Natee Meepian/iStock through Getty Photographs

U.S. property/casualty insurers’ underwriting outcomes are anticipated to enhance this 12 months on the again of upper premium charges in underperforming car and property segments, in keeping with scores company Fitch.

Nevertheless, claims volatility amid increased inflation and broader macroeconomic uncertainty might hinder a return to underwriting profitability in 2023.

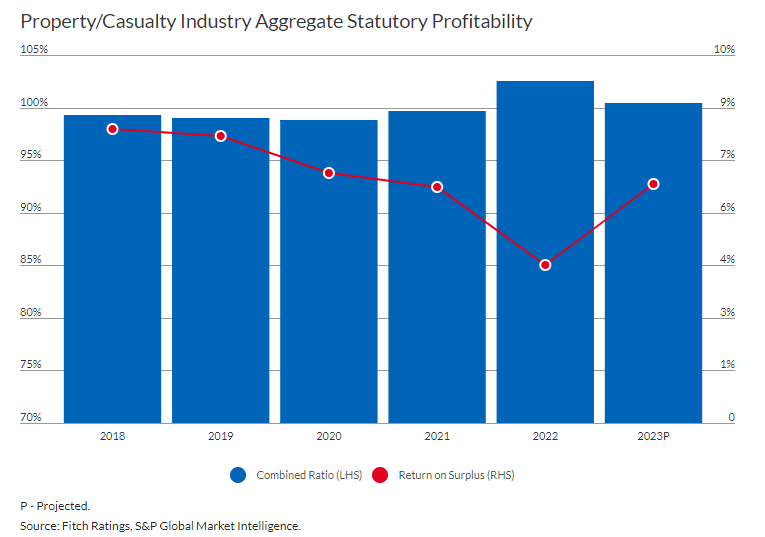

Fitch has a impartial outlook on the property/casualty insurance coverage sector, primarily based on secure to enhancing working efficiency this 12 months. It forecasts a 100.4% business mixed ratio for the 12 months.

Private strains will seemingly enhance in 2023, given latest pricing and underwriting changes amid normalizing insured disaster losses. Business strains general mixed ratios are anticipated to worsen barely from present favorable underwriting revenue ranges.

Direct written premiums development will barely average, however stay increased than historic norms on sturdy momentum in private strains premiums. Direct written premiums grew over 9% for the second straight 12 months in 2022, helped by business and private strains charge will increase.

Return on surplus fell for the fourth 12 months in a row in 2022 to 4.3%, however is predicted to rebound this 12 months. “Variability in pure disaster losses stay regarding, compounded by sharp will increase in reinsurance prices and fewer dependable out there capability,” Fitch cautioned.

Be aware that the SPDR S&P Insurance coverage ETF (KIE) gained 4.8% within the final six months, however underperformed the 6% acquire within the Choose Sector SPDR Monetary ETF (XLF) and the 15.1% enhance within the S&P 500 index.

Earlier this 12 months, S&P World Scores revised its view on the U.S. property/casualty insurance coverage sector to destructive, because of declining funding values and weaker underwriting outcomes. It expects weaker credit score tendencies to proceed this 12 months.