hapabapa

Previously I’ve revealed articles about pharmaceutical corporations regularly and one of many recurring themes in these articles was the resilience in case of a recession – that is together with current articles about AbbVie Inc. (ABBV) in addition to Amgen Inc. (AMGN). And it looks like the disaster is accelerating with a number of banks on each side of the Atlantic being in extreme bother or collapsing already.

One other main pharmaceutical firm, which isn’t solely among the many 100 largest corporations on the planet by market capitalization but additionally among the many 10 main pharmaceutical corporations, is Bristol-Myers Squibb Firm (NYSE:BMY). In concept, we will assume that BMY can be an excellent choose throughout a recession and financial decline as it’s becoming the sample. And as my final article about Bristol-Myers Squibb was revealed about one and a half years in the past it appears time for an replace.

Recession-Resilient?

Let’s begin by asking the query how recession-resilient Bristol-Myers Squibb is. Often, pharmaceutical corporations carry out very secure throughout recessions because the demand for the merchandise is staying at comparable ranges (and even will increase). The medication pharmaceutical corporations are promoting may be labeled as obligatory and important merchandise for the sufferers and as a necessity for his or her each day lives. Due to this fact, it isn’t shocking these medication are bought unbiased from the financial state of affairs.

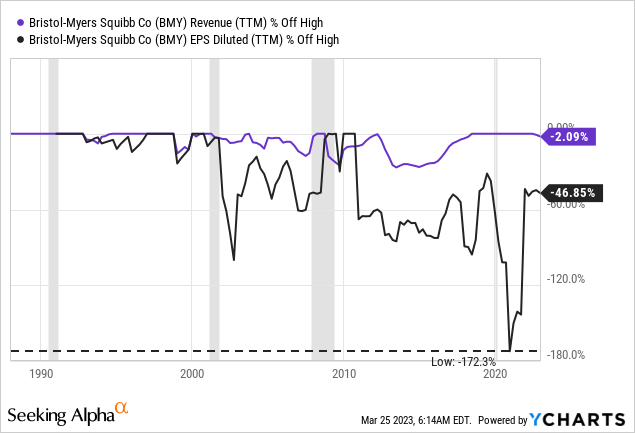

When Bristol-Myers Squibb we will see the same efficiency within the final a long time, however I might be a bit cautious and positively not name the corporate recession-proof. Whereas we see no response to the early Nineteen Nineties recession or the COVID-19 crash in 2020, we see a steep decline of 25% throughout the Nice Monetary Disaster. And earnings per share additionally present a transparent response to most recessions prior to now – nonetheless, that is the case for many corporations and shouldn’t be overrated. We are able to assume Bristol-Myers Squibb performing fairly secure throughout the subsequent recession, however I wouldn’t guess on it.

