[ad_1]

Daniil Dubov/iStock by way of Getty Photographs

This text was first posted in Outperforming the Market on June 5, 2023.

A number of members of Outperforming the Market have requested me about Tremendous Micro Pc Inc. (NASDAQ:SMCI), which I’ve performed a deep dive on. On this article, I’ll introduce SMCI and canopy varied features of the corporate, together with its segments and merchandise, aggressive panorama and benefits, amongst others.

Enterprise segments

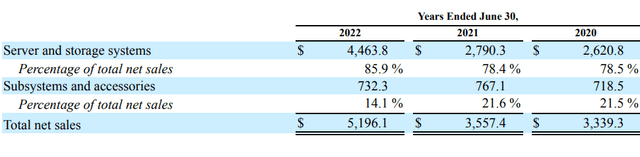

SMCI’s core enterprise is its server and storage methods section, which makes up nearly 80% of revenues. SMCI sells accelerated compute platforms and a few of its key product strains embrace its SuperBlade and MicroBlade system households that’s meant to share widespread computing sources and cut back the area and energy wants in comparison with normal servers.

The extra thrilling product line of SMCI ensuing within the latest share worth rally is its GPU or accelerated methods to cater to the growing calls for for the generative AI purposes, and knowledge heart optimized server methods that result in improved scalability and performance-per-watt and higher thermal structure.

On prime of its server and storage enterprise, SMCI has a subsystems and equipment section, which makes up 20% of revenues. A lot of the subsystems and equipment bought by SMCI are supposed to be built-in into full server and storage options. A few of the merchandise bought right here embrace server boards, chassis, energy provides and different equipment.

In FY2022, there was a rise of 60% from the prior 12 months within the server and storage methods section. This got here from SMCI’s massive enterprise and datacenter clients.

Product mixture of SMCI (SMCI IR)

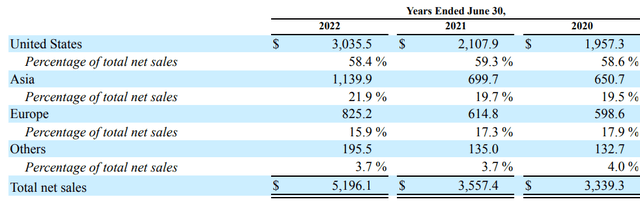

When it comes to geographical combine, the US make up nearly 60% of its revenues, whereas Asia and Europe take up round 20% and 15% respectively. SMCI highlighted that China makes up solely 3% of its revenues.

Geographical combine (SMCI IR)

Extremely aggressive business

I’d word that SMCI is working in an business that’s “extremely aggressive, quickly evolving and topic to new technological developments, altering buyer wants and new product introductions”, within the phrases of SMCI in its newest annual report.

SMCI competes with international know-how distributors like Cisco (CSCO), Dell (DELL), HP (HPQ), and Lenovo (OTCPK:LNVGY).

SMCI additionally competes with authentic design producers (“ODMs”) which might be in a position to provide low-cost manufacturing as a consequence of their scale like Foxconn, Quanta Pc, and Wiwynn Company.

Lastly, SMCI competes with OEMs, resembling Inspur.

With so many massive corporations with sturdy model names competing in opposition to SMCI, it’s working in a extremely aggressive business.

To succeed, it must:

- Be the primary to market with new rising applied sciences.

- On the similar time, be value efficient and its merchandise have to have excessive efficiency, effectivity and reliability.

The should be first and higher

SMCI acknowledged that the important thing for it to extend its gross sales and earnings is that it must be “among the many first to market with new options and merchandise”.

On account of its main indicators of success is that it wants to have the ability to introduce new merchandise as rapidly to the market as potential, delivering the most recent application-optimized server and storage options.

Thus, SMCI works carefully with the microprocessor and key element distributors like Nvidia, Intel, AMD, Samsung and Micron, amongst others, to make sure that they’re able to introduce new merchandise which might be in-line with these main gamers.

