William_Potter/iStock through Getty Pictures

Funding Thesis

The target of as we speak’s article is to indicate you the way you could possibly allocate $15,000 amongst two exchange-traded funds, or ETFs, in addition to my prime 10 dividend development firms that I’ve chosen for this month of June.

As a way to enable you obtain a better further revenue within the type of dividends from as we speak onwards, I’ve included two ETFs. I imagine they’re significantly engaging since they provide a sexy Dividend Yield [TTM], and have proven a sexy Dividend Development Price [CAGR] over the previous 5 years. For these causes, I imagine that this portfolio may be engaging not just for dividend development buyers but in addition for dividend revenue buyers.

I’ve additional ensured that these firms, which I imagine are particularly engaging in the case of danger and reward, are overweighted in this funding portfolio. That is to extend the probability of you attaining glorious funding outcomes over the long run.

The next are the 2 ETFs which are a part of this funding portfolio:

- Schwab U.S. Dividend Fairness ETF (SCHD)

- iShares Choose Dividend ETF (DVY).

The next are my prime 10 dividend development firms that I’ve chosen for June 2023:

- Apple (AAPL)

- BlackRock (BLK)

- Canadian Pure Sources Restricted (CNQ)

- Goldman Sachs (GS)

- JPMorgan (JPM)

- Mastercard (MA)

- Microsoft (MSFT)

- Nasdaq (NDAQ)

- The Charles Schwab Company (SCHW)

- Union Pacific Company (UNP).

Overview of the ten chosen Picks for June 2023, the 2 chosen ETFs and the Portfolio Allocation

|

Firm Identify |

Sector |

Trade |

Nation |

Dividend Yield [TTM] |

Dividend Development 5Y |

Allocation |

Quantity in $ |

|

Apple |

Data Know-how |

Know-how {Hardware}, Storage and Peripherals |

United States |

0.54% |

7.26% |

4% |

600 |

|

BlackRock |

Financials |

Asset Administration and Custody Banks |

United States |

2.97% |

13.60% |

5% |

750 |

|

Canadian Pure Sources Restricted |

Vitality |

Oil and Fuel Exploration and Manufacturing |

Canada |

4.12% |

21.83% |

2% |

300 |

|

JPMorgan Chase & Co. |

Financials |

Diversified Banks |

United States |

2.93% |

12.91% |

3% |

450 |

|

Mastercard |

Financials |

Transaction & Cost Processing Companies |

United States |

0.57% |

17.66% |

3% |

450 |

|

Microsoft |

Data Know-how |

Programs Software program |

United States |

0.84% |

10.02% |

4% |

600 |

|

Nasdaq |

Financials |

Monetary Exchanges and Information |

United States |

1.47% |

9.57% |

2% |

300 |

|

The Charles Schwab Company |

Financials |

Funding Banking and Brokerage |

United States |

1.78% |

21.16% |

2% |

300 |

|

The Goldman Sachs Group |

Financials |

Funding Banking and Brokerage |

United States |

2.94% |

25.93% |

3% |

450 |

|

Union Pacific Company |

Industrials |

Rail Transportation |

United States |

2.65% |

14.83% |

2% |

300 |

|

Schwab U.S. Dividend Fairness ETF |

ETFs |

ETFs |

United States |

3.75% |

15.56% |

40% |

6000 |

|

iShares Choose Dividend ETF |

ETFs |

ETFs |

United States |

3.88% |

7.00% |

30% |

4500 |

|

3.12% |

11.67% |

100% |

15000 |

Supply: The Writer, information from Searching for Alpha.

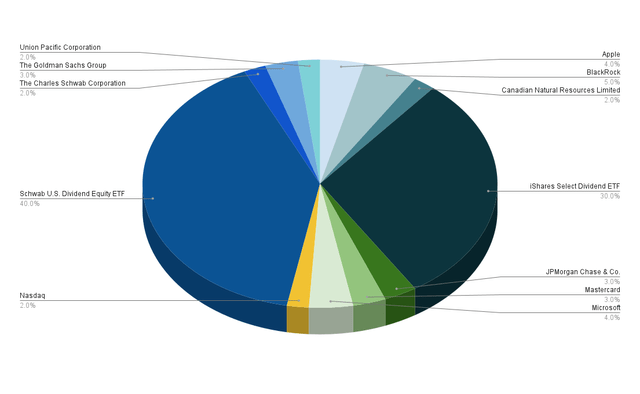

Portfolio Allocation per Firm/ETF

The next two ETFs symbolize the best proportion of the funding portfolio, which I’m presenting in as we speak’s article:

- Schwab U.S. Dividend Fairness ETF (40%)

- iShares Choose Dividend ETF (30%).

