[ad_1]

As if Apple wasn’t omnipresent sufficient in our lives, the tech large is now providing Apple Card customers the chance to open a financial savings account on their iPhones.

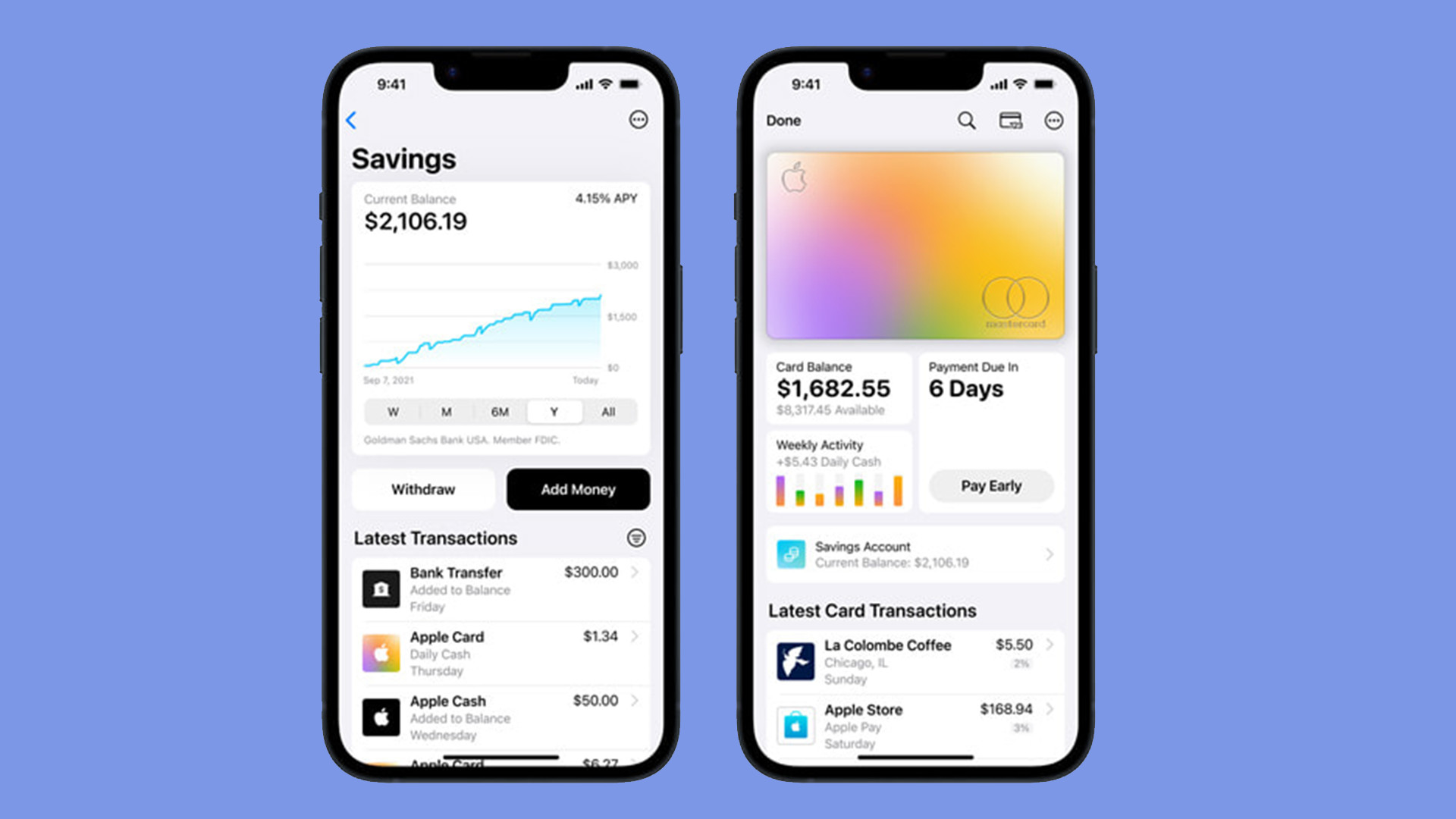

The characteristic was initially introduced again in October 2022 (opens in new tab) as a approach for Apple Card homeowners to save lots of their Each day Money rewards and develop them “in a high-yield Financial savings account from Goldman Sachs.” Some speculated the APY (annual share yield) can be 3.75 % (opens in new tab), however because it seems, it’s really 4.15 % which the corporate claims is at present “greater than 10 occasions the nationwide common”. Remember the APY is not set in stone because it might leap up or dip at any time sooner or later. Moreover the excessive yield, it capabilities equally to any outdated financial savings account (opens in new tab) you get at a typical financial institution with the additional advantage of getting “no charges, no minimal deposits, [plus] no minimal steadiness necessities”.

Moreover, all Each day Money (opens in new tab) earnings that you just gather everytime you buy one thing along with your Apple Card will robotically be despatched over to the brand new financial savings account. The neat half is there is no restrict to Each day Money though the money rebates differ from service provider to service provider. For instance, should you purchase a brand new Macbook from Apple’s on-line retailer, you get three % of that individual buy again.

Wholesome finance

Vice chairman of Apple Pay and Apple Pockets Jennifer Bailey acknowledged in a launch that the aim of this latest transfer is to offer individuals the instruments to “lead more healthy monetary lives” much like Apple Pay Later which launched in late March (opens in new tab). To additional assist, the Pockets app could have a dashboard for customers to trace account actions. Customers may also join a private checking account in the event that they need to deposit cash from a private account to their newfound Apple Financial savings. After all, it’s attainable to do the alternative by withdrawing funds to mentioned private account or out of your Apple Money card “with no charges.”

Apple states the brand new accounts will likely be protected by the identical stage of strong safety customers count on from the corporate. Since these accounts are being managed by Goldman Sachs, balances are protected (opens in new tab) by the Federal Deposit Insurance coverage Company (FDIC). So if by some freak incidence, Apple’s monetary endeavors implode, your cash is roofed by the FDIC.

Limitations

There are some limitations. First, solely individuals dwelling in america can create a Financial savings account since that’s the solely nation the place Apple Card is accessible. You have to have an iPhone sporting iOS 16.4 or later. Accounts have a most steadiness of $250,000, in line with a Deposit Account Settlement from Goldman Sachs (opens in new tab). And in that very same doc, it states “[bank] transfers have to be” between $1 to $10,000 with a weekly restrict of $20,000.

Directions on easy methods to create the account on the Apple Pockets app could be discovered on Apple’s Assist web site (opens in new tab).

It wouldn’t shock us if the thought of a financial savings account with no charges and excessive APY is making you take into account shopping for an iPhone simply to have one. If that is you, make sure you take a look at TechRadar’s lately up to date record of the most cost-effective iPhone offers for April 2023.

[ad_2]

Source link