buradaki

In America, every part goes and nothing issues, whereas in Europe nothing goes and every part issues. – Philip Roth

Introduction

Paid subscribers who considered this week’s international part of The Lead-Lag Report would be aware that I’ve highlighted how European equities are in a greater place than their US counterparts. Should you’re looking out for candidates from this hotspot it’s possible you’ll think about the European Fairness Fund (NYSE:EEA).

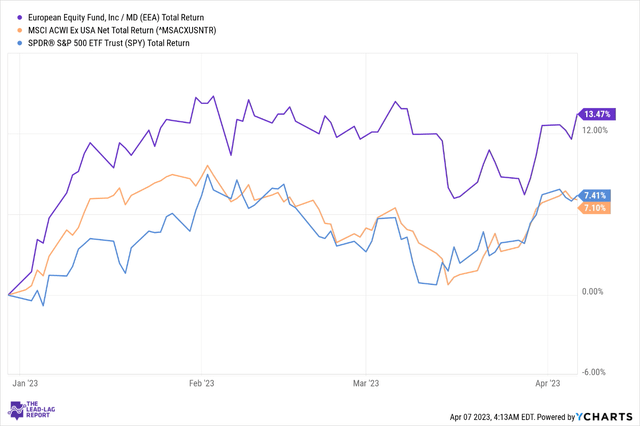

EEA is a long-standing (since July 1986) close-ended fund that gives traders publicity to 65 corporations domiciled throughout Europe. On a YTD foundation, EEA has loved a strong sufficient run, delivering double-digit returns, twice as a lot because the US markets and the worldwide markets.

YCharts

Might this outperformance proceed? Properly, I would not need to make any definitive statements, however let’s give attention to a number of the pivotal themes that might weigh on EEA’s prospects.

France

If EEA is to do properly, you’d need its French-based equities to expertise sanguine situations, as these shares account for near 1 / 4 of the entire holdings, which by the way additionally provides them the most important weight in mixture.

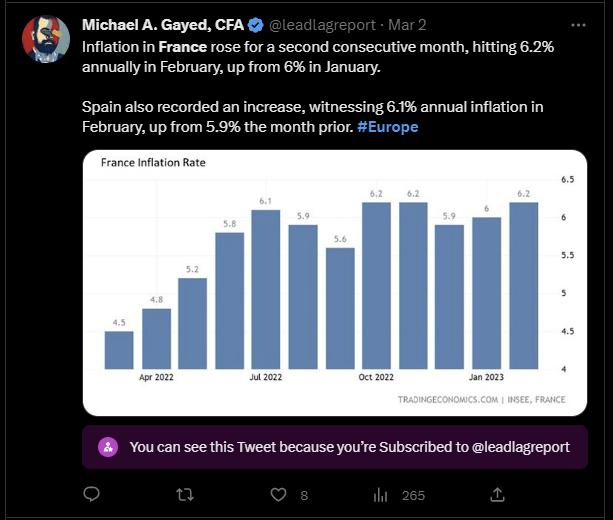

Final month, I put out a tweet on the Lead-Lag Report Twitter account noting how inflation in France continued to hover across the 6% ranges, which additionally represented its highest level in three many years. In mild of that, the latest inflation studying in March (5.6%) was little question very welcome, however I would not essentially get too enthused, as it’s nonetheless a great distance from the ECB’s consolation stage of two%.

Twitter

Crucially, it is also value noting that the lingering results of the power shock proceed to affect the sleek circulate of business manufacturing in France, notably a number of the energy-intensive industries akin to metal, paper, chemical substances, and so forth, which proceed to face double-digit declines.

Earlier this week, we acquired to know that numerous members of OPEC+ had been planning to curtail manufacturing, which may equate to over 1.6m barrels per day coming off from the system. That is certain to stoke up energy-related inflation which may put a restrict on industrial manufacturing progress in France. All in all, ING expects French industrial exercise to say no within the quarter and have a adverse contribution towards total financial development.

European financials

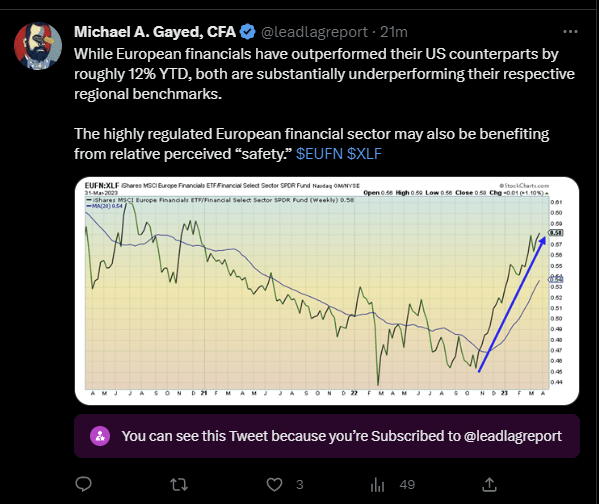

EEA’s portfolio can be dominated by monetary shares. Within the ‘Leaders-Laggers’ part of The Lead-Lag Report, I’ve additionally famous how European financials have outperformed their US counterparts.

