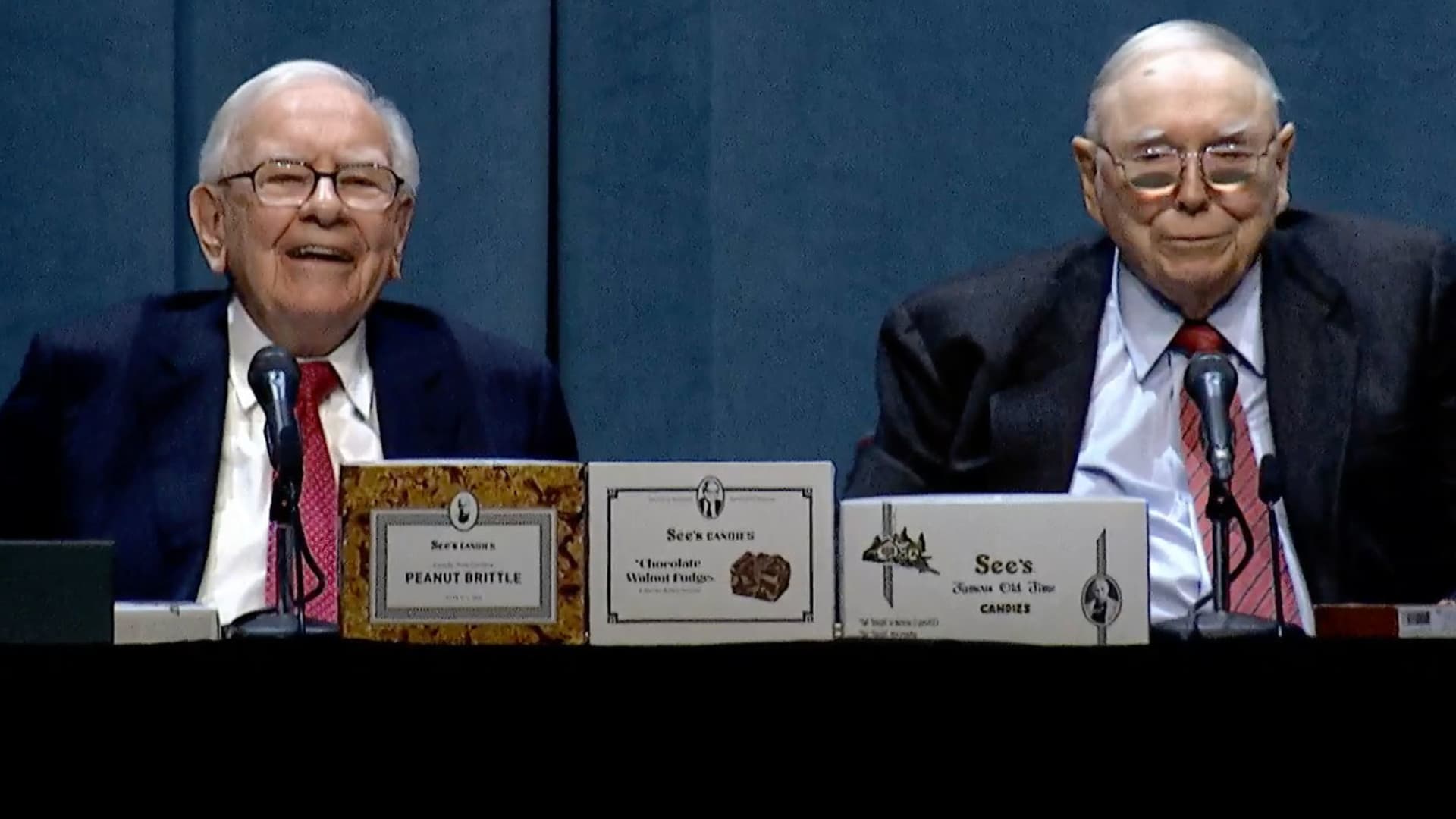

Comply with our dwell protection of Warren Buffett at Berkshire Hathaway assembly.

OMAHA, Neb. — Warren Buffett mentioned Saturday that Berkshire Hathaway would not plan on taking full management of Occidental Petroleum, an oil large the place it has amassed a stake north of 20%.

“There’s hypothesis about us shopping for management, we’re not going to purchase management,” the ‘Oracle of Omaha’ mentioned at Berkshire’s annual shareholder assembly. “We would not know what to do with it.”

In August final 12 months, Berkshire acquired regulatory approval to buy as a lot as a 50% stake. Since then, Buffett has been steadily including to his guess, together with this 12 months, boosting the conglomerate’s stake within the Houston-based power producer to 23.5%. The strikes had fueled hypothesis that the 92-year-old investor may purchase the entire firm.

“We is not going to be making any supply for management of Occidental, however we love the shares we’ve got,” Buffett mentioned. “We might or might not personal extra sooner or later however we actually have warrants on what we obtained on the unique deal on a really substantial quantity of inventory round $59 a share, and warrants final a very long time, and I am glad we’ve got them.”

Berkshire owns $10 billion of Occidental most popular inventory, and has warrants to purchase one other 83.9 million frequent shares for $5 billion, or $59.62 every. The warrants have been obtained as a part of the corporate’s 2019 deal that helped finance Occidental’s buy of Anadarko.

Shares of Occidental have been down about 3% this 12 months, after greater than doubling in 2022. The inventory was the best-performing title within the S&P 500 final 12 months.

— CNBC’s Sarah Min contributed reporting.