Antony Velikagathu

Okeanis Eco Tankers Corp. (OTCPK:OKENF, OET.OL) is a crude tanker firm, working a contemporary fleet consisting of six Suezmax and eight VLCC vessels. It’s my best choice to capitalize on the on-going crude tankers bull market.

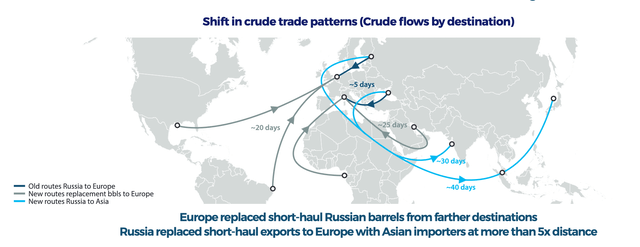

Allow us to revise the bull case for soiled tankers. The battle in Ukraine has precipitated a rerouting of crude oil voyages, resulting in a rise in tonne miles, and, due to this fact, additionally constitution charges. The EU has imposed sanctions towards each the import of Russian crude into Europe, and the transport of Russian crude to 3rd nations (until the respective crude oil is bought beneath the $60 per barrel worth cap). Such coverage was meant to limit revenues to the Russian authorities used to finance the battle in Ukraine; nevertheless, it has additionally had the aspect impact of disrupting crude commerce flows. European nations are changing Russian barrels with new imports from additional away areas, reminiscent of West and South Africa, and the Center East, whereas Russia is shifting its exports in the direction of India and China.

Shift in crude commerce patterns (Firm’s presentation)

The essential level is that Russian crude is constant to movement to the market (partly bypassing sanctions with the assistance of the tanker shadow fleet), albeit on longer commerce routes. European sanctions had been designed to place stress on Russia, however on the similar time ensure that Russian manufacturing will not be shut off and the oil market will not be thrown right into a deficit.

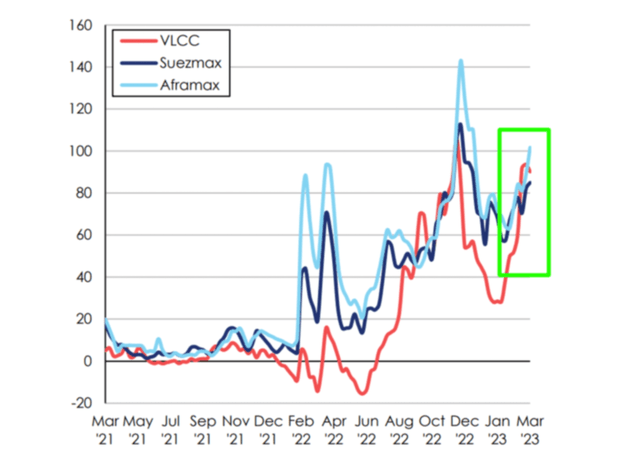

The target was achieved, as Urals oil is now buying and selling at a hefty low cost to Brent, however constitution charges have exploded upon the introduction of the ban, on December 5. They’ve since relaxed a bit, however have proven exceptional energy over the previous few weeks, specifically within the case of VLCC charges (which had been additionally helped by China reopening its financial system after the covid restrictions).

Crude tanker spot charges (Clarkson’s)

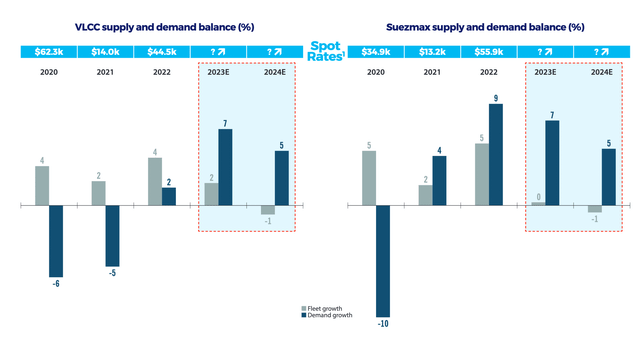

Soiled tanker firms are already exceptionally worthwhile within the present price atmosphere. Bearing in mind that demand is projected to outstrip provide in each 2023 and 2024, charges may definitely transfer even larger.