Twitter

That is totally on account of the notion that Europe is simply extra tightly regulated (and possibly higher positioned to take care of contagion dangers) than the US and the business can be largely dominated by a couple of massive names, fairly in contrast to the US the place you will have loads of poorly capitalized regional banks. FYI, the liquidity protection ratio (LCR) of European banks ranges from 146%-200%, properly above the regulatory minimal of 100% whereas the most important US banks sometimes have decrease LCRs of round 119%. Along with that, European banks are additionally priced at a price-to-book worth of solely 0.65x, a 25% low cost to the corresponding a number of of US banks.

Foreign money

Twitter

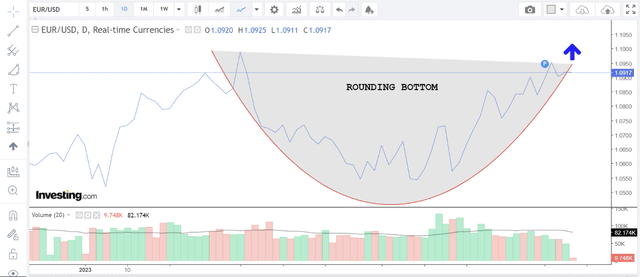

Foreign money dynamics too look like transferring in favor of EEA. In Jan I famous how the Euro had been demonstrating strong power on account of the ECB’s need to maintain urgent the speed hike pedal. That narrative nonetheless holds, even because it seems to be just like the US Fed could possibly be poised to vary its stance, thus dampening the attract of US-denominated property. We are able to see this being mirrored within the EUR/USD pair which has not too long ago accomplished a rounding backside sample and appears set to interrupt out past the 1.095 mark.

Investing.com

Having mentioned that, I might additionally urge traders to not get too carried away by the unidimensional narrative of the greenback’s demise and fairly take a while out to take heed to a latest Lead-Lag Stay Twitter Areas I did with Ryan McMaken. My visitor made a powerful case for the greenback and its safe-haven qualities that might nonetheless increase its attract as we encounter risk-off situations afterward within the 12 months

Twitter

Valuations and positioning

Regardless of the outperformance generated by EEA this 12 months, its valuation differential with US shares nonetheless seems to be very alluring. For context be aware that the close-ended European fund solely trades at 11x ahead P/E, a big low cost of over 40% to the corresponding a number of of the S&P500. In mild of such drastic variance within the valuation multiples, one would think about that the S&P500 would supply much better earnings potential, however that isn’t fairly the truth. YCharts count on the S&P500 to generate 5-year earnings of 11.7%, simply round 170bps increased than what EEA’s holdings are anticipated to generate.

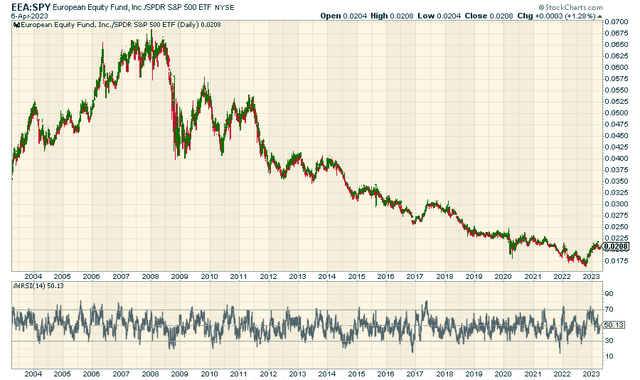

In the meantime, a long-term chart showcasing the positioning of European equities and US equities highlights how overstretched issues look, with EEA showing to supply attention-grabbing worth at these ranges.

Stockcharts.com

Apart from, as flagged in a tweet on the timeline of The Lead-Lag Report, US markets are presently largely propped up by a small group of mega-cap names, and I’ve reservations in regards to the endurance of this cohort for too lengthy. As soon as they provide approach, you possibly can see unintended situations decide up steam in April, although this has historically confirmed to be a great month for US shares.

Twitter

Editor’s Be aware: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.