[ad_1]

Prime brokerages present a mess of bundled providers to different monetary establishments, sometimes hedge funds to facilitate their operational wants like securities lending/borrowing, money loans, and danger administration. Massive hedge funds ($1B+ AUM) can work with as many as ten prime brokers whereas smaller funds could depend on just one. Sometimes, the constraint that stops these funds from using extra prime brokers is expertise implementation and integration. Clear Avenue is a tech-enabled prime brokerage that takes an API-first strategy to supply a full suite of providers which might be cloud-native. 70% of the prime brokerage enterprise has been dominated by a handful of establishments and by taking a technology-first strategy, Clear Avenue is ready to provide real-time processing and unprecedented knowledge scalability that simply isn’t potential in legacy techniques utilized by the incumbents. Presently, the corporate presents clearing and custodial providers, execution, and financing for US equities and choices for over 200 funds however plans to develop to cowl any asset class, anyplace on the globe.

AlleyWatch caught up with Clear Avenue Cofounder and CEO Chris Pento to study extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, and far, rather more…

Who have been your traders and the way a lot did you increase?

The second tranche of our Sequence B capital increase values Clear Avenue at $2.0B. This $270M funding spherical follows an preliminary Sequence B funding of $165M in Might 2022, which was additionally led by Prysm Capital and valued Clear Avenue at $1.7B at the moment. Extra traders included NextGen Enterprise Companions, IMC Investments, Walleye Capital, Belvedere, NEAR Basis, McLaren Strategic Ventures, and Validus Development Traders.

Inform us in regards to the services or products that Clear Avenue presents.

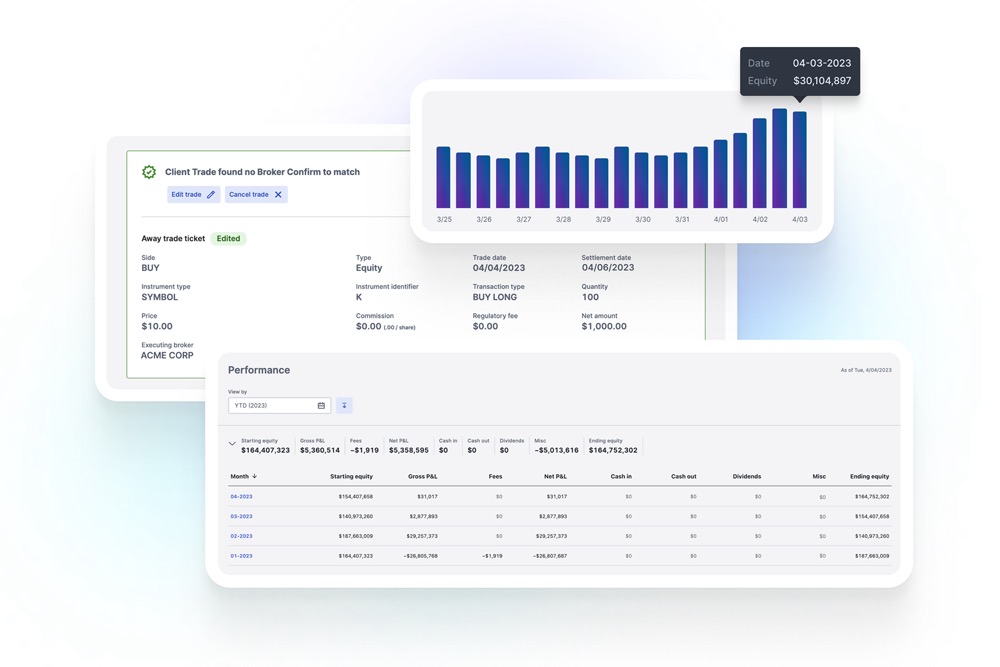

Clear Avenue is a tech-enabled unbiased prime dealer. We’ve constructed an inner platform to be API-first, which incorporates clearing, custody, prime financing and execution, that we’re dogfooding to construct a multi-asset prime dealer enterprise. At this time our platform helps U.S. equities and choices, however the purpose is to be a single supply of reality that helps any asset class, any geography, for anybody.

