-slav-

The taper tantrum commencing Could 21, 2013, kicked off a decade lengthy period of public market pessimism about REITs. It was the daybreak of a fable that actual property can’t deal with rising charges.

Actual property has performed simply tremendous. Business actual property values have roughly doubled over the previous 10 years.

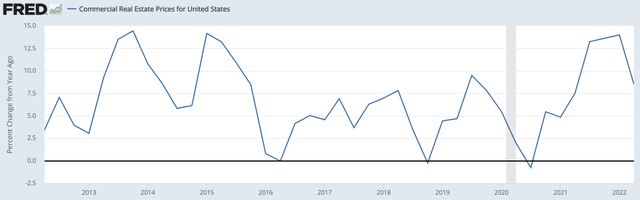

Graph #1: change in CRE worth yr over yr

FRED

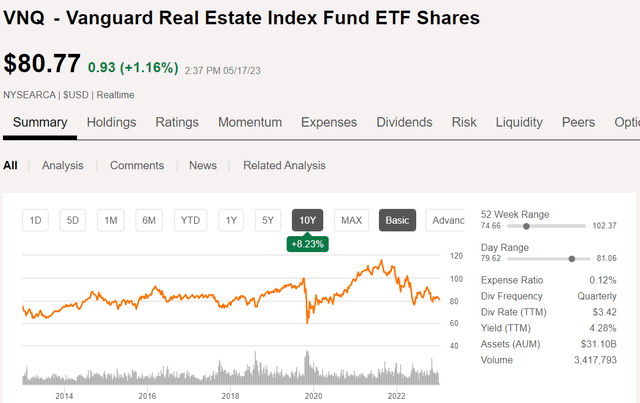

On good years actual property values elevated 7%-12% and on unhealthy years they had been up 2.5%-5%. Compounded over a ten-year interval, actual property values roughly doubled because the taper tantrum. Distinction this with the doom and gloom of publicly traded REITs which have had 10 years of flat returns as measured by the Vanguard Actual Property ETF (VNQ).

Graph #2 change in worth of public REITs

SA

I posit that what has actually occurred will not be rates of interest hurting actual property, however fairly rates of interest hurting the market’s notion of actual property. There’s a rising rift between the precise worth of properties at which they’re purchased and offered by refined homeowners and the diminished worth of public REITs.

That is evident in the usual institutional valuation metrics: web asset worth and earnings a number of (FFO a number of or AFFO a number of for REITs).

- The median REIT trades at 77.8% of Web Asset Worth (NAV).

- The median REIT trades at 12.6X 2023 funds from operations (FFO).

These are unusually low valuations at a time when the broader market is buying and selling at a fairly lofty worth to earnings a number of, round 19X (Assuming $220 ahead EPS for the S&P).

Pessimism about REITs is so heightened proper now that each valuation metrics have been largely dismissed.

The low cost to NAV is dismissed by a perception that asset values will drop as cap charges rise, since cap charges are the denominator in asset worth. Traditionally, cap charges have moved in parallel with rates of interest however with a lag. So since rates of interest simply rose by about 500 foundation factors on the brief finish and 200 foundation factors on the lengthy finish, many consider cap charges will rise considerably.

The 12.6X FFO a number of is considerably decrease than the traditional REIT a number of, round 15X-17X. It is a reflection of assorted bearish views such because the demise of workplace, impending recession, and curiosity expense will increase. Every of those might cut back FFO, thereby justifying a decrease than regular a number of.

The issue with these views is that they aren’t backed up by the information. As we already confirmed, property values have risen constantly all through the rising rate of interest interval. They’ve additionally risen via earlier rate of interest cycles.

Analyst estimates present FFO rising going ahead.

- 2023 P/FFO = 12.6X

- 2024 P/FFO = 12.1X

- 2025 P/FFO = 11.6X

In every of the three, the worth is at the moment’s worth. The explanation the a number of is dropping is as a result of FFO is anticipated to be increased in 2024 and better nonetheless in 2025. These will not be my numbers, these are the consensus of promote facet analysts throughout Wall Road as reported by S&P World Market Intelligence.

I feel the core misunderstanding is that the general public markets take a look at REITs as monetary belongings. Thus, REITs commerce down as rates of interest have risen simply as a 30-year treasury would commerce down in worth (up in yield).

REITs are bodily belongings, not monetary belongings

Whereas the general public markets are likely to solely take a look at earnings multiples and NAV for valuation, the non-public actual property purchaser makes use of a 3rd metric: alternative value.

