Gary Yeowell

British Land (OTCPK:BTLCY) gives a high-dividend yield and is undervalued, being due to this fact an excellent play for income-oriented traders inside the European actual property sector.

Firm Overview

British Land is a U.Okay. actual property firm that invests and manages business properties, with a portfolio comprising places of work, retail superstores, procuring centres, and logistics. Its present market worth is about $3.9 billion and its shares commerce within the U.S. on the over-the-counter market.

On the finish of final March, its portfolio was valued at near $11 billion, of which about 62% was associated to places of work (each underneath operation and new developments), whereas retail and logistics represented the remaining.

The property market is sort of cyclical and traditionally the market’s efficiency has broadly tracked GDP development. Inside actual property, the workplace market is without doubt one of the segments that observe financial exercise extra immediately, whereas up to now few years there have been additionally another occasions which modified the workplace market dynamics within the U.Okay., particularly Brexit and the pandemic.

Brexit has led to some multinational firms, as an example, within the monetary sector, to maneuver some operations exterior the U.Okay., whereas extra lately the pandemic has led to extra individuals working from dwelling, each occasions being headwinds for demand associated to workplace area throughout the nation.

Moreover, rates of interest are additionally an necessary driver of property values, and after a number of years of a low rate of interest surroundings within the U.Okay. and different geographies, rising charges have been a headwind for property values in current months. Whereas greater charges put downward stress on property values, this may be offset to some extent by rising rental values, however this has not been sufficient to offset yield compression.

Making an allowance for this background, it’s not stunning that British Land’s portfolio worth has decreased by 12% over the past yr, with places of work (-13% YoY) and logistics (-24% YoY) being the segments reporting essentially the most vital drops, whereas retail additionally declined significantly (-10% YoY) and procuring centres was comparatively extra resilient (-7.6% YoY).

On condition that the Financial institution of England is predicted to hike a number of extra occasions within the coming quarters as a consequence of excessive inflation ranges within the U.Okay., valuation prospects for the corporate’s property will not be significantly bullish within the quick time period.

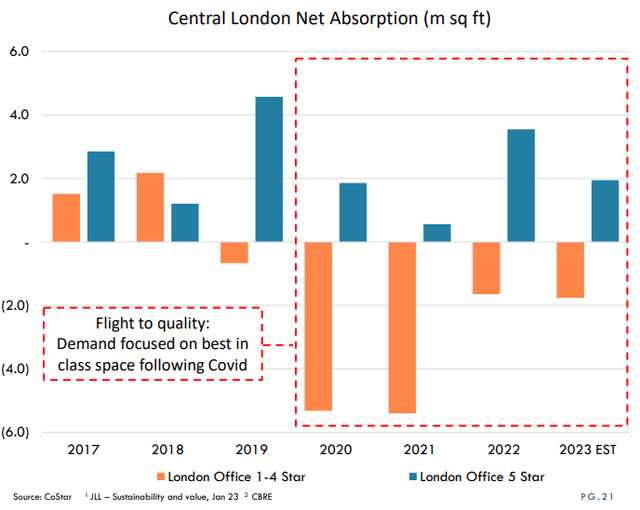

Nonetheless, British Land has an workplace portfolio concentrated in London with comparatively prime quality, which is a vital issue for a stronger efficiency in comparison with a few of its friends. Certainly, as proven within the subsequent graph, prime workplace area in London has carried out higher than lower-quality workplace area, boding nicely for the corporate’s property each by way of rental development and valuations.

Workplace market (Briitsh Land)

Exhibiting that British Land has an excellent portfolio, its total emptiness price was solely 3.3% on the finish of fiscal yr (FY) 2023 (it ends in March), which is a comparatively low stage of emptiness inside the European actual property sector and extra spectacular contemplating that British Land is uncovered to workplace and retail.

Certainly, in retail parks its occupancy price was 97.3%, which is sort of excessive, and in London city logistics the emptiness price was 2.3%. These are very robust ranges of occupancy, which is a robust sign of British Land’s high quality portfolio and constructive dynamics within the London market, which bodes nicely for its income and earnings power within the close to future.

