[ad_1]

Sitting in my agency’s funding committee assembly in April 2009, it was clear we had an issue.

An excellent drawback to have. However nonetheless an issue.

Since I began on the agency the yr earlier than, we’d been decidedly bearish. That served our shoppers effectively in 2008. We gained about 10% for the yr whereas the S&P 500 misplaced virtually 40%.

That efficiency earned us a variety of new shoppers. We began 2008 with about $80 million below administration. By the tip of the yr, we had over $150 million.

We needed to maintain the shoppers. Our administration price was 2% a yr. Conserving shoppers was good for the enterprise. However that’s the place we bumped into the issue.

Our new shoppers, who got here on board after seeing us become profitable in 2008, preferred our bearish outlook. It confirmed their opinions. Shifting course might upset them.

However in April 2009, the information pointed to a market rally. That meant we’d should shift course after proving to all these new shoppers that being bearish made cash.

However whereas everybody was on the lookout for a continued meltdown, I believed the bear market was over and the most important danger we confronted was a market “melt-up”.

I knew this may be powerful to elucidate to shoppers. However I additionally knew efficiency mattered greater than emotions.

We determined we’d talk our shift with detailed knowledge. We turned bullish.

And that bought me fascinated by swans…

Not the “black swan” you is likely to be accustomed to. And never the “white swan,” which might sign the alternative.

I began fascinated by a unique sort of swan, and the way my agency might exploit it to our benefit.

Ominous From Afar

A black swan is among the many hottest phrases in finance. It refers to an sudden occasion that crashes markets.

The pandemic was a black swan. So was the collapse of Bear Stearns and Lehman Brothers in 2008. Nobody might have seen these Wall Avenue giants collapsing in a matter of days.

These occasions are uncommon. However they appear pretty widespread, as a result of everybody’s all the time on the lookout for them. That’s very true proper now with potential black swans all over the place.

Inflation caught the Federal Reserve unexpectedly. Fed officers would possibly say it was a black swan as a result of their fashions informed them to not fear.

Others would possibly argue the present officers who missed one thing so apparent is a black swan. They might miss one thing even worse sooner or later.

Some see Russia’s invasion of Ukraine as a black swan. It triggered untold human struggling. It additionally affected power and grain markets. This compounded the struggling. It additionally created market volatility.

All of this was largely sudden, regardless of Russia amassing troops on the Ukraine border for months beforehand.

There are a lot of extra potential black swans to uncover. Analysts love trying to find them.

However similar to in April 2009, I feel we have to search for black-necked swans.

Just like the black swan, these swans are additionally uncommon. They’ve a black head and neck … however a white physique.

(Supply: Alexandria Zoo.)

To me, black-necked swans characterize market occasions that look ominous … however aren’t. There is likely to be extra potential black-necked swans than black swans proper now.

3 Charts to Counsel a Black-Necked Swan

Inflation may very well be slowing, as only one instance. Slower beneficial properties in housing and power prices level to that.

Customers will nonetheless really feel the ache. They usually’ll really feel that ache for years, because the Fed’s aim of two% inflation is each distant, and can nonetheless damage extra with costs typically greater.

However decrease inflation provides the Fed room to chop charges. So if inflation is the black neck of the swan, decrease rates of interest are the white physique.

Let’s say inflation does maintain slowing. Decrease inflation provides firms room to boost costs. If they’ll increase costs by 1% or 2%, that drives greater earnings. Many firms have already decreased their headcount and the decrease prices additionally assist earnings. It’s attainable earnings can be higher than anticipated this yr.

Even when the Fed doesn’t lower charges, it has different strategies of boosting the economic system. A technique is quantitative easing, aka shopping for bonds with printed cash.

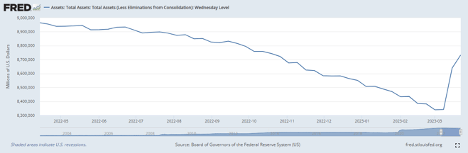

That course of really began two weeks in the past throughout the banking disaster. The Fed is shopping for bonds from banks. That’s a return to the quantitative easing insurance policies that fueled inventory market booms in 2009 and 2020. We are able to see that within the Federal Reserve Steadiness Sheet:

There’s additionally a possible shift in shopper sentiment.

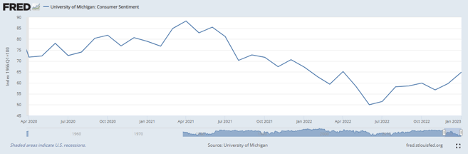

How shoppers really feel concerning the economic system exhibits a robust relationship to the inventory market. Decrease inflation ought to increase sentiment. That in flip ought to increase shares.

We’re already seeing indicators of sentiment bettering within the College of Michigan Shopper Sentiment survey.

The survey hit close to all-time lows final June. It’s up by about 15 factors since then.

