BlackJack3D/iStock through Getty Photos

What’s the Purpose of this Article?

Within the high-octane, fast-paced world of know-how, fortunes rise and fall. Few firms, nevertheless, show the sort of resilience, fortitude, and adaptableness exhibited by Nvidia Company (NASDAQ:NVDA). At first look, NVDA inventory’s excessive valuation, with a market cap nearing $939B and a P/E ratio of 197, may deter some buyers. However taking a deeper look into the corporate’s know-how moat, monetary well being, enterprise mannequin, and innovation, it turns into evident that Nvidia Company’s inventory worth has the potential to surge even increased over the subsequent decade.

I can’t predict or assure if Nvidia Company shall be a big multi-bagger by 2033, however I consider even with its’ giant market cap it could nonetheless run a lot increased than the place it’s immediately. The objective of this text is to clarify why I consider Nvidia Company shall be one of the essential firms of our future and on account of its’ innovation will all the time have a excessive valuation. Traders who want to spend money on Nvidia Company for the primary time should ask themselves how lengthy they’re prepared to carry shares so the corporate can develop into its’ valuation? and what sort of returns are they anticipating. I consider there’s a stage of reliability, optionality, and development that gives buyers nonetheless good returns that may be earned by greenback value averaging into this inventory. So, let’s examine the Nvidia Company enterprise mannequin and innovation that enables it to defy the foundations of valuation.

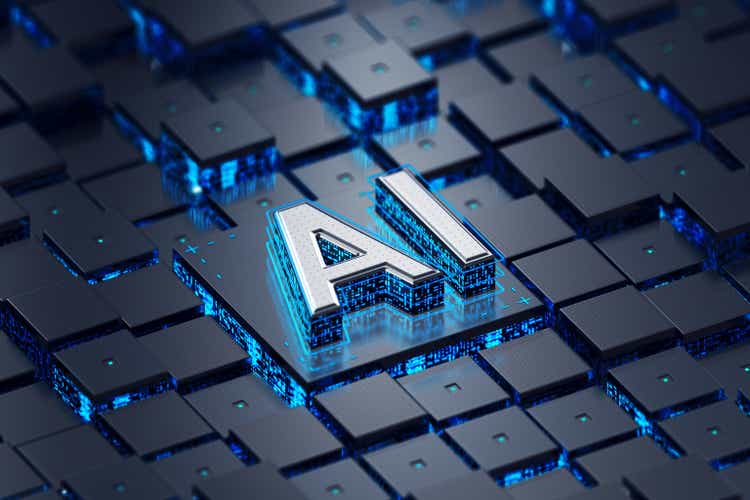

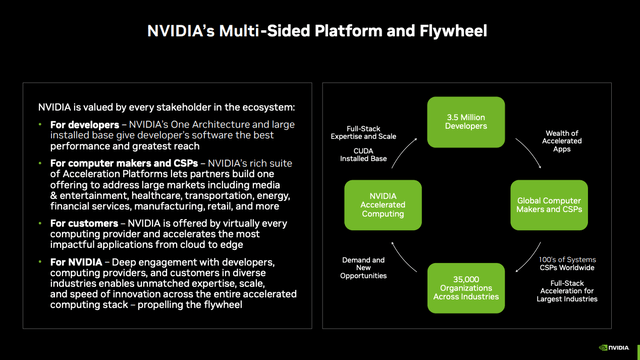

NVIDIA’s 4 Market Platforms (NVIDIA Investor Presentation This fall FY23)

Expertise Moat: The Powerhouse of Accelerated Computing and AI

For my part, NVIDIA, is a vanguard within the know-how sector and boasts a sturdy know-how moat that firmly locations it as a frontrunner in accelerated computing and Synthetic Intelligence (“AI”). This edge has largely been pushed by CEO Jensen Huang’s imaginative and prescient and execution. This firm is a superb instance of why I choose to spend money on founder-led firms, due to their visionary management, innovation, and drive to create one thing by no means accomplished earlier than.

