[ad_1]

Banks face existential challenges. That’s partly as a result of their enterprise mannequin.

They take deposits, which will be withdrawn at any time. They use these deposits to make loans which can be repaid over years. There’s an apparent mismatch there.

If rates of interest rise, depositors would possibly need increased charges on their deposits. If the financial institution received’t pay them, they’ll transfer their cash.

That’s an issue as a result of banks don’t hold all of the deposits in money. They use deposits to make loans. The banking system lends out about $3.18 for every greenback they maintain in money. This implies banks can cowl withdrawals so long as they’re lower than 1 / 4 of complete deposits.

If depositors all need their a refund shortly, the financial institution received’t have the money. This results in failures like Silicon Valley Financial institution.

Financial institution runs had been widespread earlier than the Nice Melancholy. When there have been rumors of issues, depositors lined as much as withdraw their money. They knew that in the event that they waited, the financial institution may run out of money and depositors suffered losses. That’s why deposit insurance coverage was created.

That system labored properly for many of the previous 90 years. However expertise means financial institution runs are again.

You see, depositors don’t want to face in line anymore. They’ve an app for that. Now, we’re susceptible to digital financial institution runs.

The federal government has protected depositors in current failures. However the subsequent spherical of failures might be too huge for a bailout. It may begin at any second. And the set off will probably be industrial actual property.

Business Actual Property: A Crash as Unhealthy as 2008

Proper now, industrial actual property is positioned for a fall just like the one we noticed within the housing market in 2008. House costs fell nearly in every single place. However Las Vegas might have seen the worst of the decline.

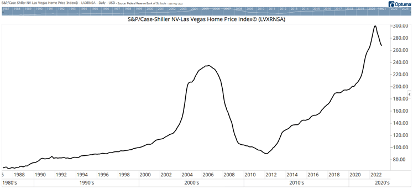

The chart beneath exhibits the S&P Case-Shiller NV-Las Vegas House Worth Index. As you may see, costs fell greater than 61% from their 2006 peak.

The decline was fast at first. That is sensible. As costs fell, householders owed far more than the house was value. They misplaced hope of recovering their funding and plenty of walked away. Defaulting, they gave the house to the financial institution. This led to a glut of low-cost houses that banks wanted to dump.

Getting again to breakeven in house costs required a 160% acquire. It takes time for a acquire like that to happen. In Las Vegas, it took nearly 15 years for house costs to get well their losses. That was 3 times longer than the decline.

Declines are sudden as a result of all it takes is just a few gross sales at decrease costs to reset the market. When just a few houses promote at decrease costs, appraisers assign decrease valuations to different houses. Distressed sellers must take any value and settle for low gives. This creates a doom cycle, which we see in all types of crashes.

Residential actual property continues to be in a comparatively good place. However industrial actual property’s doom cycle is able to start. And that would be the second shoe to drop that crushes the banking sector.

Wave of Mortgage Defaults and Digital Runs Will Crush Banks

In keeping with The Wall Avenue Journal, a 22-story constructing at 350 California Avenue in San Francisco was value round $300 million in 2019. That constructing simply offered for about $65 million. That’s a 78% decline in 4 years.

The constructing is about 75% empty. On common, San Francisco workplaces have seen occupancy fall to about 45% because the pandemic.

The brand new house owners will combat for brand spanking new renters by charging decrease rents. Rents had been as a lot $90 per sq. foot in San Francisco earlier than the pandemic. With a decrease value to service debt, the brand new house owners may cost $45, and even much less. Different house owners might want to match these charges or lose purchasers.

As rents fall, buildings will lose worth. Like in 2008, some house owners will merely cease paying mortgages on the buildings. That’s unhealthy for banks, however particularly problematic for small banks.

Banks with lower than $10 billion of deposits have lent a mean of 40% of their property on industrial actual property.

That’s not an issue so long as debtors repay the loans. But when the mortgage is $300 million and the constructing is barely value $65 million, it is sensible for house owners to stroll away. That makes industrial actual property the financial institution’s drawback.

And it’s a much bigger drawback to have than the one in 2008. Widespread sense tells us there received’t be the identical demand at foreclosures auctions for workplace area as there was for homes. Fewer individuals want workplaces generally, they usually want them lower than ever earlier than.

For the subsequent three years, banks will probably be asking debtors to refinance $270 billion value of loans a 12 months. Debtors will do the mathematics and minimize their losses. Banks don’t have that possibility.

Depositors may also do the mathematics. As financial institution issues turn into clear, digital runs will turn into widespread.

I doubt the federal government can spend trillions supporting banks. This disaster would possibly simply be the large one which the Fed has fought so exhausting to stop.

Right here at The Banyan Edge, we’re conserving a finger on the heart beat of the industrial actual property sector because it unravels. We’ll be watching to share with you the subsequent huge alternative to revenue from occasions like this.

Regards, Michael CarrEditor, One Commerce

Michael CarrEditor, One Commerce

I’ve completely nothing new to say concerning the debt ceiling debacle that hasn’t already been stated 1,000 occasions.

We’ll know quickly sufficient whether or not our leaders are capable of perform like adults and hammer out a deal.

They may or they received’t. And there’s nothing we will do about it both approach.

However whereas we anticipate this theater of the absurd to play itself out, there are another strikes we will make to decrease our tax payments.

Each greenback not paid in taxes is nearly as good as a greenback earned available in the market.

Really, it’s higher. As a result of that greenback earned available in the market is topic to taxes!

At any charge, one of the vital underutilized financial savings automobiles is the well being financial savings account (HSA).

HSAs are particular tax-advantaged accounts designed to assist Individuals pay for well being bills.

Much like a conventional particular person retirement account (IRA), contributing to an HSA account lowers your taxable earnings. In case you are within the 24% tax bracket, you “earn” 24% in saved taxes on each greenback contributed.

When Does an HSA Make Sense?

If in case you have numerous out-of-pocket well being bills, it is sensible to fund an HSA first.

Give it some thought. If the physician’s invoice is $100, that’s $100 gone that you just’ll by no means see once more.

However if you happen to put that $100 in your HSA, you’ll no less than get a tax break on it first.

Sure, you’re nonetheless shelling out $100. However you’ll no less than get $24 again in saved taxes (assuming a 24% tax bracket.)

However even if you happen to’re as wholesome as a horse, an HSA could be a implausible place to park money as a result of extra HSA funds will be invested in mutual funds or different investments.

When you’ve already maxed out your IRA or 401(okay) for the 12 months, you may turbocharge your tax-exempt financial savings by stuffing each penny you may into an HSA.

I name this a “spillover” IRA.

That’s not a authorized time period, and also you’ll by no means see it in a monetary planning pamphlet. However that’s how I personally use my very own HSA account.

As soon as I’ve maxed out my precise retirement accounts for the 12 months, I stuff any remaining money into the account.

I ought to point out that the principles are slightly totally different when withdrawing from an HSA.

For instance, you may pull money out of an IRA with out penalty beginning at age 59 and a half, whereas the age for penalty-free HSA withdrawals is slightly increased at 65. However I might hardly name {that a} dealbreaker.

In 2023, Individuals with high-deductible medical health insurance plans can solely put as much as $3,850 in an HSA plan, or $7,750 for household plans.

Now keep in mind: You may’t get wealthy via tax avoidance alone. You want actual returns for that.

However each greenback you save in taxes is a greenback that’s now out there to take a position, and get you nearer to your monetary objectives.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link