But it surely goes past the survey. House gross sales are additionally selecting up. That’s the final word signal of shopper optimism.

Shopping for a house is the biggest buy most of us make in our lives. We have to imagine the house affords worth, or we gained’t purchase. The current uptick in gross sales is bullish for the economic system and the inventory market.

Any certainly one of these occasions might result in inventory market beneficial properties.

I’m not saying I see melt-up potential, like I did in 2009. However I do see room for greater costs.

I’m additionally not saying you possibly can exit and purchase something proper now and become profitable. These moments are uncommon. We loved that sort of market in April 2009 and once more in April 2020.

At present we’re taking a look at a market the place the information may not be as dangerous as feared. That makes it the perfect market atmosphere for merchants.

When most buyers anticipate the worst, and you’ll establish areas that ought to shock these buyers, you possibly can place your self for fast rallies as buyers modify their expectations.

I’m doing that on daily basis with my subscribers in my reside Commerce Room. In simply the primary quarter-hour after the open, we now have sufficient knowledge to arrange a commerce with the potential to make 50% beneficial properties in not more than two hours.

We’ve been in a position to try this a number of occasions within the final couple weeks. As buyers frequently modify their expectations within the weeks to return, I anticipate even better revenue alternatives.

I ought to point out that this technique is certainly one of seven that my subscribers and I take advantage of in my reside Commerce Room. Buying and selling a number of methods affords each alternatives and limits our danger.

One other such technique includes producing revenue. To try this, we commerce short-term credit score spreads to generate revenue.

We’ve closed six of those trades thus far — all winners. General, we generated $185 in revenue and by no means risked greater than $500. That’s a 37% return. and we’re discovering extra of those trades on a regular basis.

If you happen to’d fascinated with how one can commerce these concepts alongside me, click on right here and get all the small print.

I urge you to do it quickly. Entry to my Commerce Room closes at present, and we could not open it once more for fairly a while.

Regards, Michael CarrEditor, One Commerce

Michael CarrEditor, One Commerce

Persevering with Mike Carr’s theme of issues wanting not fairly so dangerous, let’s take a deeper have a look at the housing market.

Yesterday, I talked concerning the challenges of being an investor in actual property. However what about as a purchaser?

As Mike identified, new house gross sales loved a significant bump final week, reversing a nasty downtrend in gross sales that had been in place for the previous yr.

In fact, the most important issue right here is affordability.

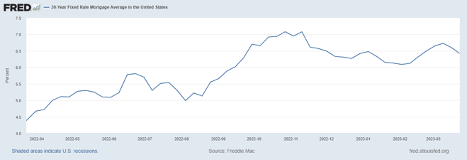

People bought sticker shock when mortgage charges shot up from 2.7% in early 2021, to over 7% by late final yr. However now, charges are trending ever so barely decrease.

As of final week, the typical 30-year mortgage price was 6.4%. That’s nonetheless excessive, however potential homebuyers have had an additional yr to get used to this inflated actuality.

Now that they noticed a modest pullback in each costs and mortgage charges, that home they needed is beginning to look somewhat extra inexpensive.

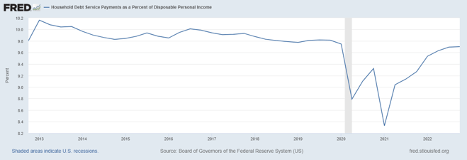

Properties are nonetheless removed from inexpensive for the typical household, notably after we bought used to phenomenally low charges throughout the COVID pandemic. There’s little doubt there. However family debt service funds are roughly on the similar ranges they have been again in 2019.

I’m not saying life was good earlier than COVID, or that each American carried a wonderfully snug quantity of debt. However this chart beneath exhibits that at present’s state of affairs isn’t fully out of line with the historic norm.

I don’t anticipate that we’ll see an explosion in house costs any time quickly. Whereas house costs have dipped somewhat, if costs transfer too rapidly, we’ll be proper again the place we began — with lack of affordability crimping demand once more.

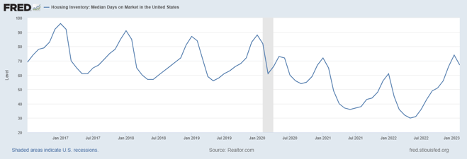

The stock knowledge suggests the market continues to be pretty tight. That’s really good.

The median days a home sits in the marketplace popped over the previous yr, nevertheless it’s nonetheless proper in the course of the widespread vary earlier than 2020.

And, for what it’s price, I nonetheless get near a dozen telephone calls per week from folks making an attempt to purchase my rental house. I briefly promote it two years in the past, and it hasn’t been listed since.

However when I get calls from strangers hoping to purchase my house, it tells me the market continues to be fairly sturdy.

I’m not suggesting you go and mortgage your self to the hilt to purchase new properties. I’m nonetheless taking part in it conservatively in the intervening time. Even so, we’ll take this as a bit of excellent information for the actual property market.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link