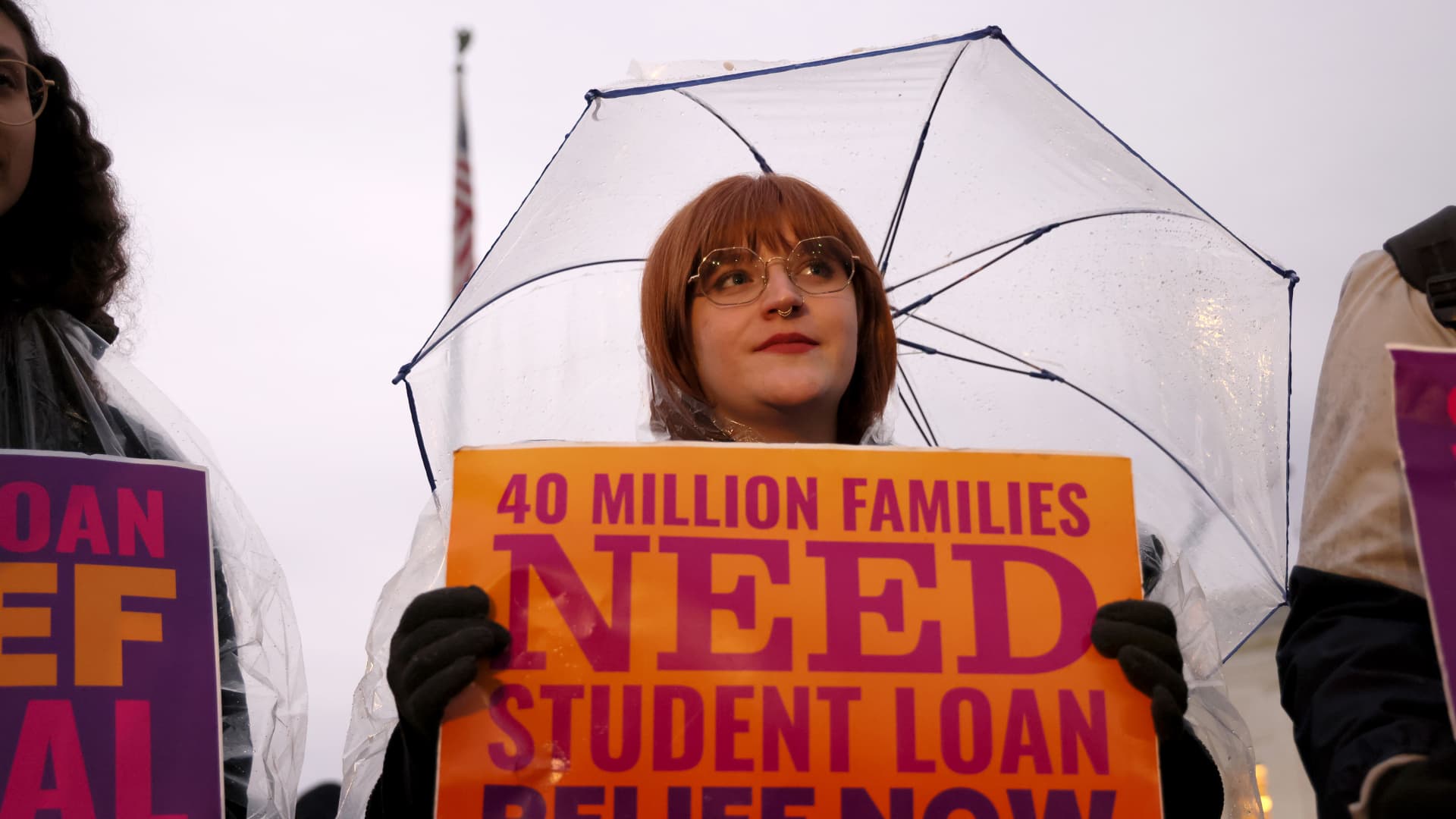

WASHINGTON, DC – FEBRUARY 27: Pupil mortgage debtors collect at Supreme Courtroom the night earlier than the courtroom hears two instances on scholar mortgage reduction to state the reduction is authorized and must occur instantly on February 27, 2023 in Washington, DC. (Photograph by Jemal Countess/Getty Photos for We The 45 Million)

Jemal Countess | Getty Photos Leisure | Getty Photos

The Supreme Courtroom resolution on whether or not or not it permits the Biden administration to maneuver ahead with the plan to cancel $400 billion in scholar debt could have life-changing monetary penalties for tens of hundreds of thousands of People.