However, its procuring centres have a decrease occupancy as this market continues to be recovering from the pandemic hit and a few tenants are nonetheless struggling. This explains why the corporate’s emptiness price was 5.9% on the finish of final FY, a suitable stage in comparison with different firms within the sector, as I’ve analyzed lately on Unibail-Rodamco-Westfield (OTCPK:UNBLF), which is a specialised firm on this phase, and has a emptiness price above 9% within the U.Okay.

Going ahead, British Land is predicted to keep up its technique, investing in new developments of which its Canada Water Masterplan is an important one and would require vital outflows over the following few years, but in addition performing energetic portfolio rotation to generate worth. Whereas within the quick time period its enterprise will seemingly proceed to be impacted by a difficult macroeconomic surroundings, the corporate is nicely managed and may create worth for shareholders over the long run as a consequence of its high quality portfolio targeted in prime places.

Monetary Overview

Relating to its monetary efficiency, the corporate has reported comparatively poor outcomes over the previous few years, negatively impacted by the pandemic, which have affected each the workplace and retail segments. As an organization strongly uncovered to those segments, not surprisingly British Land’s revenues have declined from $753 million in FY 2020, to some $548 million in FY 2023.

Nonetheless, over the previous fiscal yr, its working efficiency has improved on an annual foundation, because the reopening of the British financial system has led to greater retail gross sales and workplace hire assortment charges.

Certainly, its like-for-like rental development was 6% in FY 2023 to $548 million, which is a constructive consequence contemplating the difficult market backdrop, and its underlying revenue amounted to $324 million (+7% YoY). By segments, each workplace and retail parks reported robust rental development above 6% YoY, whereas procuring centres elevated rents extra modestly (+2.6% YoY). Its underlying earnings per share amounted to $0.35, a rise of 4.8% YoY.

Relating to its stability sheet, opposite to different European actual property firms, its leverage place is extra modest, displaying that British Land’s administration has a conservative method. On the finish of final March, its loan-to-value (LTV) ratio was 36% (up by about 300 foundation factors within the yr), and its internet debt-to-EBITDA ratio was 8.4x, whereas there are different European friends with LTV ratios above 50% and internet debt-to-EBITDA nearer to 15x, equivalent to Aroundtown (OTCPK:AANNF), which I’ve lined lately.

This extra conservative leverage place is a constructive issue for British Land’s funding case, making it much less susceptible to rising rates of interest and making it a extra defensive play inside the European actual property sector, significantly in comparison with different firms extremely uncovered to the workplace phase.

This additionally explains why British Land has resumed its dividend funds extra quickly than a few of its friends, equivalent to Unibail. Whereas British Land suspended dividend distributions again in 2020 because of the pandemic, it resumed dividend funds in 2021 and has lately elevated its annual dividend to $0.28 per share (+3.3% YoY).

That is in-line with its aim of distributing some 80% of annual earnings to shareholders, thus its dividend is immediately linked to the corporate’s annual earnings. At its present share worth, British Land gives a dividend yield of about 6.6%, which is sort of fascinating for earnings traders. Furthermore, as the corporate has a robust improvement pipeline over the following few years as a consequence of its massive challenge Canada Water, it’s seemingly that earnings will enhance and its dividend ought to comply with the identical footsteps.

Certainly, in line with analysts’ estimates, its dividend is predicted to extend to about $0.30 per share by FY 2026, which appears conservative, and the corporate might beat these estimates within the coming years.

Conclusion

British Land has an fascinating enterprise profile, provided that it’s uncovered to extremely cyclical actual property segments, however its technique of proudly owning high quality properties in London is proving to be fairly profitable. That is clearly seen on the corporate’s below-average emptiness price, boding nicely for income and earnings development forward.

Relating to its valuation, like lots of its friends, British Land is at present undervalued because of the rising rate of interest surroundings and weak investor sentiment towards actual property shares, buying and selling at some 0.57x internet asset worth and 13x FFO (vs. 19x common over the previous 5 years). Thus, its low cost valuation and high-dividend yield make it an fascinating earnings funding for long-term traders proper now.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.