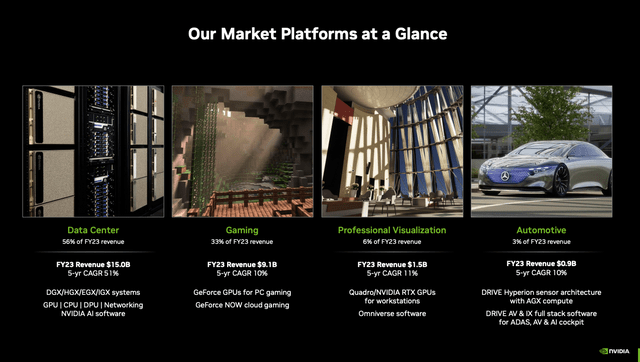

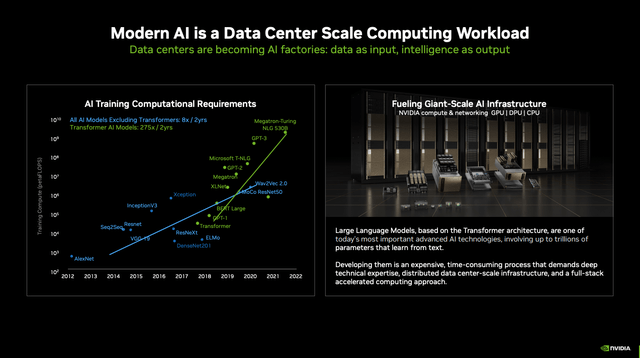

Nvidia Company has pioneered accelerated computing, which, as Huang defined within the Q1 FY24 earnings name, is a full-stack and data-center scale method ideally suited to the present know-how panorama. With CPU scaling slowing within the datacenter and demand for computing energy ballooning, accelerated computing emerges as an optimum path ahead.

NVIDIA Defining Accelerated Computing (NVIDIA Investor Presentation 2023)

I extremely encourage all present Nvidia Company and new potential buyers to hearken to this previous earnings name and the GTC 2023 convention that Nvidia hosted. On this article, I’ll share just a few very impactful excerpts and quotes from Jensen that had been mentioned within the earnings name. Throughout the name Jensen doubled down on how tough it really was to create the Accelerated Compute Platform that Nvidia Company affords to supply exponential efficiency outcomes for compute. He targeted throughout the name on how the pc trade goes via two simultaneous transitions, accelerated computing and generative AI. Jensen defined how the full-stack and data-center scale method is the very best path to creating Accelerated Computing and it took over 15 years within the making for Nvidia Company to develop.

Traders, let that data simmer for a second, Jensen and Nvidia had the ahead considering and visionary prowess to begin making an attempt to construct this full-stack compute platform 15 years in the past. That is similar to how two of my different favourite firm investments, Palantir Applied sciences Inc. (PLTR) and Tesla, Inc. (TSLA), have had visionary leaders that constructed merchandise that may lead their perspective industries years in superior. If you’re an investor in both of these different firms, I consider you’ll closely be desirous about investing in Nvidia Company inventory.

Jensen mentioned within the current Q1 earnings name:

“Keep in mind, we had been in full manufacturing of each Ampere and Hopper when the ChatGPT second got here. And it helped everyone crystallize learn how to transition from the know-how of enormous language fashions to a product and repair based mostly on a chatbot. The combination of guardrails and alignment techniques had been via reinforcement studying human suggestions, data vector knowledge bases for proprietary data, connection to look, all of that got here collectively in a extremely fantastic manner and it is the rationale why I name it the iPhone second, all of the know-how got here collectively and helped everyone understand what a tremendous product that may be and what capabilities it could have. And so we had been already in full manufacturing”

NVIDIA’s Flywheel of Expertise Driving Enterprise (NVIDIA Investor Presentation 2023)

The paradigm shift towards AI, particularly generative AI, is one other cornerstone of Nvidia’s know-how moat. Generative AI fashions have the potential to generate spectacular, nuanced content material beneath the steering of enormous language fashions to generate alpha and return on funding. Huang anticipates that these at the moment lab-bound applied sciences will quickly transition to industrial functions, radically reshaping a number of sectors and driving demand for Nvidia’s AI options.

