christiannafzger

Earnings of First Nationwide Financial institution Alaska (OTCQX:FBAK) will probably stay flattish this yr as the expansion of bills will counter mortgage development. In consequence, I’m anticipating the corporate to report earnings of $18.23 per share for 2023, down by 0.9% year-over-year. The year-end goal value suggests a average upside from the present market value. Additional, the corporate is providing a really excessive dividend yield. Consequently, I’m adopting a purchase score on First Nationwide Financial institution Alaska. Nonetheless, the corporate seems unsuitable for low-risk-tolerant buyers.

Loans to Profit from Favorable Exterior Components

First Nationwide Financial institution Alaska’s mortgage portfolio grew at an honest charge of two.7% over the past quarter of 2022, which took the full-year mortgage development to 4.9%. The outlook for mortgage development in 2023 is combined.

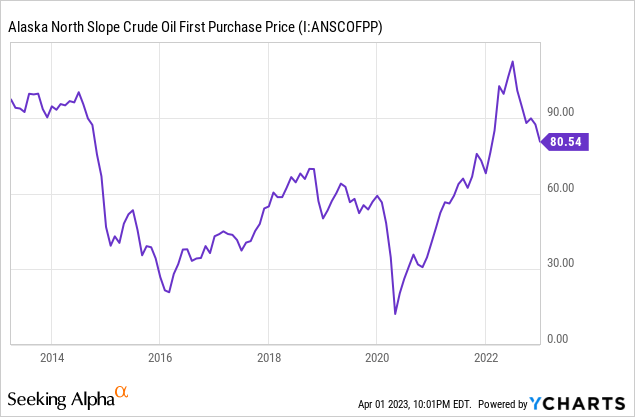

Because the Alaskan financial system depends to a big extent on its oil and gasoline trade, oil costs are an necessary indicator of credit score demand within the firm’s markets. Regardless of the downtrend that began within the latter a part of 2022, crude oil costs are nonetheless very excessive when put next with earlier years.

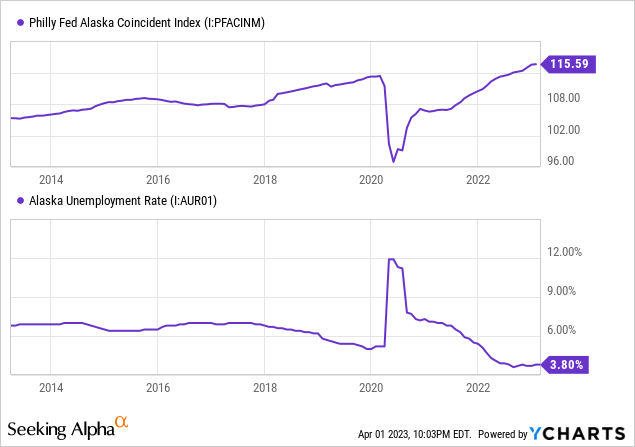

Moreover, Alaska’s labor market is presently stronger than it has been up to now decade. The coincident financial index can be in place, as proven beneath.

All these exterior elements bode properly for mortgage development within the brief time period. The one exterior issue that may harm mortgage development is the excessive interest-rate setting. One other issue that signifies a slowdown in mortgage development this yr is a weaker mortgage pipeline. Unfunded commitments had been right down to $686 million on the finish of 2022 from $811 million on the finish of 2021, as talked about within the annual report.

