steinphoto/E+ through Getty Photographs

The Financial institution of Nova Scotia (NYSE:BNS) is a Canadian large financial institution, headquartered in Toronto, Canada, however with operations in lots of worldwide areas. This text will briefly describe a number of points salient to an funding in BNS, together with:

- Canadian banking system as a secure oligopoly & penalties for buyers in Canadian banks

- BNS as possessing 4 completely different traces of enterprise that add diversification

- The observe document and traits of BNS’s inventory returns

- The present state of BNS’s enterprise traces

Canadian Banking Oligopoly

Canada’s banking system is an oligopoly with restricted competitors, comprised of 5 giant banks that signify over 90% of market share for banking:

- Financial institution of Nova Scotia (or Scotiabank)

- Royal Financial institution of Canada (RY)

- Financial institution of Montreal (BMO)

- Toronto-Dominion Financial institution (TD)

- Canadian Imperial Financial institution of Commerce (CM)

For individuals who want to learn extra on how this oligopoly arose, this working paper is a superb learn. This oligopoly has its origins within the early nineteenth century, whereby the British North America Act gave Canada’s federal authorities jurisdiction over banking. That is in distinction to the US, whose structure didn’t show for this energy to its federal authorities. Over time, Canada raised the necessities for forming banks, whereas the US didn’t. The end result was that Canadian banks had been few in quantity and had been comparatively giant, whereas the US had small banks every inside their state boundaries.

This distinction brought on the significance of shadow banking to diverge within the two international locations. As US banks had been small and quite a few, the shadow banking system grew in significance, whereas this didn’t occur within the extra centralized Canadian system. This explains why Canada’s banking system is inherently extra secure: it merely has far fewer actors and shifting components. Consequently, Canada is way extra proof against having banking crises than the US, which is a part of why Canadian banks have a tendency to supply superior threat adjusted returns.

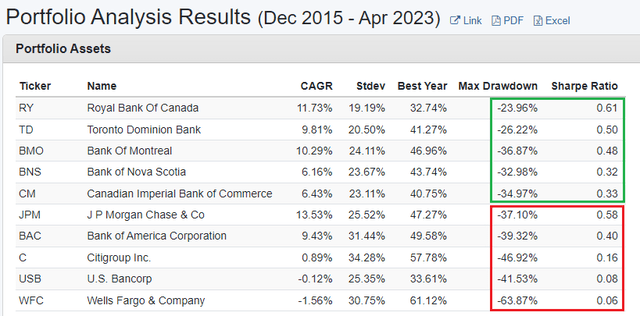

Under is an tailored screenshot of the portfoliovisualizer.com outcomes of evaluating the return traits of 5 largest Canadian banks (boxed in inexperienced) with the 5 largest American banks (JPM), (BAC), (C), (USB), and (WFC) (boxed in purple):

5 US Banks, 5 Canadian Banks (Portfolio Visualizer)

Fairly merely put, the Canadian banks as a bunch usually have the bigger CAGR, smaller normal deviations of returns, smaller drawdowns, and better Sharpe ratios. If I had been a closet indexer, I do know which group of banks I’d decide. Do be aware that this comparability was restricted by the quantity of historic information that the web site has, so this chart shouldn’t be used as a foundation for choosing financial institution shares primarily based on CAGR for this comparatively quick time interval alone.

Nevertheless, the main target of this text would be the Financial institution of Nova Scotia, which stands out amongst these banks as being probably the most diversified monetary corporations.

Financial institution of Nova Scotia’s 4 Enterprise Strains

Financial institution of Nova Scotia is greater than only a Canadian financial institution – it’s geographically diversified throughout each North and South America! The 4 traces are:

- Canadian Banking

- Worldwide Banking

- International Wealth Administration

- International Banking and Markets

I’ll briefly describe these segments, and in addition evaluate their efficiency between FY 2012 and FY 2022, so we get a way of how a lot these traces of enterprise have grown over the long term. All figures had been extracted from the 2012 and 2022 annual reviews discovered on SEDAR, the Canadian equal of EDGAR.

