[ad_1]

I do know what you’re pondering. This man is making an attempt to stretch the SVB headlines right into a multifamily actual property investing story. It should be clickbait.

I get it. However I hope you’ll give me a second to inform you two methods the SVB and different main financial institution failures may probably profit multifamily syndicators and traders. Then you’ll be able to resolve if there’s any substance to my headline.

Like all of us, I watched the information tales unfold swiftly over this previous week. Silicon Valley Financial institution went from paying bonuses to closing store inside days. There isn’t a must recount the gory particulars right here.

However as I contemplated the dangerous information falling out from this hopefully localized however probably extra important state of affairs, I spotted two potential brilliant spots for multifamily syndicators and traders. Not simply present gamers—however these desperate to get into this presently over-crowded house.

My short-term thesis is speculative, so I freely admit I may very well be incorrect on this one. However I’ll plant a assured flag on my longer-term discussions beneath since I consider these outcomes are nearly inevitable.

The Close to-Time period Affect For Present Syndicators and Buyers

Jerome Powell testified in a semi-annual go to to Capitol Hill final week, “If, and I stress that no choice has been made on this, but when the totality of the information had been to point that quicker tightening is warranted, we might be ready to extend the tempo of fee hikes,” Powell instructed the U.S. Home of Representatives Monetary Providers.

The conclusion of many Fed watchers was an rate of interest hike of 0.25% to 0.5% on March 22. This isn’t a shock since Powell is a disciple of Nineteen Eighties Fed chair Paul Volcker (who raised charges to twenty% on the eve of Reagan’s presidency) and the problem the Fed is having reining in inflation.

Silvergate Financial institution collapsed at about the identical time. Adopted by Silicon Valley Financial institution the subsequent week. Then Signature Financial institution final weekend. Now the waters are roiling throughout the pond at Credit score Suisse.

Although onlookers rightly blame selections made by financial institution administration, the state of affairs at SVB was clearly a match lit by quickly rising rates of interest. Unprecedentedly speedy.