Provide and demand progress vs constitution charges (Firm’s presentation)

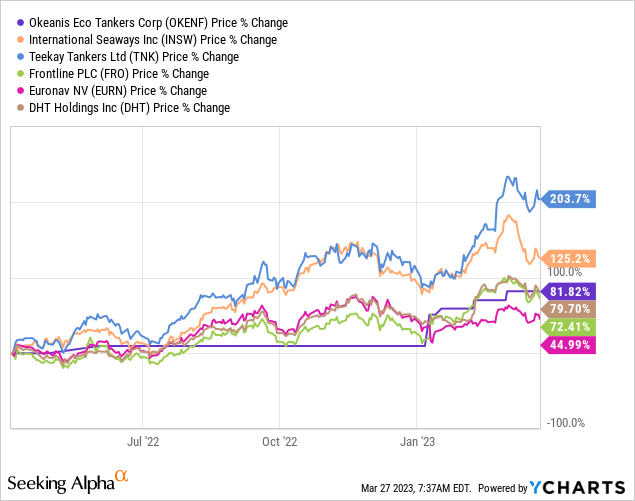

The sturdy sector outlook is already partially mirrored within the share costs, with many firms having multi-bagged during the last twelve months. One also needs to understand that the tanker market is extremely cyclical and charges are inclined to imply revert over sufficiently lengthy occasions, as larger charges appeal to new provide, which in flip results in a decline in profitability.

Nonetheless, there are causes to imagine the present charges are right here to remain, at the very least for the following few years, for the next causes.

- To start with, the rise in charges is a structural consequence of the rerouting of commerce flows attributable to the sanctions towards Russia. It appears inconceivable that such sanctions will probably be withdrawn any time quickly. Even when a peace deal could be brokered within the close to future, Russian oil will proceed to be shunned by Western nations. In different phrases, a return to the earlier establishment is unlikely.

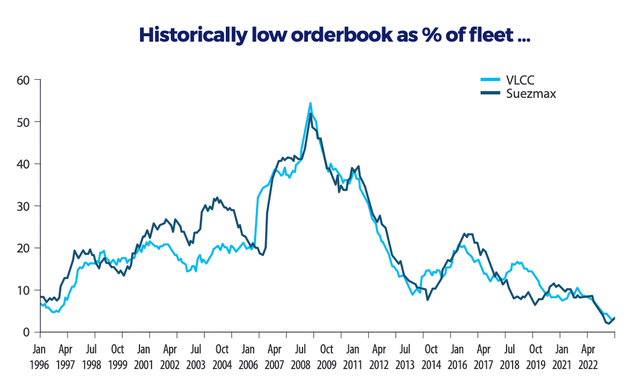

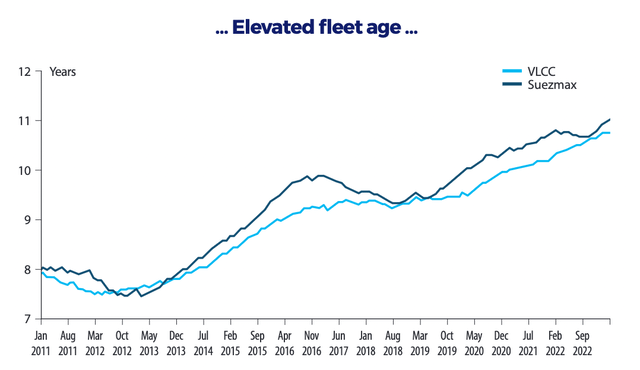

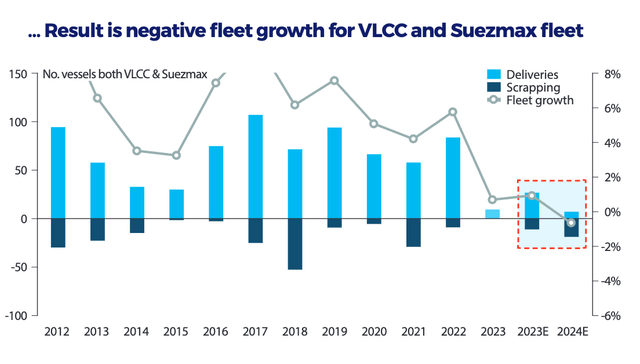

- Second, progress of the crude tanker fleet will probably be modest over the following few years, because the orderbook is at historic lows. Asian shipyards are already at most capability, with the brand new provide largely going into the container sector. Then again, very restricted provide goes to enter the crude tanker sector. That is going to be supportive of charges, particularly together with the truth that the fleet is getting old and substitute prices are skyrocketing due to inflation.

