skynesher/E+ by way of Getty Photos

Funding Thesis

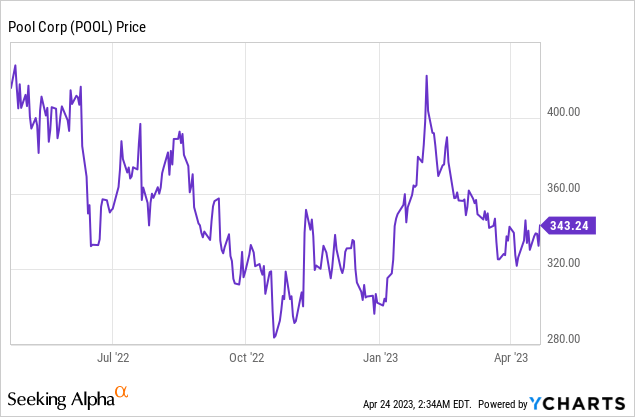

Pool Corp’s (NASDAQ:POOL) share worth is roughly flat since my earlier purchase protection in July final 12 months, however I don’t suppose the corporate is as compelling as earlier than. Whereas its fundamentals stay strong, the general macro backdrop has deteriorated meaningfully and can probably proceed to place immense strain on the enterprise. As proven within the current earnings, the macro affect is now being felt as income development was the weakest prior to now decade whereas the underside line additionally dropped considerably. The present valuation stays discounted and will present some draw back safety, however the near-term upside also needs to be restricted as a result of weakening financials. I don’t suppose the present worth level appears to be like notably engaging due to this fact I fee POOL inventory as a maintain.

Macro Headwinds

Previously few months, the inflation fee has come down considerably whereas the power of the economic system additionally weakened meaningfully. Not like different corporations, the decline in inflation will probably be a headwind for Pool Corp. Previously two years, the corporate was in a position to increase costs considerably amid excessive inflation, which boosted gross sales development. In lots of circumstances, the worth will increase at an excellent increased fee than inflation. For context, roughly 10 share factors of development have been contributed by increased pricing in FY22, whereas quantity solely contributed round 2 to 4 share factors. As inflation eases, the corporate’s pricing energy also needs to drop accordingly.

Apart from pricing, the weakening economic system can be impacting volumes. Pool development, which accounts for roughly 15% of complete gross sales, was impacted essentially the most by the macro headwinds because the housing market slows and the price of borrowing elevated. In accordance with the administration, the general pool allow quantity is down 30% whereas the demand for brand spanking new pool development is down from the excessive teenagers to over 50% in some markets. This subsequently impacts each the gear and chemical segments, which noticed gross sales drop by double digits. As a consequence of tighter budgets, some clients are additionally delaying their renovation and reworking plans, which additional weighs on demand.

Weak Q1 Earnings

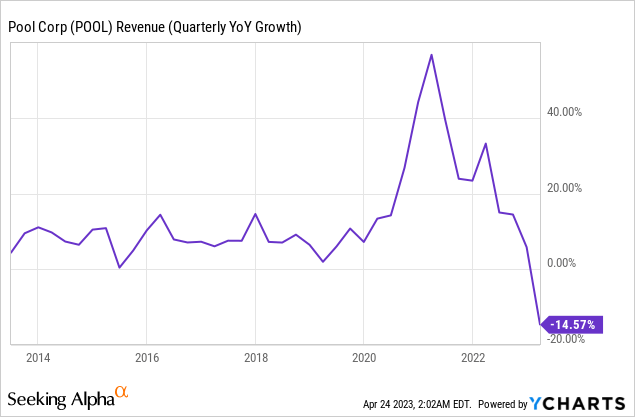

Pool Corp introduced its first-quarter earnings final week and the outcomes are very weak, as each the highest and the underside line missed expectations. The corporate reported income of $1.2 billion, down 15% YoY (12 months over 12 months) in comparison with $1.4 billion. That is the primary income decline because the nice monetary disaster from 2008 to 2010. The decline is especially attributed to macro headwinds, unfavorable climate, and difficult comps, as the corporate reported income development of 32% within the prior 12 months.

As talked about above, pool development was impacted essentially the most by macro headwinds, with gross sales down roughly 25%. The chemical and gear segments have been additionally weak, with gross sales down 14% and 11% respectively. The business swimming pool product section, which is non-discretionary, was the best-performing section with gross sales up 12%.

Regardless of the decline in income, spending really elevated as the corporate continues to make investments for long-term development. Working bills for the quarter have been up 5.9% YoY from $211.5 million to $224 million, largely attributable to a rise in lease, facility, and personnel prices. The upper spending resulted within the working earnings plummeting 38.2% YoY from $235.7 million to $145.7 million. The working margin additionally contracted 460 foundation factors from 16.7% to 12.1%. The diluted EPS was $2.58 in comparison with $4.41, down 41.5%.

As a consequence of ongoing deterioration within the macro setting, the corporate additionally lowered its steering for FY23. The diluted EPS is now anticipated to be between $14.62-$16.12 (together with a tax good thing about $0.12), vastly under the vary of $16.03-$17.03 introduced beforehand.

Valuation

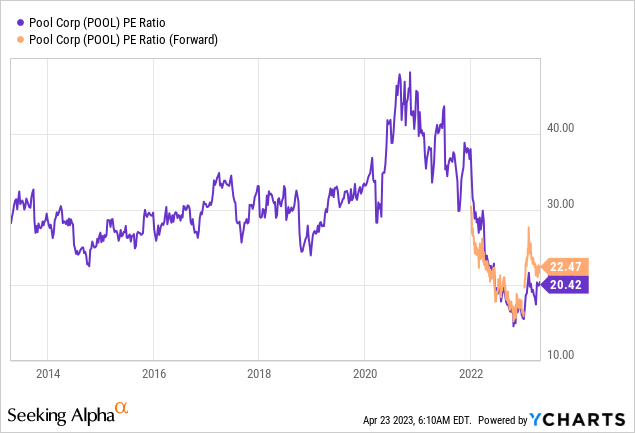

Pool Corp’s present valuation isn’t costly however I battle to see a lot upside potential within the close to time period. The corporate is buying and selling at a PE ratio of 20.4x, which stays discounted on a historic foundation, as proven within the first chart under. This a number of represents a significant low cost of 35.2% in comparison with its 5-year common PE ratio of 31.5x. Nevertheless, the a number of is anticipated to maneuver as much as roughly 22.5x within the coming 12 months as earnings proceed to shrink. Whereas that is nonetheless discounted, the declining gross sales will in all probability weigh on valuation. As proven within the second chart under, the corporate’s newest development fee of unfavourable (14.6)% is the weakest prior to now decade, and considerably decrease than its 5-year common of 17.9%. Contemplating the deteriorating financials, the upside will probably be restricted till development rebounds.

Buyers Takeaway

Whereas I nonetheless like Pool Corp’s fundamentals and its main place within the pool trade, the stronger-than-expected macro headwinds will inevitably affect its financials within the close to time period. The most recent earnings confirmed a significant slowdown in gross sales and the steering suggests additional deterioration within the coming quarters. Regardless of the valuation being discounted, the continuing weak point in development will probably restrict the near-term upside potential. Contemplating the change within the macro setting and the weak monetary efficiency, I’m downgrading the corporate from a purchase to a maintain.