Messed Image In The Previous

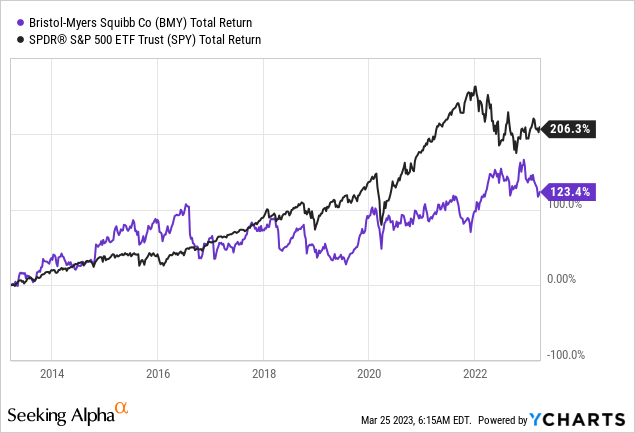

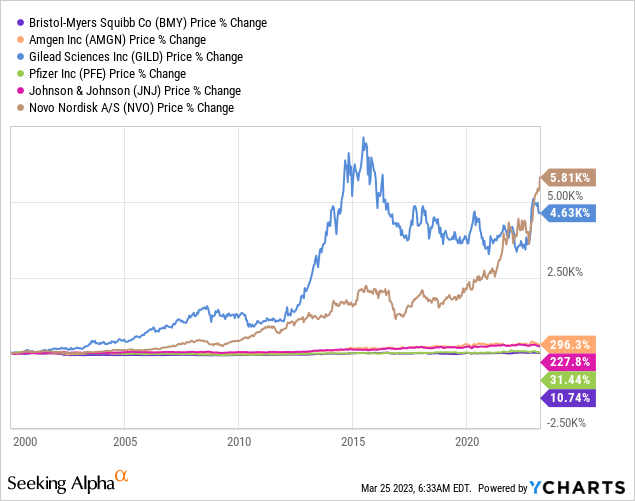

And whereas Bristol-Myers Squibb can’t be described as utterly recession-resilient (or recession-proof), the inventory can be presenting a blended and reasonably tousled image within the final 20 years. When wanting on the final ten years, Bristol-Myers Squibb clearly underperformed the S&P 500 (SPY) – as a substitute of 206% improve for the index, Bristol-Myers Squibb elevated solely 123%.

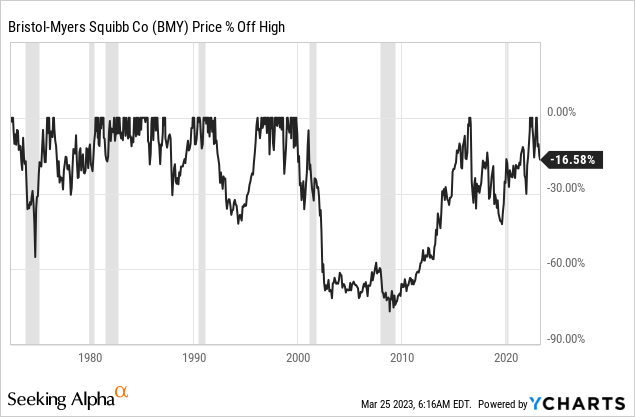

And when the previous couple of a long time the efficiency was not so nice – together with the inventory efficiency throughout recessions. Whereas throughout some recessions the inventory value was extraordinarily secure and hardly declined in any respect, we noticed steep declines round 2000 and throughout the Nice Monetary Disaster.

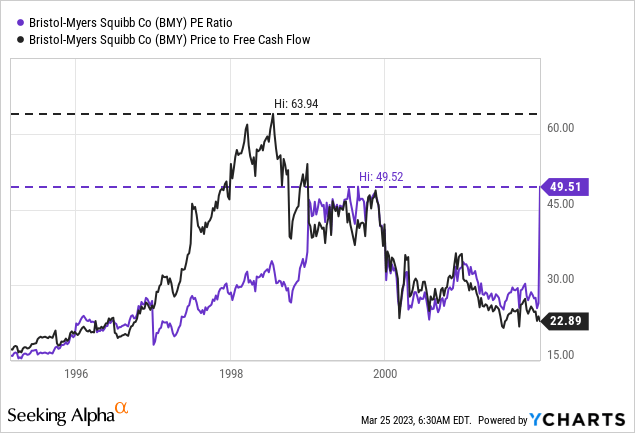

Moreover, it took BMY nearly 20 years earlier than the inventory might attain its pre-Dotcom-bubble highs once more. And a part of the reason for the steep decline within the years round 2000 have been the excessive valuation multiples earlier than. In 1999, BMY peaked at 50 instances earnings and in 1998, the P/FCF ratio was as excessive as 64. And these are with out a lot doubt unjustified valuation multiples for nearly any enterprise – particularly for a pharmaceutical enterprise which is extremely depending on analysis and growth and introducing the subsequent blockbuster.

And when evaluating Bristol-Myers Squibb to many different main pharmaceutical corporations, the efficiency since 2000 is a catastrophe. Even when excluding outperformers like Gilead Sciences (GILD) which elevated 4,630% in worth since 2000 and Novo Nordisk (NVO), which might even achieve 5,810% in worth – in each instances not together with dividends, Bristol-Myers Squibb continues to be underperforming most different main drug corporations. Even Pfizer, Inc. (PFE) might improve its inventory value by 31% whereas Johnson & Johnson (JNJ) elevated 228% and Amgen Inc. (AMGN) elevated 296%.

Full 12 months Outcomes

Whereas previous outcomes are definitely essential and inform us essential facets a couple of enterprise, we should always look at this time and the longer term to make an excellent choice a couple of enterprise and whether or not we should always spend money on it.

