[ad_1]

Lots of of us are assuming the banking disaster is over.

However what if it’s not? Are you ready?

Look, I’m definitely no “doomsdayer.” I’m a cautious optimist. I’m additionally an opportunistic dealer.

So right this moment, I hope you’ll permit me to supply a level-headed warning … and a option to revenue from what I imagine would be the “subsequent shoe to drop.”

Then you’ll be able to determine for your self what to do about it.

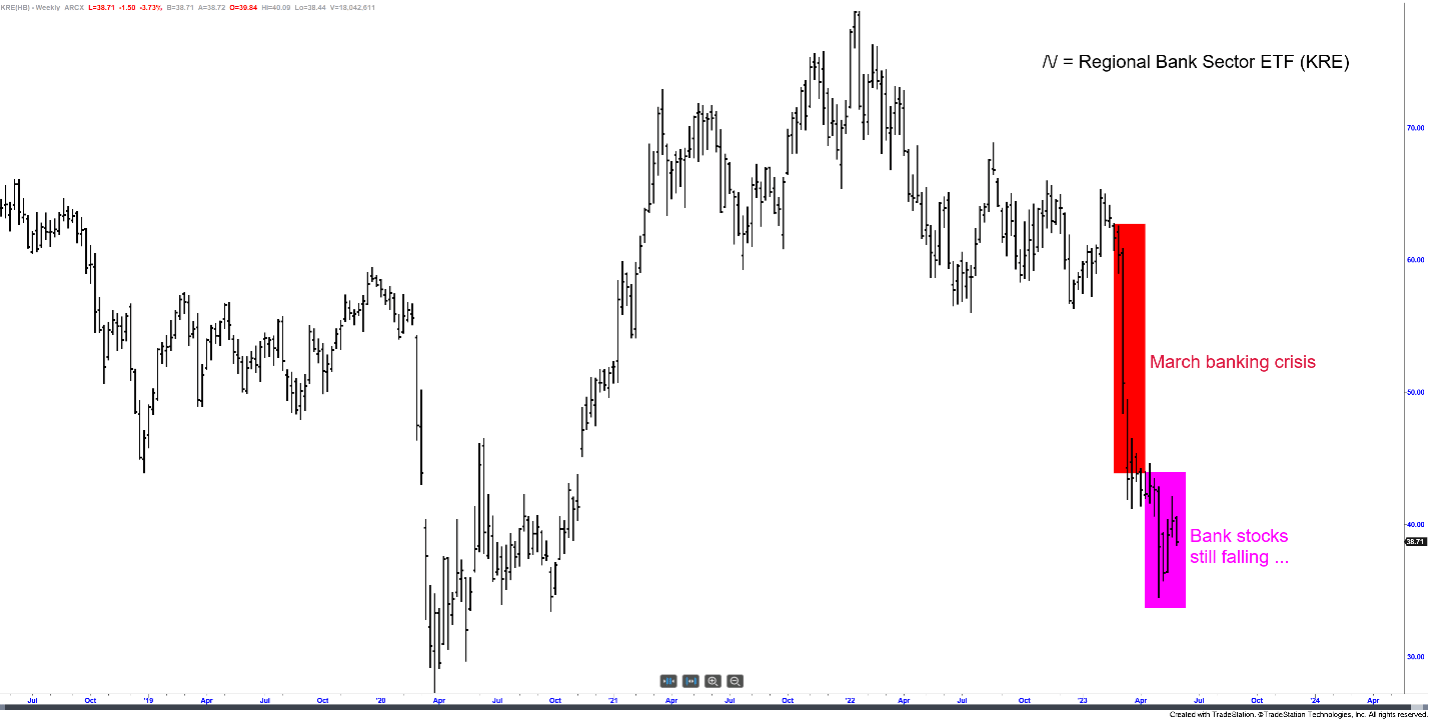

First, let me let you know that shares of the Regional Financial institution Sector ETF (NYSE: KRE) are decrease right this moment than they had been on the top of the bank-failure panic in March.

Sometimes, costs rebound within the weeks following a disaster’ climax. Brief sellers purchase shares to lock in earnings. Cut price hunters purchase shares at a “low cost.” And all that purchasing stress pushes up costs.

