[ad_1]

Black-necked swans, as I first outlined right here, are ominous-wanting market occasions.

That’s a key distinction. They look unhealthy. However they end up to not be. They may even turn into good.

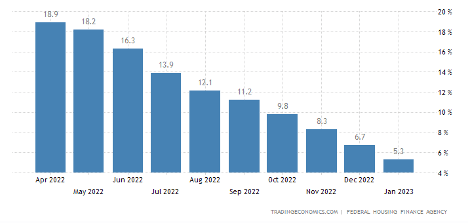

Final week, I famous there could be extra black-necked swans than black swans proper now. One instance is inflation. It’s slowing, and I anticipate that development to proceed. And the rationale why is just all the way down to how inflation is calculated.

Housing prices account for greater than a 3rd of the inflation equation. The method additionally makes use of previous knowledge to report housing prices.

Costs stopped rising quickly months in the past. That issue alone will scale back inflation for the subsequent six months.

We’d like look no additional than the plummeting yearly development fee within the U.S. Home Worth Index for the proof:

United States Home Worth Index, YoY Development

That’s why inflation is a black-necked swan. The thought of inflation is ominous … however the physique of the story hides doubtlessly excellent news.

That is one in all many black-necked swans at play proper now. A number of of them even exist outdoors the U.S.

OPEC’s current manufacturing lower is an instance. It appears to be like terrible on the floor — many analysts are calling for a return to $5+ gasoline.

However as with every black-necked swan, we have to look deeper to know how unhealthy the information actually is.

Let’s do this…

The OPEC Reduce Was No Shock

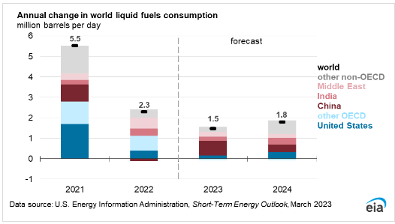

Over the weekend, OPEC lower manufacturing by over 1 million barrels per day, following a 2 million barrel reduce in October.

Now, the legal guidelines of provide and demand level to larger oil costs. Provide is contracting and demand is seemingly rising. That’s the scary headline. The black neck of the swan.

However the remainder of the story — and the swan — is about demand. And the newest estimate from the U.S. Vitality Data Administration reveals the present world oil demand is lower than provide. That really factors to decrease costs, not larger.

In 2023, the EIA estimates provide will exceed world demand by virtually 60,000 barrels per day. Subsequent yr, EIA forecasts an extra of 30,000 barrels per day.

These are small quantities. But when provide exceeds demand, costs will fall. OPEC doesn’t need costs to fall. That’s why they lower manufacturing.

Historical past reveals OPEC usually cuts manufacturing to forestall a steeper worth decline. Since 1998, OPEC introduced no less than 16 manufacturing cuts. Six months later, the value of oil was decrease seven occasions.

That’s why it is a black-necked swan. OPEC appears to deal with world financial indicators. It could be reducing manufacturing simply to keep away from a deeper worth decline when it sees weak point approaching.

Decrease inflation and falling oil costs are two main black-necked swans to look at for.

However stronger than anticipated development stands out as the largest…

Financial Information Retains Shocking to the Upside

The UK plunged into disaster final fall when rates of interest instantly jumped. Pension funds had wager on charges remaining close to zero. When charges rose, they confronted losses.

The credit score market froze. The prime minister misplaced her job in lower than a month. Now, the Financial institution of England and the federal government each anticipate a recession to start out this quarter and final into 2024.

On its face, that is all trigger for concern. The “drawback” is, financial knowledge retains popping out higher than anticipated.

Current revisions to GDP knowledge confirmed the U.Ok.’s economic system was stronger that originally reported. That reveals the economic system is extra resilient than anticipated within the face of double-digit inflation.

In March, a survey of companies confirmed enchancment in demand, confidence, hiring and funding intentions. This knowledge is much like the Institute for Provide Administration (ISM) knowledge we research within the U.S., and reveals that the economic system is continuous to develop within the U.Ok.

The U.Ok. isn’t alone. Information is healthier than anticipated in most nations.

The chart of the Citigroup Financial Shock Index reveals that. This index sums the distinction between official financial outcomes and forecasts for economies all over the world.

Readings above 0 present the economic system is doing higher than anticipated. We normally see this when world economies are rising.

(From MacroMicro.)

There are two components of that index — the forecast and the information.

The forecast is the ominous a part of the information. Precise knowledge is the excellent news. And now, with the road above 0 and trending larger, we’re taking a look at one other black-necked swan.

Developments can and have reversed instantly. Take a look at the previous three summers for proof of that.

However proper now, the Shock Index reveals blacked-neck swans are lurking in every single place.

One other space to look at — particularly in gentle of the current U.S. banking disaster — is world banks.

One other Black-Necked Swan in Credit score Suisse

We’ve already seen indicators that the banking disaster isn’t confined to Silicon Valley.

Final month, UBS agreed to purchase Credit score Suisse. When the information got here out, this appeared just like the financial institution contagion spreading additional. However in actuality, the issues at Credit score Suisse are nothing new.