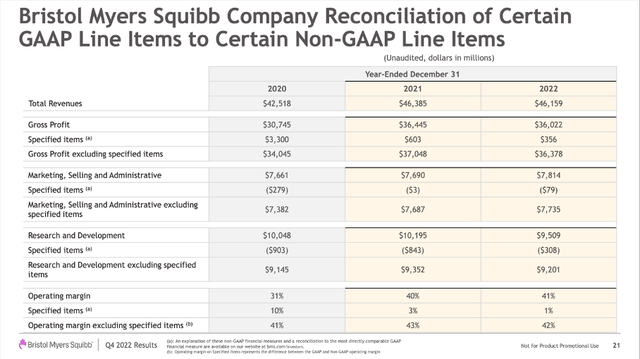

We are able to begin by wanting on the outcomes for fiscal 2022 – they usually weren’t nice. Whole income declined barely from $46,385 million in fiscal 2021 to $46,159 million in fiscal 2022 – a decline of 0.5% year-over-year. Earnings earlier than earnings additionally declined 4.8% year-over-year from $8,098 million within the earlier yr to $7,713 million in fiscal 2022. And at last, diluted earnings per share declined from $3.12 in fiscal 2021 to $2.95 in fiscal 2022 – a decline of 5.4% YoY.

Bristol-Myers Squibb This autumn/22 Presentation

Solely adjusted, non-GAAP earnings per share might improve 7.5% YoY from $7.16 within the earlier yr to $7.70 final yr.

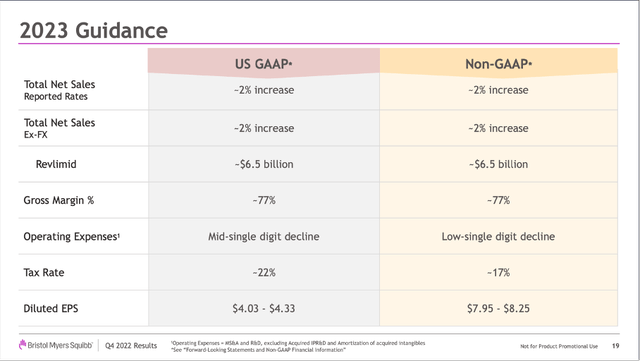

And for fiscal 2023, administration is anticipating whole gross sales to extend about 2%, whereas GAAP earnings per share are anticipated to be in a spread between $4.03 and $4.33 – leading to about 36% to 46% development. Non-GAAP earnings per share are anticipated to be in a spread between $7.95 and $8.25 – leading to about 3% to 7% YoY development.

Bristol-Myers Squibb This autumn/22 Presentation

Product Gross sales

When wanting on the totally different merchandise and gross sales, we will begin by Revlimid, which is among the causes Bristol-Myers Squibb is struggling and needed to report a declining high line. With patents expiring in March 2022, gross sales declined from $12,821 million in fiscal 2021 to $9,978 million in fiscal 2022. And for 2023 administration is anticipating the decline to proceed with Revlimid contributing solely about $6.5 billion in income.