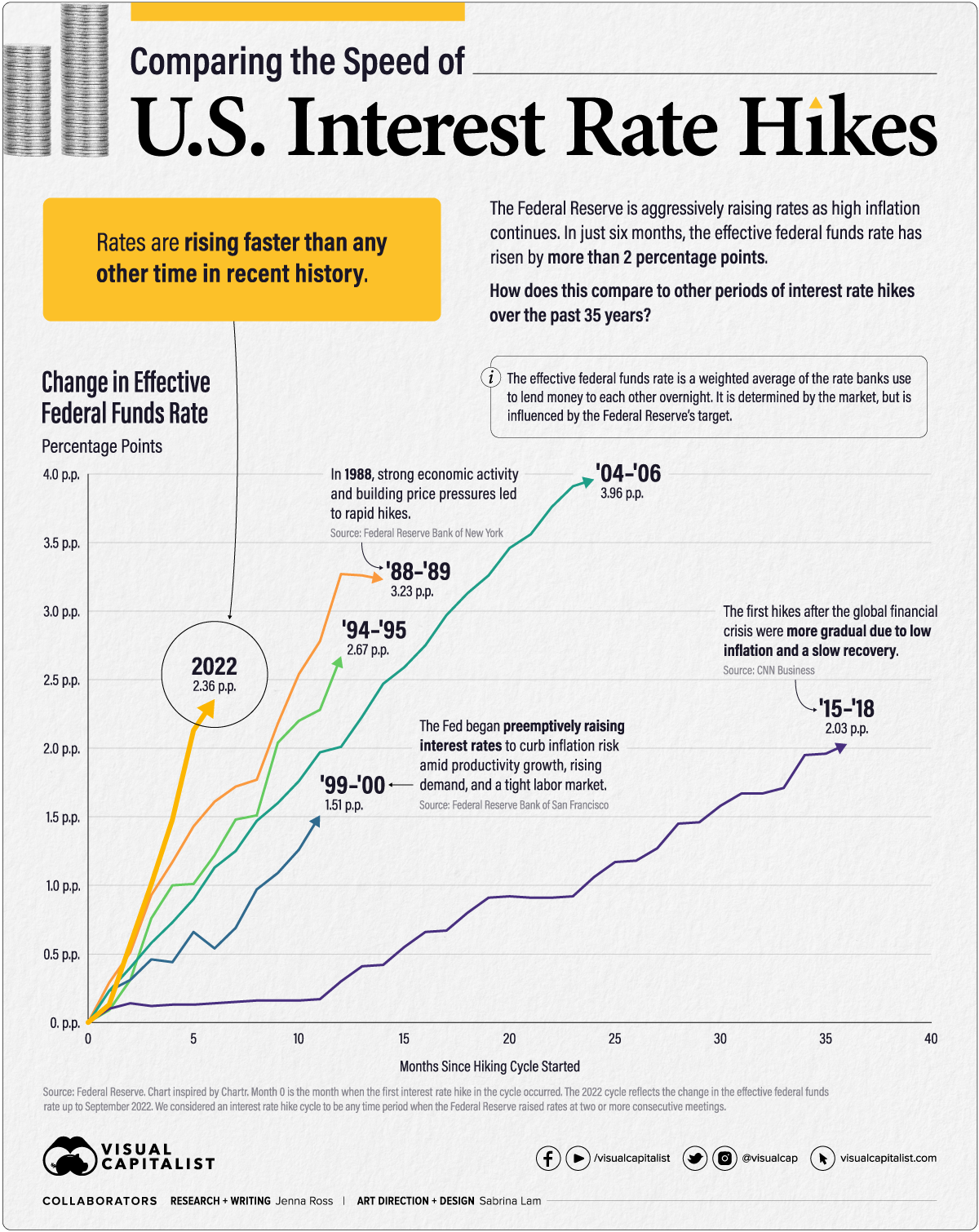

Try this graphic displaying the velocity of those will increase in comparison with prior durations:

Although the Federal Reserve’s actions had been designed to curb inflation, I doubt financial institution failures had been an supposed consequence. The velocity of those three failures and the way in which this has dominated the information cycle has brought about widespread worry.

“Which financial institution is subsequent?”

“Are my deposits protected?”

“How will this influence my line of credit score or mortgage?”

How This Scenario May Be Good Within the Brief-Time period

A whole lot of multifamily offers are in large bother. Decrease, floating fee debt was the drug of alternative this previous season as syndicators seemed for each technique to pencil offers to edge out overzealous opponents in a race to the underside.

With no prepayment penalties, floating fee debt additionally supplied a extra accessible out for syndicators planning so as to add worth and promote shortly. This technique generated billions in income for traders lately.

However floating debt has come again to chew syndicators and traders on this season of hovering rates of interest. Ballooning curiosity funds are crippling money circulation, shuttering investor distributions, and placing investor fairness in severe jeopardy.

The hovering projected price of renewing rate of interest caps is leading to lenders demanding a lot increased reserves. A syndicator good friend reported that certainly one of his offers has traditionally required month-to-month reserves for rate of interest cap renewal at roughly $2,000. His lender has elevated that very same month-to-month escrow to $70,000. (You learn that proper.)

Syndicators/traders with each floating and fixed-rate debt are struggling added fallout as lease will increase have grounded to a halt in most markets. That is profoundly impacting web working revenue and values. This can be a blow to operators trying to NOI as their potential bailout for declining values on account of increasing cap charges. This can be a actual headache for many who plan to refinance or promote quickly.

We’re listening to tales each week about syndicators reducing distributions and discussing margin calls to keep away from whole losses. We not too long ago heard a couple of syndicator paying $30,000 month-to-month out of his pocket to maintain a deal afloat.

Although I’ve no means of confirming this statistic, one educated attendee finally week’s Greatest Ever Convention acknowledged in his e-newsletter that he believes about 30% of the multifamily offers from convention attendees are in bother at some stage.

So the state of affairs is severe. The place is the so-called silver lining from the financial institution disaster?

As I stated, the Federal Reserve should actually be taking financial institution failures under consideration as they decide their subsequent transfer on March 22. If the Fed decides to sluggish, delay, or cease rate of interest hikes (and even reverse quickly), it may present a reprieve for over-stressed multifamily syndicators and their traders.

This reprieve may embrace relaxed fee cap reserve necessities, decrease money circulation bleed from debt service, much less injury to valuations, a better probability of a profitable refinance, and a decrease probability of a capital name or shedding the deal again to the lender. (Admittedly, this may increasingly simply delay the inevitable for many.)

Whereas some nonetheless consider Powell and the Fed will cost ahead with their plan to lift charges, others assume a delay is within the works. Goldman Sachs has publicly acknowledged they consider the Fed won’t increase rates of interest subsequent week in gentle of this disaster.

It gained’t take lengthy to see if this near-term silver lining performs out. However the extra sure long-term silver lining will take years.