Various causes have contributed to giving these two ETFs the best proportion of the general portfolio.

Since I intention to indicate you the portfolio allocation amongst my prime 10 dividend development shares for June 2023, I wished to lift the portfolio’s Weighted Common Dividend Yield [TTM]. That is the case as the vast majority of these dividend development firms have a comparatively low Dividend Yield [TTM] (the ten chosen picks have an Common Dividend Yield [TTM] of two.08%).

By offering the Schwab U.S. Dividend Fairness ETF (40%) and the iShares Choose Dividend ETF (30%) with the best proportion of this portfolio, the additional amount of cash you possibly can obtain through dividends will increase from as we speak, thus making this portfolio interesting for dividend revenue buyers in addition to for dividend development buyers.

I’ve additional given the Schwab U.S. Dividend Fairness ETF a fair increased proportion (40%) than the iShares Choose Dividend ETF (30%). It’s because it has proven a better Dividend Development Price [CAGR] over the previous 5 years (15.56% in comparison with 7.00%). By doing this, it helps us to lift the Weighted Common Dividend Development Price of this funding portfolio.

Another excuse why I overweighted the 2 chosen ETFs on this portfolio is that by doing so, we enhance the diversification whereas lowering its danger degree on the similar time.

Along with that, it may be highlighted that, as we are going to see within the following, no particular person place has a proportion of greater than 5% of the general portfolio. As soon as once more, this helps us to cut back the chance degree, and with this, to lift the likelihood of attaining glorious funding outcomes when investing over the long run.

The next firms symbolize the biggest particular person positions of this funding portfolio:

- BlackRock (5%)

- Apple (4%)

- Microsoft (4%)

- JPMorgan (3%)

- Mastercard (3%)

- The Goldman Sachs Group (3%).

BlackRock represents the biggest particular person place with 5% of the general portfolio.

I chosen BlackRock as the person place with the best proportion, because the firm gives buyers with a sexy Dividend Yield [TTM] of two.97% whereas having proven a sexy Dividend Development Price [CAGR] of 13.60% over the previous 5 years. Along with that, I imagine that the dangers for BlackRock buyers are comparatively low and the reward (in type of the anticipated price of return) is engaging. This makes BlackRock a sexy alternative for buyers for my part.

I additionally imagine it is smart to chubby Apple and Microsoft on this funding portfolio, since I believe that each firms are significantly engaging for buyers when contemplating danger and reward. Each have robust aggressive benefits (within the type of a excessive model worth, their very own ecosystem and their broad product diversification) and are financially extraordinarily wholesome (each have an Aaa credit standing from Moody’s). This makes me imagine that you must, with a excessive likelihood, acquire a sexy Inner Price of Return by investing in these firms over the long run.

I additionally imagine that JPMorgan (3%), Mastercard (3%) and The Goldman Sachs Group (3%) are engaging for buyers in the case of danger and reward. This is the reason additionally they get a comparatively excessive proportion of this funding portfolio.

The next firms symbolize the smallest proportion of this funding portfolio:

- Canadian Pure Sources Restricted (2%)

- Nasdaq (2%)

- The Charles Schwab Company (2%)

- Union Pacific Company (2%).

Resulting from the truth that every of those picks solely have a proportion of two% of the general portfolio, the impression they’ve can be decrease. This additionally signifies that a possible inventory decline of certainly one of these picks would have a decrease unfavorable impression on the Complete Return of your portfolio.

Illustration of the Portfolio Allocation per Firm/ETF

Supply: The Writer

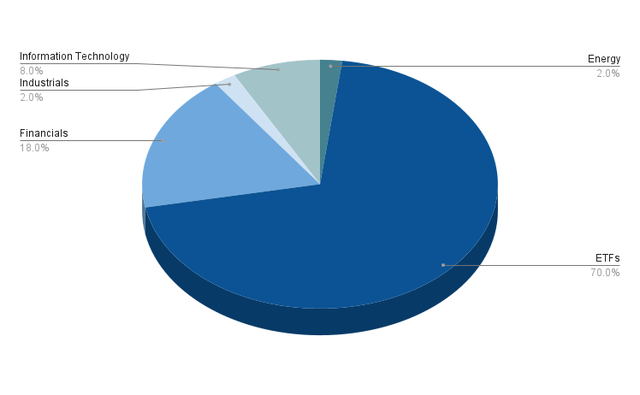

Portfolio Allocation per Sector

The 2 chosen ETFs have the best proportion of this funding portfolio: whereas the Schwab U.S. Dividend Fairness ETF represents 40%, the iShares Choose Dividend ETF makes up 30%. This means that when mixed, each symbolize 70% of the portfolio.