Monetary Well being & Enterprise Mannequin: Nvidia Company Has Sturdy Pillars

The monetary stability and adaptable enterprise mannequin of Nvidia Company are additional compelling components buyers can really feel assured within the firm. Regardless of GAAP bills anticipated to rise by 12.2% year-over-year at $2.71B, Nvidia tasks GAAP earnings to surge by 159% to a whopping $7.5B in Q2 FY2024. The expansion distinction in earnings vs. bills illustrates the healthiness of Nvidia Company’s enterprise. Nvidia’s dedication to demonstrating constant free cashflow and shareholder worth can be evident by the small dividend Nvidia Company pays and, in its plan, to repurchase shares totaling $7 billion by the top of 2023.

The adaptability of the Nvidia Company enterprise mannequin is demonstrated in its proactive response to surging demand. Nvidia Company was in a position to hold its’ working bills close to flat for the final 4 quarters whereas coping with the stock complexities of the market. In anticipation of the persevering with demand inflow, Nvidia Company is considerably boosting its provide chain, ramping up manufacturing of a number of newer merchandise, together with the H100, Grace and Grace Hopper superchips, and the BlueField-3 and Spectrum 4 networking platforms. I’d anticipate all of those new merchandise to be development catalysts for the enterprise, as they permit prospects to achieve new compute capabilities within the datacenter.

NVIDIA AI Infrastructure Redefining the Datacenter (NVIDIA Investor Presentation 2023)

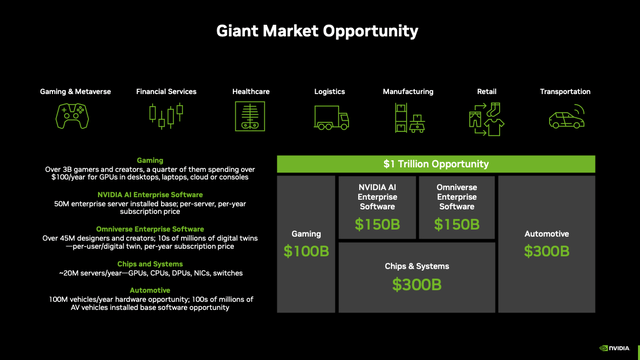

Innovation and Optionality: Nvidia’s Progress Engine

Jensen Huang and Nvidia Company’s steadfast dedication to innovation is one other cornerstone that units it aside. The corporate’s ongoing efforts to drive architectural enhancements, develop new functions, and increase its product portfolio display its capacity to remain forward of the technological curve. It’s exactly this relentless innovation that has put Nvidia Company on the forefront of what Jensen said within the Q1 earnings name, that there’s a $1 trillion international knowledge middle infrastructure transformation on the horizon. Over the subsequent decade, most knowledge facilities worldwide are anticipated to undertake accelerated computing, promising an enormous potential marketplace for Nvidia Company.

