[ad_1]

U.S. traders have had a lot to grapple with on the house entrance this yr…

Inflation … recession fears … and a banking disaster, to call a number of.

So I wouldn’t blame anybody for lacking a number of key developments involving the U.S. greenback … and its coveted standing because the world’s reserve foreign money.

Inside simply the final six months:

- The UAE started early talks with India to commerce non-oil commodities in Indian rupees.

- China additionally expressed a want to maneuver away the greenback for native commodities commerce.

- Brazil and Argentina are, of their presidents’ phrases, “advancing dialogue on a typical South American foreign money” referred to as the sur.

- Russia and Iran made headway on their gold-backed stablecoin (a cryptocurrency pegged to and backed by a reserve asset) as a substitute for the greenback.

- French President Emmanuel Macron needs Europe to scale back its dependency on the U.S. and keep away from any involvement in a U.S. — China battle over Taiwan. He additionally floated the concept of Europe changing into a “third superpower” on the world stage.

Taken alone, every occasion looks as if a one-off effort which gained’t instantly influence a lot … and will not even get off the bottom.

However taken collectively … it turns into clear international powers are attempting to wean off their reliance on the U.S. And simply as importantly, the U.S. greenback.

It appears unattainable to think about a world that doesn’t revolve across the greenback. The U.S. is deeply entrenched on this planet financial system. Until you’re over 100 years previous, the greenback has been the world reserve foreign money to your total life.

And to be clear, I see no fast menace to its significance — particularly when contemplating the may of our army.

However over the lengthy arc of historical past, foreign money regime adjustments have occurred, loads of instances.

Most lately within the Nineteen Twenties, when the greenback started to overhaul the British pound sterling to turn out to be the world reserve foreign money.

Earlier than that, it was the Dutch guilder giving approach to the pound … and earlier than that, the Spanish greenback.

Going again additional, we discover the Venetian ducat, the French franc and the Roman denarii all taking turns because the foreign money commonplace of the world.

Historical past exhibits foreign money regime adjustments occur. So why ought to anybody really feel assured it gained’t occur once more?

I don’t. The one query is when.

Whether or not this occurs subsequent yr (extremely unlikely) or a decade from now (considerably extra probably, however nonetheless no certain wager)…

Proper now, amid an apparent de-dollarization push outdoors the U.S., it’s nearly as good a time as any to have a more in-depth take a look at the brand new bull market taking form in gold…

The Shiny Yellow Metallic

“De-dollarization” is complicated. However its impact on gold could be very easy … and bullish.

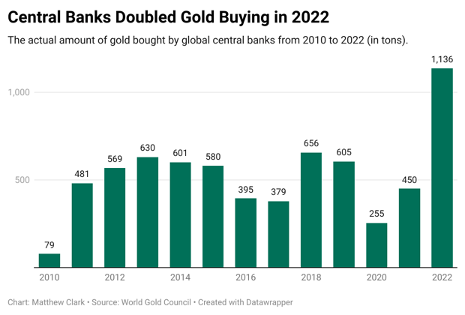

The world’s central banks purchased up gold at a file tempo final yr, including 1,136 tons of the shiny yellow steel, value $70 billion, to their stockpiles. That is essentially the most gold they’ve hoarded in over a decade — and by an enormous margin.

They’re shopping for gold as a result of it’s arguably the oldest and most-trusted retailer of worth nonetheless related right this moment, and it’s outdoors the present fiat foreign money system. It isn’t topic to the whims of 1 authorities entity — like, say, Treasury bonds are.

However what’s most fascinating is that 65% of final yr’s gold bullion purchases — 741 tons — went unreported. Analysts imagine that China and Russia account for these unreported gold purchases, as they appear to de-dollarize their world commerce actions and circumvent Western sanctions.

See, large gold reserves on the world’s largest central banks (outdoors the U.S.) are key to executing world commerce with out the greenback.

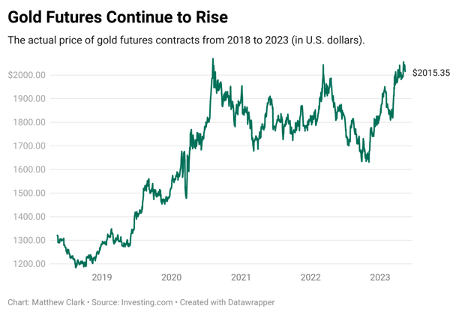

And naturally, pushed by the surge of central financial institution demand, the value of gold has moved increased.

Since final November, the yellow steel is up greater than 20% … and has even made a brand new all-time excessive.

Apart from international central banks shopping for up gold — whereas promoting {dollars} and U.S. Treasurys to fund them — there are a variety of different components pointing to a weakening greenback forward…

Pandemic “Helicopter Cash”

The pandemic sparked an enormous money-printing occasion. Fiat foreign money provides skyrocketed and led to the best ranges of inflation we’ve seen in 40 years.

Add onto {that a} large debt-to-GDP ratio, rising authorities deficits, and a debt ceiling deadlock, and it’s clear the greenback’s dealing with quite a few headwinds.

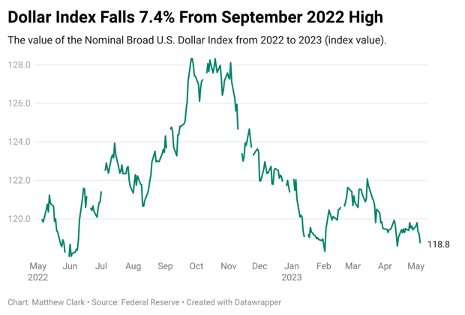

You may see the early innings of this pattern within the U.S. Greenback Index. The buck topped out late final yr and is already 10% off its highs:

The weakening greenback has helped increase the value of gold. However it’s not the one issue.

