DKosig

Funding Thesis

American Water Works Firm (NYSE:AWK) is predicted to generate elevated income and earnings per share (EPS) year-over-year in FY2023. This optimistic trajectory needs to be pushed by strategic investments in acquisitions and capital expenditure (CAPEX) inside its Regulated enterprise. Furthermore, the chance to broaden the wastewater enterprise ought to act as a progress catalyst for the corporate. Taking into consideration these promising progress prospects coupled with a lower-than-historical P/E ratio, I like to recommend a purchase ranking on the inventory.

Progress by Acquisitions

As of March 2023, AWK had performed 27 agreements to amass companies throughout 9 states together with the Butler Space Sewer Authority, Waste Water System in Pennsylvania and Towamencin Township Wastewater System in Pennsylvania which ought to add 48,200 new buyer connections within the coming years. Extra not too long ago, the corporate introduced the acquisition of a Wastewater therapy plant in Granite Metropolis, Illinois, resulting in $550 million of acquisitions beneath the settlement. Whereas the corporate had signed the acquisition settlement, the regulatory approvals are nonetheless pending to finish the acquisition. Because of this, the corporate has to this point accomplished a mere 5 acquisitions throughout two states. AWK anticipates finishing the deal of Granite Metropolis by the top of 2023 and Towamencin by mid-year 2024. These transactions are anticipated to spice up the corporate’s income stream within the upcoming years. Moreover, AWK has outlined its technique to allocate $400 million in FY23 and $3-$4 billion over the subsequent decade in direction of additional acquisitions. This deliberate funding is projected to yield important income progress for AWK within the coming future.

Advantages from Common Fee Circumstances

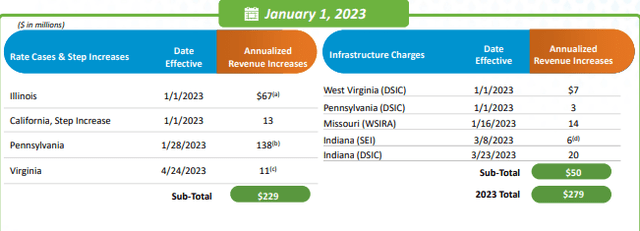

Via capital funding technique, AWK is predicted to take a position $2.5 billion in FY2023 and $27-$30 billion in ten years for the CAPEX of its Regulated enterprise. The corporate plans to make use of 68%-70% of its CAPEX in infrastructure renewal and the remaining to enhance water high quality, resiliency and many others. Such investments in infrastructure assist the corporate to file a case to the regulatory authority for normal fee will increase in its providers. Therefore, I consider these investments needs to be a big progress tailwind for the comping within the coming future. Benefiting from the investments, the corporate have already generated $279 million in annualized new income in fee instances since January 2023. This contains $229 million from normal fee instances & step will increase and $ 30 million from infrastructure surcharges.

AWK’s normal fee instances and infrastructure surcharges (Investor presentation)

The corporate has not too long ago filed a normal fee case in Missouri and the ultimate choice on the matter is predicted within the second quarter of FY2023 which ought to enhance the annualized income by $95 million. Furthermore, with a plan to take a position $27-$30 billion over ten years in CAPEX, AWK ought to proceed to learn from normal fee instances in the long run.

Alternative in Wastewater Enterprise

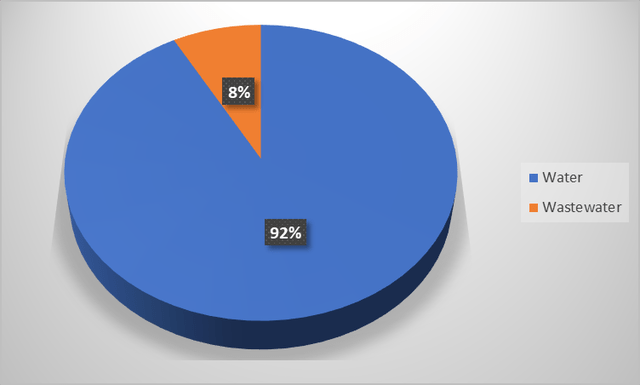

American Water Works has a buyer combine that includes 92% water and eight% wastewater, presenting a strategic alternative for increasing its wastewater enterprise within the coming years. Within the water sector, the corporate boasts an intensive buyer base, well-established operational infrastructure, gear, and profound experience. Leveraging these beneficial sources, the corporate is poised to persistently pursue its technique of buying wastewater companies carefully aligned with, or inside, its current water operations. These initiatives maintain good potential to generate compelling long-term worth, benefiting each the corporate and its shareholders.

AWK’s buyer combine (Firm knowledge, BI Insights )

Valuation

American Water Works is at present buying and selling at 30.29x FY2023 consensus EPS estimate of $4.78 and 28.19x FY2024 consensus EPS estimate of $5.13 which is a reduction to its 5-year common P/E ratio of 33.81x. Whereas the P/E ratio of AWK seems to be excessive, I consider the businesses that are engaged within the water utility enterprise normally commerce at a excessive P/E like Xylem (31.09x 2023 EPS consensus estimate $3.32) or Badger Meter (50.78x FY2023 consensus EPS estimate of $2.70).

Conclusion

American Water Works operates in a really steady and resilient business, which justifies its excessive P/E ratio. Within the fiscal 12 months 2023, AWK is predicted to attain year-over-year income and earnings per share (EPS) progress. These optimistic outcomes are anticipated to consequence from the strategic investments made in acquisitions and the capital expenditure of its Regulated enterprise. Moreover, the chance to broaden its wastewater enterprise is poised to behave as a progress catalyst for AWK’s total progress. When taking into consideration the promising progress prospects alongside the present valuation that’s decrease than the historic P/E ratio, I’m inclined to advocate a “purchase” place on American Water Works.