NVIDIA’s $1T Market Alternative (NVIDIA Investor Presentation 2023)

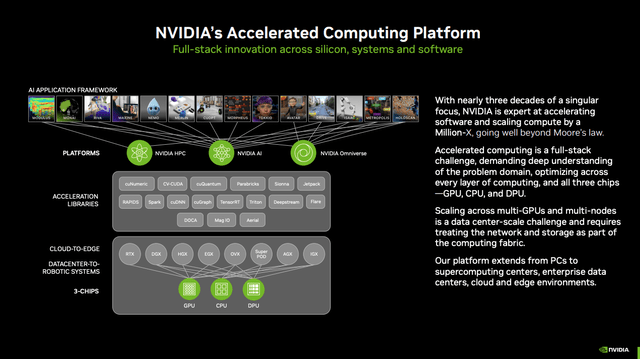

The complete-stack structure platform that Nvidia Company has created over these final 15 years, has allowed Nvidia to have the ability to present the very best worth proposition for purchasers on the lowest whole value of possession. I would really like you to see what precisely Jensen mentioned within the earnings name round this particular matter of worth and competitors. I consider these few feedback from the earnings name could provide help to understand why Nvidia will proceed to have the alternatives for innovation and staying forward of the competitors, as a result of they’re the one firm with a holistic accelerated compute platform. Let’s evaluation what Jensen has to say on this.

“Concerning competitors, we’ve competitors from each course. Begin-ups really-really well-funded and modern startups, numerous of them everywhere in the world. We now have competitions from current semiconductor firms. We now have competitors from CSPs with inner tasks. And plenty of of you realize about most of those. And so, we’re conscious of competitors on a regular basis, and we get competitors on a regular basis. However NVIDIA’s worth proposition on the core is, we’re the bottom value answer. We are the lowest TCO answer.

And the rationale for that’s, as a result of accelerated computing is 2 issues that I discuss usually, which is it is a full stack downside, it is a full stack problem, it’s a must to engineer all the software program and all of the libraries and all of the algorithms, built-in them into and optimize the frameworks and optimize it for the structure of not only one ship however the structure of a whole knowledge middle, all the best way into the frameworks, all the best way into the fashions. And the quantity of engineering and distributed computing, basic laptop science work is actually fairly extraordinary. It’s the hardest computing as we all know.”

NVIDIA’s Accelerated Computing Platform (NVIDIA Investor Presentation 2023)

“And so, primary, it is a full stack problem and it’s a must to optimize it throughout the entire thing and throughout simply the thoughts blowing variety of stacks. We now have 400 acceleration libraries. As you realize, the quantity of libraries and frameworks that we speed up is fairly thoughts blowing.

The second half is that generative AI is a big scale downside, and it is a knowledge middle scale downside, it is one other mind-set that the pc is the information middle or to knowledge middle is the pc, it is not the chip, it is the information middle and it is by no means occurred like this earlier than. And on this specific atmosphere, your networking working system, your distributed computing engines, your understanding of the structure of the networking gear, the switches and the computing techniques, the computing cloth, that total system is your laptop and that is what you are making an attempt to function. And so with the intention to get the very best efficiency, it’s a must to perceive full stack and it’s a must to perceive knowledge middle scale, and that is what accelerated computing is.

The second factor is that — utilization, which talks in regards to the quantity of the sorts of functions you can speed up and variety of our structure retains that utilization excessive. If you are able to do one factor and do one factor solely and extremely quick, then your knowledge middle is basically underutilized and it is arduous to scale that up. And the factor is, common GPU in reality that we speed up so many stacks, makes our utilization extremely excessive, and so primary is throughput, and that is software program — that is a software-intensive issues and knowledge middle structure issues. The second is utilization versatility downside and the third is simply knowledge middle experience. We have constructed 5 knowledge facilities of our personal and we have helped firms everywhere in the world construct knowledge facilities and we combine our structure into all of the world’s clouds.

From the second of supply of the product to do standing up within the deployment, the time to operations of the information middle is measured not — when you’re not good at it and never – not proficient at it, it may take months. Standing up a supercomputer, let’s have a look at, among the largest supercomputers on the planet had been put in a couple of 12 months and a half in the past and now they’re coming on-line, and so it is not – it unprecedented to see a supply to operations of a couple of 12 months.