Our tech stack makes use of trendy cloud-native infrastructure, together with resilient service orchestration, event-driven real-time processing, and scalable knowledge warehousing, which is a pointy distinction to the batch processing provided by mainframes that run many back-office techniques. Clear Avenue’s total suite of software program techniques is constructed upon this constant and cohesive expertise stack, enabling the elements to speak seamlessly.

What impressed the beginning of Clear Avenue?

In 2018, Clear Avenue set out with the daring mission to interchange the outdated infrastructure getting used throughout capital markets. The general public U.S. securities business, which strikes trillions of {dollars} a day, nonetheless depends on mainframe expertise from the Nineteen Eighties. These legacy techniques are entrenched in handbook processes and siloed knowledge, leading to expensive errors and costly technical debt. For a lot of companies, changing these antiquated techniques could be like eradicating the engine from a airplane in mid-air. It’s time-consuming and troublesome to execute with fragmented expertise.

In 2018, Clear Avenue set out with the daring mission to interchange the outdated infrastructure getting used throughout capital markets. The general public U.S. securities business, which strikes trillions of {dollars} a day, nonetheless depends on mainframe expertise from the Nineteen Eighties. These legacy techniques are entrenched in handbook processes and siloed knowledge, leading to expensive errors and costly technical debt. For a lot of companies, changing these antiquated techniques could be like eradicating the engine from a airplane in mid-air. It’s time-consuming and troublesome to execute with fragmented expertise.

Clear Avenue is dealing with the problem of outdated capital markets infrastructure head-on. We began from scratch and constructed a totally cloud-native prime brokerage and clearing system designed for a fancy, trendy world market. Our proprietary expertise platform provides important effectivity to the market, whereas specializing in maximizing returns and minimizing danger and value for shoppers.

At this time, we offer shoppers, from rising managers to massive establishments, with every little thing they should clear, custody, and finance U.S. equities and choices. Within the final 12 months, we launched capital introduction and repo companies, enhanced our securities lending capabilities, and up to date and refined our client-facing place, danger, operations, and reporting portals.

Sooner or later, our single-source platform will serve quite a lot of investor varieties, throughout a number of asset lessons, on a worldwide scale. It’s by no means been extra obvious that the forces of volatility, regulatory change, and pace are demanding instruments that enable companies to make sense of the markets in real-time.

What market does Clear Avenue goal and the way huge is it?

Our prime brokerage shoppers vary from rising managers to massive establishments. Over the previous 12 months, the variety of institutional shoppers on our platform elevated by 500%, our each day transactional quantity elevated by greater than 300%, and our financing balances elevated by almost 150%.

Our prime clearing platform processes 2.5% of the gross notional U.S. equities quantity, which is about $10 billion in each day notional buying and selling worth of U.S. equities.

What’s what you are promoting mannequin?

At this time, we’re servicing roughly 200 institutional-sized traders and a whole bunch of smaller lively buying and selling entities. Our shoppers favor anonymity so we don’t publicly identify them. We earn charges from our clients for transactions and financing of public market securities. We really feel this construction is healthier aligned than different choices within the present markets.

What components about what you are promoting led your traders to put in writing the test?

“A good portion of the monetary system’s spine is made on decades-old legacy expertise. With what we imagine to be the strongest management workforce within the capital markets business, Clear Avenue has rethought and rebuilt the core underlying infrastructure for capital markets to really modernize an antiquated business.” – Matt Roberts, Cofounder & Accomplice at Prysm Capital

The place do you see the corporate going now over the close to time period?

This funding will assist the launch of latest merchandise and our growth into new markets and asset lessons. Within the final 12 months, we’ve made key hires in Europe and within the Derivatives house. We’re additionally increasing our product providing to assist the clearing wants of Market Makers, which we see as a significant progress space for Clear Avenue.

You’re seconds away from signing up for the most popular record in Tech!

Join right this moment

[ad_2]

Source link