil fuels.

On the marketing campaign path again in 2019, Biden advised supporters: “I assure you, we’re going to finish fossil fuels.”

Then simply final week, Biden’s administration accepted a brand new oil-drilling mission within the Alaskan Arctic.

That’s a giant leap to make in three years. However even Biden is aware of the writing’s on the wall at this level.

He’s even gone as far as to confess it on this 12 months’s State of the Union deal with.

In an apparently unscripted second, he advised America that “we’re nonetheless going to want oil and gasoline for some time,” and addressed the trade’s issues particularly.

In the meantime Wall Avenue continues to be in some way behind the curve — which is nice information for Primary Avenue buyers.

As a result of it implies that we are able to nonetheless lock in among the market’s finest fossil gasoline investments at cut price costs…

Cut price Buys: Oil and Pure Fuel

Fossil gasoline has a protracted runway forward of it.

I’ve seen some estimates that oil manufacturing will proceed to rise till the 12 months 2040!

That’s why I’m long-term bullish on oil and pure gasoline.

Be mindful, I couldn’t let you know what the worth per barrel for oil could be subsequent week, subsequent month or subsequent 12 months.

However I’m extremely assured, primarily based on the easy legal guidelines of provide and demand, that oil and pure gasoline costs will likely be materially larger 5 and positively 10 years from now. Materially larger.

One potential method to revenue from this bullish power development that I see over the following decade, is to purchase the most important power ETF: Power Choose Sector SPDR Fund (NYSE: XLE).

The exchange-traded fund (ETF) owns among the largest power corporations on the earth similar to Exxon Mobil, Chevron, Schlumberger, in addition to 23 different corporations.

And 100% of these corporations are positioned within the U.S.

Like many shares this week, this ETF has taken it on the chin this week. It’s down 5%.

However that doesn’t imply there’s something essentially improper with the enterprise. It simply makes it an excellent higher cut price.

The trail to larger positive aspects will all the time take a look at buyers — to see how a lot conviction they’ve of their place within the face of downturns … like ones that comply with massive occasions like SVB’s collapse.

And if you happen to’re in search of extra direct publicity to grease and pure gasoline, I simply launched a brand new video that particulars three of the very best shares I’ve discovered.

- One of many top-five pure gasoline producers in all of North America.

- An oil 2.0 firm in a perfect place for development.

- An organization with 120,000 miles of pipelines throughout 41 American states.

You’ll be able to see all the main points and learn how to unlock my suggestions by clicking right here.

Regards,

Charles Mizrahi

Founder, Alpha Investor

P.S. Are you utilizing this time to purchase high quality corporations at cut price costs? Let me know at BanyanEdge@BanyanHill.com.

And if you happen to’re in search of suggestions … test this out beneath. ⬇️ ⬇️ ⬇️

SVB’s Collapse = Your Alternative

Backside line is that this…

We deal with the companies and never the every day gyrations of the inventory market.

While you do this, you possibly can sleep higher at night time and never fear about panics and market disruptions that gained’t impression the businesses in your portfolio.

In actual fact, in case you have the temperament for it, now is a superb time to purchase at cut price costs.

In order for you Charles Mizrahi’s suggestions, click on right here now for the main points.

Silicon Valley Financial institution’s failure is, in fact, the most important information of 2023.

Or a minimum of it was.

At the moment, evidently Credit score Suisse is stealing the eye. The Swiss banking big — which got here near failing within the aftermath of the 2008 meltdown — is now entrance and middle within the headlines.

As I write this, Credit score Suisse’s inventory has hit new all-time lows.

Why? The financial institution spooked the market by mentioning a “materials weak point” in its monetary reporting. This may lead to “misstatements of account balances or disclosures.”

Nobody is aware of precisely what which means, but it surely sounds just like the obscure notices that got here out of the banks in 2008. So identical to what occurred to SVB, buyers are promoting first and asking questions later.

And it didn’t assist that the Saudi nationwide financial institution loudly and publicly stated that it was not taken with bailing out Credit score Suisse with a capital contribution.

Nicely … we’ll see how this shakes out. Personally, I don’t consider we’re a state of affairs just like the 2008 monetary disaster.

However we might be an identical scenario to the financial savings and mortgage disaster (1986 to 1995). And that wasn’t loads of enjoyable both.

Round a 3rd of all financial savings and mortgage associations failed throughout that interval, and it hit my native Texas economic system significantly exhausting. Then, identical to now, the foundation of the issue was a mismatch between short-term liabilities and long-term property.

The historical past lesson is nice.

However extra virtually: What are you able to do to truly shield your self from a financial institution run?

Let’s make a listing:

- Don’t have greater than the $250,000 FDIC insured most in money in any single financial institution.

Sure, the federal authorities has promised to backstop the depositors of the banks which have already failed. This successfully raises the $250,000 FDIC insurance coverage most to infinity.

However, there is no such thing as a assure they are going to proceed to take action. They arbitrarily raised it, they usually can simply as simply decrease it. There’s simply no motive to danger it when you’ve gotten different choices.

- Contemplate shifting any money financial savings you don’t want for fast bills to the U.S. Treasury itself.

It will make you completely bulletproof.

Why? As a result of TreasuryDirect provides you entry to T-bills and an assortment of U.S. authorities bonds.

The debt ceiling fiasco however, you haven’t any danger with the U.S. authorities. In the event that they fail to safeguard your money, it means the zombie apocalypse is right here and your cash has no worth anyway.

- You too can sweep any massive money balances in your brokerage account into T-bills.

Up to now, the panic out there has been centered round banks. Nonetheless, that may change in a rush and unfold to brokerage corporations.

Maintaining your extra money in T-bills is secure, and the yields aren’t too shabby today. You will get about 5% in maturities of 6 to 12 months.

You don’t must run out and promote your high quality long-term shares. As Charles Mizrahi factors out, panics like these create good alternatives so as to add to high quality long-term positions — like his suggestions in oil and pure gasoline.

However along with your money — your chilly, exhausting money — there’s no motive to take danger when safeguarding it’s so easy.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link