Canadian Banking

| FY 2012 | FY 2022 | |

| Internet Revenue (hundreds of thousands CAD) | $1,938 | $4,763 |

| Return On Fairness | 39.1% | 26.3% |

| Effectivity Ratio | 50.1% | 44.8% |

| Whole Belongings (billions CAD) | $225 | $430 |

| Whole Liabilities (billions CAD) | $150 | $332 |

Canadian Banking supplies a full suite of economic recommendation and banking options to over 10 million Retail, Small Enterprise and Business Banking prospects. It serves these prospects via 941 branches and three,725 automated banking machines (ABMs), in addition to on-line, cellular and phone banking. Canadian Banking additionally supplies an alternate self-directed banking resolution to over 2 million Tangerine Financial institution prospects.

Out of the 4 traces of enterprise, that is the quickest rising line. Moreover, the 26.3% returns on fairness is actually unbelievable. Out of the 4 traces of enterprise, that is the biggest and the brightest spot. Sadly the subsequent 3 traces publish much less spectacular returns on fairness, however nonetheless respectable development charges.

Worldwide Banking

| FY 2012 | FY 2022 | |

| Internet Revenue (hundreds of thousands CAD) | $1,774 | $2,418 |

| Return on Fairness | 12.3% | 12.9% |

| Effectivity Ratio | 56.7% | 53.6% |

| Whole Belongings (billions CAD) | $109 | $207 |

| Whole Liabilities (billions CAD) | $70 | $152 |

Worldwide Banking has over 11 million Retail, Company, and Business prospects within the Pacific Alliance international locations of Mexico, Chile, Peru, and Colombia, in addition to Central America, the Caribbean, and Uruguay.

International Wealth Administration

| FY 2012 | FY 2022 | |

| Internet Revenue (hundreds of thousands CAD) | $1,170 | $1,565 |

| Return on Fairness | 14.5% | 16.2% |

International Wealth Administration delivers wealth administration recommendation and options to shoppers throughout Financial institution of Nova Scotia’s footprint, specifically each North and South America. International Wealth Administration serves over 2 million funding fund and advisory shoppers and administers over $500 billion in belongings.

Out of the 4 traces of enterprise, that is the second quickest rising line.

International Banking and Markets

| FY 2012 | FY 2022 | |

| Internet Revenue (hundreds of thousands CAD) | $1,492 | $1,911 |

| Return on Fairness | 27.9% | 14.3% |

International Banking and Markets supplies company shoppers with lending and transaction companies, funding banking recommendation and entry to capital markets. GBM is a full-service wholesale financial institution within the Americas, with operations in Canada, america, Latin America, Europe and Asia-Pacific, for a complete of 21 international locations.

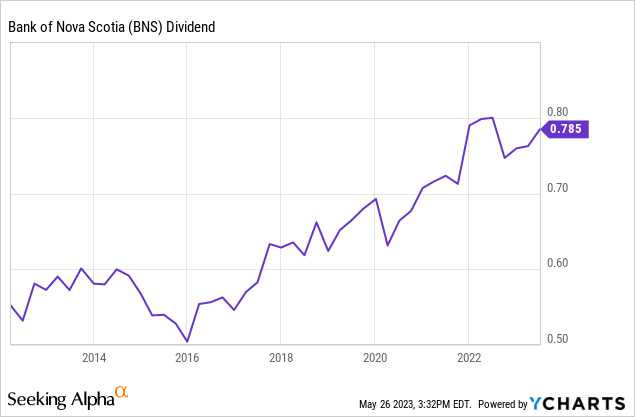

How did this imply for the dividend? Let’s do a YCharts plot:

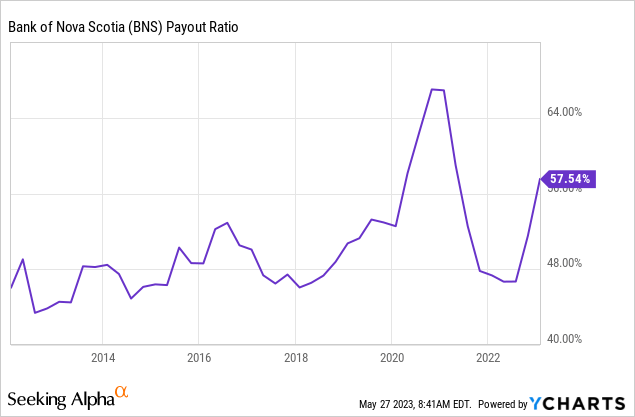

Be aware that this plot is in USD, whereas Financial institution of Nova Scotia pays dividends in CAD. Therefore there may be some noise within the plot attributable to overseas change fluctuations. However the level is evident – rising enterprise efficiency naturally results in a rising dividend. Because the inventory is at present yielding 6%, might dividend buyers rejoice! Nevertheless, as a result of development on 3 out of the 4 traces of enterprise are comparatively sluggish, the dividend payout ratio has been very progressively rising:

Right here we see the payout ratio equal the excessive 40 % vary in 2012 however enter the excessive 50 % vary now. Nevertheless, like we mentioned, Canadian banking is oligopolistic and has little competitors, permitting Canadian banks to publish excessive ranges of Tier 1 capital. I’ve compiled a time sequence of BNS’s CET1 ratio, and it’s a testomony to BNS’s stability, which is what dividend buyers need. The pattern from 2013 in direction of rising conservatism again to what it as soon as had is an added plus:

| FY 12 months Finish | CET1 ratio |

| 2012 | 13.6% |

| 2013 | 9.1% |

| 2014 | 10.8% |

| 2015 | 10.3% |

| 2016 | 11.0% |

| 2017 | 11.5% |

| 2018 | 11.1% |

| 2019 | 11.1% |

| 2020 | 11.8% |

| 2021 | 12.3% |

| 2022 | 11.5% |

| Q2 2023 | 12.3% |

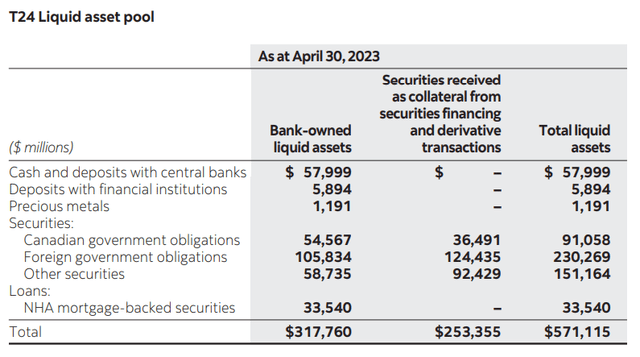

Moreover, given the current banking turmoil within the US, we’d need to know concerning the liquidity standing of BNS, even whether it is in Canada. On the floor this may make sense, since each international locations aggressively hiked rates of interest in 2022 and 2023. Let’s start with the actual fact (extracted from the Q2 2023 quarterly report) that Financial institution of Nova Scotia’s complete belongings are $1,349 billion CAD. I discovered and reformatted an exhibit in that very same report that particulars the quantity of these belongings which are liquid:

Liquid Asset Pool at BNS (Q2 2023 Quarterly Report)

Clearly, Financial institution of Nova Scotia is in no hazard of working into liquidity points. One other plus for dividend buyers.