However that didn’t occur with KRE…

A full month had handed for the reason that epic failure of Silicon Valley Financial institution. The media had moved on to different tales, as if the banking disaster was “over”…

However smart-money buyers weren’t shopping for it (myself included).

In an April 14 notice to my Max Revenue Alert subscribers, I requested the rhetorical query: “The place’s the bounce?”

Shares of KRE weren’t even an inch greater. To me, it was a transparent indication that the disaster is much from over and can finally unfold effectively past a small handful of “one-off” financial institution failures.

I really helpful an actionable commerce, and simply two weeks later we locked in earnings of 75% on a portion of it (we maintain the rest of the place nonetheless right this moment).

I don’t share this with you right this moment to impress you, however to impress upon you that the banking disaster continues to be ongoing … and that there are actions you’ll be able to take, right this moment, to organize for it … even revenue from it.

2023’s “Lehman Second” Is Coming

There was a lull within the disaster’ developments and media headlines. That’s really typical of economic crises. They progress in waves.

Give it some thought… What’s the Nice Monetary Disaster most recognized for? Most likely the collapse of Lehman Brothers in September, proper?

But in March 2008, a full six months prior … Bear Stearns had narrowly prevented chapter in a fireplace sale to JPMorgan, for a piddly $2 a share.

Everybody assumed that the worst was over when the mud settled on Bear Stearns’ collapse.

Six months handed earlier than anything substantial occurred … which left any head-in-the-sand buyers unprepared and completely shell-shocked when the failure of Lehman Brothers triggered the true “fireworks” of the disaster.

I used to be in wealth administration at a Fortune 500 agency on the time. I noticed the entire thing go down, virtually in slow-motion. And I hate to should admit this, however there was little I may do to assist my shoppers … solely as a result of I used to be hand-cuffed to my firm’s party-line recommendation, which was merely to “keep the course and hope for the most effective.”

I knew there was a greater option to handle danger … even to revenue from the disaster. And I vowed that yr to interrupt free from these handcuffs … to do every little thing in my energy to assist my shoppers navigate the subsequent disaster with success.

Humbly, I imagine my Max Revenue Alert subscribers are already benefitting from that vow I made in 2008. And I sincerely hope I can attain you, too.

I promised to point out you actionable steps you’ll be able to take to organize for and revenue from the “subsequent shoe” of this banking disaster. So let’s get right down to enterprise…

The Lazy Man’s Financial institution Commerce

I absolutely understand most buyers don’t prefer to “quick” shares. I get it. It feels uncomfortable. And it may be dangerous, particularly if you happen to don’t know what you’re doing.

In order that’s not what I’m recommending you do. It’s not essential.