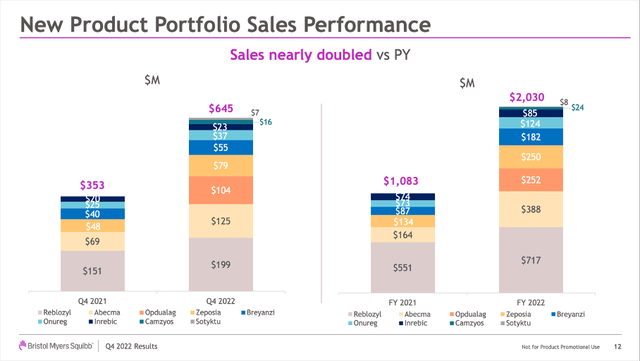

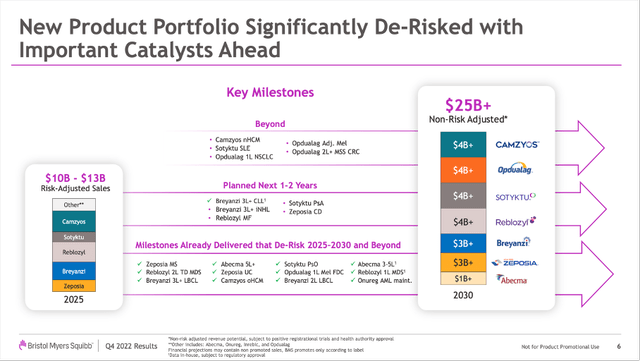

To switch the declining gross sales from this blockbuster (Revlimid was liable for nearly 30% of income in 2021), Bristol-Myers Squibb is specializing in its “New Product Portfolio”, which generated $2,030 million in income and in comparison with $1,083 million in income within the earlier yr it might report 87% year-over-year development. Development was particularly pushed by the launch of Opdualag, which generated $252 million in gross sales in 2022 and which is predicted to achieve peak gross sales of $4 billion.

Moreover, increased demand for Abecma, which might develop gross sales by 137% to $388 million in fiscal 2022 and the upper demand for Reblozyl, which might improve gross sales 30% to $717 million, contributed to development.

Bristol-Myers Squibb This autumn/22 Presentation

And administration is extraordinarily assured that its New Product Portfolio will develop with a excessive tempo within the years to come back. For 2025 administration is anticipating gross sales from these new merchandise to be between $10 billion and $13 billion and for 2030 it’s anticipating $25 billion or extra in gross sales.

Bristol-Myers Squibb This autumn/22 Presentation

And the 4 new blockbusters – Camzyos, Opdualag, Sotyktu and Reblozyl – are every anticipated to contribute about $4 billion in annual income. Sotyktu has simply been launched and generated solely $8 million in income in This autumn/22 and Camzyos was additionally launched in 2022 and generated $24 million in fiscal 2022.

And never solely the brand new product portfolio will contribute to development within the years to come back. In-line manufacturers – primarily immunology and oncology (for instance Opdivo which generated $8,249 million in gross sales in 2022) in addition to Eliquis, which generated $11,789 million in gross sales in fiscal 2022, will contribute to development. These in-line manufacturers are anticipated to contribute between $8 billion and $10 billion in extra income till 2025.

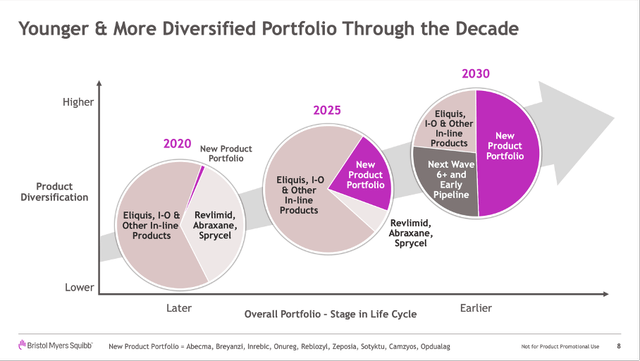

Bristol-Myers Squibb: JPM Presentation

General, this could result in a extra diversified portfolio for Bristol-Myer Squibb by changing a number of well-established medication that are near patent expiration with newer medication that may depend on patent safety for a number of years.

Stability Sheet

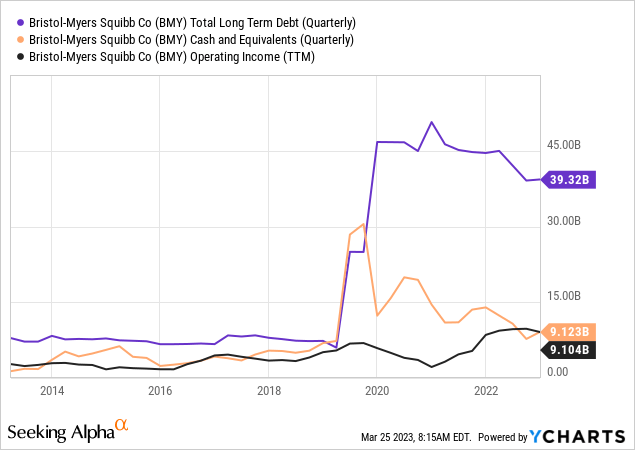

Let’s additionally check out the steadiness sheet, which isn’t good but additionally no purpose for worries about solvency or liquidity. Earlier than Bristol-Myers Squibb acquired Celgene, the corporate had an excellent steadiness sheet with reasonably low debt ranges and money in addition to money equivalents kind of equal to the corporate’s debt ranges.