Lengthy Time period Returns Profile – Peer Comparability

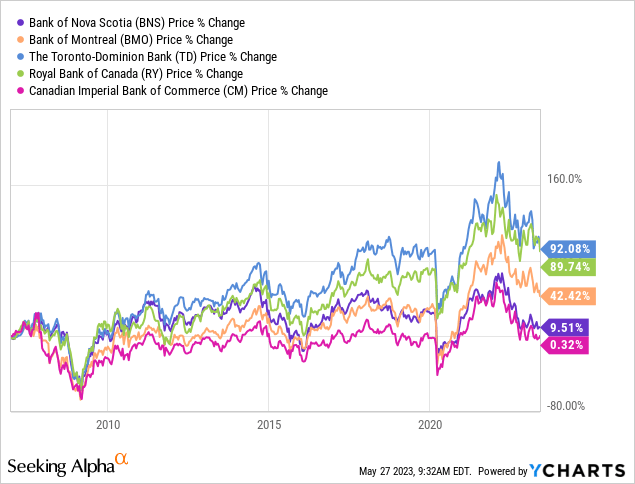

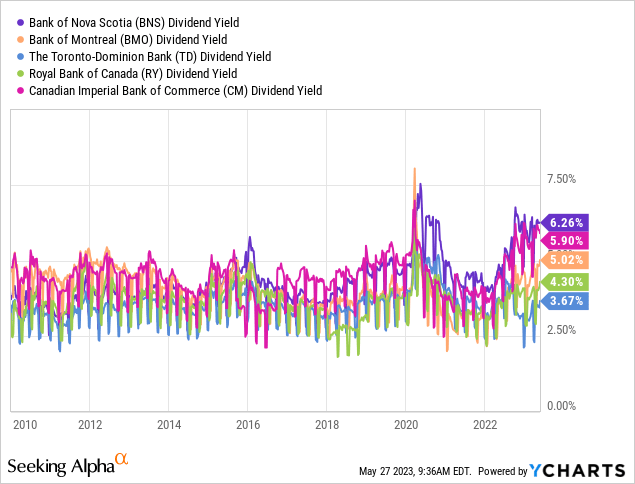

I’ll plot the share worth trajectory and dividend yield trajectory of the Massive 5 Canadian banks and see the place BNS suits in respect with its friends, and study how precisely does BNS present returns to the shareholder.

Share Value

Dividend Yield

The worth chart was picked to start out in 2007 to seize the Nice Monetary Disaster brought on by housing markets. Most notably, BNS and CM are the 2 banks with the bottom worth appreciation. This isn’t the entire story, nonetheless. BNS (and CM) are the 2 banks with the best dividend yield, BNS yielding at present a whopping 6.26%. It isn’t essentially true that BNS delivers decrease returns – slightly, virtually all of its returns are within the type of the dividend payout.

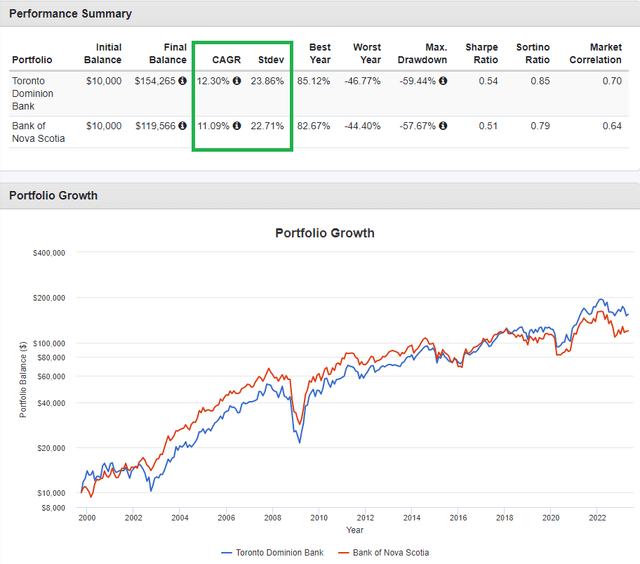

Certainly, we are able to evaluate the 2 excessive corporations BNS and TD in complete return on Portfolio Visualizer:

- TD – low dividend yield, excessive worth appreciation

- BNS – excessive dividend yield, low worth appreciation

Lengthy Run Whole Returns, BNS and TD (Portfolio Visualizer)

Over the very long term (2000 – current), these two banks present very related return and volatility profiles, suggesting that despite the fact that their mode of manufacturing shareholder returns are completely different, their precise complete returns are related. That mentioned, since BNS supplies returns in dividends, there may be an inefficiency in respect with having the pay dividend taxes, except the shares are held in a retirement account.

Abstract

To summarize the details:

- Financial institution of Nova Scotia operates as one in all 5 oligopolistic events within the Canadian banking system, benefiting from restricted competitors.

- This financial institution is a sluggish however regular grower in a mature trade and market, with Canadian (home) banking as its brightest spot by way of measurement of the road of enterprise and returns on fairness.

- Financial institution of Nova Scotia has steadily hiked its dividend concurrently rising its earnings, and at present yields 6%.

- Its capital ratios and liquidity place counsel that it’s a conservatively managed financial institution the place administration values stability.

- This can be a good funding for somebody looking for a high-yielding funding that has little potential for concern or pleasure – a dependable revenue place.

- BNS supplies the overwhelming majority of its returns in its dividend yield slightly than in share worth appreciation.