Sadly for debtors, authorized specialists stay skeptical that the justices will greenlight the reduction.

“I anticipate the courtroom will rule in opposition to the Biden administration,” mentioned Paul Collins, Jr., professor of authorized research and political science on the College of Massachusetts Amherst.

Collins predicts the six conservative justices will vote down President Joe Biden’s program, and that the three liberal justices can be in favor of it. “The Supreme Courtroom is an extremely ideological and partisan establishment in 2023 — maybe extra so than at another level in American historical past,” he mentioned.

Extra from Private Finance:

3 methods to chop ‘off the charts’ journey prices, specialists say

This free tax instrument could discover ‘ignored’ credit or refunds, IRS says

Here is Apple’s new 4.15% charge on financial savings account ranks

College of Illinois Chicago legislation professor Steven Schwinn agreed. “I predict the courtroom will rule 6-3 in opposition to it, alongside typical ideological strains,” he mentioned.

Schwinn anticipates the six conservative justices to argue that the Biden administration is exceeding its authority by attempting to cancel as a lot as $20,000 in scholar debt for tens of hundreds of thousands of individuals.

The White Home has insisted that it is performing inside the legislation, noting that the Heroes Act of 2003 grants the U.S. schooling secretary the authority to make adjustments to the federal scholar mortgage system throughout nationwide emergencies. The nation has been working underneath an emergency declaration since March 2020 due to the Covid pandemic.

That act adopted the 9/11 terrorist assaults, offering reduction to federal scholar mortgage debtors who’d been affected by these occasions.

If the Biden administration is pressured to renew scholar mortgage funds, which have been paused for over three years, with out delivering debt forgiveness, it warns that delinquency and default charges will skyrocket after the financial injury wrought by the general public well being disaster.

The plaintiffs difficult scholar mortgage forgiveness, together with six GOP-led states, argue that the Heroes Act permits a lot narrower types of reduction, not the sweeping sort of cancellation the president hoped to ship.

In different phrases, the states are principally asserting that Biden is utilizing Covid as an excuse to cross his plan, mentioned increased schooling knowledgeable Mark Kantrowitz.

“For instance, if it was an emergency, why wait three years to supply the forgiveness?” Kantrowitz mentioned. “Why current it in a political framework, as fulfilling a marketing campaign promise?”

Dan Urman, a legislation professor at Northeastern College, mentioned the conservative justices additionally appeared skeptical throughout oral arguments that the plan was allowed underneath the Heroes Act.

“I anticipate the courtroom to strike down this system,” Urman mentioned.

He can be launching his 2024 reelection marketing campaign as American’s debt collector.

Astra Taylor

co-founder of the Debt Collective

Given the partisan nature of the best courtroom, Collins, the professor on the College of Massachusetts Amherst, mentioned the six conservative justices could view blocking the plan as “dealing a blow to Biden’s historic legacy and certain reelection marketing campaign.” Biden is predicted to announce his intention of working for the presidency once more subsequent week.

Certainly, hundreds of thousands of People will doubtless be disenchanted with the president for failing to ship on his promise. Earlier than the White Home was pressured to close its utility for debt reduction amid the authorized challenges to its plan, 26 million individuals had requested or certified for the help.

“He can be launching his 2024 reelection marketing campaign as American’s debt collector,” mentioned Astra Taylor, co-founder of the Debt Collective, a union for debtors, mentioned of the president.

Nevertheless, ought to it block the help, the Supreme Courtroom will doubtless additionally take successful, Schwinn mentioned.

“The courtroom’s ruling on this case would solely contribute additional to the assumption that this courtroom is simply an instrument of the trendy Republican Get together,” he mentioned.