The Lengthy-Time period Silver Lining From Fed Curiosity Fee Hikes and Financial institution Failures

In 2016, I revealed a e-book on multifamily investing humbly titled “The Good Funding”. I’ve been poking enjoyable at myself about it since 2017 or so, nevertheless.

I’ve been saying, “The right funding isn’t excellent…if it’s a must to drastically overpay to get it.” And I’d add: “…if it’s a must to use floating fee debt to make it pencil out.”

It has been robust to search out offers that pencil out. In actual fact, it’s been robust to get multifamily offers in any respect. On-market or off-market. The competitors has blown as much as new ranges. If you happen to’ve adopted my writing, you realize I consider this is because of:

- Elevated syndication acceptance on account of relaxed guidelines from the JOBS Act.

- Viral visibility and recognition on account of social media and different on-line platforms.

- An explosion of gurus who emerged out of nowhere this decade. Some who weren’t in actual property earlier than the Nice Recession could also be thought-about “Newrus” by some.

- Elevated funding from these exiting Wall Road’s casinos and worldwide traders.

- The elevated recognition of 1031 exchanges with generally inflated costs on alternative properties.

- A rising tide that has lifted all boats for a decade—till the tide went out and uncovered Warren Buffett’s skinny dippers.

In fact, the steep rate of interest hikes have drastically slowed down multifamily funding mania. However these financial institution failures may undoubtedly end in lenders elevating underwriting requirements—beginning now.

Neighborhood and regional banks, which offer many actual property builders and syndicators entry to credit score, is perhaps reluctant to originate new loans in any respect. Particularly over the brief time period whereas the specter of financial institution runs and extra fee hikes loom. (Observe that multifamily syndicators have choices to accumulate company debt from Fannie Mae, Freddie Mac, and HUD that won’t go away in a financial institution disaster or an inflated rate of interest atmosphere.)

Worse for a lot of, these banks might pull the plug on renewing totally performing actual property loans. A good friend not too long ago visited an area banker who confirmed him a thick manila folder stuffed with performing loans they don’t plan to resume this yr.

So, identical to within the close to time period above, this example is severe. So the place is the so-called long-term silver lining from the financial institution disaster and the Fed fee hikes?

As in any recession, a longer-term influence will undoubtedly be a decreased stage of multifamily provide to satisfy demand which continues to be rising. We have already got a report variety of multifamily property coming on-line in 2023. However the Nationwide House Affiliation and the Nationwide Multifamily Housing Council say the U.S. must assemble 4.3 million extra residences by 2035 to satisfy the demand for rental housing.

How a lot is that? That’s roughly a 20% improve over the present nationwide provide. If you wish to assume of the present provide as constructed over roughly a century, contemplate that it wants to extend by 20% in simply the subsequent 12 years.

And if the Fed hikes, bolstered by financial institution failures, add brakes to the present development pipeline, that 12-year window to 2035 will quickly drop to single digits (for instance, if this slowdown drags on till 2026).

Silver lining? I will surely say sure.

A hawkish Fed plus a probable constrained credit score atmosphere, plus the potential that many common syndicators will probably be out of the enterprise within the subsequent cycle, may end in a greater atmosphere for a lot of of you who’ve been desperate to get into the enterprise.

However you won’t have to attend till the subsequent cycle.

Many distressed multifamily offers will fail within the coming yr or two. This might present alternatives so that you can purchase distressed offers at far beneath appraised worth from troubled operators or banks.

Don’t get me incorrect. I’d take completely no pleasure in anybody’s failure, and I hope you’re feeling the identical. However this can be a reality of life in each market cycle. And this may consequence within the creation of extra wealth than may very well be acquired in most up cycles.

I’ll shut with a quote from Howard Marks, the grasp of benefiting from distressed property. It might pay for us to hear intently now and in addition when the tide rises once more subsequent cycle.

“In dangerous occasions, securities can usually be purchased for costs that understate their deserves. And in good occasions, securities will be offered at costs that overstate their potential. And but, most individuals are impelled to purchase euphorically when the cycle drives costs up and to promote in panic when it drives costs down.”

Extra from BiggerPockets: 2023 State of Actual Property Investing

After years of unprecedented progress, the housing market has shifted course and has entered a correction. Now’s your time to take benefit. Obtain the 2023 State of Actual Property Investing report written by Dave Meyer, to search out out which methods and techniques will revenue in 2023.

Observe By BiggerPockets: These are opinions written by the writer and don’t essentially symbolize the opinions of BiggerPockets.

[ad_2]

Source link