GoodLifeStudio

Upwork (NASDAQ:UPWK) is among the many market leaders within the freelancer platform market. The corporate has near double the income of its closest competitor Fiverr (FVRR) with $618 million vs $337 million, reported for the complete yr of 2022. The worldwide freelance (or “gig financial system”) platform market was valued at $3.8 billion in 2020 and is forecast to develop at a strong 15% compounded annual progress fee [CAGR], with an estimated worth of $12 billion by 2028. Thus, Upwork is poised to learn from this pattern, particularly as extra organizations are seeing the profit (and want) of a extra versatile workforce. On this put up, I’ll break down the financials of Upwork, earlier than revealing my valuation mannequin and forecasts for the corporate. Let’s dive in.

Rising Financials

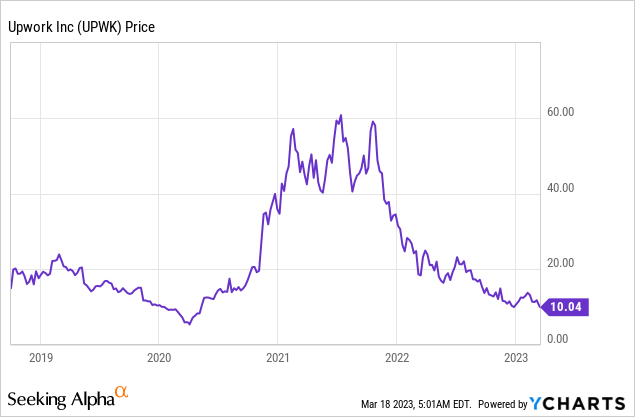

Upwork reported robust monetary outcomes for the fourth quarter of 2022. Its income was $161 million, which beat analyst forecasts by $2.15 million and elevated by 18% yr over yr. It ought to be famous this progress fee is slower than the ~24% reported in Q3,22, and ~26% in Q2,22. Nevertheless, this was anticipated because of the unsure macroeconomic setting and hiring freeze, which has occurred throughout many companies (even for freelance roles). The one silver lining is this can be a frequent pattern I’ve seen throughout nearly each enterprise I’ve studied over the previous 12 months (see my different posts), thus, it isn’t Upwork-specific. One other constructive is for the complete yr of 2022, its income grew by 23% to $618 million, which was just one% decrease than the yr 2019/2020.

Upwork income (This fall,22 knowledge)

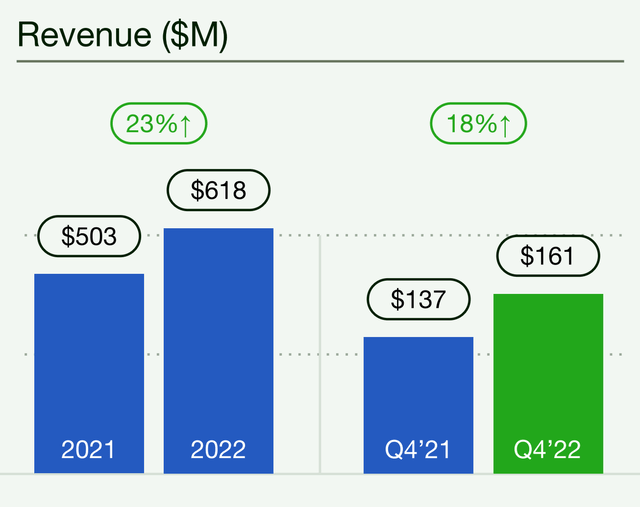

Taking a step again, Upwork’s Gross Service Quantity [GSV] could be regarded as the true “high line”. This metric is akin to “Gross Merchandise Quantity [GMV] for an e-commerce firm. On this case, GSV elevated by 5% yr over yr to $1 billion in This fall,22. For the complete yr of 2022, this metric elevated by a quicker 16% yr over yr to $4.1 billion.