Gold can be making new highs when priced in yen and euros, so the brand new bull market in gold isn’t merely a “weak-dollar” phenomenon.

If the world’s central banks are shopping for up gold to aim to diversify away from the U.S. greenback, there’s nothing the U.S. authorities can do to cease them. However as traders…

We will participate within the new gold bull market which, at this level, is powerful sufficient to proceed even when the U.S. greenback reserve foreign money regime lasts many many years extra.

And you’ve got so many good choices to take action…

A Buffet of Gold Performs

An investor right this moment has no scarcity of the way to play the gold bull market, and at a number of danger ranges…

- Bodily bullion. Arduous to argue in opposition to hold-in-your-hand gold because the lowest-risk commerce of all. It’s essentially the most direct approach to shield your wealth from inflation, fingers down. (When you’re in search of an amazing place to purchase, our buddies on the Arduous Belongings Alliance have you ever lined right here.)

- Gold mining shares and ETFs. Mining shares are sometimes referred to as “leveraged gold” trades, for his or her volatility each to the upside and draw back to the gold worth.For particular person corporations, Canada-based B2Gold (BTG) charges a Robust Bullish 96 on the Inexperienced Zone Energy Scores system. That’s a superb place to start out your search. For ETFs, the VanEck Gold Miners ETF (GDX) covers you on the majors, and VanEck Junior Gold Miners ETF (GDXJ) holds smaller corporations … providing a slight bit extra of that pure leverage.

- “Curveball” gold performs. There are a number of corporations on the market that don’t meet the outline of a conventional miner, however are nonetheless nice gamers within the gold enterprise.

Royalty and streaming corporations, for instance personal mine belongings and take a minimize of miner’s income — avoiding the “soiled work” altogether.

“Slug water” processors are one other uncommon play — they mainly pan for gold within the waste runoff from bigger mining operations.

I lately advisable two such performs to my Inexperienced Zone Fortunes and 10X Shares subscribers, respectively. I feel there’s some huge cash to be made in every — and, due to the shares we chosen, rather a lot much less danger than many conventional miners.

Now hear, I’m not saying it is best to go all-in on gold proper now. De-dollarization will take years … probably greater than a decade to play out.

However the information clearly means that gold deserves an even bigger place in your portfolio proper now. And also you don’t wish to be caught flat-footed in what could shortly turn out to be the final word funding mega pattern.

To good income,

Adam O’DellEditor, 10X Shares

Adam O’DellEditor, 10X Shares

P.S. To get the title of that royalty and streaming firm I advisable to my Inexperienced Zone Fortunes subscribers, go right here to be taught extra a couple of subscription.

For the equal of simply $4 a month, you’ll achieve entry to an advisory that presently holds a median open achieve of 31%, with new suggestions on a regular basis.

It’s the right supply for high-quality funding data you need to use to remain forward. Simply click on right here for all the small print.

Disney’s inventory worth has been within the dumps for the previous two years. After topping out at simply over $200 per share in early 2021, the shares at the moment are buying and selling within the low $90s.

Regardless of the information protection, it’s not the continued authorized spat with Florida Governor Ron DeSantis that’s pushing the shares decrease.

I personal some shares of Disney, so I is likely to be somewhat biased right here. However it seems to me like Governor DeSantis introduced a knife to a gunfight.

As one of many largest and strongest firms in America, Disney has entry to the largest, baddest, most cutthroat legal professionals to ever carry a briefcase. It is a firm that sued an elementary faculty in 2020 over an “unsanctioned screening” of The Lion King at a PTA occasion … and gained.

Good luck beating them in courtroom.

No, it’s not authorized danger that weighs on Disney’s inventory.

It’s streaming. And by extension, inflation.

In Disney’s earnings launch this week, the corporate reported that it misplaced 4 million Disney+ streaming subscribers.

Now, make no mistake. Disney’s parks are nonetheless busting on the seams, its toys and merchandise are nonetheless promoting and its Marvel superhero films are nonetheless the one factor that constantly makes cash within the film theaters.

The corporate will climate this. A lot to my chagrin, I’m certain that I will likely be combating the crowds myself when my daughter is sufficiently old to undergo the “Disney princess” expertise. Like school and a marriage, that is simply a type of bills you need to price range for when you’ve got a daughter. However I digress…

Even the lack of 4 million subscribers out of a base of 161 million could be tolerable by itself. It’s simply that Wall Avenue wager closely on streaming being the way forward for media, so shrinkage fairly than progress is a serious downside.

However why Disney is shedding subscribers?

Nicely, I lined this final week. It’s inflation, partnered with “funds creep.”

Wages haven’t saved tempo with inflation, and the financial savings price has already dwindled again to pre-COVID pandemic ranges. When you’re spending an additional greenback on requirements, meaning a greenback much less to spend on different issues.

And if you have already got Netflix and 5 different streaming providers, immediately that Disney+ subscription seems like low-hanging fruit on the chopping desk. You may all the time resubscribe when the youngsters are on summer time break.

Inflation is falling. However it’s not falling quick sufficient, and the injury is already performed. People are buying and selling down — or slumming it, as I joked yesterday. And that is going to point out up in earnings releases over the approaching quarters.

This would appear like a superb time to remain nimble, to give attention to shorter-term tradable traits. And that is precisely the place Adam excels.

His Inexperienced Zone Fortunes monetary service is structured along with his AI-based Inexperienced Zone Energy Scores system, which he created to assist traders such as you discover the most effective trades.

And the most effective half? It takes the present financial circumstances into consideration, so it’s an amazing investing instrument for any market. Test it out right here — and be taught extra about how Adam may also help you in your investing objectives.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link