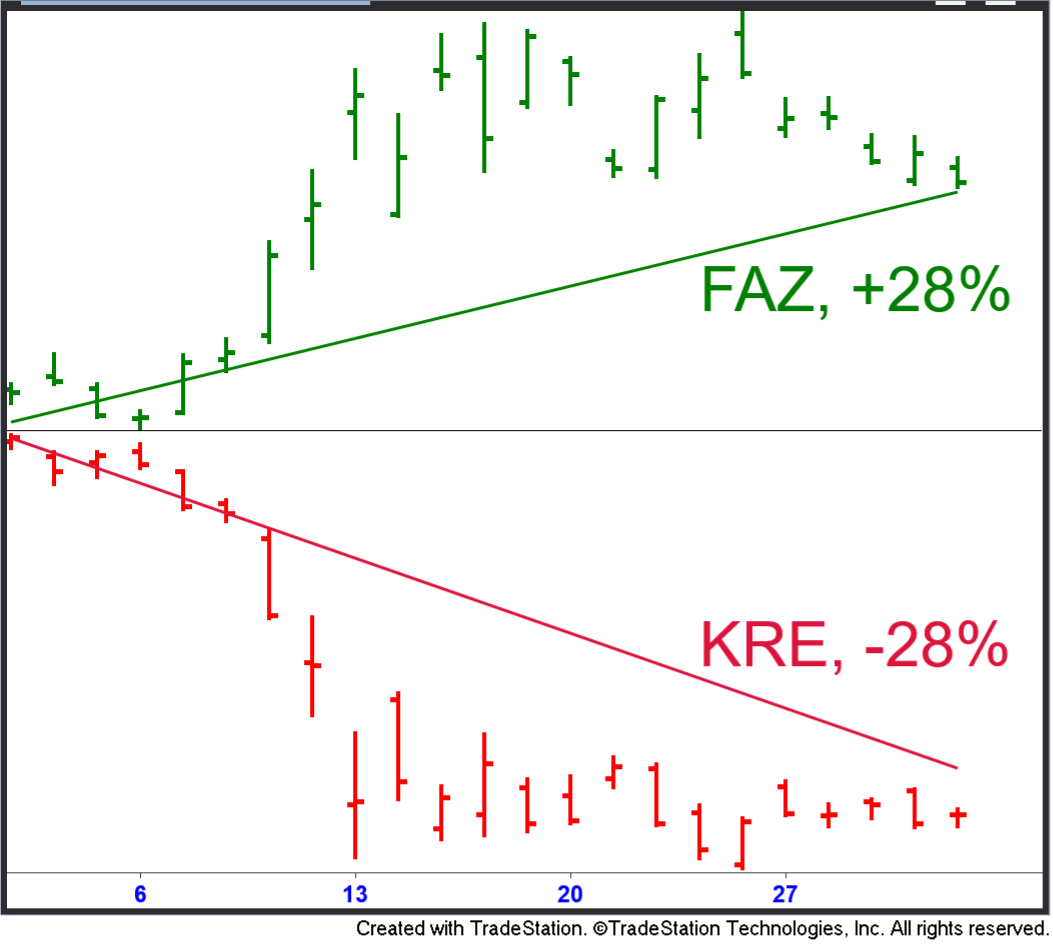

If you wish to place your self for earnings on the continuing banking disaster, the “lazy man’s” commerce is to easily purchase shares of the Direxion Day by day Monetary Bear 3x Shares (NYSE: FAZ).

That is an “inverse” exchange-traded fund you should purchase if you wish to revenue from declines within the value of a basket of economic shares. It labored wonders alongside the financial institution failures in March:

Whereas shares of the Regional Financial institution Sector ETF (KRE) misplaced 28% that month, shares of FAZ gained 28%.

However as I mentioned, I see shopping for FAZ because the “lazy man’s” option to play the banking disaster.

I imagine you are able to do much better while you watch my quick presentation — it simply went LIVE — and acquire entry to a report on the 282 monetary shares that my analysis exhibits are a excessive danger of failure.

I’m assured this report will aid you in various methods:

- For those who financial institution with one of many banks on my high-risk listing, you’ll be able to take into account transferring your deposits to a safer financial institution.

- For those who personal shares of one of many monetary shares on my high-risk listing, you’ll be able to promote them instantly (and I’ll strongly encourage you to).

- For those who be a part of my Max Revenue Alert service and decide to profiting considerably from the approaching disaster, I’ll present you easy-to-make trades (no “shorting” shares) that may profit from the collapse of any 1 of the 282 shares on my high-risk listing.

And all this apart, there’s worth in being a really knowledgeable American and investor. Even when that worth can’t be quantified within the {dollars} and cents of earnings.

Think about with the ability to supply well-researched, level-headed warnings to your mates … your loved ones … your shoppers or associates … whomever you care about.

Don’t you would like you’d had somebody like that in your camp again in 2008?

Maybe that is your probability to play the hero — to learn and ready, whether or not or not you determine to make the trades I’m focusing on earnings of 200% or extra on!

All it’s worthwhile to do is watch my quick presentation and maintain an open thoughts.

I promise you’ll be taught one thing new…

For example, there’s one other sector — exterior of the regional banking sector, however intimately tied to it — that’s simply as a lot prone to being the “subsequent shoe to drop” because the banks are.

I haven’t even touched on that sector right this moment, however I name it by identify and spell all of it out in my presentation. And among the many 282 monetary shares on my high-risk listing are a few of the greatest and most-trusted names within the area.

As I mentioned from the start, I’m no “doomsdayer.” And I most definitely don’t maintain myself out as somebody with a “crystal ball” view on the long run.