Beside the ETFs, the Financials Sector makes up the best proportion of the general portfolio (18%). This sector is represented by BlackRock (5%), JPMorgan (3%), Mastercard (3%), The Goldman Sachs Group (3%), Nasdaq (2%) and The Charles Schwab Company (2%).

In the meantime, the Data Know-how Sector represents 8%. The sector is represented by Apple and Microsoft, which every maintain 4% of the entire portfolio.

A smaller proportion of the general portfolio is held by the Vitality Sector (with Canadian Pure Sources holding 2%) and the Industrials Sector (with Union Pacific Company holding 2% of the general portfolio).

Resulting from the truth that no Sector represents greater than 18% of the entire portfolio, we are able to deduce that we’ve reached a broad diversification over Sectors.

Illustration of the Portfolio Allocation per Sector when allocating SCHD and DVY to the ETF Sector

The graphic beneath exhibits the portfolio allocation per sector when allocating each the Schwab U.S. Dividend Fairness ETF and the iShares Choose Dividend ETF to the ETF Sector.

Supply: The Writer

Under yow will discover the record of firms/ETFs that belong to every sector.

ETFs (70%)

- Schwab U.S. Dividend Fairness ETF (40%)

- iShares Choose Dividend ETF (30%)

Financials (18%)

- BlackRock (5%)

- JPMorgan (3%)

- Mastercard (3%)

- The Goldman Sachs Group (3%)

- Nasdaq (2%)

- The Charles Schwab Company (2%)

Data Know-how (8%)

- Apple (4%)

- Microsoft (4%)

Industrials (2%)

- Union Pacific Company (2%)

Vitality (2%)

- Canadian Pure Sources Restricted (2%)

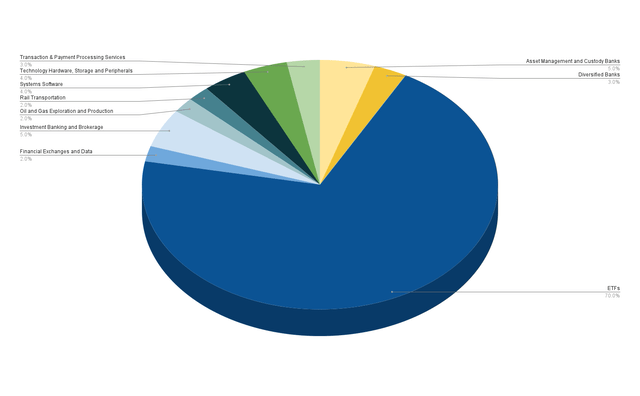

Portfolio Allocation per Trade

In addition to the ETF sector, the Asset Administration and Custody Banks Trade (5% of the general portfolio) and the Funding Banking and Brokerage Trade (5%) make up the best proportion of the general portfolio.

The Asset Administration and Custody Banks Trade is represented by BlackRock (5%) and the Funding Banking and Brokerage Trade is represented by The Goldman Sachs Group (3%) and The Charles Schwab Company (2%).

The Programs Software program Trade (represented by Microsoft with 4%) and the Know-how {Hardware}, Storage and Peripherals Trade (with Apple making up 4%) each symbolize 4% of the portfolio.

The Diversified Banks Trade (represented by JPMorgan) and the Transaction & Cost Processing Companies Trade (represented by Mastercard) every make up 3% of the general portfolio.

The Monetary Exchanges and Information Trade (represented by Nasdaq), the Oil and Fuel Exploration and Manufacturing Trade (Canadian Pure Sources), and the Rail Transportation Trade (Union Pacific Company) maintain 2% every.

In addition to the ETFs, no Trade represents greater than 5% of the general portfolio, indicating that we reached a broad diversification over industries.