Nevertheless, I believe that this aggressive benefit will not be a sustainable one within the long-term. Even when SMCI is ready to be the primary participant to market a brand new product with new options, given the extremely aggressive market, different opponents will catch up in a matter of time. As well as, from the latest quarterly outcomes, we are able to see that SMCI is experiencing a element scarcity on account of a provide chain bottleneck, and that is limiting its near-term development.

Divergence between commentaries from Nvidia and SMCI

As talked about in my article on Nvidia (NVDA), administration commented that they’ve already procured considerably increased provide for the anticipated accelerated, seen demand within the second half of 2023.

In SMCI’s 1Q23 outcomes, this was mentioned by the administration workforce, which highlights that whereas demand could also be excessive, the enterprise is constrained by provide chain bottlenecks:

We word that our shipments in opposition to a report backlog could also be constrained by provide chain bottlenecks as a consequence of excessive demand for our superior AI server platforms.

When it comes to subsequent quarter outlook, SMCI is guiding for revenues of $1.8 billion on the mid-point, which is up 12% on a 12 months on 12 months foundation and up 38% sequentially. Take word that June is a seasonally sturdy quarter so there are seasonal components to bear in mind there however administration says that backlog orders for brand spanking new platforms stay sturdy and they’re working to ease their key provide constraints.

If you evaluate this to Nvidia’s commentary about doubling within the subsequent quarter relative to its prior quarter, this tells us that the aggressive dynamics are catching as much as SMCI as Nvidia is ready to procure provide from SMCI’s opponents as SMCI solves its provide constraint situation.

Thus, what this highlights to me from the channel verify between Nvidia and SMCI is that firstly, Nvidia has a approach stronger bargaining energy over its suppliers, secondly, the suppliers are simply replaceable given the aggressive nature of the business, and lastly, that whereas SMCI has some upside from the exponential development from Nvidia, that is shared between different opponents within the business.

Foxconn sees comparable state of affairs to SMCI

Certainly one of SMCI’s largest opponents additionally noticed AI driving sturdy server demand.

Whereas their full 12 months income is predicted to be flat, servers was a powerful section for them as there’ll seemingly be a “triple-digit improve” in second half of 2023.

Moreover, Foxconn has about 40% market share within the international marketplace for servers and administration mentioned they need to improve their additional.

This highlights to me that Foxconn might be able to deal with the availability chain bottlenecks higher than SMCI given their measurement and their tripling of server income section offers additional proof that SMCI is in a extremely aggressive market.

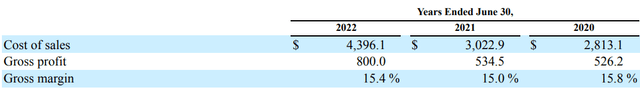

Low margin enterprise

On account of the extremely aggressive business, SMCI has comparatively low gross margins, between the vary of 15% to 16%.

The corporate’s value of gross sales is comparatively excessive as a consequence of excessive manufacturing prices, together with the price of manufacturing, value of supplies, delivery and manpower.

A big a part of the price of gross sales is set by the combo of merchandise which it sells and the price of supplies.

The power to extend its common promoting worth to offset the rising value of supplies will decide its capacity to keep up or increase gross margins over time. SMCI highlights that they don’t at present have any long-term mounted provide agreements and thus, their value of gross sales fluctuate with the altering value of supplies. In my view, this leaves SMCI’s value of gross sales very susceptible to will increase in its value of supplies.

When it comes to manufacturing, contract producers are used to fabricate subsystems, however the ultimate meeting and testing is essentially performed in SMCI’s personal manufacturing amenities.

Ablecom and Compuware are two key contract producers for SMCI, and each are associated events of SMCI. The purchases from the 2 corporations by SMCI makes up between 8% to 10% of its complete value of gross sales.

SMCI Gross Margins (SMCI IR)

Aggressive benefit

SMCI wants to have the ability to be the primary to market and ship at a sooner tempo than opponents.

