ugurhan

IQLT technique and portfolio

iShares MSCI Intl High quality Issue ETF (NYSEARCA:IQLT) began investing operations on 01/13/2015 and tracks the MSCI World ex USA Sector Impartial High quality Index. It has a portfolio of 300 shares, a 12-month distribution yield of 2.81%, and a complete expense ratio of 0.30%. Distributions are paid semi-annually.

As described within the prospectus by iShares, the underlying index weights constituents of the MSCI World ex USA Index (the mum or dad index) primarily based on market capitalization adjusted with a top quality rating together with three metrics: return on fairness (greater is best), year-over-year earnings progress (steady is best) and monetary leverage (decrease is best). Constituent weights are capped at 5% and normalized in order that sectors have roughly the identical weight as within the mum or dad index. The index is rebalanced semi-annually. The portfolio turnover price was 32% in the newest fiscal 12 months.

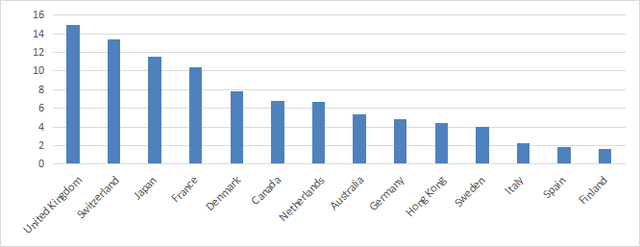

The fund invests principally in Europe (about 68% of asset worth) and in giant corporations (89%). The highest 4 international locations are the U.Ok. (15%), Switzerland (13.4%), Japan (11.5%) and France (10.4%). Different international locations are under 8%. Hong Kong weighs 4.4%, so direct publicity to geopolitical and regulatory dangers associated to China is low. The following chart lists the highest 14 international locations, representing an combination weight of 97.6%.

Geographical allocation in % (Chart: creator; information: iShares)

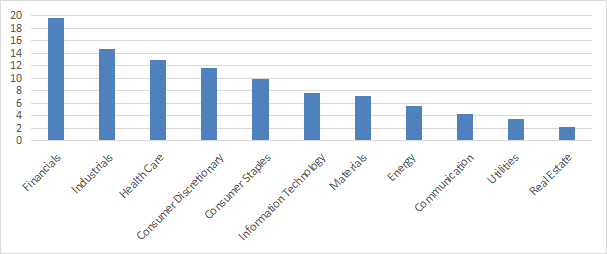

The highest 4 sectors are monetary (19.6%), industrials (14.7%), healthcare (12.9%) and client discretionary (11.7%). Different sectors are under 10%.

Sector breakdown in % (Chart: creator; information: iShares)

The portfolio has 300 constituents, however it’s fairly concentrated within the high names. The highest 10 holdings, listed under, signify 29.4% of asset worth. The heaviest one weighs 5.7%, so dangers associated to particular person corporations are average.

|

Title |

Sector |

Weight (%) |

Ticker* |

Trade |

|

NOVO NORDISK CLASS B |

Well being Care |

5.7 |

NOVOB |

Omx Nordic Exch. Copenhagen |

|

ASML HOLDING NV |

Know-how |

4.13 |

ASML |

Euronext Amsterdam |

|

NESTLE SA |

Cons. Staples |

3.68 |

NESN |

SIX Swiss Exch. |

|

LVMH |

Cons. Discretionary |

3.58 |

MC |

Euronext Paris |

|

ROCHE HOLDING PAR AG |

Well being Care |

3.47 |

ROG |

SIX Swiss Exch. |

|

BHP GROUP LTD |

Supplies |

2.22 |

BHP |

ASX |

|

BP PLC |

Power |

1.85 |

BP. |

LSE |

|

AIA GROUP LTD |

Financials |

1.82 |

1299 |

Hong Kong Exch. |

|

TOTALENERGIES |

Power |

1.49 |

TTE |

Euronext Paris |

|

ALLIANZ |

Financials |

1.46 |

ALV |

Xetra |

* Tickers in major exchanges. A few of them have ADRs listed within the U.S.: to search out them, copy and paste the corporate title in In search of Alpha’s search field.

Previous efficiency in comparison with opponents

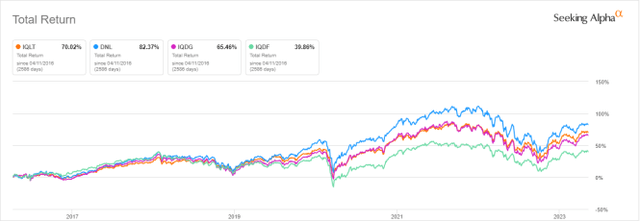

The following chart plots the entire return of IQLT and three non-hedged, quality-style worldwide ETFs:

- WisdomTree World ex-U.S. High quality Dividend Progress (DNL), reviewed right here,

- WisdomTree Worldwide High quality Dividend Progress Fund (IQDG), reviewed right here.

- FlexShares Worldwide High quality Dividend Index Fund (IQDF).

The chart begins on 4/11/2016 to match all inception dates.

IQLT vs opponents since April 2016 (In search of Alpha)

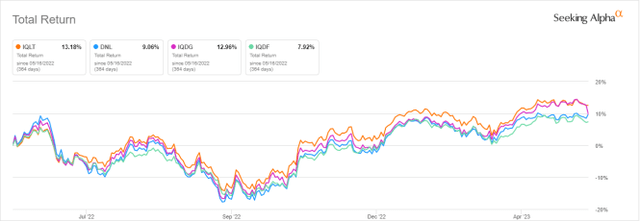

IQLT is the second-best performer after DNL, and IQDG is shut behind. It has been the very best performer within the final 12 months, as soon as once more shortly forward of IQDG:

IQLT vs opponents, final 12 months (In search of Alpha)

The annual sum of distributions has elevated from $0.70 to $1.02 per share between 2015 and 2022. It’s a 45.7% progress in 7 years, whereas the cumulative inflation has been about 25% (primarily based on CPI). Though IQLT just isn’t a dividend-oriented fund, the distribution progress price since inception has overwhelmed inflation.

Takeaway

iShares MSCI Intl High quality Issue ETF holds 300 shares from developed markets weighted utilizing a top quality rating. Corporations with the next ROE, a steady earnings progress and a decrease monetary leverage get the next weight than within the mum or dad index. The fund is well-diversified throughout international locations, sectors and holdings. The highest nation in asset worth is the U.Ok., and the highest sector is financials. Europe represents 68% of property.

iShares MSCI Intl High quality Issue ETF historic efficiency is common amongst opponents. It’s not a dividend-oriented fund, however the distribution progress price since 2015 has overwhelmed inflation.