Nonetheless, the acquisition elevated whole debt to nearly $50 billion. In the previous couple of quarters, BMY is lowering debt ranges once more and on December 31, 2022, the corporate had $4,264 million in short-term obligations in addition to $35,056 million in long-term debt on its steadiness sheet. When evaluating the entire debt to the entire shareholder’s fairness of $31,118 million, we get a nonetheless acceptable D/E ratio of 1.26. Nonetheless, when evaluating the entire debt to the working earnings of $9,879 million in fiscal 2022, it could take nearly 4 years to repay the excellent debt – a metric that’s nonetheless acceptable, however reasonably excessive. In fact, we should always consider the $9,123 million in money and money equivalents that might be used to repay excellent debt lowering the time it could take to solely about 3 years.

When speaking concerning the steadiness sheet, we also needs to point out $35,859 million in intangible belongings and whereas excessive quantities of intangible belongings are reasonably typical for pharmaceutical corporations, $21,149 million in goodwill should not nice. Nonetheless, in comparison with $96,820 million in whole belongings, the quantity appears acceptable.

Intrinsic Worth Calculation

A closing step in each evaluation is figuring out an intrinsic worth for the inventory or figuring out in another methods if the present inventory value is matching the basics and in consequence make a shopping for choice. I normally decide an intrinsic worth by utilizing a reduction money stream calculation, which is essentially the most correct for my part however has one main shortcoming: We should make a number of assumptions about free money stream an organization can generate in 5 years or 10 years from now and no one could make exact predictions at no cost money stream a number of years into the longer term. To compensate, we should always embody a margin of security into our calculation in addition to present a number of totally different eventualities and never succumb to the phantasm of with the ability to decide a exact intrinsic worth for a inventory.

As place to begin we will normally take the free money stream of the final 4 quarters, which was $11,950 million. And when taking a ten% low cost fee in addition to 2,124 million excellent shares, Bristol-Myers Squibb should develop its free money stream solely about 2% yearly to be pretty valued – a goal that appears affordable and positively achievable. Administration is extra optimistic and anticipating low-to-mid single digit development charges, so let’s calculate with a nonetheless average development fee of 4% as a substitute – this results in an intrinsic worth of $93.77 for the inventory.

Whereas we should always not fear concerning the firm with the ability to obtain 2% or 4% development within the years to come back – these are reasonably average and achievable targets – we should always take a better take a look at the present free money stream and particularly the money conversion charges.

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

|---|---|---|---|---|---|

|

Internet Revenue |

$4,920 million |

$3,439 million |

($9,015 million) |

$6,994 million |

$6,327 million |

|

Free money stream |

$6,115 million |

$7,374 million |

$13,299 million |

$15,234 million |

$11,948 million |

|

Money conversion fee |

124% |

214% |

N/M |

218% |

189% |

And in the previous couple of years, BMY was reporting extraordinarily excessive conversion charges. What would possibly sound like excellent news at first is also a warning signal that these conversion charges – and subsequently free money stream – should not sustainable. However, different pharmaceutical corporations are capable of generate a fair increased proportion of gross sales as free money stream – Gilead Sciences has a ratio round 30%, Amgen has a ratio of 33% and Novo Nordisk even a ratio of 36% proper now.

Conclusion

Bristol-Myers Squibb is presenting itself reasonably blended. For starters, the share value appears low sufficient to not be bearish about BMY. Moreover, the steadiness sheet shouldn’t be good and the efficiency within the final 20 years is off turning.

Nonetheless, I believe I’ll flip bullish about Bristol-Myers Squibb as the corporate appears to have the ability to develop with a strong tempo on this decade. And the expansion story introduced – particularly by the New Product Portfolio – sound convincing to me. And though Bristol-Myers Squibb has a blended efficiency in previous recessions, I’m assured it’s going to carry out fairly nicely in 2023 and 2024. In fact, one may also make the case for Bristol-Myers Squibb being deeply undervalued – particularly if the corporate is ready to develop its free money stream not solely within the very low single digits, however perhaps within the mid-single digits. On this case, the intrinsic worth might be $100 or increased.