[ad_1]

It was like a scene proper out of the film It’s a Great Life…

Within the film, George Bailey took over the household enterprise of the Bailey Bros. Constructing & Mortgage. The Constructing & Mortgage took in deposits and lent out the cash within the type of mortgages.

The distinction between the curiosity they pay to depositors, and the curiosity they obtain from mortgages, is the Constructing & Loans gross revenue.

At one level within the film, there’s a run on the financial institution…

(Click on right here to observe the clip.)

Panicked depositors need their cash — all on the similar time. George tells them that he doesn’t bodily have their cash … it’s in mortgages.

And people mortgages helped their neighbors purchase houses locally.

After calming the mob, George persuades them to withdraw simply the cash they instantly want, which happily he has readily available.

The townsfolk take George’s recommendation and a run on the financial institution is averted.

Effectively, on March 8, Silicon Valley Financial institution (SVB) wasn’t so fortunate. It witnessed a Twenty first-century financial institution run.

With a couple of faucets on their financial institution app, depositors transferred $42 billion out of SVB in at some point.

Signature Financial institution was proper behind it. Clients had been spooked by the collapse of SVB and withdrew greater than $10 billion in deposits.

Now there’s panic available in the market.

When Mr. Market freaked out about SVB closing, financial institution shares offered off sharply. A number of regional banks had been down as a lot as 60% the Monday following the failure!

And final week, Moody’s positioned six regional banks below overview for potential credit standing downgrades.

First Republic Financial institution was one of many banks on the listing and is down near 80% because the starting of March.

We’ve by no means owned any banks in our portfolio and have prevented the carnage that financial institution shares are going by.

However Mr. Market’s panic unfold by to the entire market — not simply financial institution shares. So if you happen to see crimson in your portfolio and different traders panic promoting their shares, I would like you to maintain one factor in thoughts…

The trail to greater positive aspects will all the time check traders — to see how a lot conviction you may have in your place within the face of downturns.

So when that occurs, merely ask your self two questions on the businesses in your portfolio…

Don’t Overlook

Mr. Market measures an organization’s efficiency in quarters, however we measure it in years.

To find out if we need to proceed proudly owning the shares, we ask ourselves…

No. 1: Did something basically change in regards to the enterprise?

Present me the cash!

I might learn the newest earnings report and quarterly transcript.

Is the corporate nonetheless rising for the long run? Is it reserving real-world revenues? Does it nonetheless have a rock-star CEO targeted on driving shareholder worth?

If sure, why would you promote? Nothing has modified. And ultimately, the inventory worth will observe the enterprise, not the opposite method round.

No. 2: On the present share worth, is the enterprise priced at a discount?

When traders panic, inventory costs drop. That’s the character of the beast in terms of investing.

And if you happen to don’t have the best temperament, it would preserve you awake at evening.

However if you happen to’ve checked query No. 1, low inventory costs may be like manna from heaven!

As a result of high quality companies that we need to personal for 5 years or extra are buying and selling at a fair higher discount than after we really useful it.

I like to recommend utilizing these durations to BUY.

⬆️ 140%+ in ONE Yr

Over time, inventory costs will ultimately observe the enterprise’s success.

Or … its failure.

I’ve shared with you all yr that we’re in a complete new period for the inventory market — one the place investing success is all about selecting the correct enterprise.

That is very true in terms of microcaps.

They supply a few of the finest alternatives in in the present day’s market — however you must know the place to look! (Don’t fear, that’s what you’ve bought me for.)

Within the phrases of legendary investor Peter Lynch: “The perfect solution to earn a living is in a small development firm that has been worthwhile for a few years and easily goes on rising.”

Which is precisely what we’ve been doing with my analysis service Microcap Fortunes all alongside.

Right here’s a real-time instance of why it pays to carry your shares by volatility and market panic.

Certainly one of our well being tech firms has already grown income from 0 to over $51 million…

The founder and CEO is a rock star. After launching a brand new drug simply accredited by the FDA, he’s assured that inside two years, the corporate’s income will greater than double.

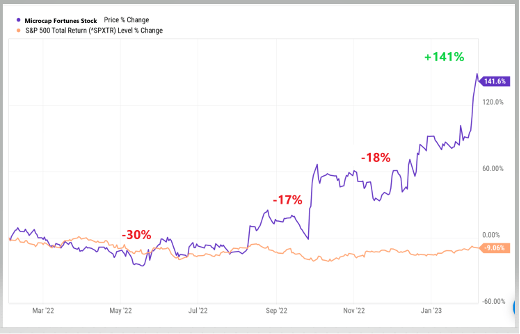

Firstly of the yr, the inventory hit greater than 140% whereas the inventory market was down -9%…

(Click on right here to view bigger picture.)

Nonetheless, 141% wasn’t a straight shot up … it by no means is.

Take a look at the chart once more.

My readers needed to endure three double-digit drawdowns to get to 140%.

And we’re nonetheless holding the inventory within the portfolio for greater positive aspects forward. And only a few days in the past, ANOTHER inventory hit 102% since including it in September.

It gained’t all the time really feel simple, however volatility is the worth we pay for giant positive aspects.

Have you ever held your shares throughout this drawdown? Or did you panic and promote? Let me know at BanyanEdge@BanyanHill.com.

There’s ALWAYS a purpose to promote… However if you happen to did, you’d be kicking your self in the present day.

Large drawdowns would check the endurance of most traders.

For those who had no concept what the corporate did, its prospects or who the CEO was … you would possibly’ve offered.

However not us.

As a result of we had an excellent concept of the underlying value of the enterprise. So when costs fell, I informed my readers to purchase extra shares at a greater discount worth!

Your Flip

Microcaps proceed to be one of many largest bargains within the inventory market proper now.

They’re like small hidden gems available in the market.

And right here’s why…

Large establishments can’t put money into them as a result of they’re too small. That offers us an enormous edge.

On common, there are 5 occasions as many analysts masking large-cap firms in comparison with the typical microcap.

Since there are few to no institutional traders following these firms, they change into very effectively priced. And that’s as a result of a lot of the buying and selling is finished by particular person retail traders that take a look at them as lottery tickets.

When inventory costs rise, they soar aboard. And when costs fall, they be a part of within the promoting … no matter worth.

That’s music to my ears as a result of it creates alternatives for us. As a result of the inventory worth tells you nothing in regards to the enterprise.

Connected to each inventory is a enterprise. So whereas retail traders purchase and promote shares primarily based on worth, I spend my time researching the enterprise.

We make our cash when the inventory worth trades at an enormous low cost to the value of the enterprise.

And that’s the time to purchase them.

Are you able to cease buying and selling out and in of shares primarily based on wiggles and jiggles on a chart or massive headlines within the information?

And able to make investments by specializing in the enterprise? (And sleep higher at evening!)

If that’s the case, then click on right here to get began earlier than the subsequent 140%-plus achieve passes you by.

Regards,

Charles Mizrahi

Founder, Alpha Investor

[ad_2]

Source link