Contemplating these factors, I’m anticipating the mortgage portfolio’s development this yr to be considerably in the midst of the historic mortgage development vary. The next desk reveals my stability sheet estimates.

| Monetary Place | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Web Loans | 1,935 | 1,992 | 2,190 | 2,104 | 2,208 | 2,321 |

| Development of Web Loans | 7.7% | 2.9% | 9.9% | (3.9)% | 4.9% | 5.1% |

| Different Incomes Belongings | 1,598 | 1,589 | 2,391 | 3,356 | 2,886 | 2,944 |

| Deposits | 2,420 | 2,388 | 3,113 | 4,217 | 4,225 | 4,440 |

| Complete Liabilities | 3,247 | 3,261 | 4,109 | 5,027 | 4,930 | 5,159 |

| Frequent fairness | 507 | 548 | 587 | 555 | 408 | 415 |

| E book Worth Per Share ($) | 159.9 | 172.8 | 185.2 | 175.1 | 128.7 | 130.9 |

| Tangible BVPS ($) | 159.9 | 172.8 | 185.2 | 174.1 | 127.8 | 130.0 |

| Supply: FDIC Name Experiences, Annual Monetary Experiences, Creator’s Estimates(In USD million except in any other case specified) | ||||||

Regardless of the 425 foundation factors hike within the fed funds charge, the web curiosity margin remained virtually unchanged by means of most of final yr. It is because each mortgage yields and deposit prices are very sticky. I’m anticipating final yr’s development to proceed this yr, and the margin to stay largely secure in 2023.

Anticipating Flattish Earnings

The anticipated mortgage development will assist earnings. Then again, heightened inflation will drive up non-interest bills, which can drag earnings. Additional, the availability expense for mortgage losses will most likely return to a standard degree this yr, which will even harm earnings development. Total, I’m anticipating First Nationwide Financial institution Alaska to report earnings of $18.23 per share for 2023, down by 0.9% year-over-year. The next desk reveals my earnings assertion estimates.

| Earnings Assertion | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Web curiosity earnings | 132 | 137 | 145 | 146 | 145 | 152 |

| Provision for mortgage losses | 2 | 0 | 2 | 2 | (1) | 2 |

| Non-interest earnings | 26 | 23 | 26 | 27 | 24 | 24 |

| Non-interest expense | 86 | 86 | 91 | 92 | 93 | 98 |

| Web earnings – Frequent Sh. | 54 | 56 | 58 | 58 | 58 | 58 |

| EPS – Diluted ($) | 17.07 | 17.56 | 18.17 | 18.45 | 18.39 | 18.23 |

| Supply: FDIC Name Experiences, Annual Monetary Experiences, Creator’s Estimates(In USD million except in any other case specified) | ||||||

Earnings at Threat are Very Excessive as a result of Large Unrealized Losses

First Nationwide Financial institution Alaska’s available-for-sale (“AFS”) securities portfolio is even bigger than the mortgage portfolio, which may be very unlucky within the wake of the SVB Monetary Group’s (OTC:SIVBQ) case. Attributable to mounted charges on most of those securities, the rising rates of interest led to a drop of their market worth, leading to unrealized mark-to-market losses. These unrealized losses amounted to $204.8 million on the finish of December 2022, as talked about within the annual report. To place this quantity in perspective, $204.8 million is round half of the full fairness stability on the finish of 2022, and three.5 instances the web earnings reported for 2022. Subsequently, these losses are too giant, and a giant trigger for concern.

Probably, these losses will reverse when the charges begin declining subsequent yr. Nonetheless, there’s a chance, nevertheless small, {that a} deposit run might power the corporate to promote its securities portfolio and incur a crushing loss. Aside from the unrealized losses, the corporate’s threat degree is low, as mentioned beneath.

- The corporate doesn’t have publicity to dangerous asset courses, like enterprise capital belongings or cryptocurrencies.

- The corporate operates in Alaska, with no overlap with the Californian markets that SVB Monetary operated in.

- The capital is way better than regulatory necessities. The corporate reported a complete capital ratio of a whopping 19.24% for the tip of 2022, which is way larger than the minimal regulatory requirement of 10.50%.

Dividend Yield of over 6%, Dividend Seems Safe

The First Nationwide Financial institution Alaska is providing a excessive dividend yield of 6.4% on the quarterly dividend charge of $3.2 per share. The corporate additionally offers an annual particular dividend of $3.2 per share. Together with the particular dividend, the corporate is providing a really excessive dividend yield of 8.0%. The earnings and dividend estimates (together with the particular dividend) indicate a payout ratio of 88%. Though this ratio may be very excessive, the payout seems safe because of the following two causes.

