In context: Arm’s proprietor Softbank has been dealing with monetary woes for some time and need to improve income from their most useful asset, the Arm instruction set. Chips primarily based on the Arm structure are present in almost all cellular computing gadgets, additionally making their approach into servers extra just lately. With a brand new proposed pricing mannequin, Arm is seeking to change how their chip licensing mannequin works.

British chip designer Arm has put forth a proposal that modifies how they cost for chip licensing, in response to a report by Monetary Occasions. With their present mannequin, Arm prices royalties of 1-2% primarily based on the worth of the chip, says Sravan Kundojjala, an analyst at TechInsights.

This presently implies that when chipmakers like Qualcomm use an Arm design in certainly one of their SoCs just like the Snapdragon, they pay Arm royalties primarily based on the worth of the chip.

The brand new proposed mannequin would implement a giant change, the place Arm would cost royalties primarily based on the common promoting value of the gadgets. This may imply that as an alternative of charging Qualcomm, Arm would now cost producers like Motorola and Samsung.

The common value for a smartphone chip from Qualcomm is $24, whereas the common value for a smartphone offered within the US was $299 for 2022. Based mostly on this, Arm means to spice up their income, granted in the event that they hold the royalties inline of the place they’re at this time.

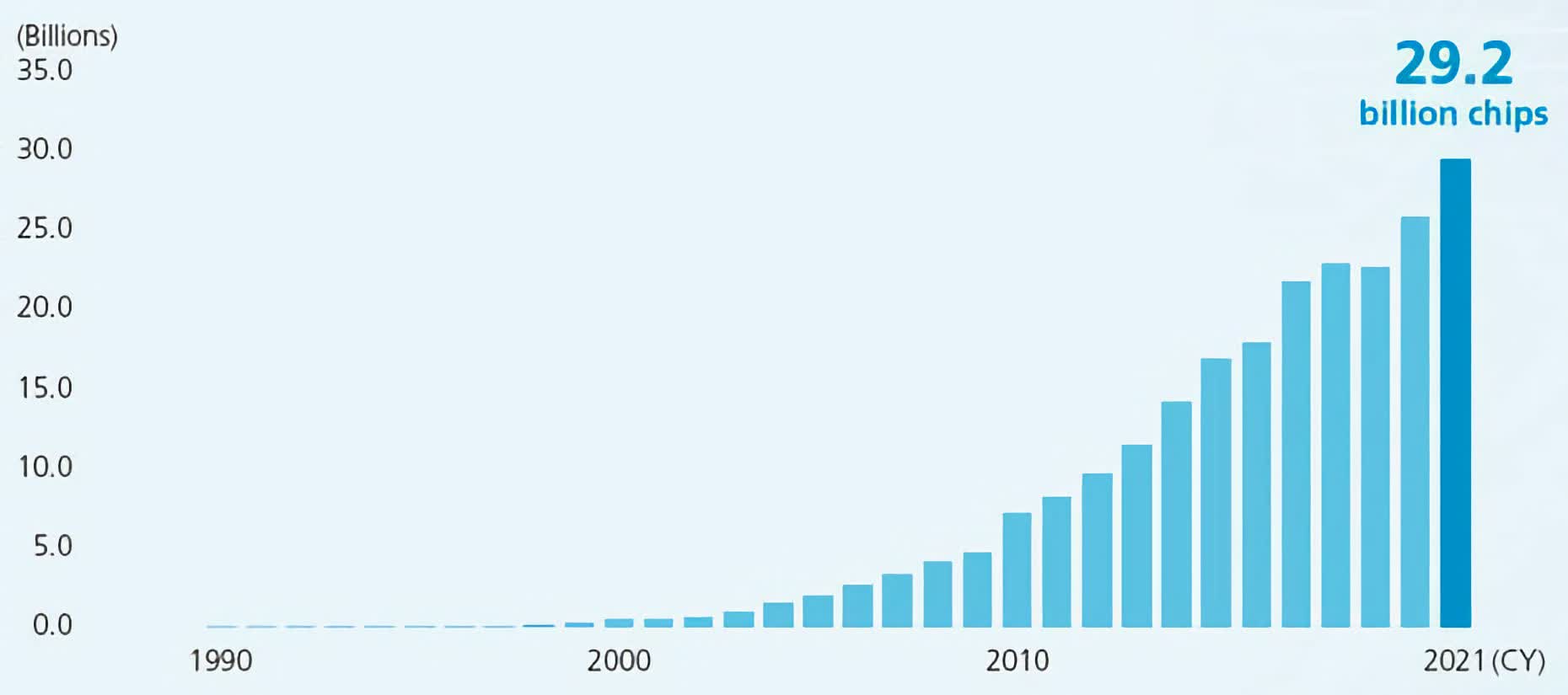

Of their Q3 FY22 earnings, Arm reported whole income of $746 million, up 28% yr on yr with all of that stemming from licensing and royalties. Some readers may keep in mind Nvidia’s try of taking up Arm for the sum of a minimum of $40 billion, a deal that finally fell by way of after failing to beat regulatory points.

A number of folks have already identified that this transfer by Arm may give a chance to RISC-V, an open supply instruction set structure that launched in 2015, however has solely seen restricted use exterior of IoT gadgets. Seeing as Arm mainly has a monopoly on the cellular market, and Apple having nearly accomplished their swap to Arm throughout all platforms, this newest transfer could open the door for rivals if producers discover Arm’s new mannequin too expensive.