[ad_1]

I’m a short-term dealer. The explanation for that’s as a result of I perceive long-term dangers.

Lengthy-term traders are sometimes too comfy of their perception that the market of right now will probably be there once they get up many years from now.

The very fact is, economies change drastically in that point. And passively investing via all of it can severely harm your returns.

Any scholar of historical past understands this, and that’s why I’ve been an lively market dealer for nearly 40 years.

Wanting again to after I began … The world was very totally different as I used to be getting ready to depart faculty in 1983.

Inflation — and the common concern of rising costs — drove most tendencies. This led to excessive rates of interest, low general inventory market returns and robust bond returns.

Issues modified not too lengthy after that, fueling a generational bull market that has solely simply ended.

Within the aftermath, we’re now in a totally totally different form of financial system that almost all are usually not ready for.

And I’m going to arrange you for this new world right now and remainder of this week, as a result of understanding what has modified — and what it is best to do — will probably be important to guard and development the wealth you could have.

Proper now, rates of interest are climbing once more and inflation is excessive. It’s a special market than the one we’ve loved for 40 years…

The Menace to Lengthy-Time period Buying and selling Returns Is Right here

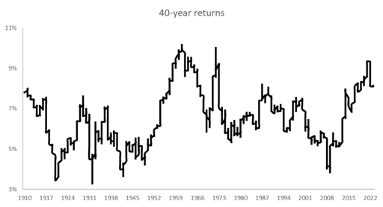

All we actually have to do to know the risk to long-term returns is take a look at this chart:

It reveals annualized returns of the earlier 40 years beginning in 1910. You’ll discover there are three notable peaks within the chart — in 1961, 1973 and 2022.

Returns hit a file excessive in 1961. That was the identical time rates of interest turned increased.

Charges would rise steadily for the following 20 years alongside inflation. Rates of interest on 10-year Treasurys rose from 3.7% in 1961 to fifteen.3% in 1981. The Shopper Worth Index went from 0.8% to 14.6% over that point.

The second peak within the chart occurred in 1972. That’s as a result of returns from the worst of the Nice Despair within the Thirties dropped out of the calculation at that time. That shortly reversed, and market features returned to their earlier vary in a matter of months.

What’s necessary to know about this period is that it was an extended interval of upper rates of interest, increased inflation and low inventory market returns. It ended within the mid-Eighties as low rates of interest and low inflation drove increased inventory costs.

The third and most related peak occurred in January 2022. The rate of interest on the 10-year Treasury was at 1.5% and began to maneuver increased. Inflation was at 7.6% however Federal Reserve officers nonetheless assured us it was transitory.

Now, the Fed admits inflation is an issue, and is elevating rates of interest to repair it.

The official inflation goal stays at 2%. Officers challenge reaching that stage in 2025. Shoppers count on inflation to be nearer to three% till no less than 2028.

So long as inflation expectations stay excessive, the massive traders who command trillions of capital within the bond market — pension funds, life insurers, mutual funds — will demand increased rates of interest.

It will weigh on the inventory market, since excessive charges make bonds extra enticing to particular person traders as nicely.

The chart of 40-year returns reveals that highs are adopted by lows. With inflation and rates of interest tilting in opposition to traders, there’s no motive to struggle the pattern. These long-term tendencies will weigh on inventory market returns for many years.

Your Excessive-Inflation, Excessive-Charges Battleplan

Because of this I say the inventory market of the final 40 years is gone.

Traders had been spoiled by a close to half-century of low inflation and low rates of interest, driving excessive inventory returns. We’re now dealing with the other, and this case will seemingly stay for the same size of time.

You’ll be able to’t rely on long-term buying and selling, passive investing in a high-inflation atmosphere like you might within the low-inflation atmosphere we simply left behind.

So what must you do as a substitute?

I consider it is best to commerce extra actively. For my cash, the approaching many years will probably be unstable. Shares may present zero or detrimental returns to those that purchase and maintain.

Volatility is a scourge for individuals who make investments passively. However for lively merchants, volatility is the best reward you might ask for.

We’ve seen loads of volatility out there this final 12 months. And I’ve been actively exploiting that volatility for normal features.

Sure, it’s extra work. It’s additionally very a lot value this further effort.

You see, I’ve give you a manner to make a commerce each single day at 9:46 a.m. Jap time that targets 50% features in not more than two hours. And we’ve hit that revenue goal in as little as 5 minutes.

Up to now week, 5 out of eight trades had been winners. When you’d traded an equal variety of contracts on every place, you’d have a complete return of 19%.

For reference, the S&P 500 rose 1% final week — chopping backwards and forwards the entire manner.

I dove deeper into this technique in a particular presentation that went stay final Thursday. To see if it could be best for you, click on this hyperlink.

Communicate to you then, Michael CarrEditor, One Commerce

Michael CarrEditor, One Commerce

[ad_2]

Source link