However I’ll say that I’m rising extra involved about this under-the-surface disaster by the day. And my conviction that shorting shares tied to this disaster grows together with it.

In the present day, in truth, shares of KRE are down 4%. 4 %! (And FAZ shares are up 5%).

And with the Fed’s subsequent charge hike liking approaching June 14 — which was exactly the set off that introduced Silicon Valley Financial institution’s buyers to their knees — the time to act is now.

All the small print are proper right here.

To good earnings,

Adam O’DellEditor, 10X Shares

Adam O’DellEditor, 10X Shares

P.S. For those who take nothing else from watching this presentation, please write down the names of the 4 banks on my shortlist and, on the very least, take into account your relationship with them.

The very last thing I would like is one other 2008 to influence hardworking American households. If even one individual is ready to withdraw their cash from a failing financial institution earlier than issues actually go south, all this analysis will probably be price it.

Once more, you’ll be able to hear the names of these 4 banks at this hyperlink, proper now.

(From Bnn.)

There’s a deal brewing for the debt ceiling … a minimum of in precept.

It nonetheless wants congressional approval, and that guarantees to be messy. However assuming the debt ceiling settlement will get authorized, let’s check out what it consists of and the way that may have an effect on us as buyers:

- It avoids the U.S. defaulting.

That is, in fact, the largest advantage of the deal — in addition to main disruptions like late Social Safety checks or furloughed authorities staff.

For now, the query of: “What occurs to the Treasury bonds in my portfolio if the federal government defaults?” will stay theoretical. That alone is large, and the information was sufficient to ignite a multiday rally within the inventory market. The whole lot else is incidental.

All the identical, let’s see what else the invoice consists of.

- The debt ceiling could be suspended till January 1, 2025.

We’ll should cope with this once more relying on how the 2024 election shakes out. However the metaphorical “tin can” is a minimum of kicked down the highway. There isn’t any danger of default for a minimum of the subsequent yr and a half.

- Authorities spending can also be capped for the subsequent two years.

I’ve my doubts right here, as I’m all however sure Congress will discover artistic methods to cheat. (Primarily by spending greater than agreed, whereas concurrently beating the drum of fiscal self-discipline.)

But it surely’s a begin. Spending progress will probably be curtailed.

Naturally, that’s good for the long-term well being of the nation. It probably saddles our kids with much less debt. But it surely additionally means that if we do get a recession within the coming months, we’ll have much less authorities largesse to cushion the blow.

Total, we’ll name the spending cap a optimistic, although within the quick quick time period, it’s not going to have any actual influence.

A number of different provisions of the debt ceiling deal are principally superficial, however may have a minimum of some influence…

- The freeze on scholar mortgage funds will lastly be lifted.

It’s baffling {that a} freeze on mortgage repayments relationship to the pandemic continues to be in impact years later given how sizzling the labor market is, and it’s gone time that was fastened.

However each greenback spent on debt reimbursement is now a greenback not obtainable to be spent within the economic system. Thousands and thousands of scholar mortgage debtors have but to restart funds, so we’re speaking a few probably vital chunk popping out of shopper spending.

By way of the quick financial outlook, we’ll should name this a adverse.

- There could be new work necessities for Individuals receiving welfare help.

This would possibly a minimum of assist chip away on the labor scarcity we’ve got right this moment. We’ll name this a small optimistic.

Now, there’s one ultimate provision that received’t have a lot of a right away influence. However in the long run, it needs to be an unambiguous optimistic.

- There could be an overhaul of the power allowing course of.

This provision ought to make it considerably simpler to get new power tasks authorized and began.

That is good for conventional oil and gasoline tasks, nevertheless it’s additionally true of wind farms, photo voltaic panel arrays and the limitless miles of transmission traces wanted to make all of it work.

Adam O’Dell has been bullish on each inexperienced power and conventional oil and gasoline for a number of years now, and this improvement makes the power story all of the extra compelling.

Now, Adam’s brand-new webinar is simply as fascinating. It particulars a commerce alternative that thrives in market volatility. It has the potential to double, and even triple, your return on funding.

Wish to be taught extra? Go right here for all the small print.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link