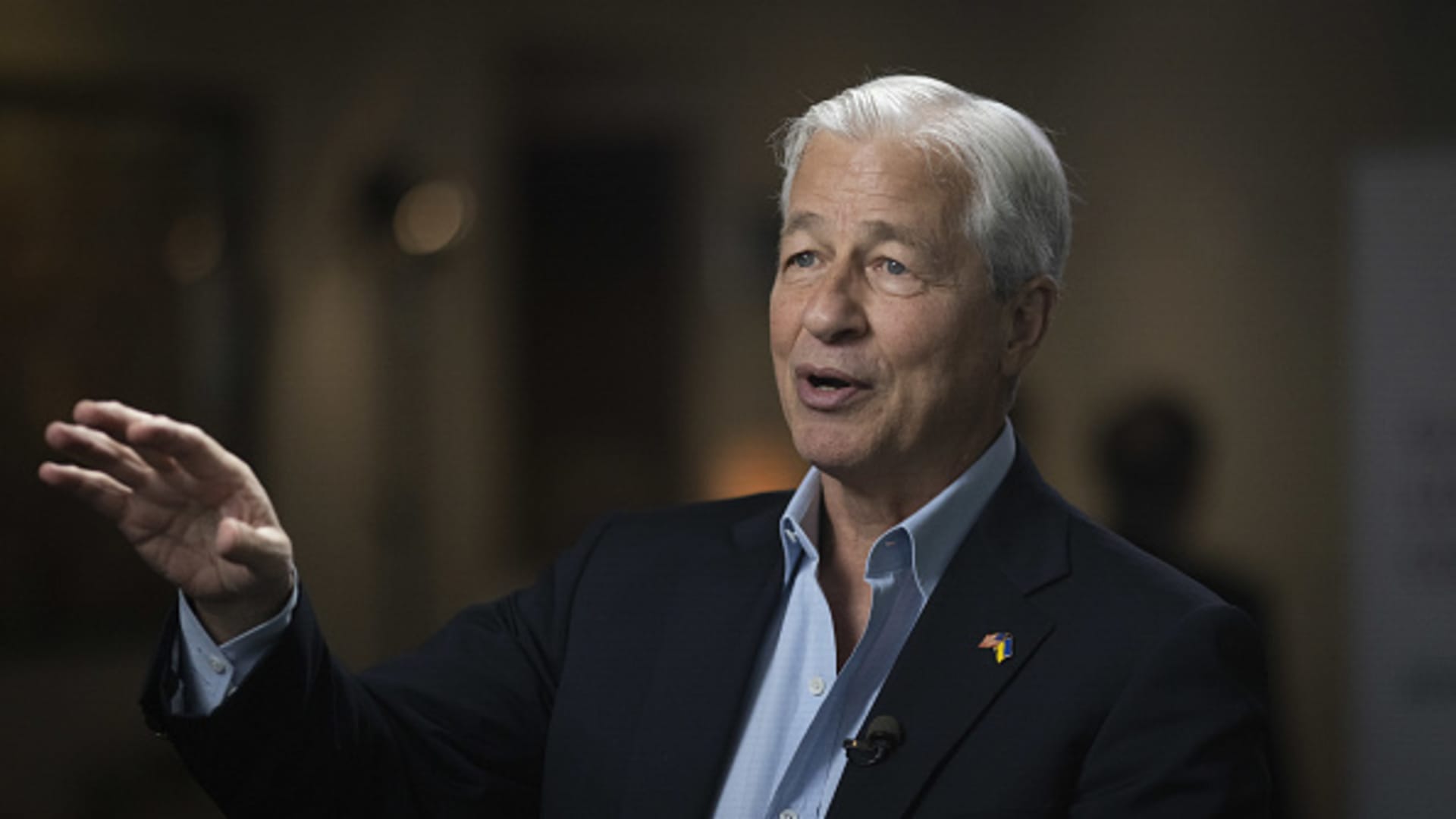

Jamie Dimon, chairman and chief govt officer of JPMorgan Chase & Co., throughout a Bloomberg Tv interview on the JPMorgan International Excessive Yield and Leveraged Finance Convention in Miami, Florida, US, on Monday, March 6, 2023.

Marco Bello | Bloomberg | Getty Photos

JPMorgan Chase raised a key efficiency goal on the heels of its government-brokered takeover of First Republic earlier this month.

The financial institution will generate about $84 billion in web curiosity earnings this 12 months, New York-based JPMorgan stated Monday in slides for an all-day investor presentation.

That is $3 billion greater than steering given in April. On the time, JPMorgan raised its web curiosity earnings outlook by $7 billion, a transfer that spurred JPMorgan’s largest earnings day inventory bump in 20 years.

The financial institution added that “sources of uncertainty” round deposits and the financial system may affect its forecast. Web curiosity earnings is the distinction between what banks earn from loans and investments and what they pay to depositors.

JPMorgan, the most important U.S. financial institution by belongings, has emerged as a beneficiary of the latest regional banking tumult. It was one of many solely banks to see deposits climb within the first quarter as panicked prospects sought security at large establishments; then it received a weekend public sale for First Republic, a transfer anticipated to spice up earnings and advance its push for rich shoppers.

The financial institution on Monday additionally disclosed expectations that bills would rise to $84.5 billion, unchanged from earlier steering, excluding $3.5 billion in prices to combine First Republic. About half of these integration bills will probably be acknowledged this 12 months, CFO Jeremy Barnum stated Monday.

Buying and selling and funding banking income within the second quarter is headed for a 15% decline in contrast with the year-earlier interval, the financial institution stated.

Longtime JPMorgan CEO Jamie Dimon wrapped up the occasion with a question-and-answer session.

He was requested what number of extra years he anticipated to function CEO after rival chief James Gorman of Morgan Stanley final week introduced plans to step down inside a 12 months.

Dimon deflected the query, saying that his plans hadn’t modified.

“I can not do that eternally, I do know that,” Dimon stated. “However my depth is identical. I believe when I haven’t got that form of depth, I ought to depart.”