Gross Service Quantity (GSV) (This fall,22 knowledge)

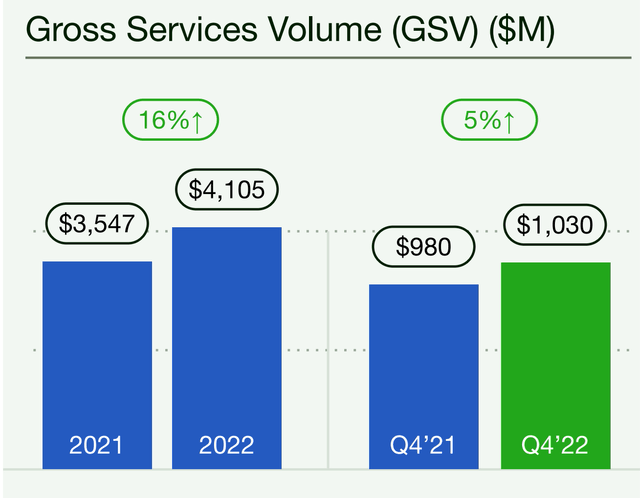

In keeping with my calculations, Upwork takes ~15% payment for freelancer providers. On its web site, I calculated the charges on a $1,000 bill. On this case, the freelancer would “take dwelling” 85% or $850, whereas Upwork would take $150. Total, I believe this can be a strong mannequin and never overly detrimental to the freelancer or the enterprise hiring the employee. I have a look at this like a 15% tax, just like VAT or Worth Added Tax, which is frequent in lots of nations.

Upwork payment calculator (This fall,22 report)

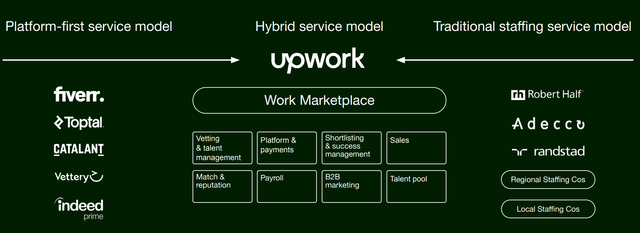

Upwork has expanded its enterprise right into a “Hybrid Service mannequin”. This principally combines the very best of a “platform” with a conventional staffing mannequin. Thus, this contains the whole lot from expertise administration to gross sales, Payroll, and even B2B advertising and marketing.

Upwork enterprise mannequin (This fall,22 report)

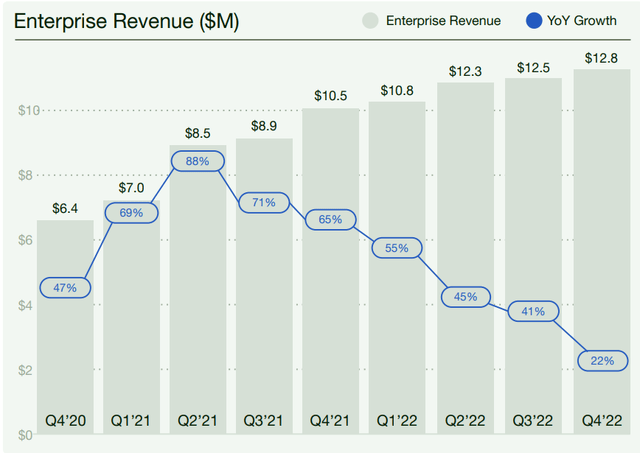

Essentially the most notable utility of Upwork’s superior platform is its enterprise service. I consider this could possibly be an immensely profitable a part of the platform, as in my expertise, there’s a lack of stickiness with small companies. For instance, at my advertising and marketing company, I’ve used Upwork a few instances, however by no means constantly. The difficulty is the standard of freelancers varies considerably and belief have to be constructed with every initially which takes time. A constructive for the enterprise phase is Upwork has particular options to assist bolster this product. This contains consumer exercise experiences, expertise efficiency experiences, and versatile approval for workflows. Its enterprise income elevated by 22% yr over yr to $12.8 million in This fall,22. Though this phase contributed to simply 7.95% of complete income within the quarter, the potential is huge.

Enterprise Income (This fall,22 Information)

Upwork added 26 new enterprise shoppers in This fall,22. This included well-known manufacturers comparable to HTC, Lucid Motors (LCID), JLL, Sweetwater Sound, and lots of extra. Nevertheless, it ought to be famous that the corporate noticed its gross sales cycles improve by ~20% and its fee of latest buyer acquisitions was not as excessive because the 32 achieved in This fall,21.

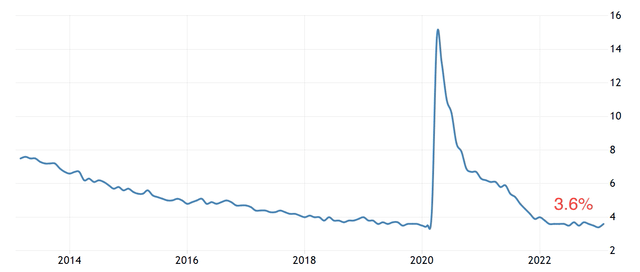

A macroeconomic constructive for Upwork is the tight labor market with an unemployment fee of simply 3.6% for the U.S. reported for February 2023. Subsequently, regardless of the “tech layoffs”, there nonetheless appear to be loads of individuals at work, much more so than in 2018.