Certainly one of its key benefits is its in-house Constructing Block Options structure in addition to its in-house design capabilities. What this allows SMCI is that its clients can then select from a variety of merchandise which might be in a position to meet their goal utility necessities.

Asa results of its constructing block options structure, SMCI is then in a position to deliver new merchandise to market sooner than its friends, because it has performed with Nvidia’s H100, Intel’s Sapphire Rapids and AMD’s Genoa releases.

One other key differentiator for SMCI is its experience in excessive energy effectivity and thermal experience that is ready to handle these challenges as knowledge facilities more and more take up extra energy.

In consequence, I believe that SMCI seems to be to have the ability to have some differentiating components in being the primary time-to-market participant, and a participant with decrease TCO prices. This may occasionally allow SMCI to achieve extra new design wins sooner or later.

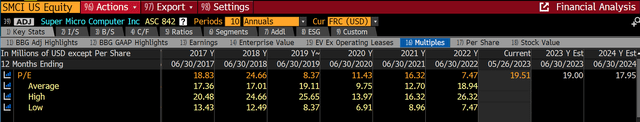

Valuation

SMCI is at present buying and selling at 18x 2024 P/E. SMCI has been buying and selling at a 6-year P/E common of about 16x P/E, which means that on a relative valuation perspective, SMCI is buying and selling at a 13% premium to its previous valuation.

SMCI valuation (Bloomberg)

Based mostly on the present inventory worth of round $221 per share, assuming a terminal 2027F P/E of 16x and value of fairness of 10%, SMCI would wish to develop EPS at 18% CAGR over the following 5 years for the inventory to be pretty valued right now.

SMCI implied 5-year EPS CAGR based mostly on present share worth (Writer generated)

Dangers

Out of date stock threat or inadequate stock threat

SMCI wants to supply clients with extra selections by way of its product portfolio and thus, it wants to keep up a excessive stage of stock. This excessive stage of stock is critical to make sure that SMCI is ready to meet the calls for of its clients on a well timed foundation. There’s a threat that SMCI is unable to have ample stock ranges to fulfill the wants and calls for of its clients.

As well as, if it overestimates the demand for a product, it may result in extra stock and thus, result in a threat of obsolescence of its stock whether it is unable to promote these merchandise.

In consequence, SMCI must handle its stock nicely to make sure that it doesn’t have an excessive amount of or too little stock for its enterprise operations.

Price of producing

On account of the fee construction of SMCI, it wants to have the ability to increase its common promoting worth to offset any adjustments in the price of manufacturing, which incorporates issues like value of supplies, amongst others.

If SMCI is unable to lift costs in an atmosphere the place the price of supplies is rising, this might result in downward stress on its gross margins.

Pace to market

SMCI must be one of many first to market new merchandise which might be in demand by its clients. The failure to take action will end in loss in market share as different opponents which might be sooner to develop and market new merchandise will achieve market share.

Conclusion

Whereas I believe that SMCI performs properly to the theme of AI and cloud computing given its enterprise includes promoting accelerated compute platforms, I’m of the opinion that SMCI could not have a sustainable aggressive benefit within the area. The business that SMCI is working in is crammed with massive gamers with loads of monetary sources and powerful model picture. Whereas SMCI could have some benefit within the type of its in-house constructing block options structure and in-house designing capabilities, the extremely dynamic and aggressive nature of the business, the should be the primary to market, and the low gross margins that SMCI is incomes suggests to me that the business is one which I don’t need to be investing in. Even when SMCI could have the lead right now, this lead could also be taken over by one other participant within the near-term.

On prime of that, SMCI must develop EPS at 20% CAGR over the following 5 years for its present share worth to be thought to be pretty valued. Whereas potential, I believe that the danger reward for SMCI is slightly low on the present valuation stage. Moreover, SMCI is at present buying and selling at 18x 2024 P/E, which is at a 13% premium to its 6-year P/E common of about 16x P/E.

Thus, I’m initiating SMCI with a impartial score. I would wish to see a extra sustained aggressive benefit and a extra favorable business dynamic for me to be extra constructive on the corporate.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link