Love Worker

Pfizer’s (NYSE:PFE) acquisition of Seagen (NASDAQ:SGEN), introduced in March, is predicted to enhance the pharma big’s present portfolio of oncology therapies.

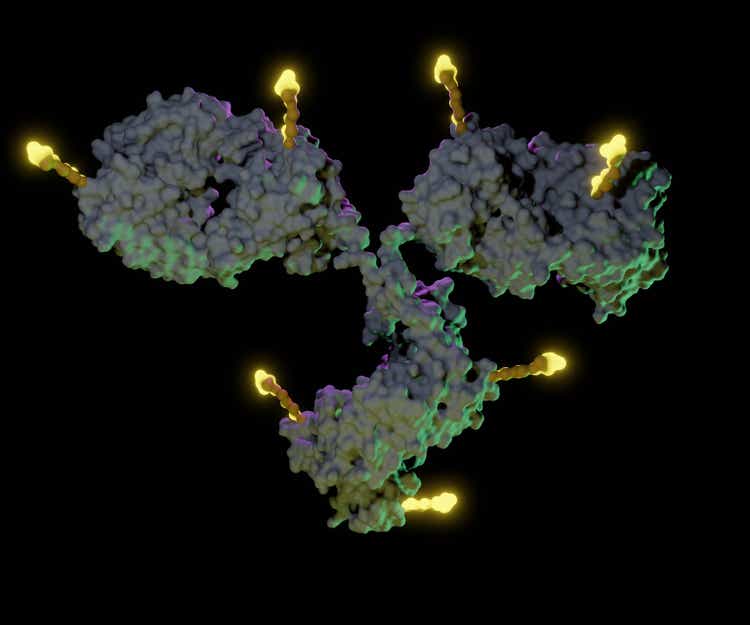

Seagen focuses on antibody-drug conjugates (ADCs), a know-how that the corporate says can “harness the concentrating on energy of antibodies to ship small molecule medicine to the tumor.”

The biotech has three marketed ADCs: Adcetris (brentuximab vedotin), Padcev (enfortumab vedotin), and Tivdak (tisotumab vedotin). They’re authorized for numerous varieties of most cancers.

As well as, it markets a non-ADC, Tukysa (tucatinib), which is authorized for breast and colorectal cancers.

On March 13, Pfizer (PFE) stated it will purchase Seagen for $43B. Ought to the deal undergo, it will be the largest within the pharma sector since AbbVie (ABBV) paid $63B in 2019 for Allergan.

Regardless of the steep price ticket for Pfizer (PFE), the payoff down the road is predicted to be large. In a latest report, information and analytics firm GlobalData stated Pfizer’s (PFE) complete cumulative income from Seagen’s (SGEN) merchandise is projected to hit $36B by 2028.

The acquisition comes at a essential time for Pfizer (PFE) as it’s going through declining revenues of its COVID-19 vaccine and antiviral Paxlovid, two merchandise which considerably padded its prime line lately.

In its This fall and full-year 2022 earnings report launched in January, Pfizer (PFE) stated that Paxlovid generated ~$19B in gross sales for the 12 months. Nonetheless, it warned that in 2023, that determine would decline 58% to $8B.

The excellent news for Pfizer (PFE) is that GlobalData sees the Seagen (SGEN) acquisition as a great match. “What’s most spectacular…is Seagen’s (SGEN) capability to develop a variety of monoclonal antibodies, that focus on totally different most cancers varieties,” says GlobalData Oncology & Hematology Analyst Israel Stern. “This capability will now be enhanced by leveraging Pfizer’s (PFE) protein engineering capabilities.”

Stern famous that each one 4 of Seagen’s (SGEN) at present marketed therapies are anticipated to have $1B in income within the subsequent 5 years. Adcetris, the biotech’s top-selling drug, is authorized for a number of lymphoma varieties. GlobalData initiatives it should turn into a billion-dollar drug in 2024.

Padcev, which was developed with Astellas Pharma (OTCPK:ALPMF)(OTCPK:ALPMY) urothelial most cancers, is projected to overhaul Adcetris as its top-selling drug by 2024, Stern added.

Padcev may see extra use as it’s at present beneath Precedence Overview by the US FDA together with Keytruda (pembrolizumab) for urothelial most cancers.

Seagen’s (SGEN) pipeline can also be promising. In addition to pursuing extra indications for its marketed merchandise, it has two ADCs in section 2, disitamab vedotin and ladiratuzumab vedotin. The previous is beneath investigation for HER2 expressing urothelial most cancers, whereas the latter for triple-negative breast most cancers and stable tumors.