Crude tanker orderbook is at historic lows (Firm’s presentation) Crude tanker fleet is ageing (Firm’s presentation) The online impact is modest progress, turning into destructive progress ranging from 2024 (Firm’s presentation)

- Third, an additional long-term bullish basic is represented by the enforcement of ESG insurance policies. Delivery firms are underneath stress to scale back their greenhouse gasoline emissions. The Worldwide Maritime Group (IMO) has launched a Carbon Depth Indicator (CII) ranking scheme, that classifies vessels into 5 courses (from A to E) based mostly on the quantity of CO2 emitted. As well as, it has outlined an Power Effectivity Current Ship Index (EEXI), which measures power effectivity in comparison with a baseline. The target is to scale back carbon depth from all ships by 40% by 2030 in comparison with 2008. The introduction of the CII and EEXI schemes is the stepping stone to forcing delivery operators to scale back emissions by means of new laws. For instance, ranging from February 1, 2023, operators will probably be required to submit CII rankings for all ships over 5000 tonnes. Any ship that obtains a D ranking for 3 consecutive years (or E for only one 12 months) must take corrective actions to realize at the very least a C ranking. Such laws are going to extend prices particularly for previous, inefficient vessels, whereas they characterize a aggressive benefit for operators of extra fashionable, eco vessels. Because the best strategy to scale back emissions is to decrease velocity, the tanker fleet will probably be compelled to go slower on common, which goes to extend voyage lengths. Particularly, eco ships will command a premium, since they are going to have the ability to journey quicker than non-eco ships, a substantial benefit particularly in a bull market.

After all, there are additionally dangers to the thesis. For my part, the primary threat is that constitution charges collapse as oil demand plummets due to a monetary-policy induced recession. In current weeks, crude oil costs have notably weakened. Curiously, tanker equities have traded in a correlated manner with oil costs. That is counterintuitive, since decrease oil costs indicate decrease bunker gasoline costs, i.e., decrease prices for tanker firms. As well as, decrease oil costs (all different issues being equal) indicate a stronger demand for crude, as for example refiners margins improve. Is the oil market actually anticipating a recession and a requirement drop? It’s tough to say with any diploma of certainty. For my part, if such an occasion had been to occur within the close to future, it could provide a wonderful entry alternative, given the long-term bullish fundamentals.

Allow us to assume that the present bull market goes to proceed over the following 3 years. How can we play it? I have a tendency to judge tanker firms based mostly on the next issues:

- Leverage: in a bull market, the upper the leverage the higher.

- Shareholder returns: the corporate ought to have a transparent technique to return capital to shareholders. Close to the highest of the cycle, dividends are to be most well-liked to share buybacks. Unwarranted enlargement of the fleet can be a transparent purple flag.

- Trendy fleet: eco vessels command a premium, and the benefit in contrast with older vessels is just going to extend with time. That is why I take into account it important to put money into firms with a low fleet age, even when this implies sacrificing some leverage.

- Administration: delivery is a risky and infrequently capital-destroying enterprise. I need my capital to be within the palms of administration who’s competent and has pores and skin within the recreation.

- Low valuation

I imagine that Okeanis represents an excellent compromise between all standards.

To start out with, the corporate is sufficiently leveraged. In line with the corporate’s definition (leverage = web debt divided by web debt + e-book fairness), leverage stood at 61% on the finish of 2022. The truth is, this can be a fairly excessive ratio amongst comparable soiled tanker firms. Throughout 2022, whole debt elevated to $739 million, up 28% in contrast with 2021, as the corporate acquired two new VLCC vessels in anticipation of sturdy market situations. As well as, Okeanis is leveraged to identify charges, by protecting round 80% of its fleet within the spot market, which permits it to seize the complete good thing about decrease gasoline prices.