Illustration of the Portfolio Allocation per Trade when allocating SCHD and DVY to the ETF Trade

Supply: The Writer

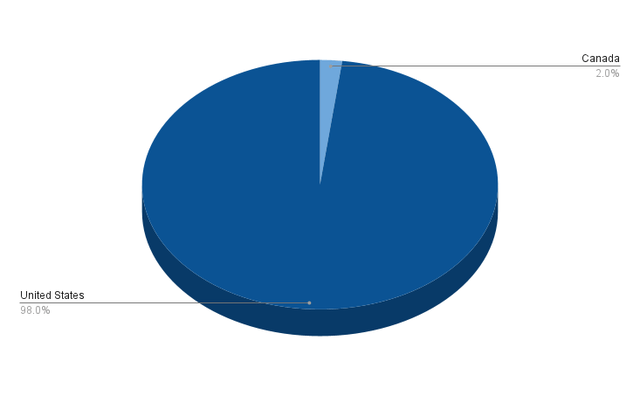

Portfolio Allocation per Nation

98% of this funding portfolio, which I’m presenting in as we speak’s article is invested in firms from america whereas solely 2% are invested in firms from one other nation. Canada is represented by Canadian Pure Sources, which holds 2% of the general portfolio.

Resulting from the truth that solely 2% of the chosen firms are from exterior america, it can’t be said that we reached a broad diversification over nations.

Nonetheless, I wouldn’t interpret this as being a weak spot of this portfolio. It’s because I contemplate it extra essential to pick out firms with robust aggressive benefits and a powerful monetary well being when investing over the long run, relatively than prioritizing firms in a method that solely achieves a broad geographical diversification.

Nonetheless, I might recommend that when buying extra positions for this funding portfolio, you could possibly embody some picks from exterior america in an effort to enhance its geographical diversification.

Illustration of the Portfolio Allocation per Nation

Supply: The Writer

The way to obtain a fair Broader Diversification

If you wish to obtain a fair broader diversification than this funding portfolio presents, you may contemplate make investmentsing in a further ETF: you could possibly take a more in-depth have a look at the iShares Core Dividend Development ETF (DGRO), because it gives you with a comparatively engaging Dividend Yield [TTM] of three.37% and a Dividend Development Price [CAGR] of 10.32% over the previous 5 years.

In case you ask your self if it makes sense to solely put money into SCHD, I wish to spotlight some benefits of choosing shares individually over solely investing in ETFs:

- It gives your portfolio with extra individuality and suppleness

- You possibly can defend your funding portfolio in opposition to the following inventory market crash by including firms with a low Beta Issue (an instance of an organization with a low Beta Issue can be Johnson & Johnson, which is a part of this portfolio)

- You possibly can chubby industries with which you might be extra acquainted and you’ll keep away from others you don’t need to put money into

- You possibly can choose shares which you assume are in a position to beat the market or you possibly can choose ones to lift the Weighted Common Dividend Yield or Weighted Dividend Development Price of your funding portfolio

- You can too obtain a fair broader geographical diversification of your portfolio

In my article, “10 Dividend Shares To Present The Benefits Of Investing In Particular person Shares Over ETFs,” I talk about some great benefits of the choice of shares over ETFs in better element.

Conclusion

The purpose of as we speak’s article was to indicate you the way you could possibly allocate $15,000 amongst my prime 10 dividend development firms I’ve chosen for the month of June.

The ten chosen picks have an Common Dividend Yield [TTM] of two.08%. As a way to assist enhance the Common Dividend Yield [TTM] of this funding portfolio, I’ve included two ETFs: the Schwab U.S. Dividend Fairness ETF and the iShares Choose Dividend ETF.

By offering the Schwab U.S. Dividend Fairness ETF with a proportion of 40% of the general portfolio and the iShares Choose Dividend ETF with a proportion of 30%, we have been in a position to enhance the Weighted Common Dividend Yield [TTM] of this portfolio to three.12%. The allocation of the businesses additionally contributed to attaining this Weighted Common Dividend Yield [TTM] of three.12%.

Along with that, the portfolio has reached a broad Diversification over Sectors and Industries, since no Sector represents greater than 18% of the general portfolio and no Trade represents greater than 5%.

On the similar time, I anticipate the reward (within the kind of a pretty compound annual price of return) of this funding portfolio to be engaging and the chance degree to be comparatively low. This is because of the truth that I’ve overweighted the businesses that I imagine are significantly engaging in the case of danger and reward.

Writer’s Notice: Thanks very a lot for studying and I might recognize hearing your opinion on this funding portfolio and its allocation! Do you personal or plan to accumulate one of many chosen picks? Any suggestion to enhance my analyses is way appreciated! Thanks!