US unemployment fee (This fall,22)

Margins and Stability Sheet

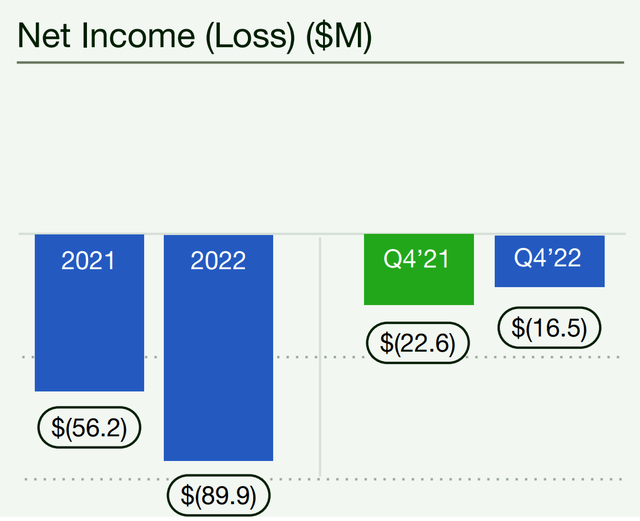

Shifting onto profitability, the corporate reported earnings per share [EPS] of unfavorable $0.13, which surpassed analyst forecasts by $0.06. Its internet loss additionally improved from unfavorable $22.6 million in This fall,21 to unfavorable $16.5 million as of This fall,22, which was a constructive signal.

Web Loss (This fall,22 knowledge)

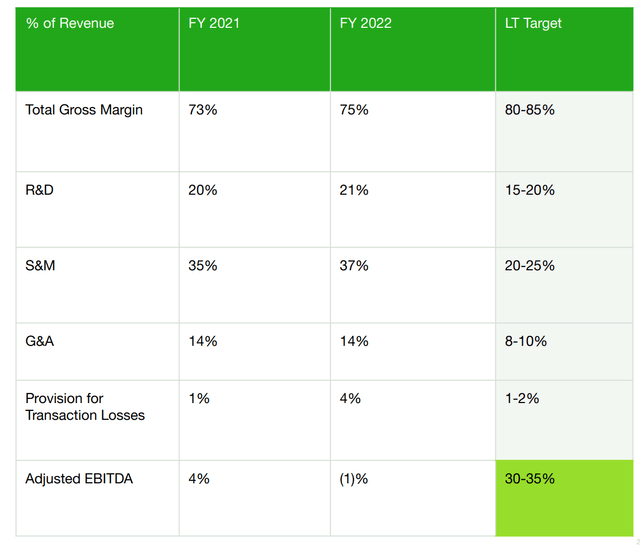

Upwork is anticipated to generate additional indicators of working leverage long run. Its R&D bills are anticipated to fall between 15% and 20% of income down from 21% in FY2022. Its S&M bills are forecast to fall between 20-25%, down from 37% in FY2022, which is a constructive signal. From my analysis on-line, I found the corporate achieves ~77% of its huge web site visitors (44 million visits) from direct searches. This can be a robust constructive because it means Upwork has a powerful model and its buyer acquisition prices ought to proceed to fall in consequence. The corporate has additionally forecast G&A bills to fall to between 8% to 10%, as a portion of income long run.

Bills and Margins Lengthy Time period (This fall,22 knowledge)

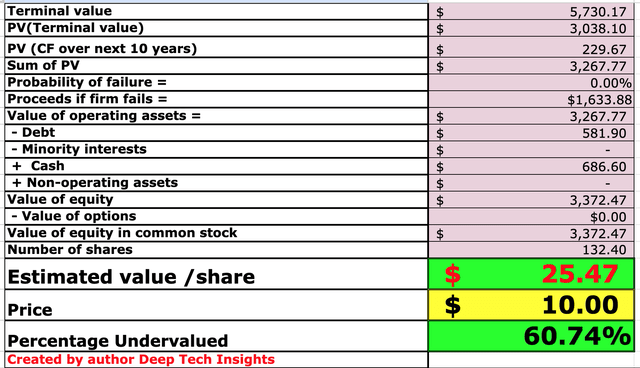

Upwork has a strong stability sheet with $686.6 million in money and short-term investments. The corporate does have pretty excessive complete debt of $581.9 million, however the overwhelming majority of this ($564 million) is long-term debt and thus manageable.