Our supply to operation is measured in weeks. And we have taken knowledge facilities and supercomputers and we have turned it into merchandise, and the experience of the crew in doing that’s unbelievable, and so. So, our worth proposition is within the closing evaluation, all of this know-how interprets within the infrastructure, the very best throughput within the lowest potential value. And so I feel — our market is in fact very, very aggressive, very giant. However the problem is really-really nice.”

NVIDIA TCO Financial savings vs. Conventional Computing (Nvidia Investor Presentation 2023)

Demand and Partnerships: The Gas for The Nvidia Company Rocket

A key driving issue for Nvidia’s continued development would be the rising demand for its merchandise and options. The transformation of worldwide knowledge middle infrastructure, the shift in direction of accelerated computing, and the arrival of generative AI all symbolize an amazing market alternative for Nvidia.

All organizations, giant or small, revenue or non-profit, personal, or public sector, and many others. want to all the time make higher selections to generate increased revenues, revenue, alpha in opposition to the competitors and a greater buyer expertise. Generative AI and enormous language fashions are the know-how transformation that can allow this for extra folks on the planet than ever earlier than.

NVIDIA GTM Throughout Cloud and On-Premises (NVIDIA GTC 2023 Investor Presentation)

The partnerships and platforms NVIDIA is fostering additionally promise to gasoline demand. The corporate is collaborating carefully with all the giant cloud and web service suppliers corresponding to Amazon.com, Inc. (AMZN) AWS, Microsoft Company (MSFT) Azure, GCP, Oracle Company (ORCL) Cloud, Meta Platforms, Inc. (META), and creating platforms for big enterprises. Partnerships with main gamers corresponding to Microsoft, Dell Applied sciences Inc. (DELL), ServiceNow, Inc. (NOW), and Adobe Inc. (ADBE) additional underscore NVIDIA’s dedication to serving to organizations leverage generative AI securely and successfully.

NVIDIA outlined a number of Enterprise buyer examples of demand for various use instances of Generative AI within the Q1 earnings name. Particular industries which can be seeing excessive demand had been automotive, monetary providers, healthcare, and telecom. CFO Colette Kress shared on the earnings name:

“Bloomberg introduced its’ BloombergGPT product, to assist with processing duties corresponding to sentiment evaluation, named entity recognition, information classification, and query answering. Auto Insurance coverage firm, CCC Clever Options is utilizing AI for estimating repairs. And AT&T is working with us on AI to enhance fleet dispatches so their subject technicians can higher serve prospects. Amongst different enterprise prospects utilizing NVIDIA AI are Deloitte for logistics and customer support and Amgen for drug discovery and protein engineering.”

NVIDIA Enterprise Partnership Examples (NVIDIA GTC 2023 Investor Presentation)

The Ultimate Verdict

Sure, Nvidia Company valuation is excessive, but it surely’s important to look past the figures. The corporate’s formidable know-how moat, stable monetary well being, adaptable enterprise mannequin, ceaseless innovation are what make it very tough to foretell a future valuation. Traditionally, Nvidia Company has all the time held a excessive valuation however has additionally pushed its know-how to new boundaries and went from a graphics card firm within the 90’s with 30% gross margins to the chief in GPUs within the 2010’s and 50% gross margins, and evolving to the world’s first ever accelerated compute platform that’s producing close to 70% gross margins.

NVIDIA’s Stance on AI and the Future (NVIDIA Investor Presentation 2023)

For me, the funding thesis on Nvidia Company is easy: I consider we’re firstly levels of the fourth industrial revolution and Nvidia shall be one of the essential firms of our time to propel trade, enterprise, and innovation ahead. As a lot of my readers and buddies know, a big portion of my cash is on Jensen, Elon, and Karp to rework how knowledge is used and the excellent enterprise outcomes they may allow for his or her prospects. It is going to be a enjoyable rollercoaster journey to look at over the subsequent few a long time. If you want to know extra about my evaluation on Nvidia Company, Tesla, and Palantir, you possibly can learn extra of my articles right here.