- The payout ratio has averaged 82% within the final 5 years. It appears illogical for a corporation to chop its dividend and ship a detrimental sign to the market simply because the payout ratio is a couple of share factors larger than common.

- The capital degree is extra than simply sufficient in keeping with regulatory necessities, as mentioned above. Subsequently, there appears to be no risk of dividend cuts from regulatory necessities.

Adopting a Purchase Score

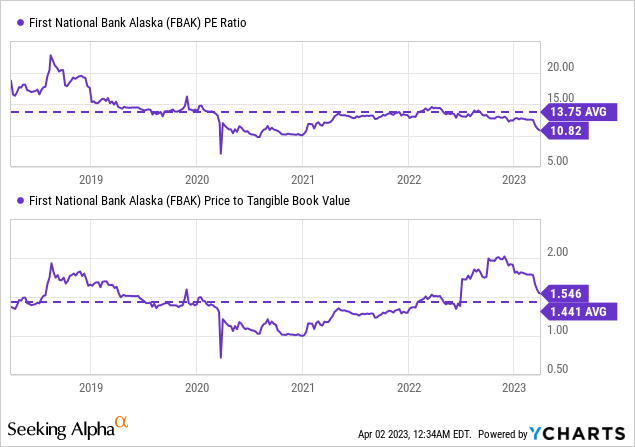

I’m utilizing the historic price-to-tangible guide (“P/TB”) and price-to-earnings (“P/E”) multiples to worth First Nationwide Financial institution Alaska. FBAK inventory has traded at a median P/TB ratio of 1.44x and a median P/E a number of of 13.75x up to now, as proven beneath.

Multiplying the typical P/TB a number of with the forecast tangible guide worth per share of $130.0 offers a goal value of $187.4 for the tip of 2023. This value goal implies a 5.8% draw back from the March 31 closing value. The next desk reveals the sensitivity of the goal value to the P/TB ratio.

| P/TB A number of | 1.24x | 1.34x | 1.44x | 1.54x | 1.64x |

| TBVPS – Dec 2023 ($) | 130.0 | 130.0 | 130.0 | 130.0 | 130.0 |

| Goal Worth ($) | 161.4 | 174.4 | 187.4 | 200.4 | 213.4 |

| Market Worth ($) | 199.0 | 199.0 | 199.0 | 199.0 | 199.0 |

| Upside/(Draw back) | (18.9)% | (12.4)% | (5.8)% | 0.7% | 7.2% |

| Supply: Creator’s Estimates |

Multiplying the typical P/E a number of with the forecast earnings per share of $18.2 offers a goal value of $250.6 for the tip of 2023. This value goal implies a 25.9% upside from the March 31 closing value. The next desk reveals the sensitivity of the goal value to the P/E ratio.

| P/E A number of | 11.75x | 12.75x | 13.75x | 14.75x | 15.75x |

| EPS 2023 ($) | 18.2 | 18.2 | 18.2 | 18.2 | 18.2 |

| Goal Worth ($) | 214.1 | 232.4 | 250.6 | 268.8 | 287.1 |

| Market Worth ($) | 199.0 | 199.0 | 199.0 | 199.0 | 199.0 |

| Upside/(Draw back) | 7.6% | 16.8% | 25.9% | 35.1% | 44.2% |

| Supply: Creator’s Estimates |

Equally weighting the goal costs from the 2 valuation strategies offers a mixed goal value of $219.0, which suggests a ten.0% upside from the present market value. Including the ahead dividend yield offers a complete anticipated return of 18%. Therefore, I’m adopting a purchase score on First Nationwide Financial institution Alaska. Nonetheless, as mentioned above, the corporate’s threat degree is presently reasonably excessive because of the giant stability of unrealized losses. Subsequently, the inventory doesn’t seem like appropriate for low-risk-tolerant buyers.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.