[ad_1]

Do you keep in mind your first time utilizing the web?

The massive cumbersome “field” in your desk that made that sound I’ll always remember when it was connecting. (Right here it’s if you wish to step again in time for a second.)

Unexpectedly, the world was on-line and at your fingertips.

It modified all the things.

Internet 1.0 within the mid-Nineties introduced us internet browsers like Netscape on these large brick-like computer systems… Internet 2.0 within the 2000s gave us running a blog, Twitter and YouTube.

Now we’re getting into a brand new period.

Internet 3.0 (or Web3): A extra “decentralized” model of the web that wouldn’t be managed by Huge Tech corporations like Fb and Google.

(AKA: The businesses you give your private data to.)

As a substitute, Internet 3.0 might be backed by blockchain expertise, the constructing blocks of cryptocurrency.

That is what is going to make it decentralized, and why the concept of Web3 is so tightly linked to crypto.

Even the time period “Web3” was coined by a co-founder of Ethereum (ETH), Gavin Wooden. However that’s not the one connection Ethereum has to the Web3 venture.

In at this time’s video, we break down what this new model of the web could have in retailer…

And the #1 option to put money into a Internet 3.0 future:

(Or learn the transcript right here.)

Sizzling Matters in Immediately’s Video:

- Reader Query: “Are there any publicly traded corporations targeted on fusion-generated power?” [1:00]

- Market Information: The S&P 500’s first 100 days of buying and selling bodes very properly for its shares this 12 months. (Plus, extra on the debt ceiling debacle, and three key financial releases for this week.) [3:25]

- World of Crypto: Bitcoin’s largest convention of the 12 months simply completed in Miami. (And signups have already began for bitcoin2024 in Nashville.) How bitcoin is changing into extra “Ethereum-like.” [11:10]

- Mega Pattern: We’re getting into a brand new period of the web: from Internet 2.0 to Internet 3.0. Right here’s the most recent in Web3 developments. [14:35]

- Investing Alternative: Why these three cryptos are paving the best way for Web3 (and why it is best to put money into them). [21:00]

- To seek out out extra about why crypto is at a turning level in its evolution, try my free webinar right here!

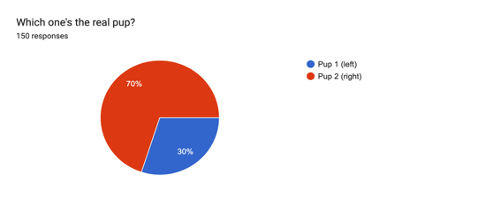

Survey Outcomes: Spot the AI

We requested you should you may inform us which pup was actual and which one was created by synthetic intelligence on this image:

With out additional ado, listed below are the outcomes!

Most of you bought it proper! Pup 1 is the AI and pup 2 is the actual deal.

If in case you have any questions on synthetic intelligence, cryptos like Ethereum and methods to put money into these areas — tell us at BanyanEdge@BanyanHill.com.

See you quickly,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

I’ll be straight with you.

I don’t know how this debt ceiling fiasco ends.

It will finish, of that I’m sure. It’s ridiculous to think about that the world’s largest economic system will merely select to not pay its money owed, satan could care.

However on the identical time, it’s not so exhausting to imagine that politics could have us stumble into default, even when it’s a brief one.

Give it some thought.

Speaker of the Home Kevin McCarthy has a razor-thin majority within the Home of Representatives, and he isn’t liked by the Democrats … or his personal social gathering, for that matter.

It took 15 rounds of voting for him to ultimately get the Speaker job. The Democrats don’t have any incentive to do him any favors, and if he loses even 5 Republican votes, he gained’t be capable of get approval for any deal he manages to make with President Biden.

If it seems like he’s giving an excessive amount of away to Biden, he’ll lose the suitable flank of his social gathering … and sure his job as Speaker of the Home.

So basically, he’s incentivized (for higher or worse) to drive a tough cut price that the Democrats could have a tough time accepting.

In the meantime, we’re a 12 months away from an election. The Democrats are properly conscious of this, and of the truth that they will’t be seen as weak.

That is notably true of Biden. If he makes a deal that includes chopping the funding for the applications he sees as his legacy … he’ll be out of a job in 2024.

All of it involves this: There’s a very actual likelihood that we are able to find yourself stumbling into default … because of the pursuit of narrowly self-interested job safety.

When Politics Results Financial system

Each Republicans and Democrats are purchased and offered by their donors.

Their donors usually are not going to be completely happy if we default (and even practically do). As a result of a default will, after all, trigger market volatility.

Our elected leaders are idiots, however they’re good sufficient to know who pays them. So whereas I don’t assume a default is seemingly, it’s attainable. We have to put together for that chance.

I wouldn’t advocate promoting all the things and going into “bunker mode” together with your rations. However I feel it is sensible to maintain a bit of further money available, and maybe, to unwind lower-conviction holdings.

Even when the U.S. doesn’t go into default, this expertise ought to make it abundantly clear that having investments outdoors of the standard monetary system is sensible.

Ian talked about that he believes Ethereum, the second-largest crypto, may ultimately evolve into the world’s new reserve foreign money.

In my view, investing in crypto is a no brainer transfer to make.

Having publicity to treasured metals like gold additionally is sensible. I personally have some gold cash that I preserve locked in a financial institution secure deposit field. It’s not a large proportion of my portfolio, but it surely’s large enough to serve its goal as a hedge.

And at last, proudly owning a bit of actual property abroad is an effective means of getting money out of the monetary system — and into an asset class that has traditionally crushed inflation. It’s additionally produced massively on tax-advantaged revenue.

Yesterday, I sat down with worldwide actual property investor Ronan McMahon. As at all times, he was filled with nice funding concepts. His newest is a beachfront neighborhood subsequent door to Mexico’s Playa del Carmen.

Watch the episode under!

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link