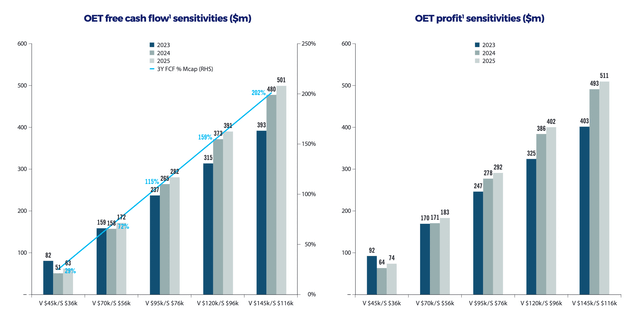

The corporate discloses the next sensitivities of free money movement and web earnings based mostly on totally different charges atmosphere. Final 12 months was nearer to situation quantity 2, whereas 2023 (for the time being) is nearer to situation 4. If such situations had been to proceed, Okeanis would generate 1.5 its whole market capitalization in free money movement over the following 3 years.

Sensitivities (Firm’s presentation)

Okeanis additionally has a beneficiant dividend coverage. The truth is, it has the best dividend yield amongst its friends. The corporate is included within the Marshall islands, in order that there isn’t a withholding tax on dividends or returns of capital. For This autumn 2022, Okeanis has declared a distribution of $1.25 to shareholders. This corresponds to an roughly 20% dividend yield (at present share costs). Moreover, it’s virtually sure that Q1 2023 goes to be an excellent higher quarter than This autumn (and, given the place charges are buying and selling for the time being, Q2 is shaping as much as be one other sturdy quarter). Thus, I’d not be shocked to see even larger dividends within the close to future.

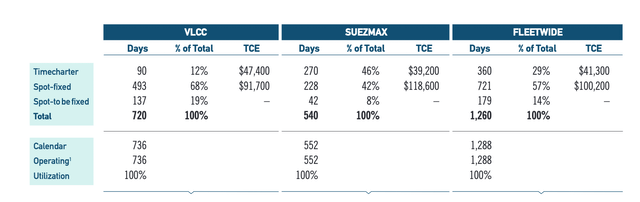

That Q1 2023 probably will probably be a report quarter is evidenced by the truth that the vast majority of the sturdy voyages fastened in This autumn had been carried over to Q1, and that contracted spot charges are going to be larger throughout Q1 than This autumn. The truth is, we all know already that for VLCCs 78% of obtainable Q1 spot days had been fastened at $91,700 per day, for Suezmaxes 84% had been fastened at $118,600 per day. For comparability, throughout This autumn 2022, the corporate achieved a mean TCE of $63,800 per day ($65,400 for VLCCs and $61,600 per day for Suezmaxes).

Q1 2023 steering (Firm’s presentation)

A key aggressive benefit of Okeanis is its fashionable eco-fleet. This enables the corporate to have decrease prices than friends and makes it future-proof in reference to upcoming laws.

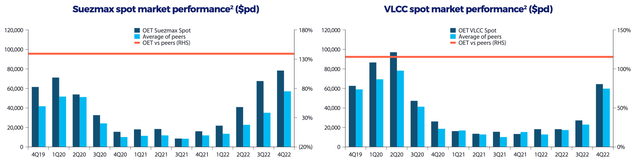

Administration is definitely probably the greatest within the sector. That is additionally evidenced by the truth that Okeanis has persistently achieved higher charges than friends. As well as, administration is aligned with shareholders, with the Alafouzos household nonetheless holding a controlling stake (56.82%) of the corporate.

Spot market efficiency vs friends (Firm’s presentation)

Lastly, regardless of an nearly 50% rise YTD, Okeanis Eco Tankers Corp. will not be costly. Adjusted EBITDA throughout 2022 was round $150 million, in contrast with a present market capitalization of round $760 million. Extra importantly, by any metric, 2023 is shaping as much as be an excellent stronger 12 months. If present situations persist, Okeanis Eco Tankers pays a sustainable annual dividend yield in extra of 25%. In conclusion, I see Okeanis Eco Tankers Corp. as a best choice amongst crude tanker firms, to make the most of the present bull market over the following 3 years.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.