[ad_1]

Typical monetary planning and evaluation groups spend the majority of their time on data-gathering and administering processes. That’s as a result of they usually need to take care of cumbersome techniques and software program instruments, leaving little time to give attention to producing insights that may drive enterprise development.

At the least, that’s in response to Bijan Moallemi, the co-founder of Mosaic, a startup constructing a platform that makes an attempt to centralize operational information from throughout a company. Mosaic as we speak introduced that it raised $26 million in a Collection C funding spherical led by OMERS Ventures with participation from Founders Fund, Basic Catalyst, and Mates and Household Capital, bringing its whole raised to $73 million.

Moallemi co-launched Mosaic with Joe Garafalo and Brian Campbell, who he met in 2012 at Palantir, the massive information analytics firm, whereas serving to to construct Palantir’s finance group.

“Tasked with supporting enterprise selections for a corporation — Palantir — in hypergrowth, we had been annoyed by the gradual pace, excessive complexity and inefficiencies of present instruments out there,” Moallemi informed TechCrunch in an electronic mail interview. “Realizing that the function of the CFO had grown in scope, however our toolkit had not, we got down to construct a platform that will deal with the technical challenges modern-day finance and enterprise groups face.”

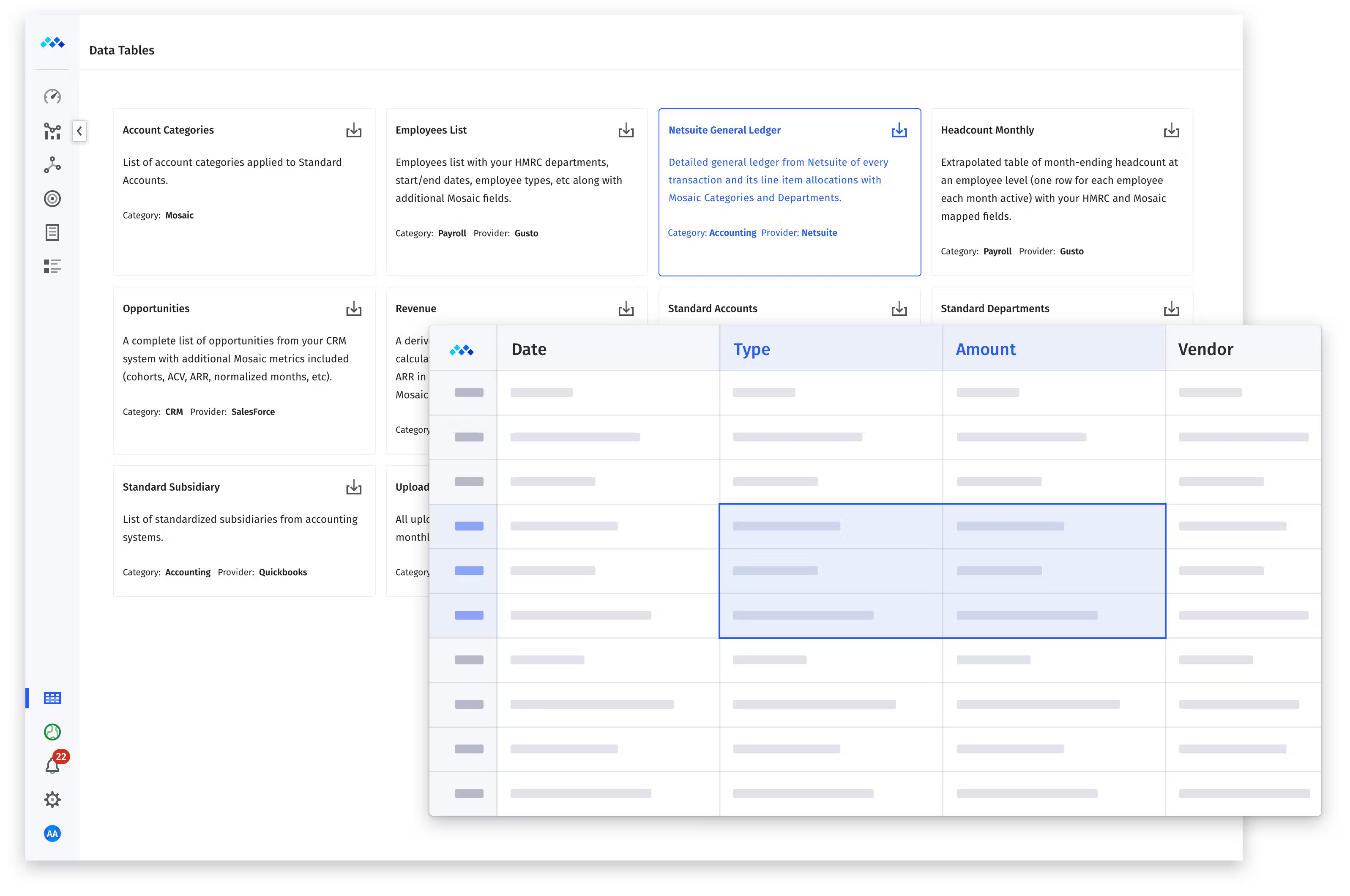

Moallemi describes Mosaic as a “real-time planning and analytics” platform. Stripping out all that advertising jargon, Mosaic offers dashboards, modeling and information visualization instruments geared towards monetary planning use circumstances, permitting customers to shortly share insights with stakeholders.

Picture Credit: Mosaic

With Mosaic, corporations can acquire a greater sense of when to execute on their plans, Moallemi says, like when to broaden their gross sales groups or increase one other spherical of funding. Customers can create division or govt views for due diligence and go-to-market evaluation, offering a unified — however custom-tailored — supply of reality.

“Previously, implementing a legacy FP&A platform took months, bogging down the IT division with important demand for engineering assets,” Moallemi stated. “We’ve architected Mosaic to remove the necessity for IT assets in implementation or upkeep … As an alternative of needing IT to reply to requests for information, enterprise customers can get real-time perception into the metrics that influence their each day actions.”

Mosaic, who counts Emerge, Sourcegraph and Drata amongst its clients, claims enterprise has “tripled” annually since its founding in 2019 and that the burn price — the speed at which it’s spending cash in extra of revenue — is steadily reducing. Moallemi credit the pandemic with the expansion, partially, in addition to the present common financial uncertainty.

There’s reality to what he says. In line with a latest survey from Capterra, the bulk (73%) of monetary professionals plan to spend extra on software program this yr than they did in 2022. They listed managing a hybrid office, safety considerations and cyberattack dangers as their prime motivators.

“Through the pandemic, the rise of distant work created extra demand for collaborative workflows in finance,” Moallemi stated. “Macro slowdowns require everybody to do extra with much less. And the reply to that’s implementing expertise that will increase the quantity of labor folks can do with out forcing the corporate so as to add headcount.”

Within the close to time period, Mosaic, which has 80 full-time workers, plans to construct out the platform’s AI capabilities and introduce instruments alongside the strains of its recently-launched Metric Builder, which lets clients create, analyze and plan {custom} monetary metrics. Added Moallemi: “We’ll proceed to broaden our planning and evaluation options whereas additionally making AI a core a part of the platform to empower this era of agile, strategic finance leaders.”

[ad_2]

Source link