Valuation and Forecasts

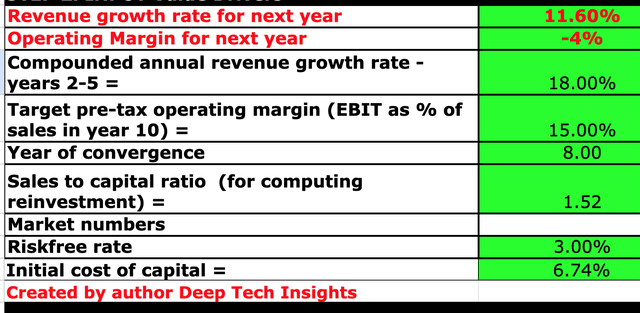

So as to worth Upwork, I’ve plugged its newest monetary knowledge into my discounted money circulation valuation mannequin. I’ve forecast simply 11.6% income progress for “subsequent yr” or the complete yr of 2023 in my mannequin. This degree is predicated upon the underside finish of administration’s steerage of between $690 million and $705 million for 2023. This progress fee could be slower than the 18% achieved in This fall,22 and it’s primarily pushed by the macroeconomic setting. In years 2 to five, I’ve forecast a return to the 18% progress fee achieved in This fall,22. That is based mostly upon an financial rebound that may comply with the historic pattern.

Upwork inventory valuation 1 (Created by creator Deep Tech Insights)

To extend the accuracy of my mannequin, I’ve capitalized R&D bills, which has boosted internet earnings. I’ve forecast a pretax working margin of 15% over the following 8 years, which ought to be achievable given the common margin for the software program business is 23%. I anticipate this to be pushed by the bettering working leverage within the enterprise bills, as mentioned beforehand.

Upwork inventory valuation 1 (created by creator Deep Tech Insights)

Given these components, I get a good worth of $25 per share. UPWK inventory is buying and selling at ~$10 per share on the time of writing and thus is over 60% undervalued, in keeping with my mannequin and forecasts.

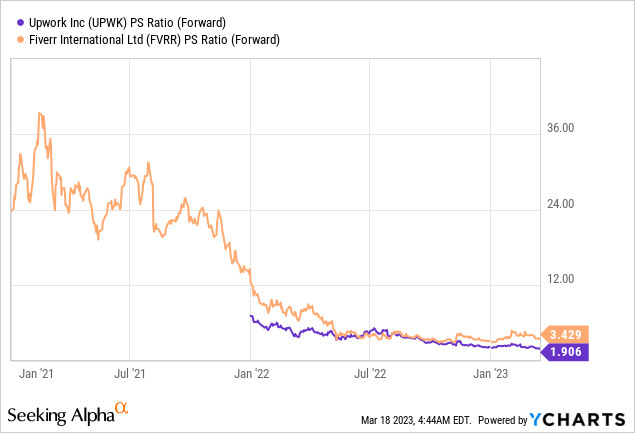

Upwork additionally trades at a price-to-sales ratio = 2, which is considerably cheaper than its historic degree of over 6. The corporate additionally trades at a less expensive valuation than Fiverr, which trades at a P/S ratio = 3.4.

Dangers

Competitors/Recession

As talked about above, the primary competitor within the freelancer platform area is Fiverr, which principally provides the identical service. I personally tried each platforms however did discover myself utilizing Upwork extra. Different platforms embrace Amazon’s (AMZN) “Mechanical Turk”, Toptal, Jooble, and many others. As talked about within the introduction, Upwork is the market chief by income, so though there may be competitors, it isn’t main given the massive complete addressable market (~$12 billion by 2028). Nevertheless, the forecasted “recession” is a threat for Upwork and its progress fee is already beginning to decelerate.

Remaining Ideas

Upwork is the main freelance expertise market and has executed properly with its financials beating analyst forecasts for This fall,22. Administration’s transfer into the enterprise could possibly be the sign of a profitable market alternative if the corporate can present worth for that business. I do anticipate the corporate to face a troublesome time all through 2023, as organizations cut back hiring. Nevertheless, given my valuation mannequin and forecasts point out the inventory is undervalued intrinsically, I’ll deem it to be a “purchase” on the time of writing.