The financial institution’s inventory has been in a downtrend since 2007. Shares of Credit score Suisse fell in 11 of the previous 15 years. Lastly shutting the financial institution down could possibly be a constructive improvement.

The identical could possibly be true for Deutsche Financial institution. That financial institution’s inventory has additionally declined in 11 of the previous 15 years. (Against this, the SPDR Monetary Choose Sector ETF (XLF) fell in simply 7 of these years.)

Closing down inefficient massive banks frees up capital for productive investments. That is the inventive destruction that Austrian economists imagine clears the best way for financial development.

That makes the failure of enormous banks a doubtlessly constructive end result from what, once more, sounds terrible.

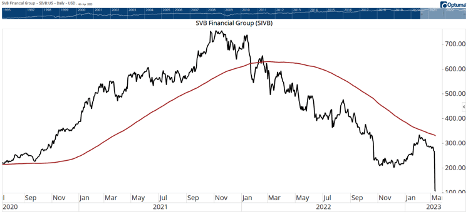

After all, the end result for shareholders in failed banks can be destructive. Which means it’s necessary to take a position correctly. Easy instruments like a 200-day transferring common will help you do this.

A chart of Silicon Valley Financial institution is under. Costs (black line) fell under the 200-day MA (purple line) in February. The inventory traded above $600 then. By the point the financial institution’s issues had been within the headlines, the value was greater than 55% decrease.

It’s simple to get caught up within the negativity of headlines. Since 2010, analysis reveals that information headlines have grown more and more destructive and decreasingly constructive. Seemingly, destructive information drives extra consideration.

Traders don’t have a lot good purpose to get caught up on this. As a result of opposite to fashionable perception, cash is what drives markets — not information.

Within the instance above, capital outflows from Silicon Valley Financial institution signaled a collapse greater than a yr earlier than it occurred. There have been no headlines from January 2022 suggesting something of the type.

I encourage you to remain skeptical of any negative-sounding headline you see, and discover methods to look deeper and examine the narrative in opposition to the information. You’ll probably discover that there’s extra purpose for optimism than pessimism.

Regards, Michael CarrEditor, One Commerce

Michael CarrEditor, One Commerce

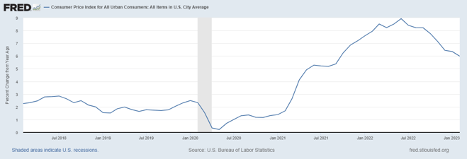

As Mike Carr identified, inflation is usually trending in the best course.

Client worth inflation continues to be clocking in at about 6%, which is way too excessive for my consolation degree. Nevertheless it’s loads higher than the 9% we noticed final summer season, and it’s persevering with to inch decrease.

We’ve probably reached “peak inflation.” And the disruption that it’s induced ought to recede from right here, as we will see within the chart under.

That mentioned…

Client worth inflation is a median. It contains “a bit of of the whole lot,” and a few costs have a tendency to regulate extra rapidly than others.

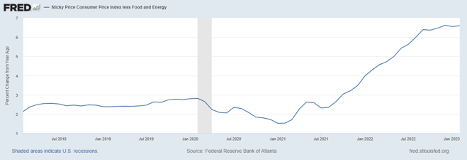

The Federal Reserve Financial institution of Atlanta tracks what they name the “sticky” Client Worth Index, which covers the costs of things that have a tendency to alter slower.

This index is made up of a broad assortment of industries, together with automobile insurance coverage, medical care, cell phone service, meals in eating places and even booze, amongst different issues.

However the knowledge within the following chart is telling a unique story than the primary. Inflation has leveled off at round 6.5%, nevertheless it’s not trending decrease simply but.

Once more, this isn’t essentially all unhealthy. Inflation has stopped getting worse. That’s good!

However we’re nonetheless seeing annualized inflation at 6.5% within the costs of issues that don’t usually transfer all that a lot. A few of this “stickiness” is because of structural components that don’t have any fast answer, just like the labor scarcity.

Nevertheless, there are just a few takeaways from this.

First, as Mike identified, the rumors of the economic system’s demise are tremendously exaggerated. The general state of affairs appears to be stabilizing.

Whereas inflation isn’t going away, its fee tempo is not accelerating. And but, the costs on most typical items are nonetheless getting 6.5% dearer yearly. Which means the Fed will proceed to face strain to maintain charges excessive.

Inflation is nice for sure asset lessons like commodities, treasured metals, actual property and the shares of corporations with sturdy pricing energy. It’s not nearly as good for long-term bonds and start-up corporations.

Nevertheless it’s additionally nice for the vitality sector — particularly within the oil and gasoline trade.

Yesterday, Charles Mizrahi identified that the worldwide oil provide is projected to fall in need of demand in 2023. This may make oil costs soar within the subsequent few years. You may benefit from this in two methods:

- You may commerce on his beneficial ETF, the Vitality Choose Sector SPDR Fund.

- You may watch his free video presentation detailing his high beneficial commerce within the vitality sector — proper right here!

Both method, be sure to benefit from the sectors which can be thriving even within the throes of inflation.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link