The S&P 500 (SP500) on Thursday ended marginally decrease by 0.10% at 4,105.02 factors for the holiday-shortened week, posting beneficial properties in two periods and losses within the different two. Its accompanying SPDR S&P 500 Belief ETF (NYSEARCA:SPY) slipped 0.05% for the week.

The benchmark index snapped a run of three successive weeks of beneficial properties with the slight underperformance, as market members gave the impression to be principally non-committal forward of the nonfarm payrolls report due on Good Friday.

Financial knowledge by means of the week pointed to cooling in each the trade and the labor market. It has sparked issues that the Federal Reserve’s rate-hiking marketing campaign has been too aggressive and {that a} fast curbing of the economic system can result in recession.

Traders parsed a greater-than-anticipated drop within the ISM manufacturing buying managers index and a more-than-expected drop in a key gauge of financial exercise within the providers sector. The labor market was within the highlight after the JOLTS report confirmed a lot lower-than-forecasted job openings, the ADP personal payrolls report added lower than anticipated, and the variety of Individuals submitting for preliminary jobless claims declined.

Merchants have principally been in a risk-off temper, snapping up secure shares equivalent to utilities and different defensive sectors, together with different property equivalent to bonds – sending Treasury yields to multi-month lows – and gold.

On the similar time, inflation expectations have needed to be readjusted considerably after the oil-producing OPEC+ nations, together with Saudi Arabia and Russia, final Sunday agreed to a shock manufacturing lower, resulting in huge beneficial properties in crude costs (CL1:COM) (CO1:COM) and a giant soar in vitality shares. For the Fed, greater oil costs would imply greater inflation, which might put strain on them to maintain charges elevated.

Talking of charges, markets have continued to fluctuate of their expectations concerning the central financial institution’s transfer at its subsequent financial coverage committee assembly in Could. The possibilities have saved swinging backwards and forwards in favor of no hike to a 25 foundation level hike. Based on the CME FedWatch device, the percentages at present stand at virtually precisely 50/50.

“As investor sentiment swings from laborious financial touchdown to comfortable touchdown, from sticky inflation to decrease inflation, and from believing the Fed will maintain charges greater for longer to the potential of a pivot, the market has swung backwards and forwards from pessimism to optimism,” Keith Lerner, co-chief funding officer at Truist, mentioned in a be aware on Wednesday.

“Energy within the mega cap development shares has aided market efficiency this yr, given their massive weighting in market indices. Nevertheless, market power is much less obvious beneath the floor as solely 36% of shares inside the S&P 500 are outperforming the index itself over the previous three months,” Lerner added.

Turning to the weekly efficiency of the S&P 500 (SP500) sectors, six ended within the pink, led by Industrials and Client Discretionary. Defensive stalwarts Utilities and Well being Care topped the gainers, whereas the Vitality sector additionally ended with beneficial properties, helped primarily by the response to the OPEC+ output lower. See beneath a breakdown of the weekly efficiency of the sectors in addition to their accompanying SPDR Choose Sector ETFs from March 31 near April 6 shut:

#1: Utilities +3.11%, and the Utilities Choose Sector SPDR ETF (XLU) +3.13%.

#2: Well being Care +3.08%, and the Well being Care Choose Sector SPDR ETF (XLV) +3.14%.

#3: Vitality +3.03%, and the Vitality Choose Sector SPDR ETF (XLE) +2.60%.

#4: Communication Companies +2.33%, and the Communication Companies Choose Sector SPDR Fund (XLC) +1.66%.

#5: Client Staples +0.91%, and the Client Staples Choose Sector SPDR ETF (XLP) +0.87%.

#6: Financials -0.65%, and the Monetary Choose Sector SPDR ETF (XLF) -0.50%.

#7: Actual Property -0.77%, and the Actual Property Choose Sector SPDR ETF (XLRE) -0.75%.

#8: Data Know-how -1.15%, and the Know-how Choose Sector SPDR ETF (XLK) -1.28%.

#9: Supplies -1.26%, and the Supplies Choose Sector SPDR ETF (XLB) -1.28%.

#10: Client Discretionary -2.95%, and the Client Discretionary Choose Sector SPDR ETF (XLY) -3.08%.

#11: Industrials -3.37%, and the Industrial Choose Sector SPDR ETF (XLI) -3.37%.

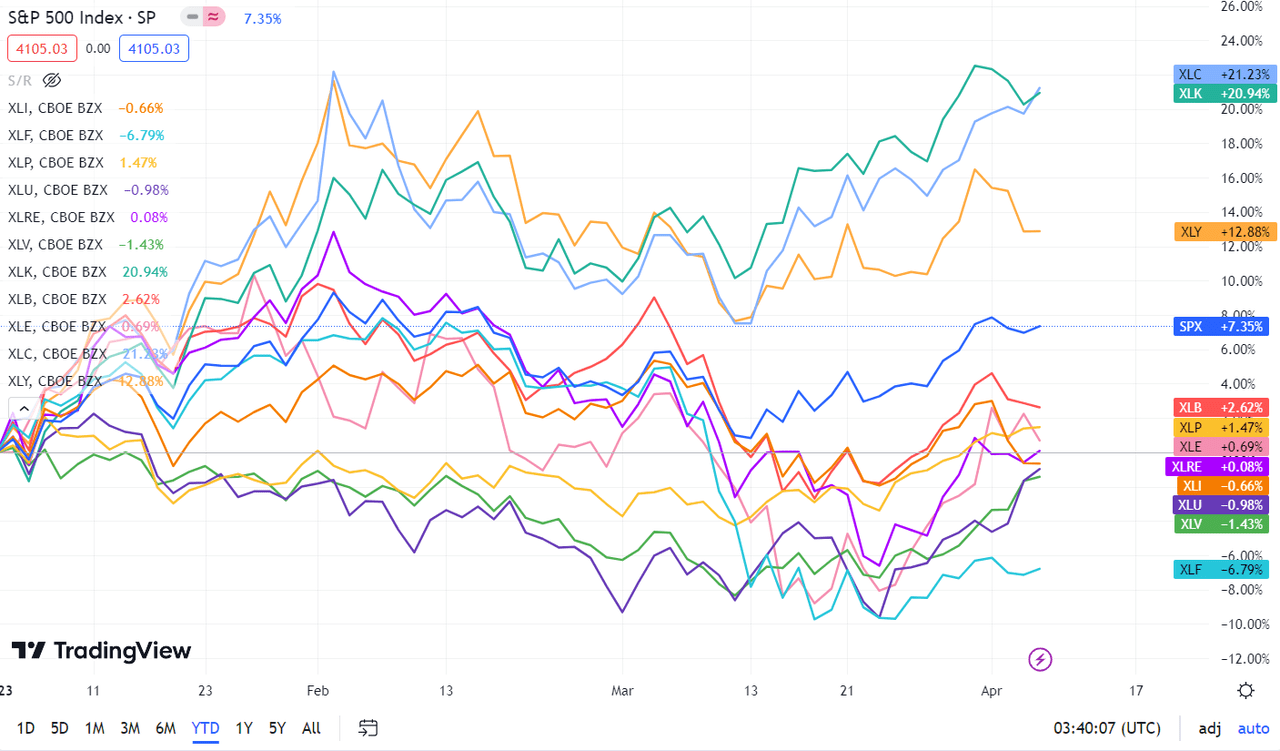

Beneath is a chart of the 11 sectors’ YTD efficiency and the way they fared towards the S&P 500.