The speculation of alternative value as a baseline worth

A standing constructing ought to be value not less than as a lot as the associated fee to construct a property of equal high quality as long as two situations are met:

- There’s demand for the property

- Extra properties of that sort will should be constructed in some unspecified time in the future

Thus, it could be affordable for one thing like workplace to commerce under alternative value as a result of there’s inadequate demand for the class, and it’s unclear that we as a rustic might want to construct any extra workplace for fairly a while. As such, the associated fee to assemble a brand new workplace tower is basically irrelevant to the worth of an current workplace.

Most sectors, nonetheless, do meet the above standards. For instance, roughly 2% of current stock of flats must be constructed annually simply to maintain tempo with family formation. The worth of standing flats which might be money flowing at the moment ought to keep above the price of constructing an equal property, as there can be no incentive to construct an condominium at a price of larger than X if one can simply purchase a property for X.

Alternative value is a metric that may be a bit more durable to seek out information on as a result of it’s so location particular and property sort particular. Thus, my information is usually at a nationwide stage and associated to alternative value of properties on the whole versus one thing particular like a 100-unit garden-style condominium in an Atlanta suburb.

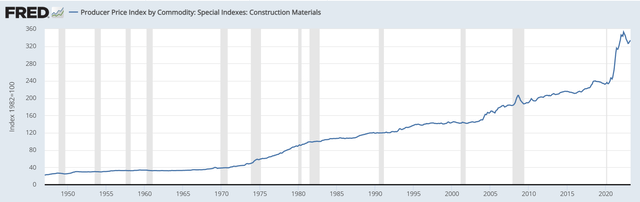

Graph #3 supplies value of development

FRED

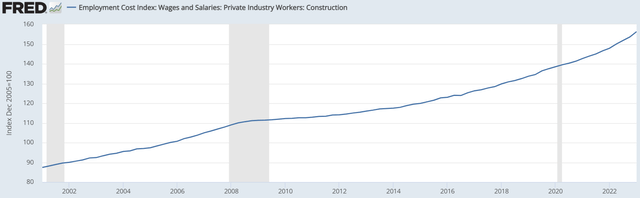

This has been an unusually inflationary time interval ensuing within the supplies value of development hovering. An analogous though much less excessive surge has been documented within the labor value of development.

Graph #4 Labor prices of development rising

FRED

Land costs have risen as effectively, however these will increase are much more native in nature. Timberland in Georgia can nonetheless go for $500 per acre whereas prime Miami land may be effectively over $1 million for a fraction of an acre. Thus, a nationwide graph would maybe be deceptive to the native realities of development prices.

Given these figures, I discover it very odd that the general public market thinks actual property costs are going to drop considerably. Maybe an upward cap charge adjustment might take costs down somewhat bit, however given the fairly excessive magnitude with which development prices have risen, I discover it extra possible actual property values will proceed to rise.

The logic is easy: Actual property is required and the associated fee to create alternative actual property is increased. Subsequently, the worth of standing actual property is increased.

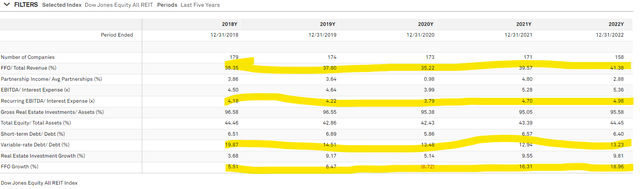

Graph #5: Enchancment throughout quite a lot of metrics

S&P World Market Intelligence

- FFO margins elevated from 38.35% in 2018 to 41.38% in 2022.

- EBIDTA protection of curiosity expense improved from 4.18X in 2018 to 4.98X in 2022. Sure, although rates of interest are up, REITs have higher debt protection now than they did when rates of interest had been 0.

- Variable charge debt has declined to 13.23% of complete debt from 19.87% in 2018. Brief time period debt additionally decreased, however it was already a really small share. Most REIT debt at the moment is fastened charge and termed out.

- FFO has grown considerably in annually with exception to a pandemic dip in 2020. Inclusive of the pandemic dip, FFO is up materially.

REITs improved whereas costs stagnated

Thus far we have now proven that actual property values elevated considerably whereas REIT market costs stagnated. Cashflows have additionally improved together with firm high quality throughout a number of metrics.

Valuation is each an artwork and a science. It makes use of arduous numbers which lends itself to mathematical calculations, however the inputs for these numbers usually contain assumptions concerning the future that are in fact unknown. analyst would possibly be capable of make extra educated guesses concerning the future, however it’s removed from exact. As such, I favor to take a look at valuation from a number of angles. The extra valuation strategies by which a inventory seems low-cost, the extra possible that it really is reasonable.

On condition that REITs are attractively valued on NAV, FFO multiples and alternative value evaluation I discover it extremely possible that the asset class will outperform going ahead.