Dan Kitwood

The irrational banking panic of 2023 has unfold itself into different sectors comparable to insurance coverage. AIG (NYSE:AIG) is trying deeply undervalued at present ranges. AIG’s administration has executed a transformative enchancment in underwriting which I profiled in a earlier article. This has created a a lot stronger enterprise with a far decrease threat profile, however Mr. Market in its present mania, appears to be treating it as if it’s the AIG of 2008, with Monetary Merchandise enterprise that doomed it. The earlier article talked so much in regards to the enterprise, so I’m going to focus extra on the valuation at the moment and can replace after 1st quarter earnings come out. Lengthy-term traders ought to make the most of the disconnect between value and worth introduced right here.

AIG ended the 4th quarter of 2022 with an Adjusted tangible e-book worth per share of $67.43, up from $62.82 the prior 12 months. Guide worth per share declined considerably to $53.83 from $79.97. This was the results of declines in AIG’s giant mounted revenue portfolio because of the enhance in rates of interest, which resulted in plummeting bond values. Insurance coverage firms like AIG are long-term traders, notably in its Life and Retirement Corebridge enterprise, which partly depends on spreads between deposit prices and funding revenue. The upper yields have been helpful for brand spanking new investments which are often made however they’ve resulted in mark to market losses on the prevailing holdings, as we’ve seen with most firms within the business that had length dangers. AIG will not be a financial institution and subsequently shouldn’t be fearful a financial institution run, as appears to be the fad after Silicon Valley Financial institution’s VC depositors began their panic, which created this mess. These are length losses and never credit score losses and in the end the bonds ought to mature at par. The latest decline in rates of interest because of the panic ought to scale back these losses by fairly a bit in the event that they maintain by the tip of the 1st quarter.

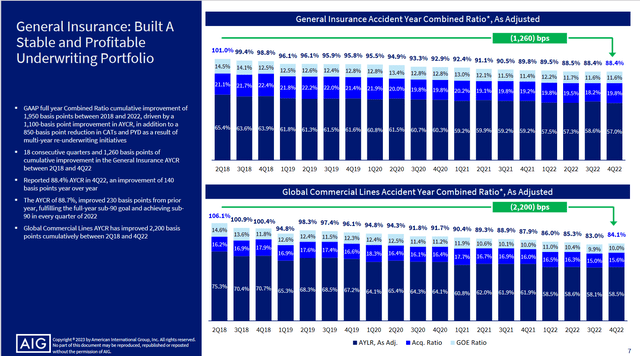

AIG’s mixed ratio continued its significant enchancment, reaching 91.9%, down from 95.8%. The accident 12 months loss ratio, as adjusted (AYLR) improved to 57.6% from 59.4%. A mixed ratio beneath 100%, primarily means that you’re paid to tackle float and the funding revenue is gravy. Previous to latest administration initiatives over the previous couple of years, this ratio was often above 100% for AIG. AIG’s Normal Insurance coverage enterprise has seen an over $7B cumulative enhance in full 12 months Normal Insurance coverage underwriting revenue since 2016. 2022 was the twond consecutive 12 months of underwriting profitability enchancment of no less than $1B. A part of the development is because of a far decrease threat profile, as AIG has lowered its gross restrict by $1.2T throughout its portfolios since 2018, with roughly 75% of that coming from Property insurance coverage. Robust mixed ratios together with larger charges on mounted revenue, ought to result in robust earnings enchancment transferring ahead for the corporate.

AIG 4th Quarter Earnings Presentation

Whole adjusted pre-tax revenue for 2022, was $5.140B, down from $5.92B. The decline was largely pushed by decrease different funding returns because of the bear market of 2022. AATI attributable to AIG shareholders was $3.586B, or $4.55 per diluted share. These figures have been down from $4.430B, or $5.12B within the prior 12 months. AIG trades at simply 8.1x ahead earnings and has a market capitalization of solely $37B. Based mostly on 734.1MM shares excellent, AIG’s market capitalization is simply $34.68B. The inventory trades at simply 70% of adjusted tangible e-book worth per share, and 88% of its This fall e-book worth, which seemingly can be fairly a bit larger after the 1st quarter, based mostly on latest actions in bond costs. AIG lowered its shares excellent by 10% in 2022, utilizing $5.1B. AIG was additionally capable of set up the capital construction for Corebridge as a standalone public firm and deleverage AIG. There are not any near-term maturities over $1B in any given quarter till 2048, so it is a very robust monetary framework.

AIG’s administration has a technique to get the corporate in direction of a double digit ROCE. The plan is for continued momentum on enhancing underwriting profitability, together with the separation of the Life & Retirement Enterprise. The corporate will proceed to skinny out its working mannequin for extra expense financial savings. Then lastly, the corporate will use its extra capital to purchase again inventory and/or scale back debt. The plan is to scale back shares excellent to 600-650MM, whereas sustaining leverage within the low 20s together with AOCI. Administration has a golden alternative at present share costs to purchase again inventory and quickly develop e-book worth because of the accretion from the low cost to all key e-book worth metrics. This might additionally speed up earnings progress. AIG has $3.8B remaining on its share repurchase authorization so let’s hope they swing large and present their perception within the worth of the enterprise. I consider AIG inventory is value round $70 per share, so there’s a vital margin of security at present costs. The present dividend yield is 2.71%, so traders ought to see a strong shareholder yield as soon as once more. The inventory has been dropping violently seemingly day by day since final week, however the fundamentals are strong. This isn’t a time for panicking and dollar-cost-averaging into positions is at all times a rational technique! As I discussed beforehand, I’ll attempt to replace this report after Q1 earnings.